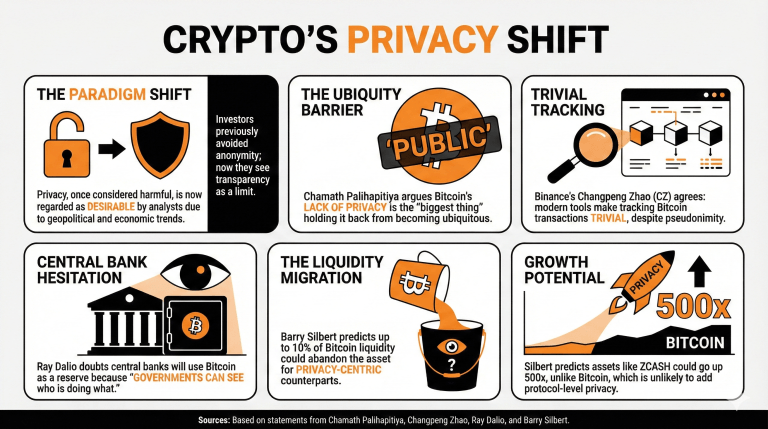

Privacy, a property once considered harmful to cryptocurrency assets, is now regarded as desirable by bitcoin analysts because of recent geopolitical and economic trends.

Not so long ago, exchanges avoided currencies like Monero or Zcash due to their anonymity properties. Nowadays, investors like Chamath Palihapitiya, Changpeng Zhao, Ray Dalio, and Barry Silbert have singled out bitcoin’s lack of privacy as a growth-limiting factor.

Recently, Palihapitiya stated that he would not classify himself as a bitcoin maximalist because of BTC’s lack of privacy features. While interviewing Binance co-founder Changpeng Zhao, he underscored that this was probably “the biggest thing” holding back bitcoin from becoming ubiquitous.

Zhao agreed, highlighting that privacy played a fundamental role in our society and that bitcoin’s design strived for pseudonimity, but that today’s possibilities made tracking a bitcoin transaction trivial. Both acknowledged that there were use cases where privacy was very important.

In January, Palihapitiya predicted that central banks would move from gold and bitcoin to a new cryptographic paradigm composed of “fungible, tradable, and completely secure and private” assets.

Legendary investor Ray Dalio, a gold proponent, also pointed out the problems that central banks trying to acquire bitcoin as a reserve asset would face.

“I doubt that any central bank will take it on as a reserve currency because everybody can understand and watch. Governments can see who is doing what transactions on it. There’s no privacy to it,” he stated in October.

And now, Digital Currency Group’s (DCG) founder, Barry Silbert, has even predicted that up to 10% of bitcoin liquidity would abandon the prime cryptocurrency for privacy-centric counterparts.

“Unless the U.S. dollar completely collapses, Bitcoin is not going to go up 500x. I think Zcash can go up 500x. I think a Bittenser can go up 500x,” he added, explaining that bitcoin was unlikely to include privacy features at a protocol level.

- How has the perception of privacy in cryptocurrency changed recently?

Privacy, once seen as a drawback for cryptocurrencies, is now viewed as an asset by analysts due to shifting geopolitical and economic conditions. - What do notable investors say about Bitcoin’s lack of privacy features?

Investors like Chamath Palihapitiya and Changpeng Zhao believe Bitcoin’s insufficient privacy is a significant barrier to its broader adoption. - What concerns did Ray Dalio express regarding Bitcoin as a reserve asset?

Ray Dalio highlighted that central banks would likely avoid Bitcoin due to its transparency, making it unsuitable for use as a reserve currency. - What predictions have been made about Bitcoin liquidity in favor of privacy coins?

Barry Silbert suggested that up to 10% of Bitcoin’s liquidity could shift to privacy-focused cryptocurrencies if Bitcoin does not incorporate necessary privacy features.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。