U.S. stock indexes showed narrow, uneven moves by mid-morning Monday, Feb. 9, as markets remained open and liquidity stayed thin following Friday’s powerful rebound. The Nasdaq Composite and S&P 500 hovered modestly higher, while the Dow Jones Industrial Average eased lower after briefly topping the historic 50,000 mark late last week, according to live market data.

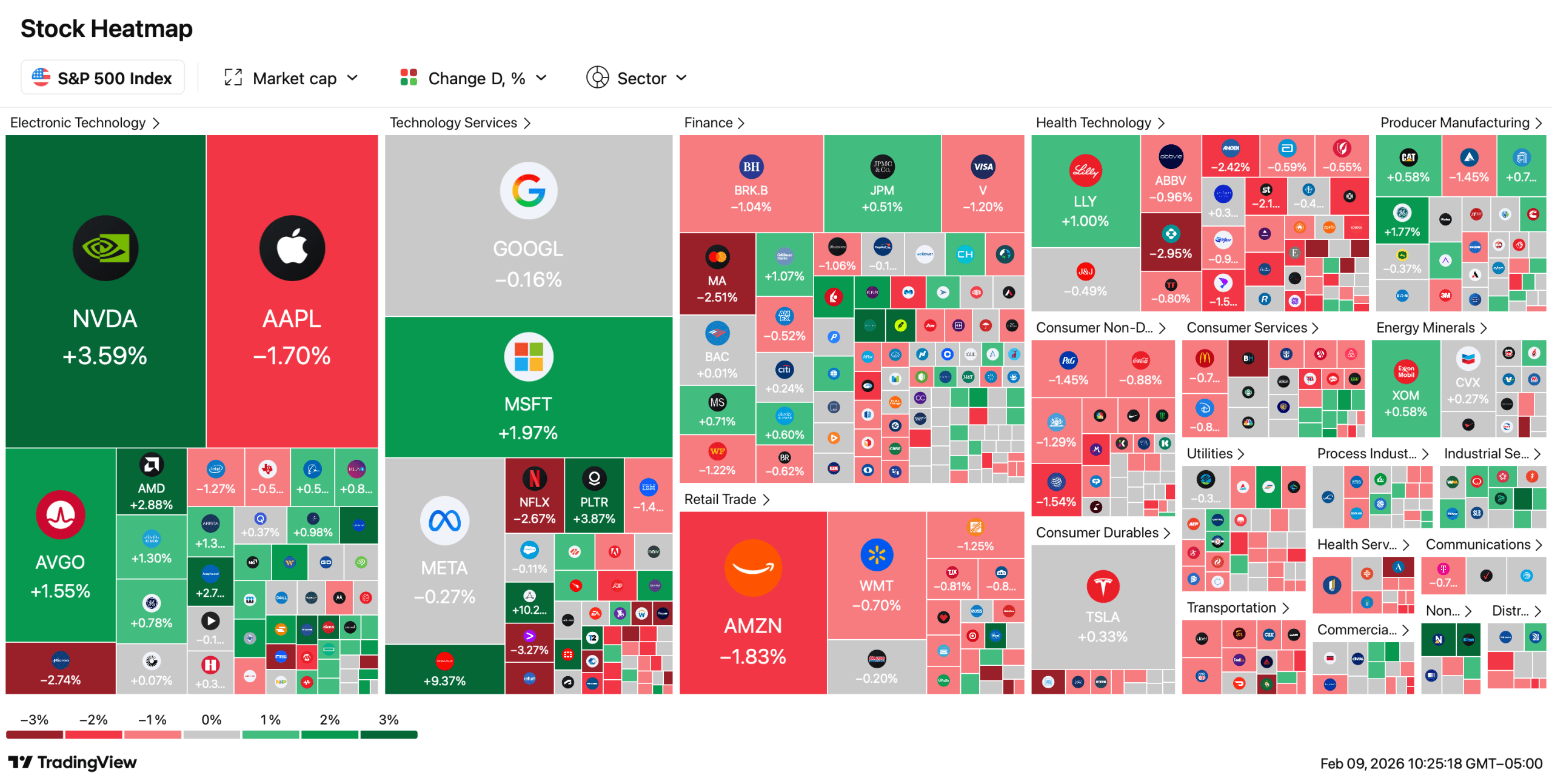

S&P 500 on Feb. 9, 2026.

As of roughly 11:10 a.m. Eastern time, the Nasdaq Composite rose about 0.3%, supported by selective strength in technology and software names, while the S&P 500 edged fractionally higher near record territory. The Dow slipped roughly a quarter of a percent, reflecting profit-taking after Friday’s triple-digit point sprint that capped a volatile but ultimately bullish week.

