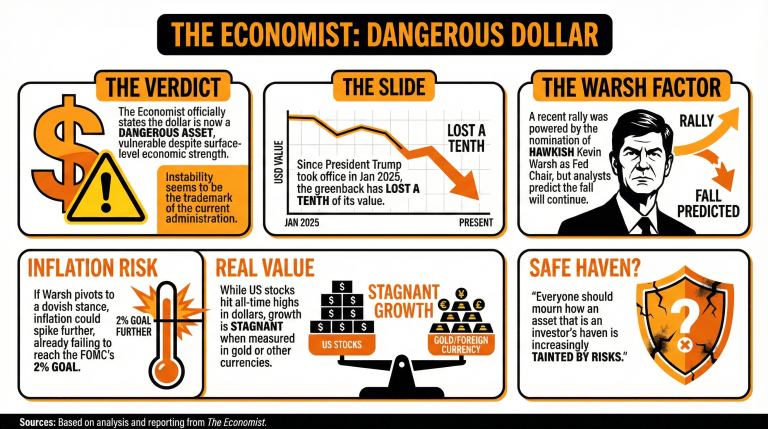

The Economist, a recognized financial news magazine, is now officially acknowledging that the dollar is a dangerous asset, vulnerable to many variables, even when a superficial snapshot of the U.S. economy would indicate the opposite.

Before the recent dollar rally, powered by the nomination of hawkish Kevin Warsh to become the next Chairman of the Federal Reserve and the generalized speculation on his upcoming actions, the greenback had been on a slide since President Trump took office in January 2025, losing a tenth of its value.

Even with the current, burgeoning stock market, which has touched all-time highs, and the reduced yields on Treasuries, the magazine’s analysts concur that the dollar can still keep falling, as instability seems to be the trademark of the current administration.

They declared:

“When Mr. Trump backs off his maddest ideas, normality returns. But the spasms offer glimpses of a topsy-turvy world in which dollar assets are no longer safe.”

Furthermore, if Warsh assumes a dovish position, following the administration’s wishes, it might push inflation higher, even as current figures have not reached the 2% goal established by the Federal Open Market Committee (FOMC) under former Chairman Ben Bernanke’s guidance.

The jump in precious metals’ prices, with gold and silver rising and experiencing high volatility, and the stagnant growth of U.S. stock markets when measured in currencies and assets other than the dollar, also support the view of the greenback as an overvalued currency bound to slide further.

“Everyone should mourn how an asset that is an investor’s haven is increasingly tainted by risks the whole world must now bear,” the outlet concluded.

Read more: Is the US Dollar Dominant or Doomed? Analysts Read the Same Data—Very Differently

- What recent assertion has The Economist made about the U.S. dollar?

The Economist has labeled the dollar a dangerous asset, highlighting its vulnerability to various factors despite a seemingly strong snapshot of the U.S. economy. - How has the dollar performed since President Trump took office?

Since January 2025, the dollar has lost about 10% of its value, even amid a recent rally fueled by Kevin Warsh’s nomination to the Federal Reserve. - What financial indicators contribute to the view of the dollar as overvalued?

While the stock market has reached all-time highs, analysts note rising precious metals prices and stagnant growth in assets measured against currencies other than the dollar. - What concerns are associated with the potential policies under Kevin Warsh?

If Warsh adopts a dovish stance, inflation could rise, complicating the already unstable outlook for the dollar as it struggles to meet the Federal Open Market Committee’s 2% inflation target.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。