Canaan Inc. reported fourth-quarter revenue of $196.3 million, a 121.1% increase from a year earlier, driven largely by surging demand for its mining machines, according to unaudited results released Feb. 10 . Full-year revenue climbed 96.7% to $529.7 million, reflecting a broad recovery across the bitcoin mining supply chain.

Product revenue from mining hardware accounted for $164.9 million in the quarter, up 124.5% year over year, as customers placed large orders to upgrade fleets and chase higher efficiency. The company said fourth-quarter computing power sales hit a record 14.6 exahash per second (EH/s), pointing to how quickly miners returned once economics improved.

Self-mining operations also added a meaningful lift. Canaan mined 300 bitcoins during the quarter, generating $30.4 million in mining revenue, nearly doubling from the prior year. Installed hashrate reached 9.91 EH/s by year’s end, with 7.65 EH/s actively operating, an 82% annual increase that outpaced overall network growth.

Despite the revenue pop, profitability remained elusive. Canaan posted a fourth-quarter net loss of $85.0 million, weighed down by noncash items including $44.3 million in fair-value losses tied to cryptocurrency holdings and $13.9 million in inventory write-downs. Management framed those charges as accounting headwinds rather than operational cracks.

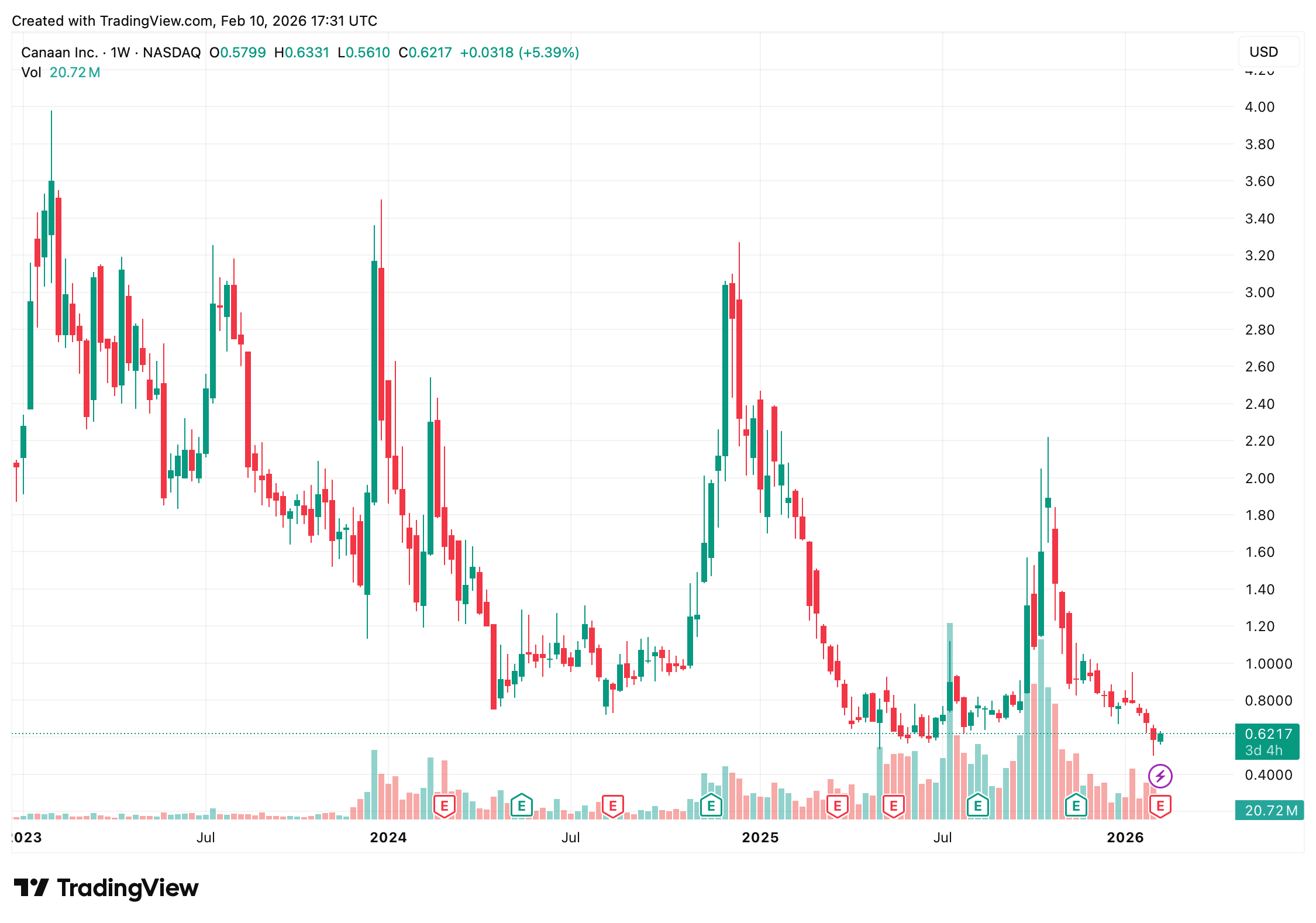

Canaan shares on Nasdaq on Feb. 10, 2026.

The balance sheet told a more upbeat story. Canaan ended the year holding roughly 1,750 BTC and 3,951 ETH, giving the company one of its largest crypto treasuries to date. Cash and cash equivalents totaled $80.8 million, providing flexibility as market conditions evolve.

Also read: MrBeast Expands Into Finance With Acquisition of Teen Banking App

Strategically, the company is pushing beyond pure hardware sales. Executives said Canaan is expanding into energy-compute infrastructure and household-focused products, while targeting gigawatt-scale power capacity in the United States by the end of 2026.

Looking ahead, management projected first-quarter 2026 revenue of $60 million to $70 million, a sequential pullback that reflects customer timing and shifting order cycles. Still, after a fourth-quarter rebound of this size, Canaan has clearly reentered the conversation among bitcoin mining suppliers.

- Why did Canaan’s revenue jump in Q4?

A rebound in bitcoin mining hardware demand drove a surge in product sales. - Did Canaan return to profitability?

No, the company posted a net loss due mainly to noncash valuation charges. - How large is Canaan’s crypto treasury?

Canaan held about 1,750 BTC and 3,951 ETH at year’s end. - What is Canaan’s outlook for early 2026?

The company expects lower first-quarter revenue as orders normalize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。