Introduction

Many people first click on the exchange's "Wealth Management/Earning Coins" page when the market is in its most awkward state.

The coin price is stagnant.

News is flying everywhere.

As you watch others flaunt their profits on social media every day, you become increasingly hesitant to take action.

You are unsure if it's a bull market.

You also don't know if it will continue to fall.

You even doubt whether "holding stablecoins now" is the right choice.

So, you start to think:

Since I can't see the direction clearly for now, can I at least put my money in a relatively safe place and not let it sit idle?

This is where the vast majority of people start their journey with exchange wealth management.

The goal is not to get rich quickly, but to avoid wasting time.

But the problem is—

When you actually open the exchange's wealth management page, you will find:

Current savings, fixed savings, dual currency, structured products

Annualized returns of 3%, 10%, 20%

Various "locking", "redemption", "reward pools"

The longer you look, the more it feels like reading a book in a foreign language.

This article is written for beginners:

Without complex terminology, without deep strategies, only focusing on one thing:

If you are a beginner doing exchange wealth management for the first time, how should you proceed to earn income while avoiding pitfalls?

1. First, clarify: What exactly is exchange wealth management?

Many people have a natural misunderstanding of the term "wealth management."

Because in traditional finance, "wealth management" sounds like bank deposits or something like Yu'ebao—safe, stable, and won't lose value.

But in the crypto market, exchange wealth management is not bank deposits; its returns do not come from nowhere.

Its returns come from fundamentally three sources.

1. Lending income: You earn interest from "someone wanting to borrow money"

This is the most common and fundamental type of wealth management model.

For a simple example:

You deposit 1000 USDT into the exchange's current savings.

The exchange lends this part of USDT to leveraged traders.

The leveraged traders pay interest.

The exchange takes a portion as a fee and distributes the remaining interest to you.

Therefore, what you earn is actually: the interest from the market's leverage demand.

When the market is active, the fluctuations are large, and many people engage in leverage, the lending demand is high, and so is the yield.

Conversely, when the market is quiet, and no one is willing to borrow money for leverage, the yield will significantly drop.

This is also why you might see:

For the same USDT current savings, sometimes the annualized yield is 2%, and sometimes it is 8%.

This is not because the platform has changed its conscience, but because the market demand has changed.

