Bitcoin is now in the public eye as the asset faces challenges in finding its place in the future financial arena.

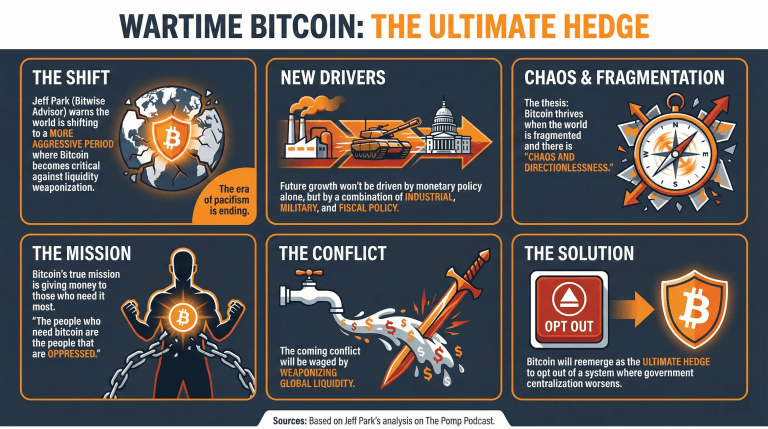

Jeff Park, CIO at Procap and advisor at Bitwise, states that the world is shifting into a more aggressive period, warning that bitcoin will become more relevant as the world becomes more fragmented, rising again as a tool to fight liquidity weaponization and capital controls.

On The Pomp Podcast, Park explained that during this upcoming “wartime” period, bitcoin’s performance will be defined by elements different from those that usually affect it.

He stated:

“Wartime bitcoin is different because wartime means it’s actually not monetary policy that is driving the future outlook for how we’re thinking about growth. It’s probably going to be a combination of industrial policy, military policy, and fiscal policy.”

Park highlighted that the current thesis is that bitcoin will do well when the world is more fragmented, and there is “chaos and directionlessness,” remembering that bitcoin’s mission is to give money to the people who really need it.

For Park, Americans have lots of options besides bitcoin to bet on. “They can do a lot of stuff. The people who need bitcoin are the people that are oppressed,” he concluded.

He stressed that he was bullish on the future of bitcoin in this new order, currently rising, where the centralization of the government’s role will worsen. “The era of pacifism is ending, and the coming conflict will be waged by weaponizing global liquidity. Bitcoin will reemerge as the hedge, the ultimate hedge to be out of and opt out of that system,” he concluded.

Read more: Analysts Double Down on $150K Bitcoin as Market Faces ‘Weakest Bear Case’

- What challenges is bitcoin currently facing in the financial market?

Bitcoin’s role is being scrutinized as it navigates its place amidst evolving global economic challenges and fragmentation. - What insights did Jeff Park share about bitcoin’s relevance during turbulent times?

Jeff Park believes bitcoin will gain importance as a tool against liquidity weaponization, particularly in a fragmented and chaotic world. - How will bitcoin’s performance be influenced in this “wartime” period?

Park explained that bitcoin’s future will hinge more on industrial, military, and fiscal policies rather than traditional monetary policies. - What is Park’s outlook on bitcoin’s future amidst increasing government centralization?

He is optimistic about bitcoin’s potential as a hedge against escalating government control and its ability to serve those most in need.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。