The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focused on digital currency market analysis, striving to convey the most valuable cryptocurrency market information to the vast cryptocurrency community. Welcome all cryptocurrency friends' attention and likes, and refuse any market smoke bombs!

This article serves as the final chapter before the New Year, wishing everyone a Happy New Year in advance. For those around the Spring Festival, take a moment to see how the market trends will drive the next market, ultimately allowing yourself to calm down a bit. There’s nothing much to summarize about the Year of the Snake; from the benefits perspective, the Year of the Snake has not been good for the cryptocurrency market. I will mainly talk about the trends for the coming year. Within this year, compared to Bitcoin, it is actually quite considerable, but personally, I chose to eliminate investments in Bitcoin. Choosing some smaller market cap currencies has led to current paper losses, but fortunately, the contract market this year has provided significant assistance to me, allowing me to comprehensively recover the losses at the last moment. Looking at cryptocurrency applications individually, more and more countries are joining, and countries like South Korea, Japan, and even Vietnam and Thailand are vigorously promoting cryptocurrency market applications.

Looking at the European market again, the establishment of the UK, France, and Germany has already occurred, and our neighbors India and Russia are applying it even more widely. Many friends also do not understand why the domestic market is so tightly restrained. In fact, the logic is not difficult to explain; the opening of the financial market does not suit us at this moment. Especially the cryptocurrency market itself is extremely speculative. Which industry related to Bitcoin does not have some connection to the gray market? Our path is based mainly on the real industrial economy, not virtual economy. Russia’s inclusion is merely due to sanctions; various countries do not recognize the ruble, while Korea and Japan push for financial policies that align extremely well with cryptocurrencies. Vietnam does not need much mention, as there are casinos, and Thailand focuses on tourism economy. The domestic currencies of these countries do not account for much in the global payment system, not to mention their close relations with the United States; the survival of small countries requires backing from big countries.

There is no need to speculate too much on Europe; their alignment has already generated currencies like the euro, and cryptocurrency is merely allowing them to have another consensus currency. However, the need for solidarity requires a strong fire. From Bitcoin’s perspective, these countries must embrace it; only after unifying their currency can their interests be greatly amplified. The countries that cannot support this are also very clear: one is a huge agricultural country, and the other is an industrialized country. These are all labor-producing nations, and their openness can only harm their national interests. This remains a consensus logic; everyone with money wants better support, and naturally, the outflow of assets needs to be controlled. On this point, I share the same view as CZ: freedom is always within rules. If a great person says to take a step back for one person to become rich first, the result is that the rich person starts to flow out; what remains for the others?

From these contradictions, we can see that the promotion of cryptocurrencies has a long way to go. How can all countries accept it? In my understanding, this is not an easy task; not even peace can be guaranteed. Once the cryptocurrency chain is opened, for us, it would be akin to a financial crisis. Therefore, I support the domestic crackdown on cryptocurrencies; everyone should be clear that suppression and prohibition are two different concepts; individual users can still purchase. Based on the previous application scenario of Bitcoin, it does indeed have the potential for explosive growth at this stage. Many of the aforementioned countries previously had a hostile attitude towards the cryptocurrency circle; their current acceptance is actually a pass for the crypto circle, indirectly promoting its growth. So for ordinary users, all they need to do is find valuable coins and then verify them. Which coins will have actual value in the future? My view may differ from many; firstly, in my understanding, Bitcoin does not have long-term holding value.

Everyone should remember the term long-term; this long-term may be a ten-year period. Due to the rapid growth of the crypto circle in the past two years, many novices have joined. Therefore, their understanding of the crypto circle is slightly off. Bitcoin processes only 7 transactions per second, and this alone determines that future stable coins will not use the Bitcoin channel for symbiosis. Utilizing the Bitcoin channel would cause congestion, a congestion that many novice users have not experienced. I still remember in reality, before 2020, when using the ERC channel, it hadn’t yet upgraded to 2.0, encountering severe market fluctuations, a single transfer could even wait in line for half an hour. This was with Ethereum’s channel; don’t even mention Bitcoin, which takes even longer when congested. The future use of Bitcoin channels will not be too widespread; instead, these stable coin application channels may hold great potential. In my view, Bitcoin serves more as a collectible value; as long as there is consensus, Bitcoin will not collapse.

