At this level, bitcoin is perched at a technical crossroads, hovering just beneath a clearly defined resistance band as momentum works to stabilize price action. While the broader structure remains corrective within a larger downtrend, shorter time frames are beginning to lean upward, pressing against a key inflection point that could determine whether this consolidation resolves into continuation or fades back into prevailing weakness.

On the daily chart, bitcoin continues to reflect a relief bounce inside a dominant bearish structure. Price previously printed a major high near $97,900 before cascading to $59,930, followed by a rebound into the $70,000 to $71,000 region. However, lower highs remain intact, and consolidation is unfolding beneath $72,000. Resistance levels are clearly defined at $72,000, $75,000, and $80,000, while support rests at $65,000 and the major structural pivot at $60,000. A loss of $60,000 would confirm continuation of the broader downward trend. In short, the daily bias remains technically bearish, and this current advance resembles a corrective rally rather than a confirmed reversal.

BTC/USD 1-day chart via Bitstamp on Feb. 15, 2026.

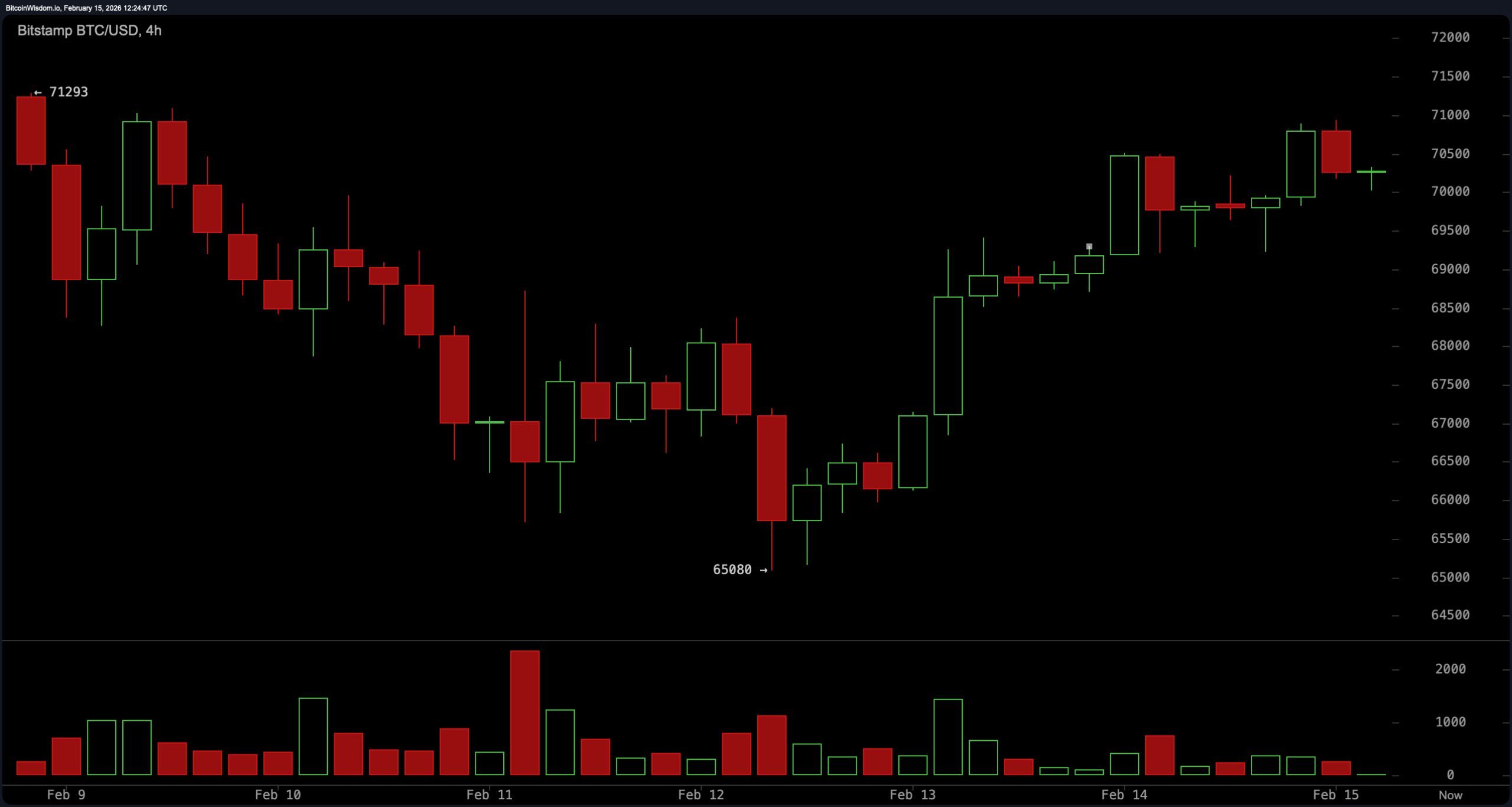

The four-hour chart tells a more nuanced story. A higher low formed at $65,080, followed by a sequence of higher highs pushing into the $71,000 area. That establishes a short-term bullish structure within the broader daily downtrend. Price is now stalling beneath the $71,500 to $72,000 breakout zone. A decisive four-hour close above $72,000 would open the path toward $75,000, while rejection in this region increases the probability of a retracement toward $68,000. Should $68,000 fail to hold, 65,000 becomes the next critical support. This is a textbook compression under resistance, and the market rarely rewards hesitation.

BTC/USD 4-hour chart via Bitstamp on Feb. 15, 2026.

On the one-hour chart, price action shows higher highs into $70,937, followed by a modest pullback. Volume is not expanding aggressively, suggesting participation is measured rather than euphoric. The structure resembles a shallow consolidation or bull flag formation beneath resistance. However, without a convincing surge in volume, breakout attempts risk fading. In other words, this is a decision zone, not an impulse zone. Bitcoin is coiling, but it has yet to prove it can deliver sustained follow-through.

BTC/USD 1-hour chart via Bitstamp on Feb. 15, 2026.

Oscillators reflect a market lacking decisive momentum. The relative strength index ( RSI) prints 39, signaling neutral conditions. The Stochastic oscillator stands at 47, also neutral, while the commodity channel index (CCI) registers negative 43, remaining neutral. The average directional index (ADX) reads 56, indicating trend strength but without directional bias. The Awesome oscillator shows negative 13,224, neutral. Momentum, at 7,509, signals upside pressure, and the moving average convergence divergence ( MACD) level at negative 5,000 signals positive momentum per the dataset. Collectively, oscillators show stabilization rather than conviction, which aligns with the consolidation narrative.

