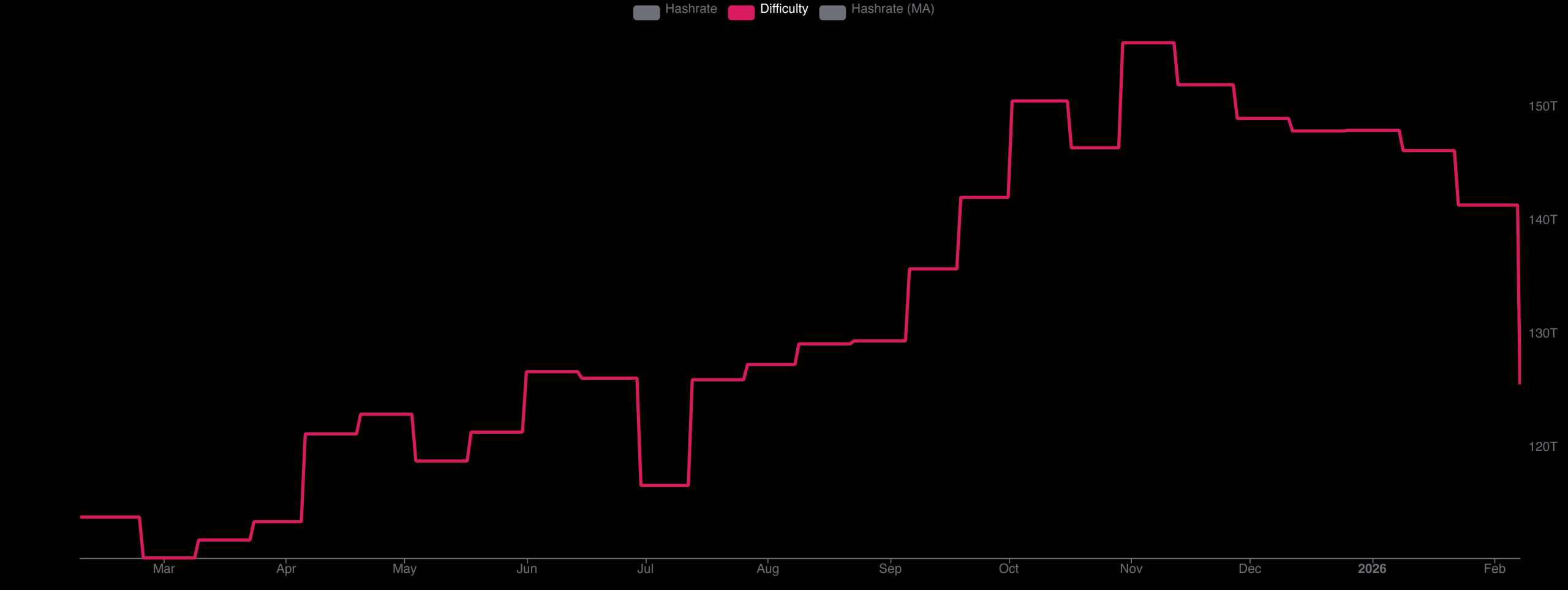

After a winter storm ripped through dozens of U.S. states—pushing major mining firms to dial back operations so the power grid could operate at maximum capacity—the network’s mining difficulty fell sharply at block height 935424. At that block, the difficulty metric moved from 141.67 trillion to 125.86 trillion, a hefty 11.16% drop that did not go unnoticed.

Bitcoin difficulty over 1-year via mempool.space metrics.

Historical data indicates the network has not experienced a decline of this magnitude since China moved against bitcoin mining in the summer of 2021. That 2021 ban set off a sweeping departure of miners and hashrate from the country, a shift widely labeled across the industry as the “great mining migration.” Estimates assume 60% to 70% of the global hashrate was located in China before the 2021 crackdown.

A first-quarter 2026 heatmap from hashrateindex.com today shows China still accounting for roughly 16.41% of the global hashrate. The Chinese government’s crackdown sent difficulty tumbling at the time. Data shows that at block height 689472, amid China’s 2021 hashrate exodus, the network’s difficulty fell by a staggering 27.94%.

From that point forward through Feb. 7, 2026, the network avoided any double-digit percentage difficulty reductions, with the largest pullback during that span (July 2021 to Feb. 2026) registering a 7.48% drop at block 903168. The 11.16% cut this weekend offers miners a bit of breathing room after revenue had been sliding in step with BTC spot prices.

Two days earlier, on Feb. 5, the hashprice—the estimated daily value of a single petahash per second (PH/s)—fell to a record low of $28.70 per PH/s. With bitcoin prices rebounding, that same petahash was fetching roughly $34.86 by Saturday afternoon.

Read more: ‘I’ll Keep Buying’: Dave Portnoy Doubles Down on XRP as Price Falls

In simple terms, an 11.16% difficulty reduction makes finding a block reward that much easier. That relief, however, is temporary, lasting only 2,016 blocks and projected to run its course around Feb. 20. The adjustment was triggered because block intervals had slowed considerably, stretching beyond 12 minutes per block ahead of the latest epoch.

That dynamic has since shifted, and as of 4 p.m. Eastern time on Saturday, the average block time has tightened to nine minutes 22 seconds. If the current pace holds, the next difficulty adjustment on Feb. 20 is likely to swing a great deal higher.

- Why did Bitcoin’s mining difficulty drop 11.16%?

The reduction was triggered after winter storms slowed block production as U.S. miners curtailed operations to support power grid stability. - When did Bitcoin’s difficulty adjustment occur?

The adjustment took place at Bitcoin block height 935424 during the latest difficulty epoch in early February 2026. - How long will the lower difficulty last?

The easier conditions apply for 2,016 blocks and are expected to remain in effect until around Feb. 20. - Why is this difficulty drop significant?

It marks Bitcoin’s largest difficulty reduction since China’s 2021 mining crackdown and the “great mining migration.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。