On Tuesday, Interactive Brokers announced the launch of nano bitcoin and nano ether futures contracts listed on Coinbase Derivatives, making the products available to eligible clients directly through the IBKR platform. The contracts include monthly expirations as well as perpetual-style structures and trade around the clock, giving market participants another way to gain crypto exposure without leaving a regulated futures venue.

Nano contracts are intentionally modest in size—0.01 bitcoin and 0.10 ether—lowering capital requirements and allowing for more precise position sizing. Perpetual-style futures are designed to closely track spot prices, reducing the need for frequent contract rollovers while preserving flexibility for active traders.

For Interactive Brokers, the move is less about novelty and more about refinement. The firm already gives clients access to more than 170 markets globally, spanning equities, options, futures, foreign exchange, bonds, and digital assets. Adding Coinbase Derivatives’ nano crypto futures tightens the link between traditional derivatives trading and crypto exposure within a single interface.

Chief Executive Officer Milan Galik framed the rollout as a practical expansion rather than a leap into speculation, emphasizing flexibility, lower margin requirements, and regulated execution. Coinbase Institutional Co-CEO Greg Tusar echoed that theme, pointing to accessibility and regulatory structure as key design goals.

To understand why Interactive Brokers’ crypto expansion looks the way it does, it helps to zoom out. The firm was founded in 1977 by Thomas Peterffy, decades before online trading became standard. What began as a market-making operation evolved into one of the earliest fully automated electronic brokerages, built on proprietary technology and aggressive cost control.

Interactive Brokers went public in 2007 and steadily grew into a global platform serving active traders, institutions, hedge funds, and registered investment advisers. As of late 2024, the firm reported more than 3.3 million client accounts and roughly $568 billion in client equity, with the majority of users located outside the United States.