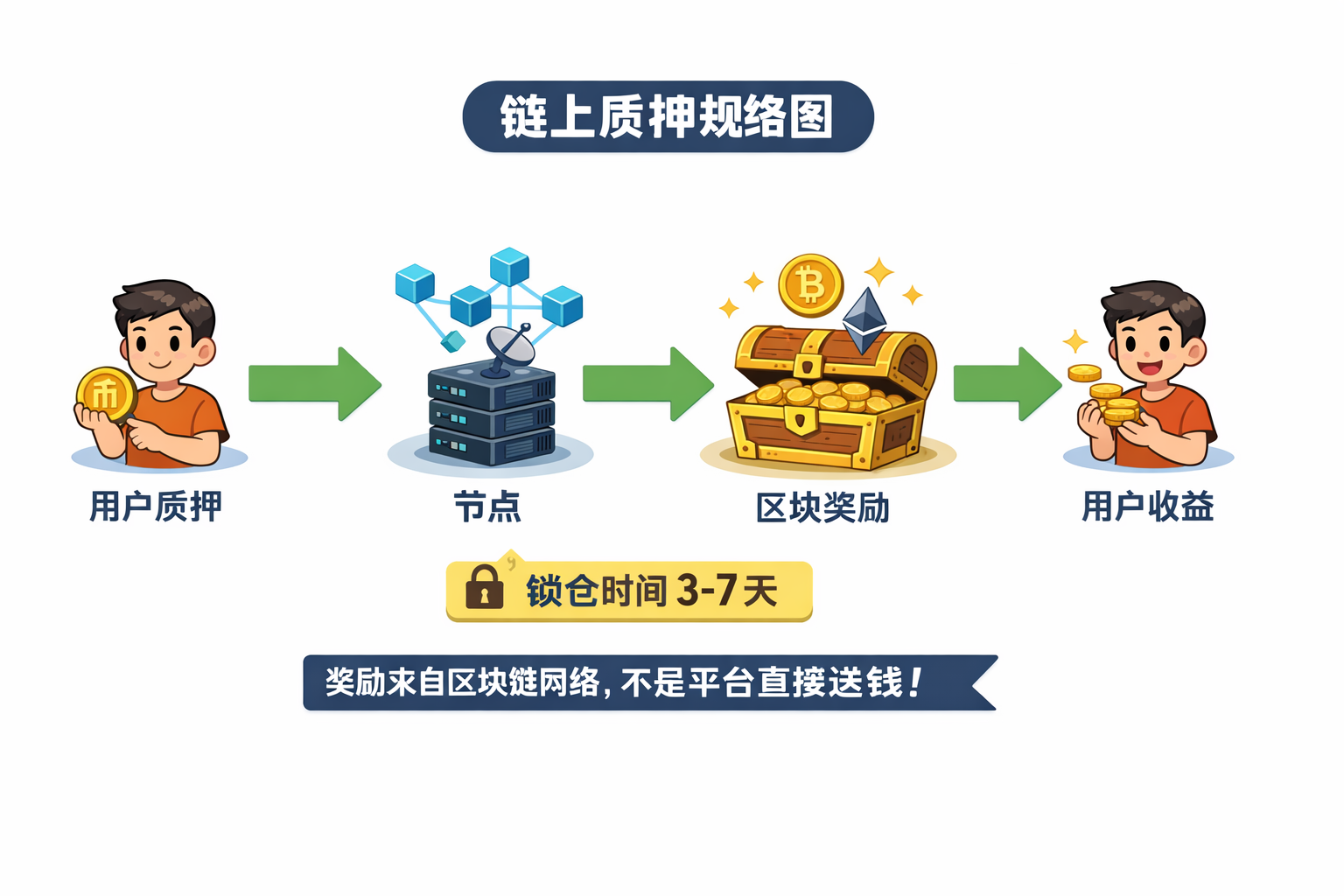

2. Staking income: You earn "rewards issued by the on-chain system"

If you hold assets like ETH, SOL, ATOM, etc., you will find that exchanges often have a "staking" feature.

What is staking?

You can understand it as:

Putting your coins to participate in the operation of the blockchain network, and the system rewards you.

For example, PoS chains (Proof of Stake) require validating nodes to maintain network security.

Nodes need to stake assets as "credit collateral" to participate in validating blocks and bundling transactions.

When you stake your assets, you essentially delegate them to nodes for use; the nodes will share a portion of the block rewards with you after earning.

So the sources of staking income are: on-chain fees and block rewards (inflation issuance).

The characteristics of this type of income are:

- Relatively stable

- Longer cycles

- Redemption times may be slow

Especially on some chains, staking redemption may require waiting for an unlocking period, which can be 3 days, 7 days, or even longer.

Therefore, staking wealth management is more suitable for:

Those who are already in for the long term, rather than those who want to enter and exit at any time.