Moving averages (MA) lean decisively toward caution. The exponential moving average (EMA 10-day) at $70,146 and the simple moving average (SMA 10-day) at $69,107 signal short-term upward pressure. However, the EMA (20) at $73,841 and SMA (20) at $74,184 shift back to downside pressure, a pattern that continues with the EMA (30) at $76,965 and SMA (30) at $79,518, the EMA (50) at $81,187 and SMA (50) at $84,269, the EMA (100) at $87,842 and SMA (100) at $87,696, and the EMA (200) at $94,124 alongside the SMA (200) at $100,569 — all reflecting broader downside structure. In short, short-term averages are attempting stabilization, but the higher time frame trend still looms large, and resistance is not easily intimidated.

Bull Verdict:

If bitcoin secures a clean four-hour close above $72,000, the short-term bullish structure gains confirmation and opens the path toward $75,000, with $80,000 as the next extension level. The higher low at $65,080 and the sequence of higher highs on the four-hour chart provide a constructive base, while short-term moving averages — notably the EMA (10) and SMA (10) — are aligned with upside pressure. Momentum and the MACD are also signaling positive short-term conditions per the dataset. A sustained breakout, accompanied by expanding volume, would shift this from a relief rally to a more durable recovery phase.

Bear Verdict:

Failure to clear $72,000 followed by a loss of $68,000 would shift control back toward the broader daily downtrend. The daily structure remains technically bearish, with lower highs intact and price consolidating beneath key resistance. The majority of higher time frame moving averages — including the EMA (50), SMA (100), EMA (200), and SMA (200) — continue to signal downside pressure. A break below $65,000 would expose the major structural pivot at $60,000, and a loss of that level would strongly reinforce continuation of the prevailing bearish trend.

- What is the current bitcoin price on Feb. 15, 2026?

Bitcoin is trading at $69,397with a 24-hour range between $69,286 and $70,897. - Is bitcoin bullish or bearish right now?

The daily chart remains technically bearish, while the four-hour chart shows short-term bullish structure under $72,000 resistance. - What are the key bitcoin resistance and support levels?

Major resistance sits at $72,000, $75,000, and $80,000, while key support levels are $68,000, $65,000, and the structural pivot at $60,000. - What do bitcoin’s technical indicators signal today?

The relative strength index ( RSI), Stochastic oscillator, and commodity

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。