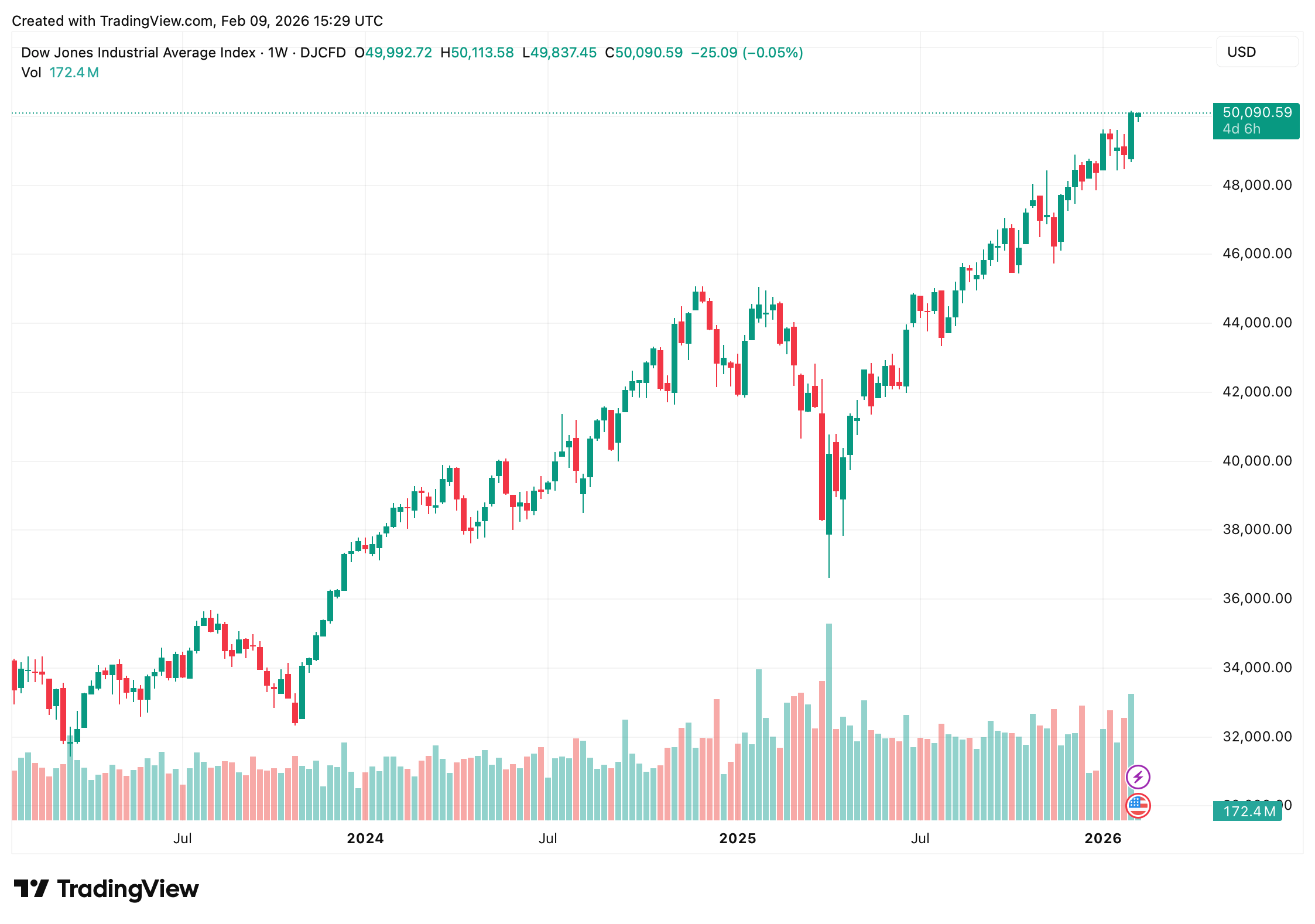

Dow Jones Industrial Average on Feb. 9, 2026.

Markets opened softer across the board before stabilizing, a familiar early-week pattern as traders recalibrate risk following strong gains. Friday’s close saw the Dow jump more than 1,200 points to finish above 50,000 for the first time, while the S&P 500 and Nasdaq both logged gains north of 2%, powered by industrials, energy, and a rebound in select tech stocks.

Under the hood, stock-specific moves told a livelier story. Applovin, Oracle, Kroger, Corning, and Palantir paced the gainers, while shares of Waters, Workday, Best Buy, and General Motors traded lower. The action reflected ongoing sector rotation, with investors shifting away from last week’s battered mega-cap software names and toward cyclicals and value-oriented plays.

Macro signals remained subdued, with no major U.S. economic releases scheduled for Monday following delays tied to the partial government shutdown. Treasury yields ticked slightly higher, with the 10-year yield hovering around 4.22%, suggesting mild repricing around interest-rate expectations rather than any full-blown risk-off move.

Global markets offered modest support early in the session. Asian equities advanced overnight, with Japan’s Nikkei 225 touching record levels, while European stocks opened firmer before losing momentum as U.S. trading got underway. Commodity markets were relatively calm, with oil steady and gold holding above $5,000 an ounce.

Also read: Saylor Buys Again: Strategy Adds 1,142 BTC as Paper Losses Top $5 Billion

Attention now turns squarely to the rest of the week. Investors are bracing for a packed calendar of rescheduled January data, including nonfarm payrolls, consumer price index figures, and producer inflation reports, alongside earnings from Coca-Cola, Cisco, McDonald’s, Applied Materials, and others. Any inflation surprises or guidance missteps could quickly jolt a market that’s already walking a tightrope.

For now, Wall Street’s mood is best described as alert but not alarmed. With major indexes parked near all-time highs and February’s seasonal choppiness lurking, traders appear content to wait, watch, and keep risk tightly managed as the next round of macro headlines approaches.

- Why are U.S. stock markets mixed today? Investors are consolidating gains from last week while waiting for key economic data and earnings.

- Which index is underperforming mid-day? The Dow Jones Industrial Average is modestly lower, while the Nasdaq and S&P 500 are slightly higher.

- What data are investors watching this week? Nonfarm payrolls, CPI inflation, retail sales, and producer price data dominate the calendar.

- What time of day does this market snapshot reflect? The pricing reflects live mid-day trading while U.S. markets remain open.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。