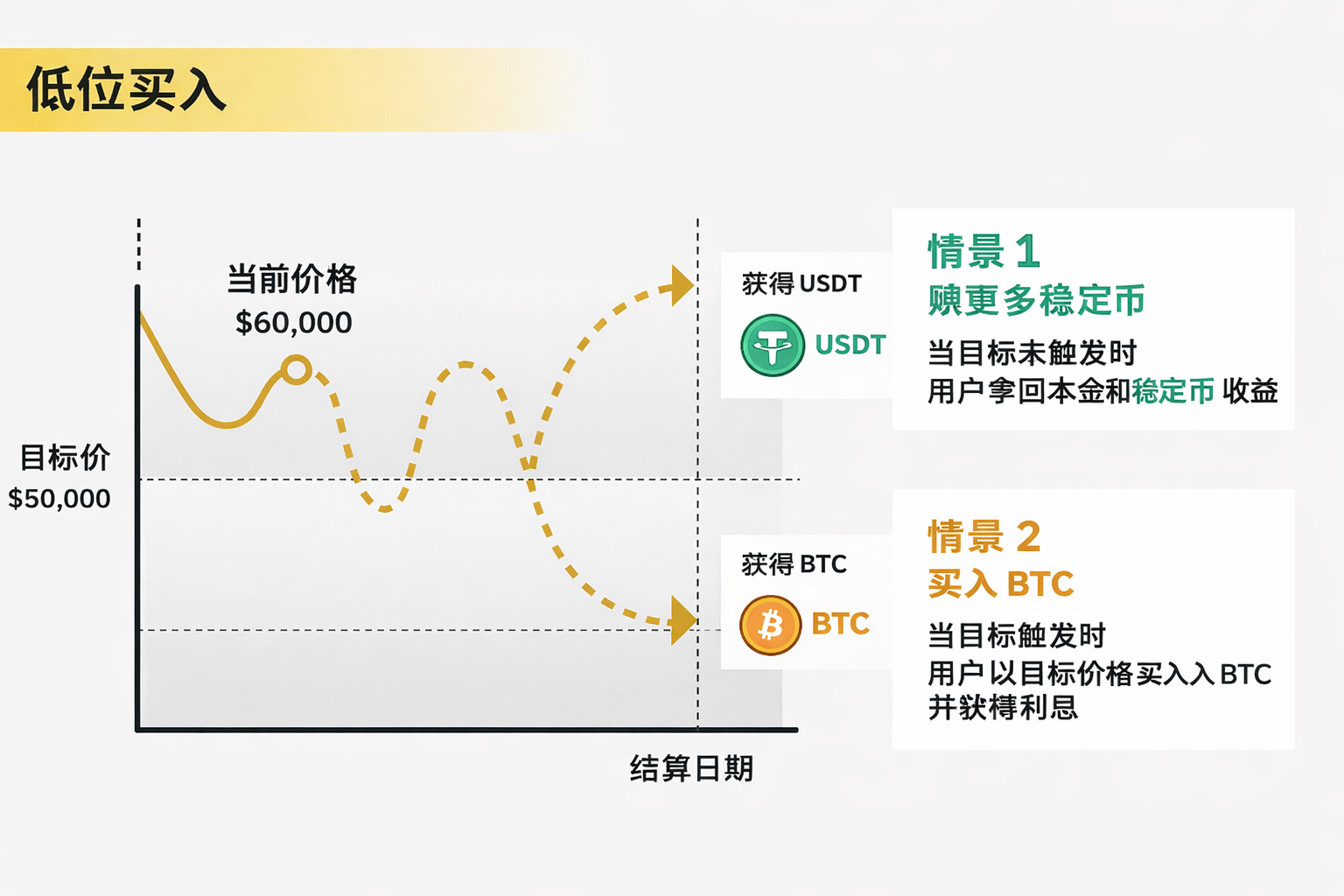

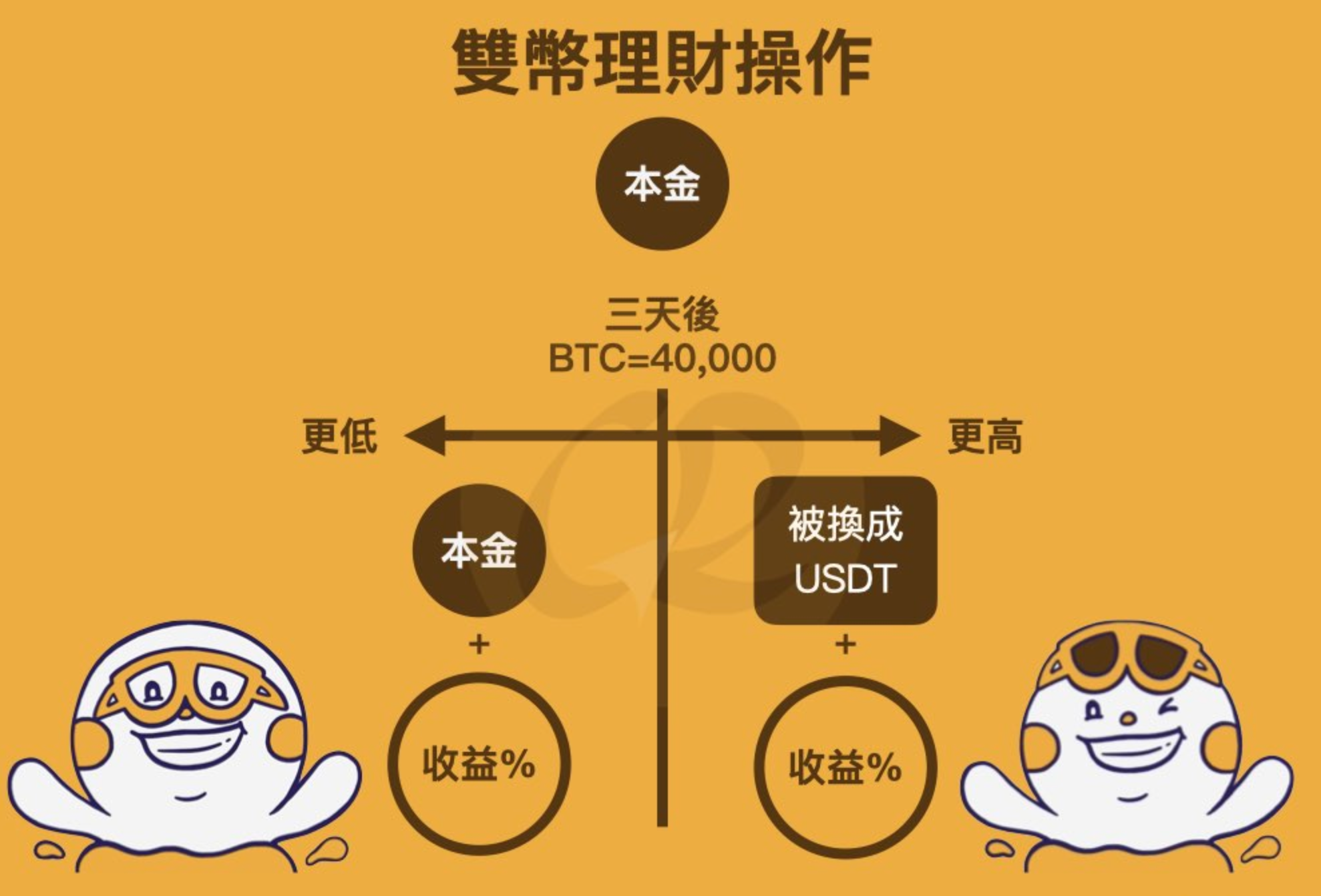

3. Structured products (such as dual currency investments): You earn "volatility premium"

This is the highest-yielding type of wealth management on exchanges, but it is also the one that most easily leads beginners to pitfalls.

It looks very enticing:

- USDT dual currency annualized 300%

- BTC dual currency annualized 400%

But behind it is not "the platform giving away money," but the additional risks you undertake.

Dual currency investment is essentially:

You are selling an option in exchange for profit.

In simpler terms:

The assets you put in may not be returned to you in the original asset form.

For instance, if you use USDT for a dual currency product, at expiration it might turn into BTC;

if you use BTC for a dual currency product, it could turn into USDT at expiration.

If you do not understand this logic, you might mistakenly think:

"What I deposited was USDT, at expiration it will definitely still be USDT."

Only to find at expiration the asset has changed to another coin, and you happened to buy at a high point; that feeling of mental collapse is quite common.

So the most important principle for beginners is:

If you don't understand structured products, don't touch structured products.

Wealth management is meant to reduce anxiety, not create more anxiety.

2. The First Step for Beginners: Doing Just One Thing is Enough

If you are doing exchange wealth management for the first time, the most recommended method is actually just one:

Stablecoin current savings.

The reason is simple.

What you lack most as a beginner is not profit but experience.

The advantages of current savings are:

- Withdrawable at any time (in most cases)

- Relatively low risk

- No risk of asset conversion

- Returns credited hourly

It's like the "Yu'ebao" in the crypto world; although the yields are not high, it's perfect for practice.

Moreover, it can solve the most painful problem for beginners:

Not knowing when to buy assets, so you park your money first to avoid wasting time.

You can understand it as:

When you are momentarily unable to make judgments, current savings are your "waiting mode."

3. How to Choose Wealth Management Across Major Exchanges?

Different exchanges have different names for wealth management products, but the underlying logic is similar.

Beginners do not need to pursue complex comparisons, you just need to know the style of each platform.

