The Japanese Liberal Democratic Party’s decisive electoral victory provided a notable tailwind for both digital and traditional markets Monday, Feb. 9. Japan’s Nikkei 225 briefly surged past the historic 57,000 mark for the first time, buoyed by investor optimism. According to the BBC, analysts expect Sanae Takaichi’s pro-business agenda to revitalize Japan’s stagnant economy and address rising cost-of-living concerns. This bullish sentiment rippled across Asia, helping the Shanghai Composite reclaim the 4,100 level.

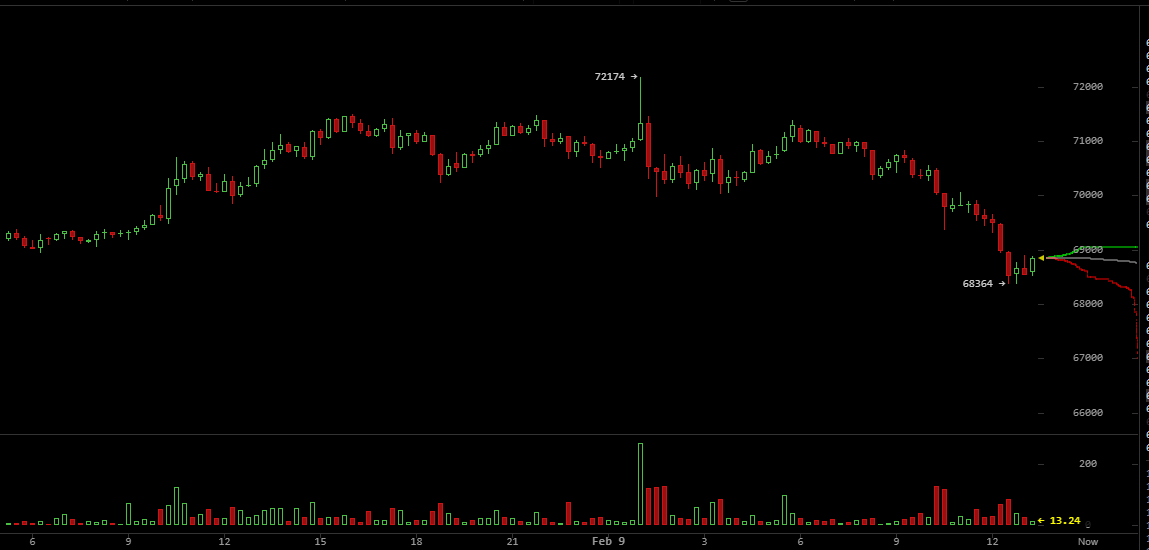

Mirroring equities, the cryptocurrency market—still reeling from last week’s downturn—initially rallied on the news. Bitcoin climbed from a $70,000 open to a peak of $72,174. However, the momentum proved unsustainable; by 5:23 a.m. EST, the asset retreated below the $69,000 threshold. This brief “fakeout” caught bears off guard, resulting in the liquidation of nearly $82 million in short positions within a 12-hour window.

Read more: Bitcoin Compresses at $68K as Technical Signals Set the Stage for a Decisive Break

The reversal in bitcoin’s price coincided with reports that South Korean authorities have launched an investigation into Bithumb’s reported erroneous transfer of $40 billion on bitcoin to users. Lee Kang-hee, chief of the Financial Supervisory Service (FSS), noted that the sector’s structural vulnerabilities necessitate immediate, more stringent oversight.

The investigation follows reports that the exchange accidentally disbursed more than $40 billion in assets. Lee emphasized that recipients are legally mandated to return the funds. Furthermore, the FSS signaled a cautious approach toward what it described as “ghost tokens” and bitcoin spot exchange-traded funds (ETFs), announcing plans to expand its authority through secondary legislation under the Digital Asset Basic Law.

The downward pressure on bitcoin was further intensified by reports that Chinese financial regulators have instructed domestic banks to aggressively scale back their exposure to U.S. Treasuries. While Beijing’s official rhetoric frames the mandate as a pragmatic response to heightened market volatility, market strategists see it as a component of China’s broader strategy to insulate its economy from the U.S. dollar-based financial ecosystem.

By systematically diversifying away from the greenback, Beijing is attempting to mitigate the risk of Western financial sanctions and reduce its vulnerability to U.S. monetary policy. For the crypto sector, this pivot signals a period of heightened macro uncertainty; as the world’s two largest economies decouple, alternative assets like bitcoin often face volatile liquidations as liquidity flows are recalibrated.

Bitcoin’s drop below $70,000 saw its market capitalization fall below the $1.4 trillion threshold, leaving the broader crypto economy’s capitalization around $2.4 trillion. With the cryptocurrency currently stuck in the $68,000 to $70,000 range, optimists are targeting a recovery band between $72,000 and $82,000 for the remainder of February.

However, analysts at Zacks Investment Research suggests a potential fall to $40,000 within the next eight months should liquidity remain tight, while Standard Chartered predicts a “worst-case” floor of $55,000 if ETF outflows accelerate.

- How did Japan’s election impact markets? Japan’s Liberal Democratic Party win pushed the Nikkei 225 past 57,000 and lifted Asian equities.

- What happened to bitcoin after the rally? Bitcoin spiked to $72,174 before sliding below $69,000, liquidating $82M in shorts.

- Why is South Korea investigating Bithumb? Authorities are probing a $40B erroneous bitcoin transfer and tightening oversight under new digital asset laws.

- How is China’s policy affecting crypto?

Beijing’s move to cut U.S. Treasury exposure adds macro uncertainty, pressuring bitcoin and alternative assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。