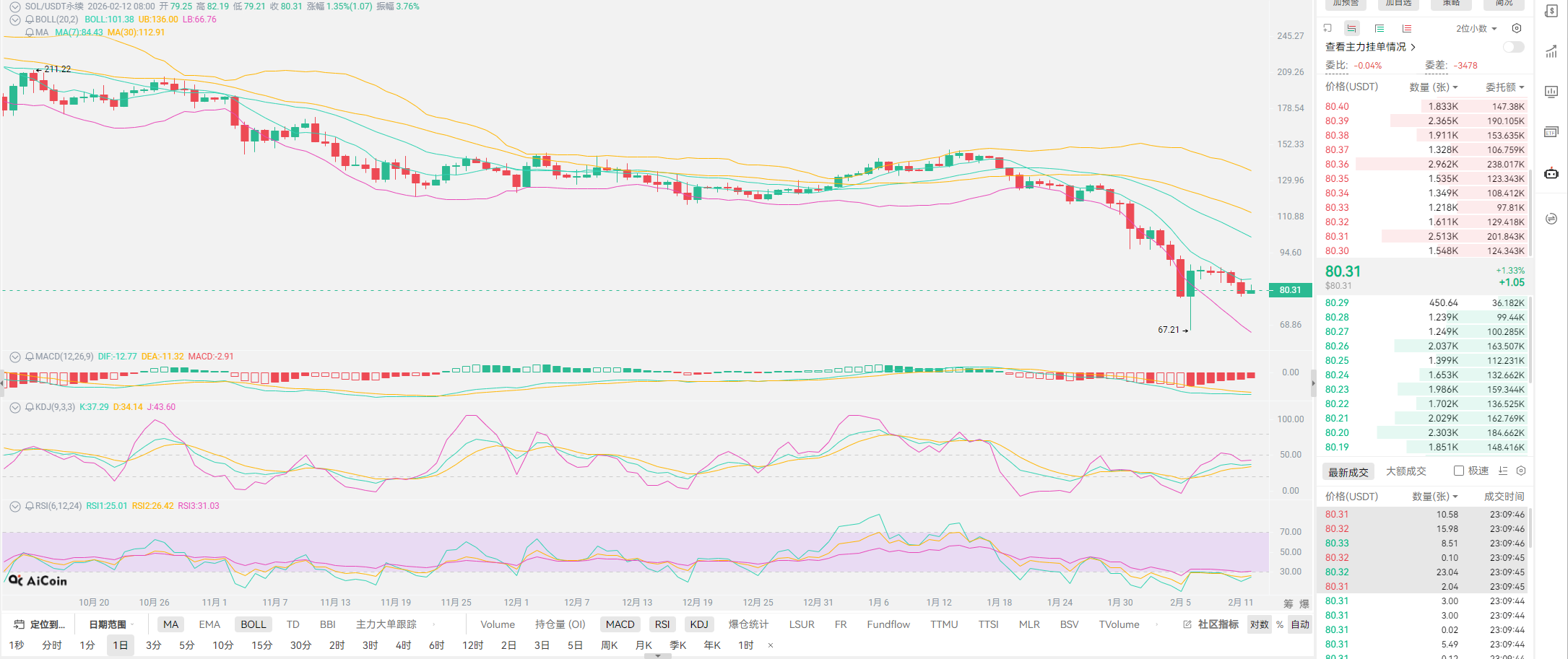

It is not to say that if the use is not extensive, the value of this coin is not great; BTC is an extremely special existence. The emergence of stable coins is more aimed at BTC. Among all cryptocurrencies, those possessing decentralized attributes now only include BTC. Meanwhile, the future applications of Ethereum and SOL are completely different from Bitcoin; their on-chain capacity and operational speed far exceed traditional cryptocurrencies. This can be seen from the issuance quantities of UCDC; the reliance on stable coins will drive up coin prices. If anyone believes that stable coins will become the mainstream in the future, as stable coins are issued more and more, the greater the market grows, the more blocks will open for these two types of coins, and the more participants in maintenance will increase. Even if quantum decryption appears in the future, most people would not dare to touch coins related to stable coins; referring to the paths of Alipay and WeChat makes this clear. It is precisely because of this, I hold strong confidence in these two coins; as long as the crypto circle still has a bull market, these two coins will definitely reach new highs.

