Bitcoin exhibited a characteristic lack of momentum on Wednesday, remaining largely range-bound even as the community descended into a fierce ideological civil war. Throughout the preceding 24-hour window, the top cryptocurrency oscillated between $65,840 and $68,000. While the price experienced several instances of high-velocity “whipsaw” movements—straying briefly before a rapid corrective snapback—it ultimately found its gravity within that narrow corridor.

As of 3 p.m. EST, bitcoin was again trading just below the $66,000 mark, logging a 2.6% decline over the day. This price action left the total market capitalization of the crypto-economy essentially drifting lower, alongside reflecting a “wait-and-see” approach from institutional desk traders.

The day’s primary narrative was dominated by Cryptoquant CEO Ki Young Ju, whose latest X article has sent shockwaves through the ecosystem. Ju has posed a pointed question to the community: Should it authorize a protocol-level “freeze” on dormant coins, particularly Satoshi Nakamoto’s storied 1.1 million BTC trove?

“Would you support freezing dormant coins, including Satoshi’s, to save BTC from quantum attacks? Or is it against Bitcoin’s core ethos? If this alone already divides us, the quantum debate must start now,” the Cryptoquant executive wrote.

Ju estimates that 6.89 million BTC are currently housed in legacy P2PK (pay-to-public-key) addresses. Because these older address types expose public keys directly on the blockchain, they are theoretically vulnerable to future quantum computing attacks that could derive private keys and drain the funds.

Critics, however, have decried the idea of such changes as a fundamental betrayal of bitcoin’s core value proposition. To freeze these coins, the network would require a drastic protocol upgrade, effectively breaking the rule of immutability. While there is a broad consensus regarding the long-term threat of quantum computing, the community remains bitterly divided over whether the cure is worse than the disease.

Despite the high-stakes debate over Satoshi’s coins, bitcoin’s price action on Feb. 18 appeared largely detached from internal politics, focusing instead on the escalating drums of war in the Middle East. Media reports suggest that U.S. and Israeli military strikes on Iran are imminent, a development that threatens to plunge the region into a state of total kinetic conflict.

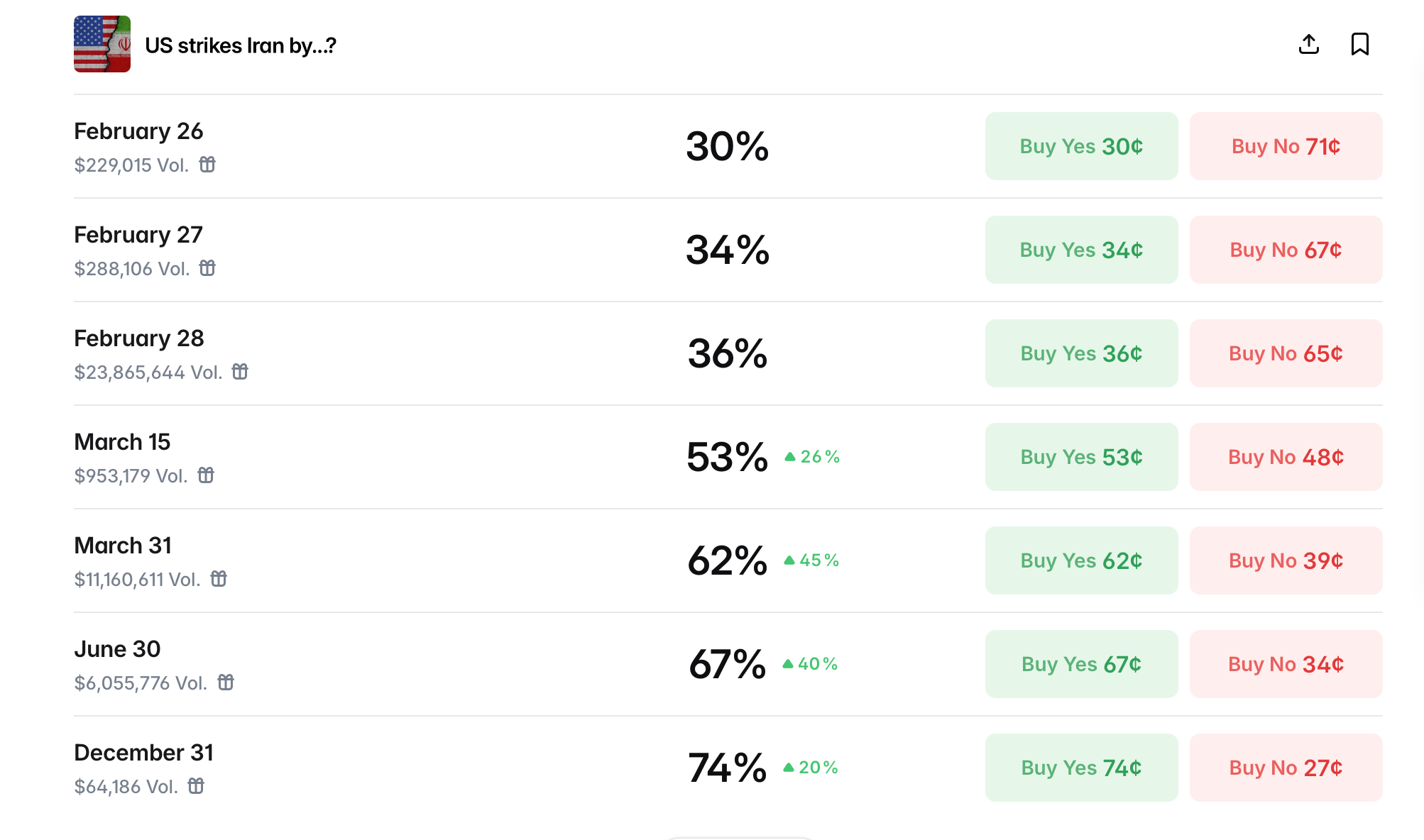

Polymarket odds on the escalation between the U.S. and Iran on Feb. 18, 2026, at 3 p.m. EST.

A wider conflict is expected to disrupt critical trade arteries and send crude oil prices into a vertical climb. For bitcoin, the impact remains a subject of intense speculation. While long touted as digital gold, recent price correlations suggest bitcoin has behaved more like a risk-on tech asset. This means, in the event of a regional conflagration, the initial reflex from investors may be a flight to traditional safe-haven assets, including U.S. Treasuries and gold.

This will potentially put further downward pressure on bitcoin as liquidity tightens across global markets.

- Where is bitcoin trading now? It hovered between $67K and $68K, showing little momentum.

- What sparked the community debate? Cryptoquant’s CEO proposed freezing dormant coins, including Satoshi’s stash.

- Why is the proposal controversial? Critics say freezing coins breaks bitcoin’s immutability despite quantum risks.

- How do geopolitics affect bitcoin? Escalating Middle East tensions, specifically between Iran and the U.S., have pushed investors toward gold and Treasuries, pressuring BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。