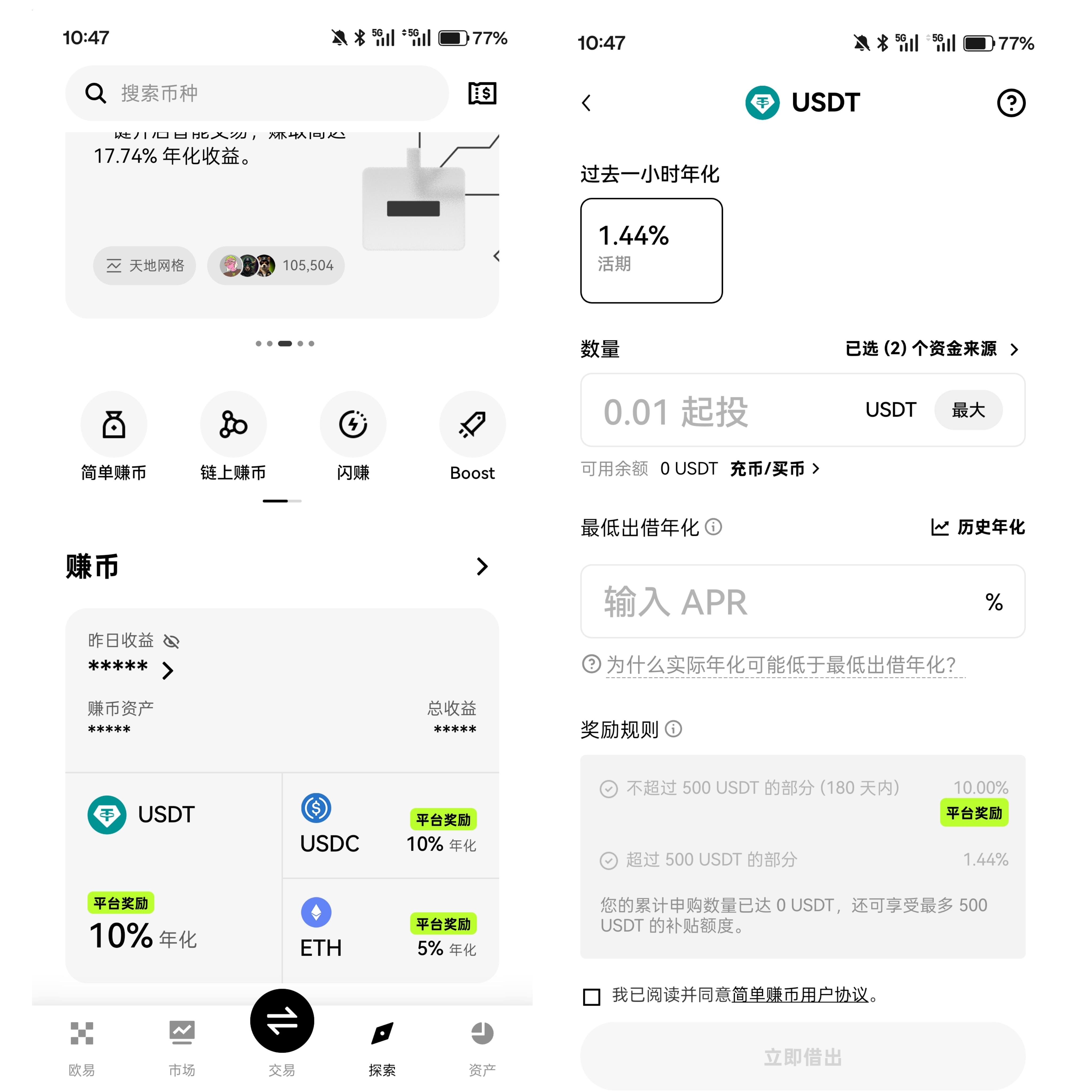

1. OKX: Clear Interface, More Comfortable for Beginners

Register for OKX using the invitation code 【aicoin20】 to enjoy a permanent 20% rebate on trading fees.

Registration link:

https://www.okx.com/zh-hans/join/aicoin20

The wealth management module on OKX can be directly found in the Explore - Earn Coins section.

OKX's characteristics include:

- Product categories are clear

- The boundary between current and fixed savings is distinct

- Operation steps are more "user-friendly"

OKX's current savings products usually tell you:

- Minimum investment amount

- Historical annualized yield

- Reward rules

Who is OKX wealth management suitable for?

Suitable for:

- Those who do not want to study complicated products

- Those who place more emphasis on the operating experience

- Those who want to earn some income using stablecoins

OKX's wealth management style resembles a "wealth management tool" rather than an "activity center."

This is a good thing for beginners.

