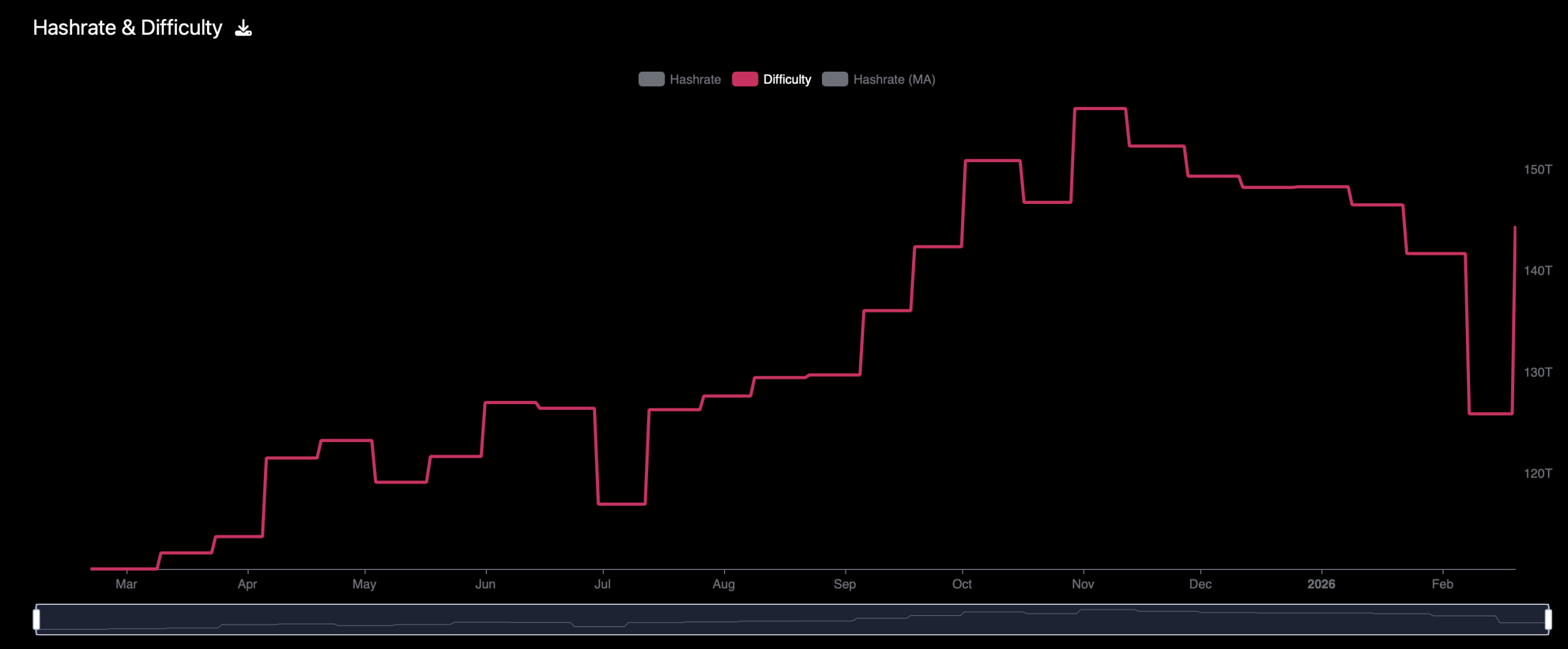

Bitcoin’s difficulty registered a steep decline on Feb. 7, marking the most pronounced downward adjustment since 2021, when China prohibited bitcoin mining within its borders. At block 935424, the metric fell 11.16%, a notable retreat by any measure.

The pullback was driven in part by an Arctic storm that battered the United States, prompting U.S.-based miners to scale back operations to ease pressure on the power grid. But when operators flipped the switches back on, they returned with intensity, even as revenue lingers at multi-year lows.

Hashrate vaulted beyond the 1 zettahash per second (ZH/s) threshold, compressing block intervals well below the 10-minute norm and setting the stage for Thursday’s adjustment. As Bitcoin.com News previously reported, the latest epoch not only reversed the 11.16% drop but exceeded it, climbing 14.73% and effectively canceling out the earlier retreat.

Bitcoin difficulty on Feb. 19, 2026. Chart source via mempool.space.

Once again, the network delivered a jolt not seen since 2021—specifically at block 683,424 on May 13, 2021—when difficulty advanced 21.53%. Since then, there have been meaningful gains above 13%, including block 758,016 on Oct. 10, 2022.

Thursday’s recalibration stands out, and while hashrate has climbed and block production has accelerated, miner revenue has fallen even further than during the Arctic storm curtailments. Miners are currently earning $29.30 per petahash per second (PH/s), according to hashprice data tracked by hashrateindex.com.

Hashprice has not hovered at these levels since bitcoin traded below two digits in its infancy. A 14.73% increase in difficulty, under such lean conditions, tightens margins further and makes the daily grind of mining an even more exacting enterprise.

Bitcoin’s latest adjustment illustrates a network that recalibrates with mechanical precision, indifferent to miner margins or meteorological drama. Whether operators can sustain this pace with hashprice scraping historic lows will determine how long this high-difficulty chapter endures.

- What happened to Bitcoin mining difficulty on Thursday? Bitcoin’s mining difficulty increased 14.73%, fully reversing the 11.16% decrease recorded on Feb. 7.

- Why did Bitcoin difficulty drop on Feb. 7? The 11.16% decline at block 935424 followed an Arctic storm in the United States that led miners to temporarily scale back operations.

- How high did Bitcoin’s hashrate climb after miners returned? The network’s hashrate pushed above 1 zettahash per second (ZH/s), accelerating block times and triggering the latest adjustment.

- What does a 14.73% difficulty increase mean for miners? A higher difficulty raises competition and compresses margins, especially with hashprice hovering near multi-year lows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。