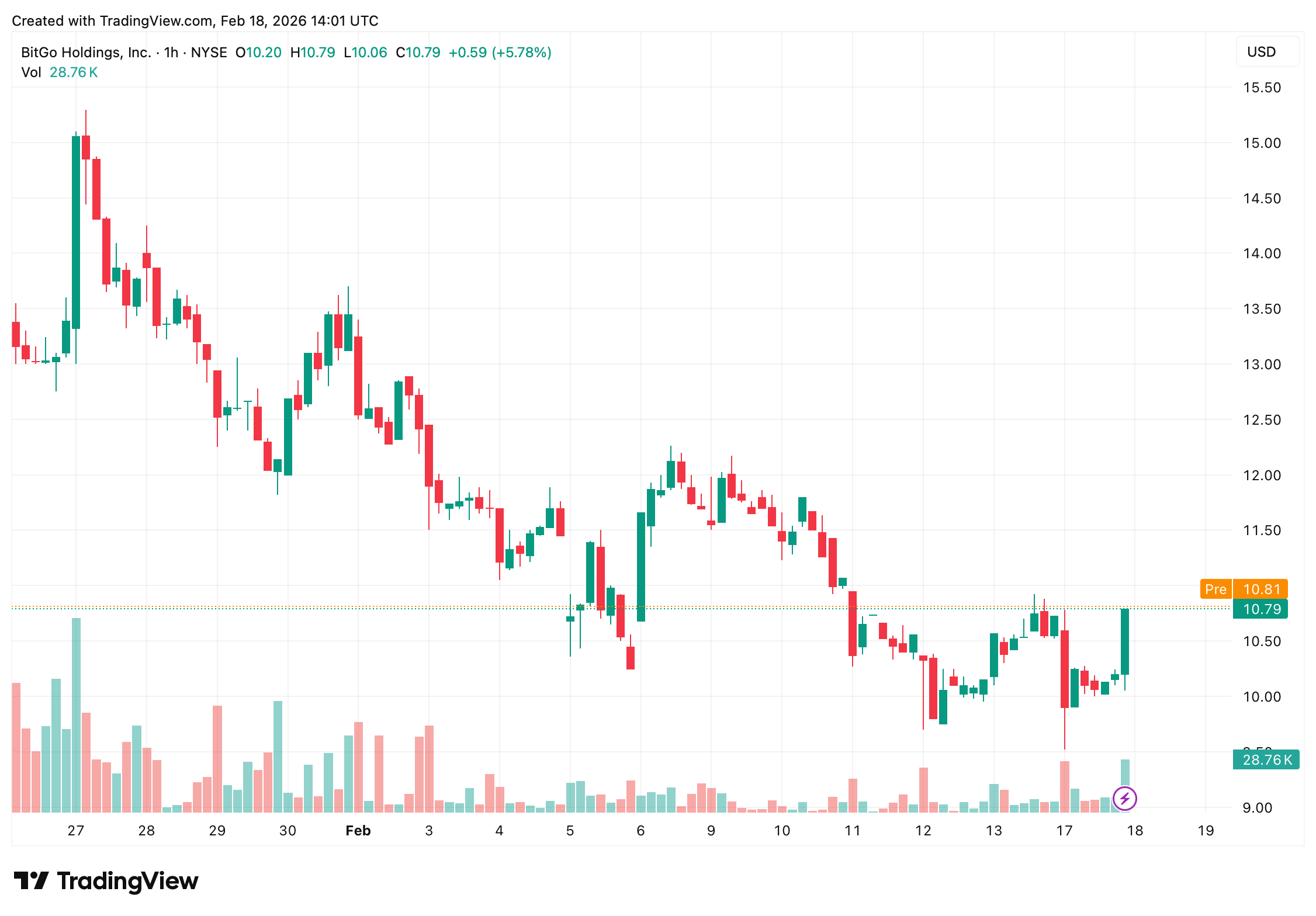

In a Feb. 17 note, Mizuho analysts Dan Dolev and Alexander Jenkins launched coverage of Bitgo Holdings Inc. (NYSE: BTGO) with a target implying roughly 50% to 60% upside from the stock’s recent closing range near $10.87. The call arrives as shares remain under pressure following the company’s public debut, with the stock sliding about 50% in terms of all-time percentage losses logged by tradingview.com.

The Mizuho analysts describe Bitgo’s custody infrastructure as “military-grade,” pointing to its security record and institutional focus as key differentiators. Founded in 2013, the company has avoided major hacks, a track record Mizuho frames as critical in a sector where security lapses can be existential.

Unlike crypto firms heavily dependent on trading volumes, Bitgo derives more than 80% of revenue from stable, recurring streams such as custody and staking services. That composition, Mizuho strategists argue, provides insulation during downturns and positions the firm more like infrastructure than a brokerage.

Scale is another pillar of the Mizuho thesis. Bitgo safeguards more than $100 billion in assets under custody, a figure researchers highlight as evidence of institutional trust. Revenue is projected to grow at a compound annual rate of about 28% through 2027, outpacing some competitors, as adoption of cryptocurrencies, stablecoins, and tokenized real-world assets ( RWAs) expands.

The firm also points to Bitgo’s proprietary Go Network, which allows clients to trade and settle transactions while keeping assets in cold storage, describing it as a defensive moat. Regulatory positioning, including U.S. trust charters and a national trust bank structure, could further support domestic and international growth.

Still, risks remain. Crypto price swings, intensifying competition from banks and other custodians, and regulatory hurdles could weigh on performance. On the day of the report’s release, Bitgo shares closed down nearly 5%, a reminder that even “military-grade” narratives must pass the market’s stress test. By Wall Street’s open on Tuesday morning, Bitgo shares have seen a percentage point gain since yesterday’s close.

- Why did Mizuho initiate coverage on Bitgo?

Mizuho launched coverage with an Outperform rating, citing Bitgo’s security record, recurring revenue model and institutional positioning. - What is Mizuho’s price target for Bitgo?

The firm set a $17 target, implying roughly 50% to 60% upside from recent levels. - How much has Bitgo stock fallen since its IPO?

Shares have declined about 50% from their all-time levels. - How large is Bitgo’s custody business?

The company safeguards more than $100 billion in client assets under custody.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。