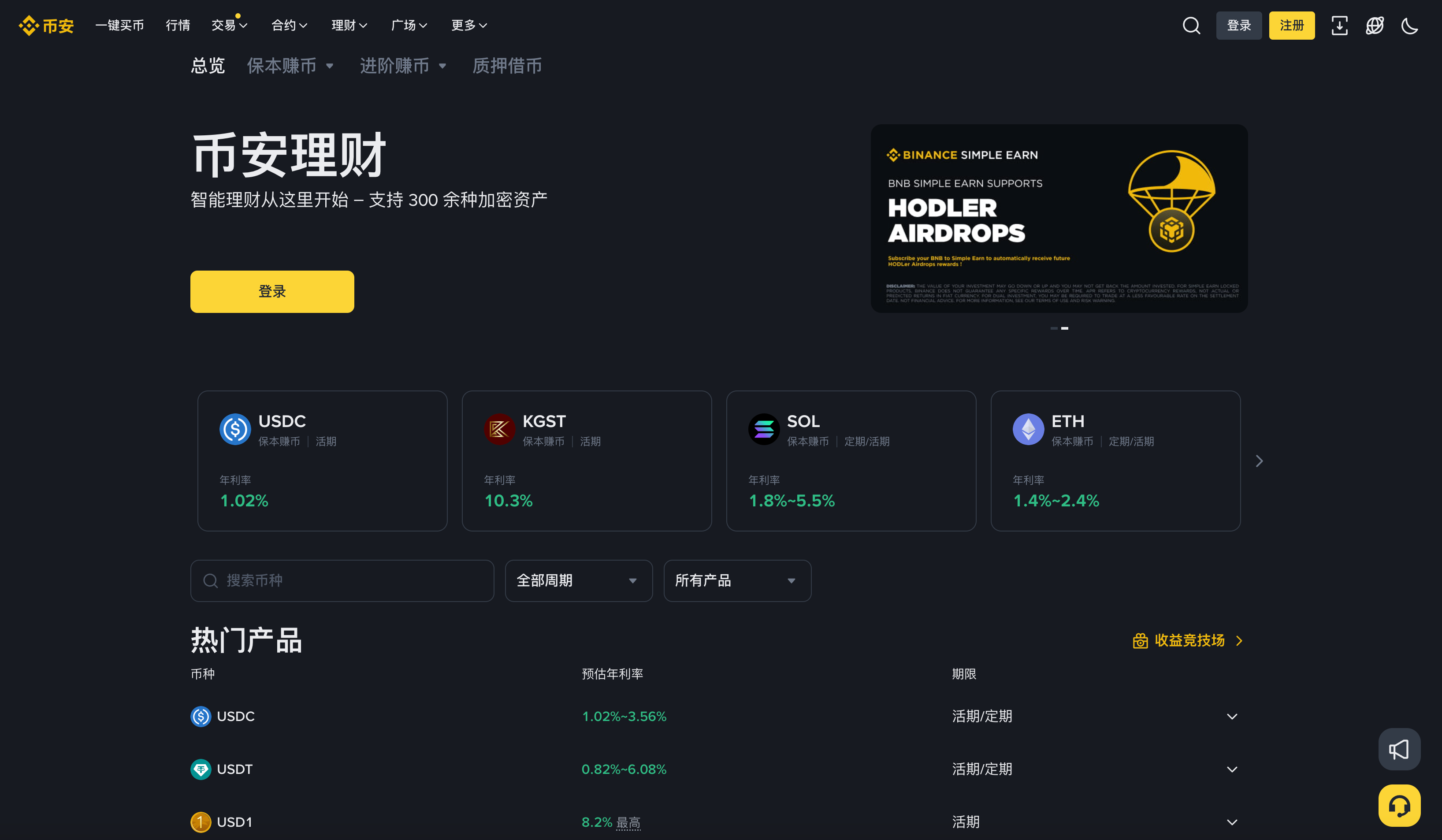

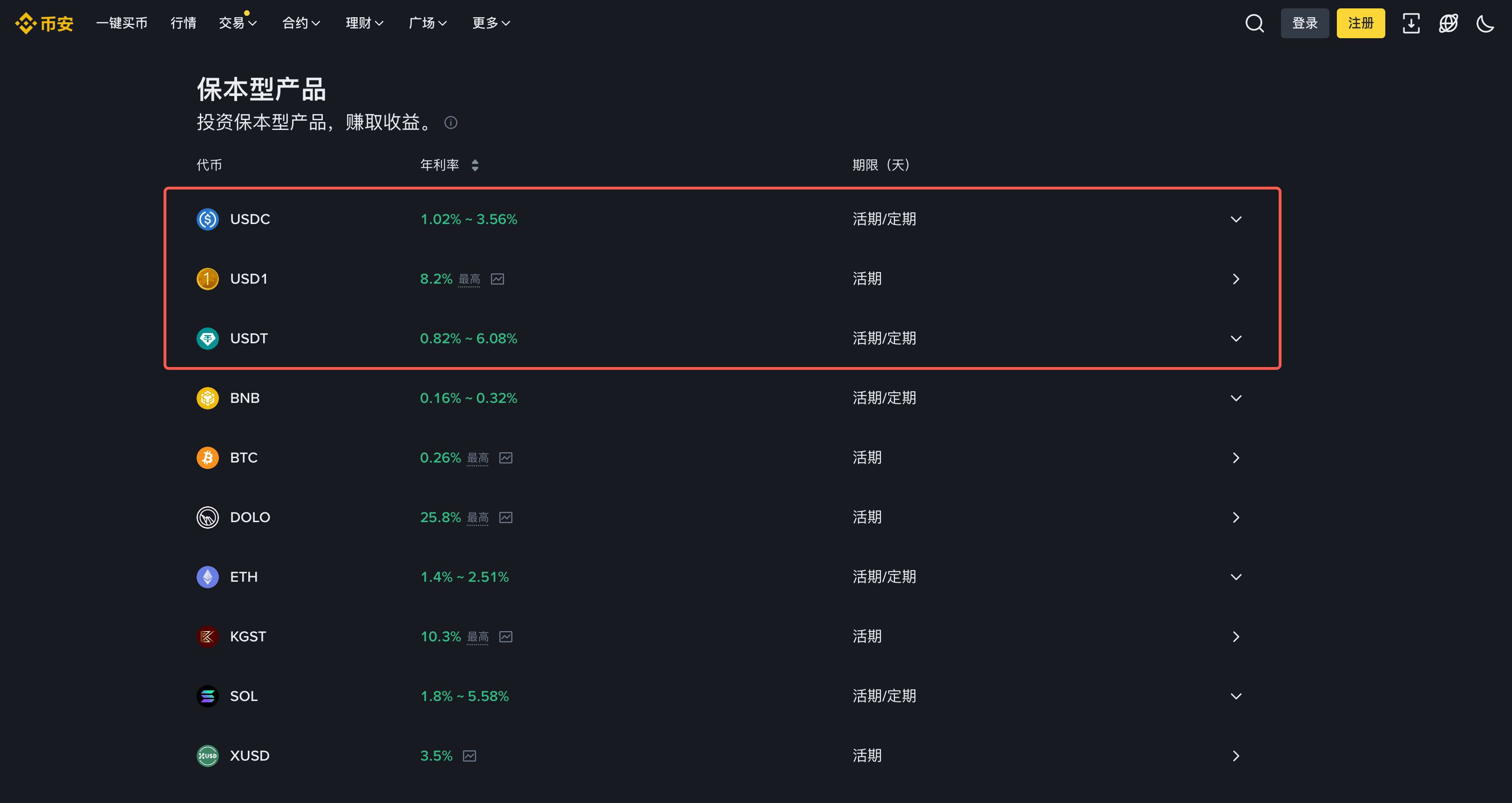

2. Binance: The Most Products, the Most Mature System

Register on Binance and use the invitation code 【h9qr216i】 to get a 10% spot trading fee rebate.

Registration link:

https://accounts.binance.com/zh-CN/register?ref=aicoin668

Binance's wealth management system is currently the most complete in exchanges.

Beginners opening Binance's wealth management page for the first time are often overwhelmed by the amount of information:

- Simple Earn (Principal Protection Earnings)

- RWUSD BFUSD (Stablecoin Earnings)

- Dual Investment

- Discount Buy

- ETH Staking

But remember one thing:

As a beginner, you only need to look at one entry on Binance: Simple Earn (Principal Protection Earnings).

How do beginners operate?

The general pathway is:

Home → Earn/Wealth Management → Simple Earn (Principal Protection Earnings) → Select USDT/USDC → Current Savings

Then you will see:

- APY Annual Percentage Yield

- Available Balance

- Estimated Daily Earnings

Who is Binance wealth management suitable for?

Suitable for:

- Those who want a rich selection of products

- Those who want to participate in Launchpool in the future

- Those who want to gradually learn about structured products

The biggest advantage of Binance is:

You only need one exchange from beginner to advanced.