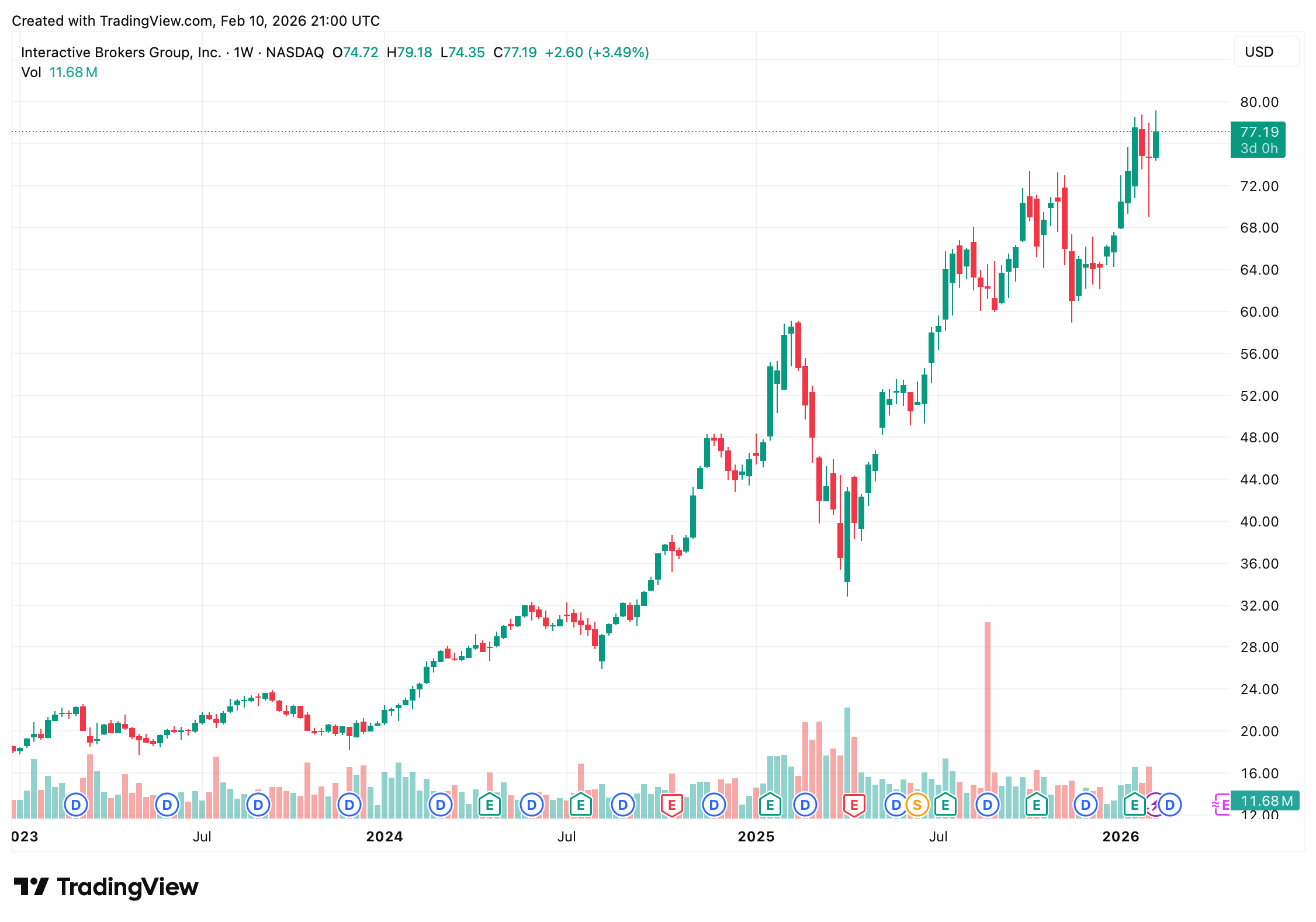

Interactive Brokers (Nasdaq: IBKR) stock at the closing bell on Feb. 10, 2026.

Interactive Brokers’ first encounter with crypto dates back to December 2017, when it became one of the earliest traditional brokers to offer access to bitcoin futures listed on regulated U.S. exchanges. The decision allowed clients to trade price exposure without custody risk, at a time when spot crypto markets were still largely unregulated.

That derivatives-first approach set the tone. Rather than rushing into direct crypto trading, the firm waited for clearer regulatory guardrails and institutional-grade partners.

In September 2021, Interactive Brokers expanded into spot crypto trading through Paxos Trust Company, initially supporting bitcoin ( BTC), ethereum ( ETH), litecoin ( LTC), and bitcoin cash ( BCH). A month later, the firm extended crypto trading to U.S.-registered investment advisers, allowing advisers to manage digital asset exposure alongside stocks, bonds, and options.

Commissions were set deliberately low, and execution and custody remained with regulated third parties—a structure that insulated IBKR from many of the failures that later rippled through the crypto sector.

Also read: Stablecoin-Focused Startup Tempo Adds Farcaster Founders After Neynar Acquires Social Protocol

From there, Interactive Brokers broadened crypto access region by region. Hong Kong clients gained limited crypto trading in 2023 through OSL Digital Securities, followed by an expansion into the United Kingdom in 2024. Each rollout reflected local regulatory frameworks rather than a one-size-fits-all strategy.

In 2025, the firm accelerated asset additions, bringing in solana ( SOL), cardano ( ADA), XRP, dogecoin (DOGE), and later chainlink (LINK), avalanche (AVAX), and sui (SUI) through partnerships with Zero Hash and Paxos. That same year, Interactive Brokers began rolling out stablecoin funding, starting with USDC deposits for U.S. accounts and later expanding blockchain support in early 2026.

The goal was operational convenience—24/7 funding and lower friction—rather than issuing a proprietary token.

The Coinbase Derivatives launch fits squarely into this measured trajectory. By offering nano futures on a regulated exchange, Interactive Brokers is giving clients another risk-management tool without altering its core philosophy. Smaller contract sizes widen participation, while perpetual-style structures appeal to traders who want continuity without constant maintenance.

It is also a reminder that IBKR’s crypto strategy is additive, not transformational. Crypto lives alongside equities, futures, and forex—not above them.

A Brokerage Growing Without Reinventing Itself

Interactive Brokers’ strength has always been infrastructure. Its crypto evolution reflects that same DNA: regulated partners, low fees, deep liquidity, and tight integration with existing trading tools. The firm has avoided splashy ventures into NFTs or decentralized finance, opting instead for functionality that appeals to professional users.

By adding Coinbase Derivatives’ nano bitcoin and ether futures, Interactive Brokers is not chasing trends—it is refining access. The move reinforces the firm’s position as a bridge between traditional markets and digital assets, built for traders who value precision, regulation, and scale over spectacle.

FAQ ❓

- What did Interactive Brokers announce?

Interactive Brokers added nano bitcoin and nano ether futures from Coinbase Derivatives to its trading platform. - What are nano crypto futures?

They are smaller futures contracts designed to lower entry costs and improve position sizing. - Are the contracts regulated?

Yes, the futures trade on a regulated U.S. exchange through Coinbase Derivatives. - Who can trade them?

Availability depends on jurisdiction, account type, and trading permissions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。