The second full week of February unfolded like a tug-of-war. Early inflows offered hope, but midweek selling pressure ultimately defined the tape, especially for bitcoin and ether.

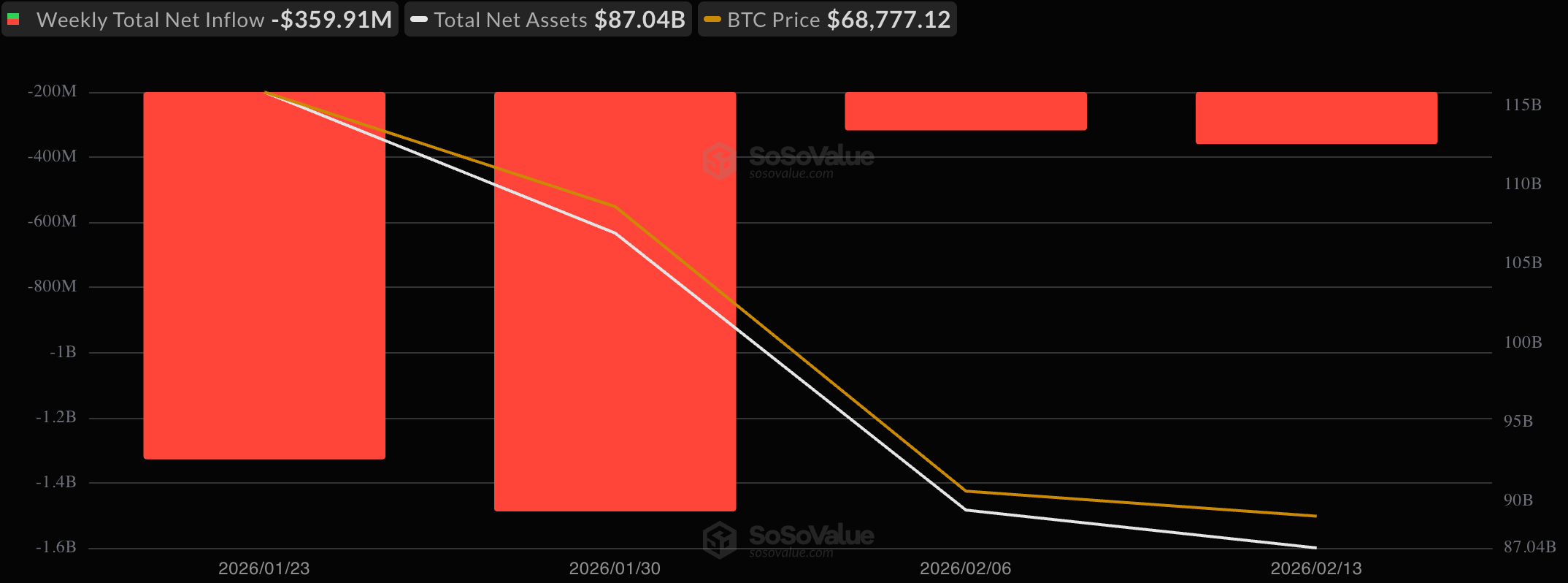

Spot bitcoin ETFs closed the week with $359.91 million in net outflows. Blackrock’s IBIT endured sustained pressure, beginning with a $20.85 million outflow on Monday, Feb 9, followed by $73.41 million on Wednesday, $157.56 million on Thursday, and another $9.36 million on Friday, partially offset by a $26.53 million inflow on Tuesday, leaving the fund down roughly $234 million for the week.

Fidelity’s FBTC swung sharply, opening with a $3.08 million inflow before shedding $92.60 million and $104.13 million midweek, then recovering with $11.99 million on Friday, a net weekly loss of about $124 million. Grayscale’s GBTC finished down roughly $77 million, while Ark and 21shares’ ARKB lost close to $19 million. Smaller products, including BITB, HODL, EZBC, BTCO, and BRRR, all ended negative, while Grayscale’s Bitcoin Mini Trust was one of the few bright spots, posting net weekly inflows of roughly $7 million.

Four consecutive weeks of outflows for bitcoin ETFs

Ether spot ETFs recorded $161.15 million in weekly outflows. Blackrock’s ETHA led losses with cumulative redemptions exceeding $112 million, while Fidelity’s FETH shed roughly $40 million across multiple sessions. Grayscale’s ETHE was negative with a $24.90 million exit, but its Ether Mini Trust saw inflows of $49.90 million. Bitwise’s ETHW (-$32.82 million) and 21Shares’ TETH (-$2.88 million) also contributed to the drawdown. Despite brief inflow days, ether finished the week fully in the red.

XRP spot ETFs, by contrast, delivered $7.65 million in net inflows. Franklin’s XRPZ ($5.42 million) and Bitwise’s XRP ($3.92 million) consistently attracted capital, while Canary’s XRPC added incremental gains. Grayscale’s GXRP experienced midweek volatility but ultimately failed to reverse the broader positive trend. XRP quietly emerged as one of the week’s steadiest performers.

Solana spot ETFs posted $13.17 million in net inflows, the strongest relative showing among major crypto ETFs. Bitwise’s BSOL ($12.72 million) accounted for the bulk of gains with steady buying throughout the week. Fidelity’s FSOL and Invesco’s QSOL added support, while minor outflows from Vaneck’s VSOL did little to derail momentum.

In the end, the week reflected a clear divergence. Bitcoin and ether absorbed heavy institutional selling, while XRP and aolana attracted selective capital, a sign that investors are rotating, not retreating, within the crypto ETF market.

FAQ 📊

- Did bitcoin ETFs lose money this week?

Yes, bitcoin spot ETFs recorded roughly $360 million in net outflows from Feb. 9–13. - How did ether ETFs perform?

Ethereum spot ETFs saw about $161 million in cumulative outflows during the week. - Which crypto ETF category performed best?

Solana ETFs led with approximately $13 million in net inflows. Were XRP ETFs positive overall?

Yes, XRP spot ETFs posted around $7.6 million in net inflows for the week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。