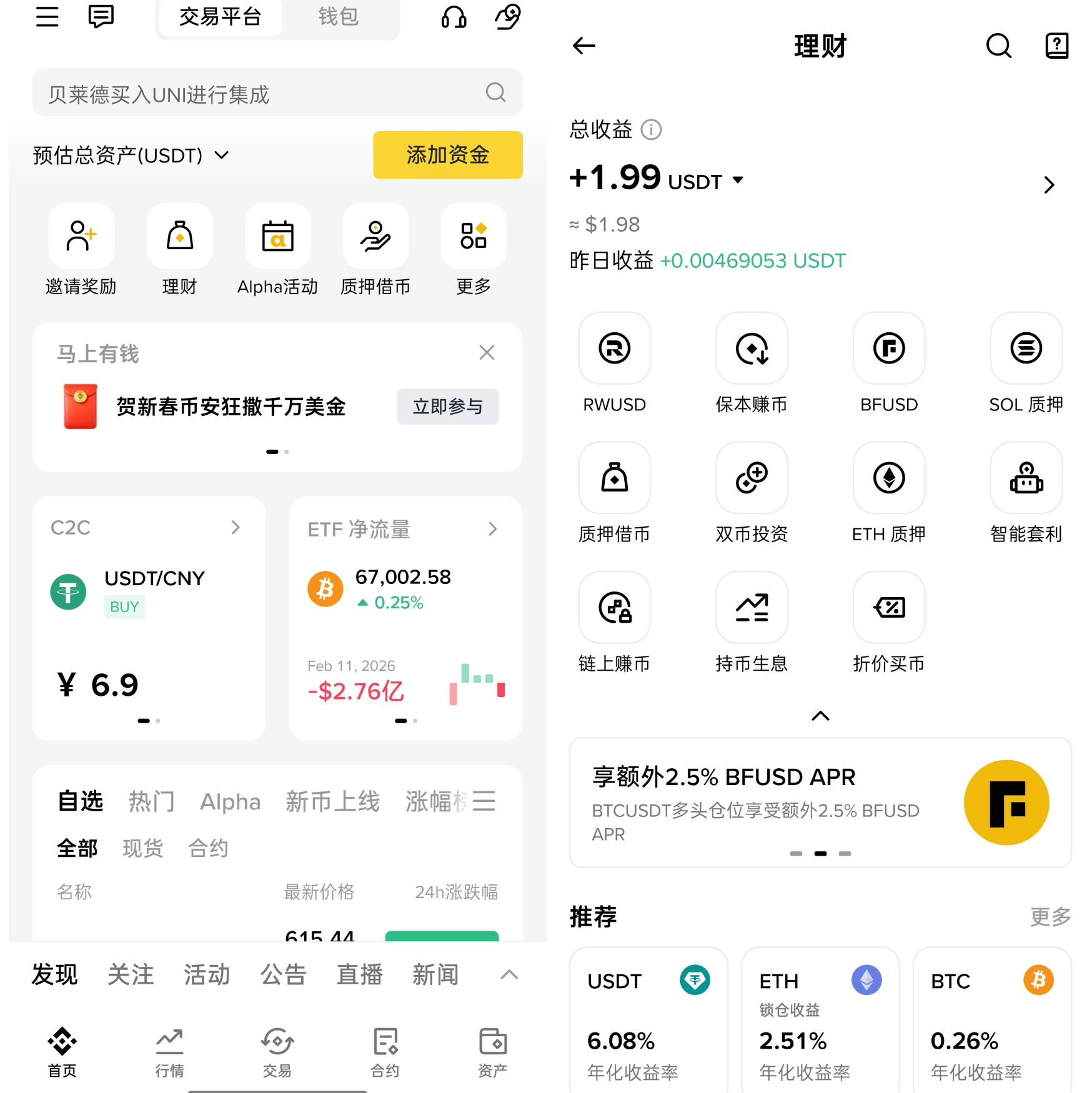

3. Gate, Bitget, etc.: Many Activities, but More Like "Hunter Mode"

Register on Bitget to enjoy a 10% fee rebate.

Registration link:

https://www.bitget.com/zh-CN/expressly?channelCode=fxbu&vipCode=hktb3191&languageType=1

Register on Gate to participate in activities and win up to $10,000+.

Registration link:

https://www.gate.com/zh/signup?ref_type=103&ref=AICOINCN

These kinds of platforms often have very attractive promotions:

- 7-day annualized 15%

- Exclusive 20% annualized for new users

- Stablecoin limited purchase

These activities can indeed bring higher returns, but beginners need to understand:

They are usually not long-term products, but short-term subsidies.

If you want to cash in on its returns, you need to meet:

- Time windows

- Grab quotas

- Activity rules

- Task requirements

Therefore, it resembles a "promotional hunting" mode.

How should beginners use this?

If you have time to study the rules, you can participate with small capital.

But do not treat it as your main wealth management channel.

Because what beginners need most is stability, not stimulation.

4. Common Pitfalls in Wealth Management Across Major Exchanges

Many beginners lose money in wealth management, not because of the market, but because they "didn't read the rules."

Here are the three most common pitfalls.

⚠ Pitfall 1: Only looking at annualized returns, not income types

You see an annualized return of 20% and excitedly click in.

Only to find:

20% is the "highest return"

But only for the first 100 USDT

The amount over this gets only 5%

This is a common "tiered return" situation.

Many platforms will write:

Up to 20%

Beginners must understand:

Up to means "the maximum possible," not "you will definitely get it."

⚠ Pitfall 2: Current savings redemption not being instant

Some platforms take time to redeem current products.

For example:

- Need to wait for system settlement

- Need to queue for redemption

- Requires T+1 before it reaches your account

This may cause your funds to still be on the way when you want to buy at the bottom.

Beginners must clearly check before operating:

- Whether redemption is instant

- Redemption arrival time

If it's not clearly stated, it's better to earn a little less and choose a more flexible option.

⚠ Pitfall 3: Dual currency investments "look like wealth management," but are actually like trading

This is the most dangerous pitfall for beginners.

With high returns from dual currency investments, beginners find it easy to think:

"After all, it's wealth management, guaranteed profit."

But the essence of dual currency products is:

You are betting on a price range with your assets.

For example:

You use 1 BTC to make a dual currency investment, targeting the price of $40,000.

At expiration:

If BTC rises above $40,000, your BTC will be sold at $40,000, earning USDT + interest.

If BTC falls, you will receive BTC + interest back.

It sounds fine, but the key is:

You do not know at what price you will be passively executed.

Once beginners are passively sold at the wrong price, they will experience:

"We earned 30U in interest, but the asset price soared by 300U."

Mental breakdown is a direct consequence.

So the conclusion is simple:

Beginners should avoid dual currency investments unless they fully understand options logic.

Conclusion

Exchange wealth management is not a tool for getting rich quickly, but a "waiting mode" for funds.

When you cannot see the market direction clearly, it can help you improve some fund utilization; however,

if you do not understand the rules, it could also lead you to pay your first tuition fee.

The most important thing for beginners is not how high the annualized return is but:

✔ Understanding the source of income

✔ Clearly seeing the locking rules

✔ Not being misled by "high returns"

✔ Not touching products you do not understand

For beginners doing exchange wealth management for the first time, just focusing on one thing is sufficient—

Protect your principal, learn the rules.

Leave the remaining profits to time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。