The prediction market phenomenon is changing how information is perceived and valued, and macroeconomic figures are not the exception.

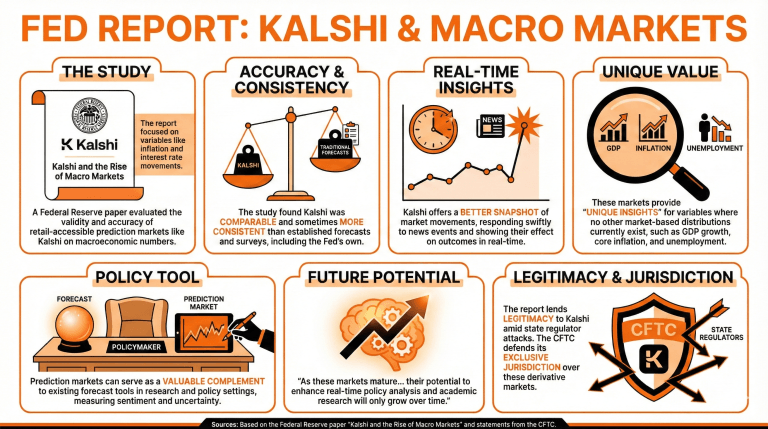

A recently issued Federal Reserve paper titled “Kalshi and the Rise of Macro Markets,” which was set to evaluate the validity and accuracy of large liquidity, retail accessible markets on macroeconomic numbers, such as inflation and interest rate movements, found that the platform was comparable, and sometimes more consistent than figures offered by other traditional options.

The report established that Kalshi, as a continuous alternative to surveys, forecasts, and even the Survey of Market Expectations run by the Federal Reserve Bank of New York, offers a better snapshot of how markets move around these macroeconomic numbers, responding swiftly to news events and showing how these affect outcomes in real time.

Reinforcing the relevance of Kalshi markets to some of these macroeconomic numbers, the paper states that they “provide unique insights—particularly for variables like GDP growth, core inflation, unemployment, and payrolls, for which no other market-based distributions currently exist.”

Finally, it agrees that prediction markets “can serve as a valuable complement to existing forecast tools in both research and policy settings,” opening new possibilities to measure market sentiment and macroeconomic uncertainty related to a macroeconomic variable.

“As these markets mature and liquidity deepens, their potential to enhance real-time policy analysis and academic research will only grow over time,” it concluded, giving Kalshi and similar platforms a larger significance for their results.

The report lends legitimacy to Kalshi and other platforms that have been under attack by state regulators from Tennessee and Massachusetts, which equate them to wagering platforms. Nonetheless, the Commodity Futures Trading Commission has repeatedly stated that these platforms are under its jurisdiction, with CFTC chair Mike Selig stressing that the organization would “defend its exclusive jurisdiction over these derivative markets.”

What recent Federal Reserve paper analyzed prediction markets?

The Federal Reserve paper titled “Kalshi and the Rise of Macro Markets” evaluated the accuracy and validity of prediction markets in relation to macroeconomic indicators like inflation and interest rates.How does Kalshi compare to traditional forecasting methods?

The report found that Kalshi’s continuous markets often provide more consistent and timely insights into macroeconomic numbers than traditional surveys and the Survey of Market Expectations by the Federal Reserve Bank of New York.What unique insights do prediction markets offer, according to the report?

Kalshi markets provide valuable insights for variables like GDP growth, core inflation, unemployment, and payrolls, which currently lack other market-based distributions.How do prediction markets relate to regulatory discussions?

Despite facing scrutiny from state regulators who view them as wagering platforms, the Commodity Futures Trading Commission (CFTC) confirms its jurisdiction over these derivative markets, advocating for their legitimacy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。