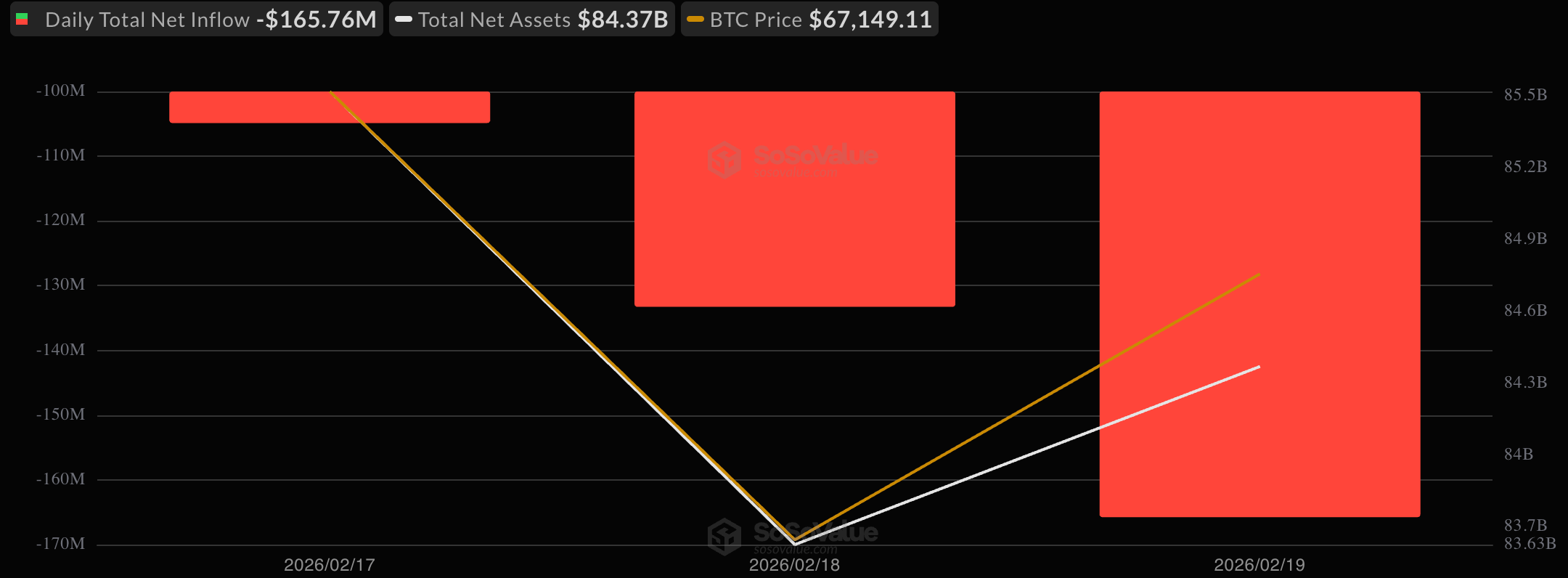

Another day, another wave of redemptions for bitcoin funds. Thursday, Feb. 19 saw spot bitcoin ETFs recorded $165.76 million in net outflows, marking their third straight day in the red.

The pressure was overwhelmingly concentrated in Blackrock’s IBIT, which alone accounted for $164.06 million in exits. Valkyrie’s BRRR posted a smaller $1.70 million outflow. Despite steady trading activity of $2.40 billion, total net assets across bitcoin ETFs settled at $84.37 billion.

Three days of consecutive outflows for bitcoin ETFs this week.

Ether ETFs faced even heavier selling relative to their size. The segment logged $130.19 million in outflows. Blackrock’s ETHA led the decline with $96.80 million in redemptions, followed by Grayscale’s Ether Mini Trust at $18.44 million, Fidelity Investments’s FETH at $11.62 million, and Bitwise’s ETHW with $3.34 million in outflows. Trading volume reached $677.01 million, and net assets edged down to $11 billion.

In contrast, XRP ETFs attracted fresh capital. The category posted $4.05 million in net inflows, driven primarily by Bitwise’s XRP with $2.52 million and Franklin’s XRPZ adding $1.53 million. Total value traded stood at $7.98 million, with net assets closing at $1.01 billion.

Solana ETFs also extended their recent momentum. The group saw $5.94 million in inflows, led by Bitwise’s BSOL with $5.46 million, while Fidelity’s FSOL added $481,830. Trading volume came in at $21.43 million, pushing total net assets up to $710.27 million.

Overall, Thursday’s session reflected continued caution around bitcoin and ether exposure, with concentrated redemptions in flagship products. At the same time, investors rotated selectively into XRP and solana ETFs, suggesting a tactical shift rather than a full retreat from crypto-linked funds.

FAQ📊

Why did Bitcoin ETFs record a third straight day of outflows?

The majority of redemptions came from Blackrock’s IBIT, indicating concentrated institutional selling or portfolio rebalancing rather than broad-based exits across all issuers.How significant were Ether ETF outflows on February 19?

Ether ETFs saw $130.19 million in withdrawals, led by Blackrock’s ETHA, reflecting sustained pressure on large-cap crypto exposure.Which crypto ETFs saw inflows during the session?

XRP ETFs recorded $4.05 million in inflows, while solana ETFs attracted $5.94 million, signaling selective demand for alternative crypto assets.What were the total assets under management after trading closed?

Bitcoin ETFs ended with $84.37 billion in net assets, ether ETFs with $11 billion, XRP ETFs with $1.01 billion, and solana ETFs with $710.27 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。