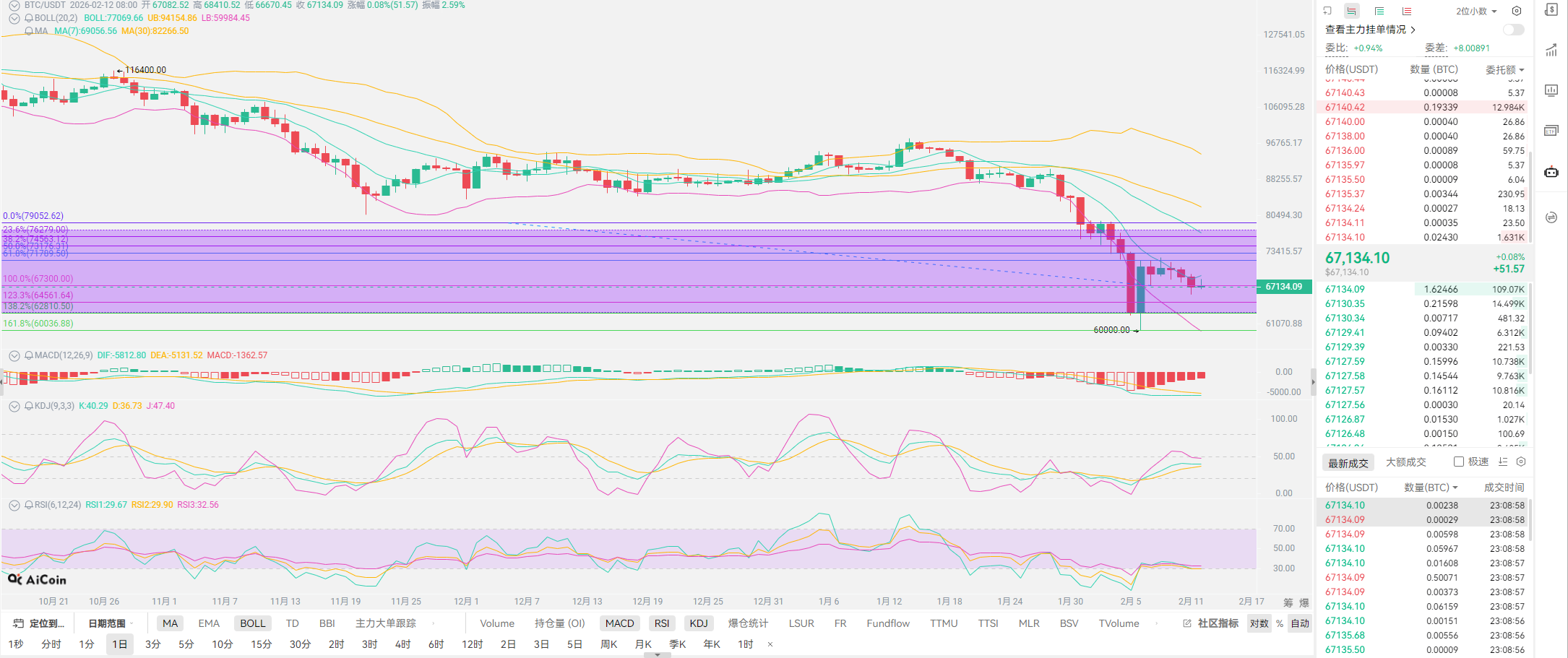

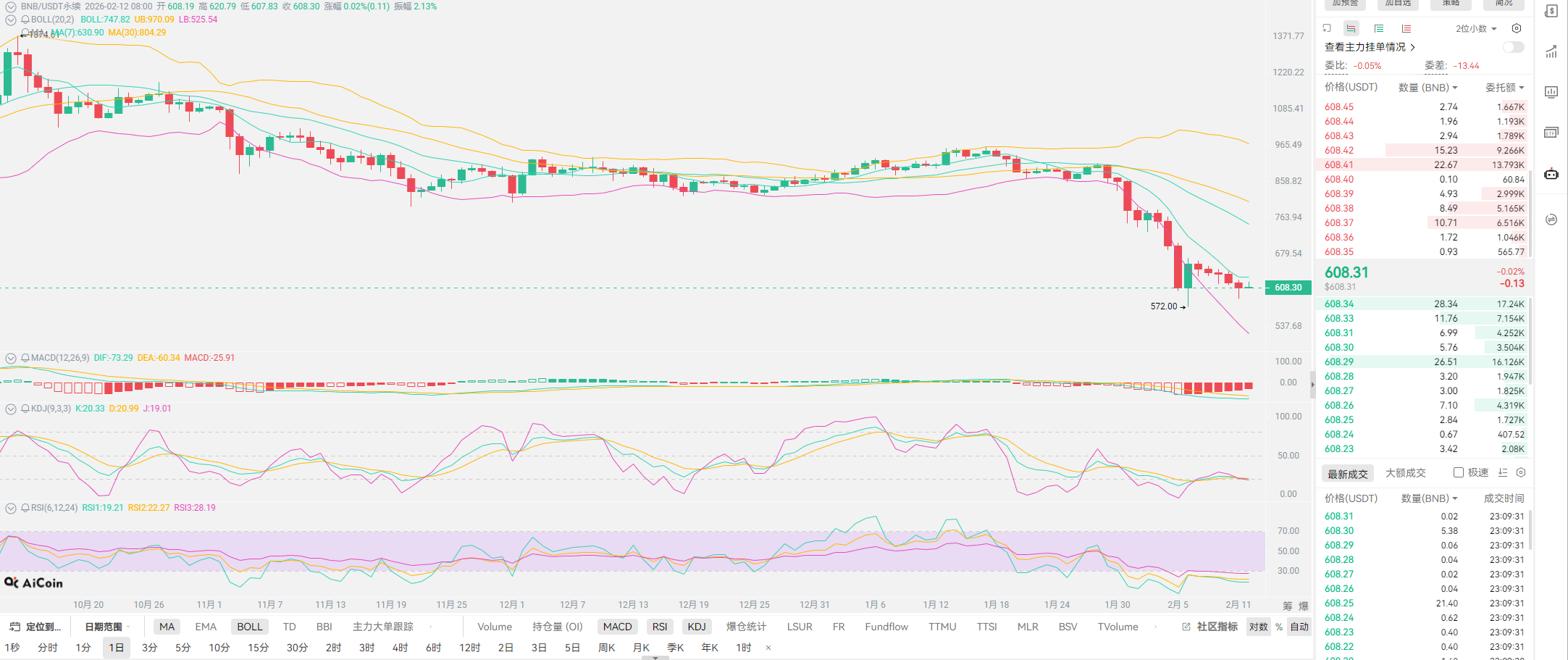

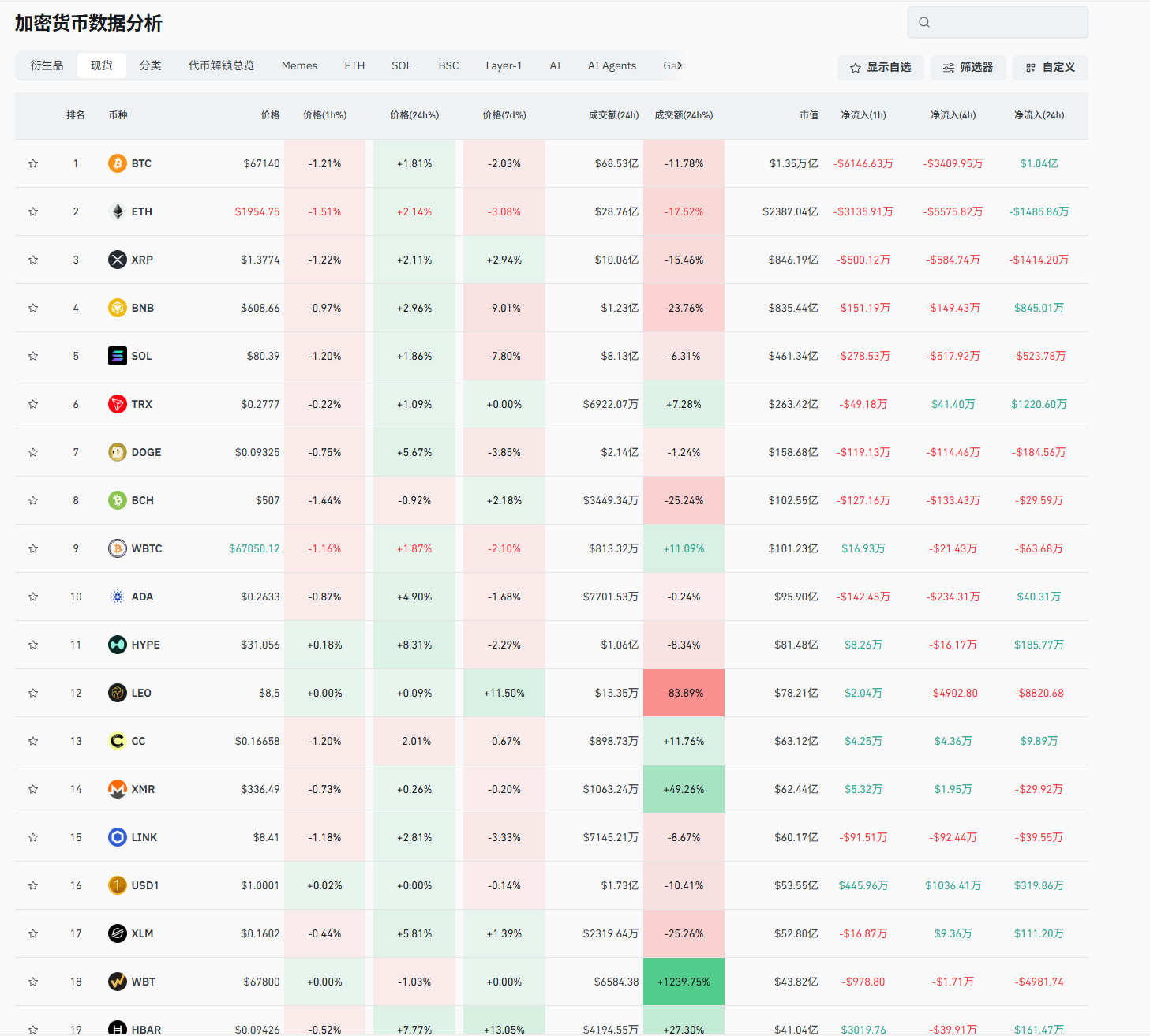

I summarize: In the past two days, there has also been a peak of data explosion from the US, but I did not explain much about non-farm data. Everyone should remember, as long as there is no expectation of interest rate cuts in the short term, non-farm data will not hold much significance for the cryptocurrency market. This year’s interest rate cuts have been postponed to mid-year; the reference significance of the data at the beginning of the year is not significant; if there are no rate cuts in March, the only valuable reference data left will be in April and May; these two months' data will determine whether there are rate cuts in June and July. I remind everyone that there is indeed a possibility that Walsh's appointment could coincide with rate hikes and balance sheet reductions, which are currently the two most concerning points for the market. These two points will definitely not occur this year, but 2027 needs close attention; risks that need to be avoided should be prepared by the end of 2026. Regarding short-term market conditions, I have drawn a range chart; you can learn to look at it yourself, this structural chart has been provided to you long ago. During the Spring Festival, everyone pay attention to the risks; those with spot positions should uninstall Binance, and those with contracts should pause and wait until I am back to work to discuss further. If you have market questions, you can ask me before the 15th; although the articles will be paused, subsequent work will still continue. At the end of the article, once again wish everyone a prosperous New Year! There will definitely be new highs in 2027!

Original creation by WeChat public account: Lao Cui Talks about Coins For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; masters can see five steps, seven steps, or even ten steps ahead, while the less skilled can only see two or three steps. The master considers the big picture and the overarching situation, not weighing every single piece or plot, aiming for the ultimate victory; the less skilled will fight for every inch, frequently switching between long and short positions, only competing for the momentary short-term, consequently struggling frequently.

This material is for learning and reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。