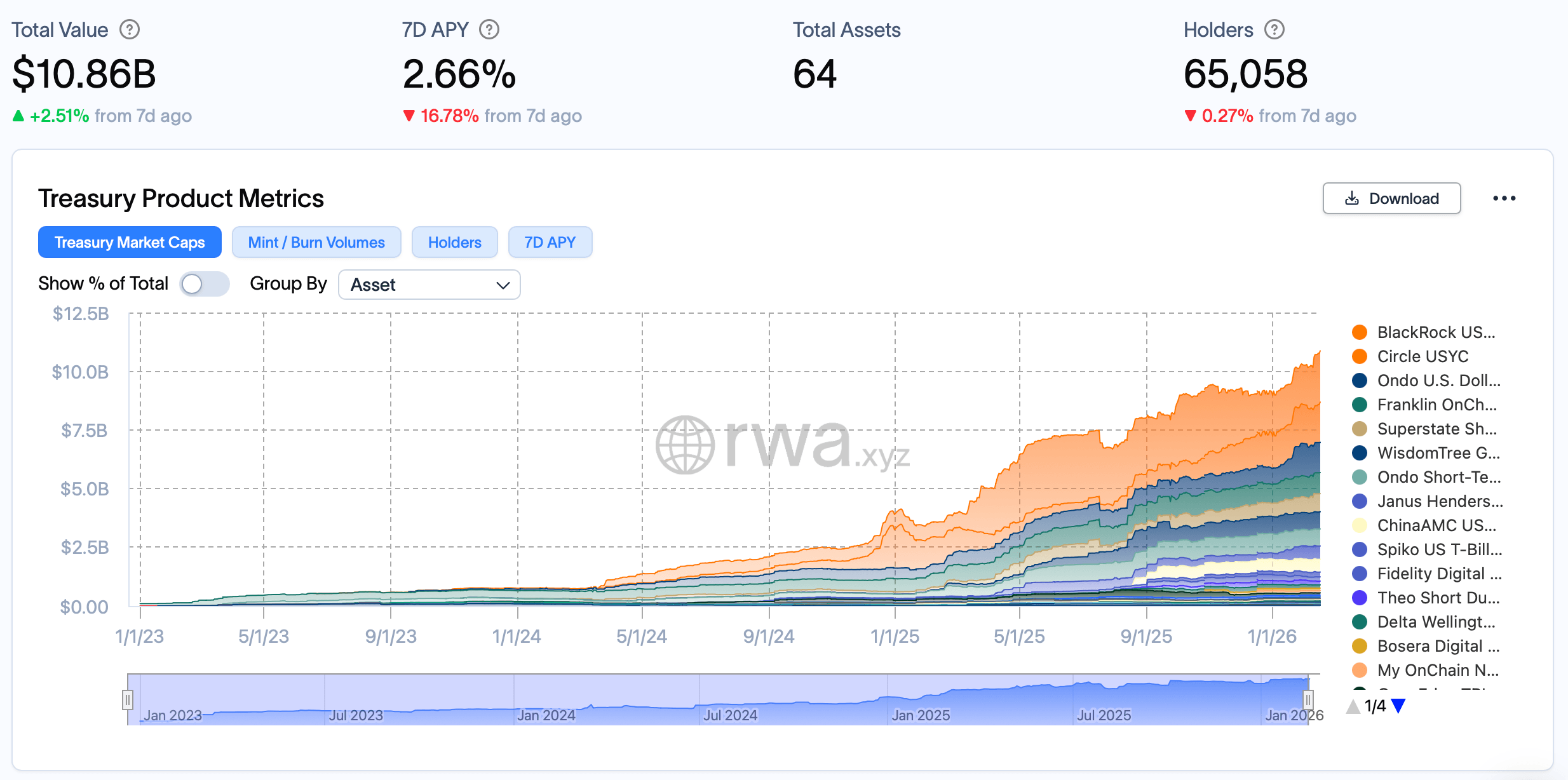

This week, rwa.xyz data shows the tokenized U.S. Treasuries sector climbing 2.51% over the past seven days, inching ever closer to the $11 billion mark. At present, it sits just shy of that line at $10.86 billion.

Rwa.xyz figures show the average seven-day annual percentage yield across the sector at 2.66%, a 16.78% drop from the prior week. The total number of tokenized U.S. bond holders today stands at 65,058, marking a 0.27% dip over the same stretch. When it comes to chain distribution, Ethereum still wears the crown, hosting $5.5 billion of the tokenized U.S. Treasury sector’s total value.

BNB Chain comes next with $2.1 billion, while Solana carries $892.6 million and Stellar represents $829.3 million. Smaller — yet still meaningful — slices include Aptos at $304.8 million, XRP Ledger at $299.8 million, Avalanche C-Chain at $294.1 million and Arbitrum at $197.3 million, with the rest spread across a mix of other networks.

Over the past month, Blackrock’s BUIDL fund led the pack with $460 million in net inflows. Ondo’s USDY product pulled in $302 million, trailed by Circle’s USYC at $251 million. Superstate’s USTB added $148 million, while Centrifuge’s JTRSY secured another $103 million. Additional inflows rolled in from Spiko’s USTBL at $37 million, Libeara’s CUMIU at $31 million and Zeconomy’s DCP at $30 million, adding a few more bricks to the steadily rising pile.

On the outflow front, Fidelity’s new tokenized U.S. Treasury fund, FDIT, posted a $36 million drop, while Ondo’s OUSG logged $45 million in net redemptions. As of today, the sector includes 64 treasury products in total. Blackrock’s BUIDL, issued by Securitize, sits at the top of the table with $2.17 billion in value.

BUIDL is trailed by Circle’s USYC at $1.71 billion and Ondo’s USDY at $1.28 billion. Franklin Templeton’s BENJI holds $897.1 million, while Superstate’s USTB accounts for $771.9 million. Wisdomtree’s WTGXX commands $730.6 million, with Ondo’s OUSG close behind at $727.2 million.

Janus Henderson’s JTRSY stands at $566.5 million, ChinaAMC’s CUMIU carries $544.3 million and Spiko’s USTBL accounts for $204.1 million. Fidelity’s FDIT closes out the lineup with $179.4 million in assets.

With the sector hovering just below the $11 billion mark, that milestone now looks less like a distant target and more like a formality waiting to be checked off. Capital continues to rotate into tokenized Treasuries at a measured pace, reinforcing their role as a digital extension of traditional fixed-income exposure.

Growth has remained consistent since last year’s wave of demand first gathered momentum, and the cadence has yet to meaningfully cool. If the current trajectory holds, the sector’s climb toward — and likely beyond — $11 billion appears more procedural than speculative.

- What is the total value of the tokenized U.S. Treasury market in 2026? The sector stands at approximately $10.86 billion and is nearing the $11 billion milestone.

- How much has flowed into tokenized U.S. Treasuries this year? Since the start of 2026, these products have recorded $1.9 billion in net inflows.

- Which blockchain hosts the most tokenized U.S. Treasury products? Ethereum leads all networks, holding $5.5 billion of the sector’s total value.

- Which funds control the largest share of tokenized Treasury assets? Blackrock’s BUIDL ranks first at $2.17 billion, followed by Circle’s USYC and Ondo’s USDY.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。