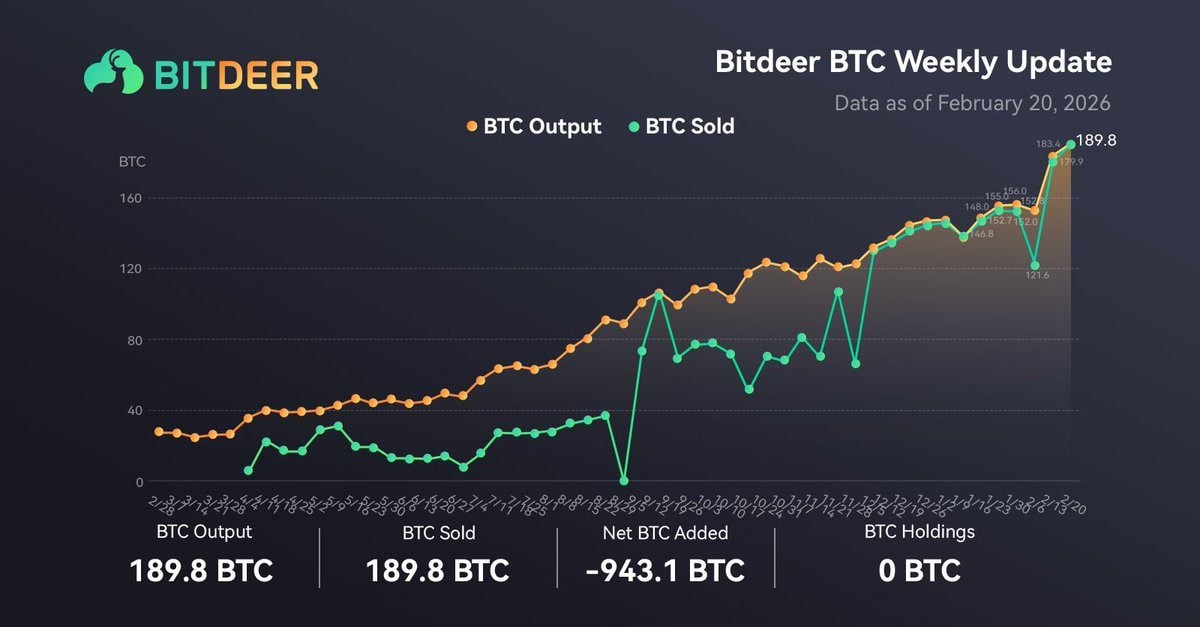

The move, disclosed in a weekly operational update, brings Bitdeer’s pure corporate bitcoin holdings to zero as of Feb. 20, excluding customer deposits. The latest transaction included 189.8 BTC mined during the week and an additional 943.1 BTC drawn from reserves, resulting in a net reduction of 943.1 BTC for the period.

The sale caps an eight-week drawdown that began at the end of December 2025, when Bitdeer held roughly 2,017 BTC. Since then, the company has steadily sold more bitcoin than it produced, trimming its balance sheet coin by coin until the cupboard was bare.

In January alone, Bitdeer mined 668 BTC but sold about 1,155 BTC, reducing holdings to 1,530 BTC. By mid-February, reserves had slipped below 1,000 BTC before the final liquidation pushed holdings to zero. The company has adopted a same-week sales approach for newly mined coins, effectively ending its prior strategy of retaining bitcoin as a treasury asset.

Before making its exit, Bitdeer ranked as the 51st largest publicly traded bitcoin treasury firm, sitting just ahead of Ming Shing Group. That ranking has now been wiped off the board. Founded by Jihan Wu and headquartered in Singapore, Bitdeer operates large-scale mining and data center facilities across the United States, Canada, Norway, and Bhutan.

By early 2026, its self-mining hash rate had climbed above 63 exahash per second (EH/s), reflecting continued operational expansion even as its bitcoin balance dwindled. The treasury exit aligns with an aggressive refinancing effort. Bitdeer priced an upsized $325 million 5.00% convertible senior notes offering due in 2032 and completed a $43.7 million registered direct stock sale.

Net proceeds are earmarked for data center buildouts, AI and high-performance computing (HPC) initiatives, Application-Specific Integrated Circuit (ASIC) mining rig development and general corporate purposes. Part of the new capital will also refinance existing debt. The company intends to repurchase $135 million of its 5.25% notes due 2029, a maneuver designed to extend maturities while managing interest costs.

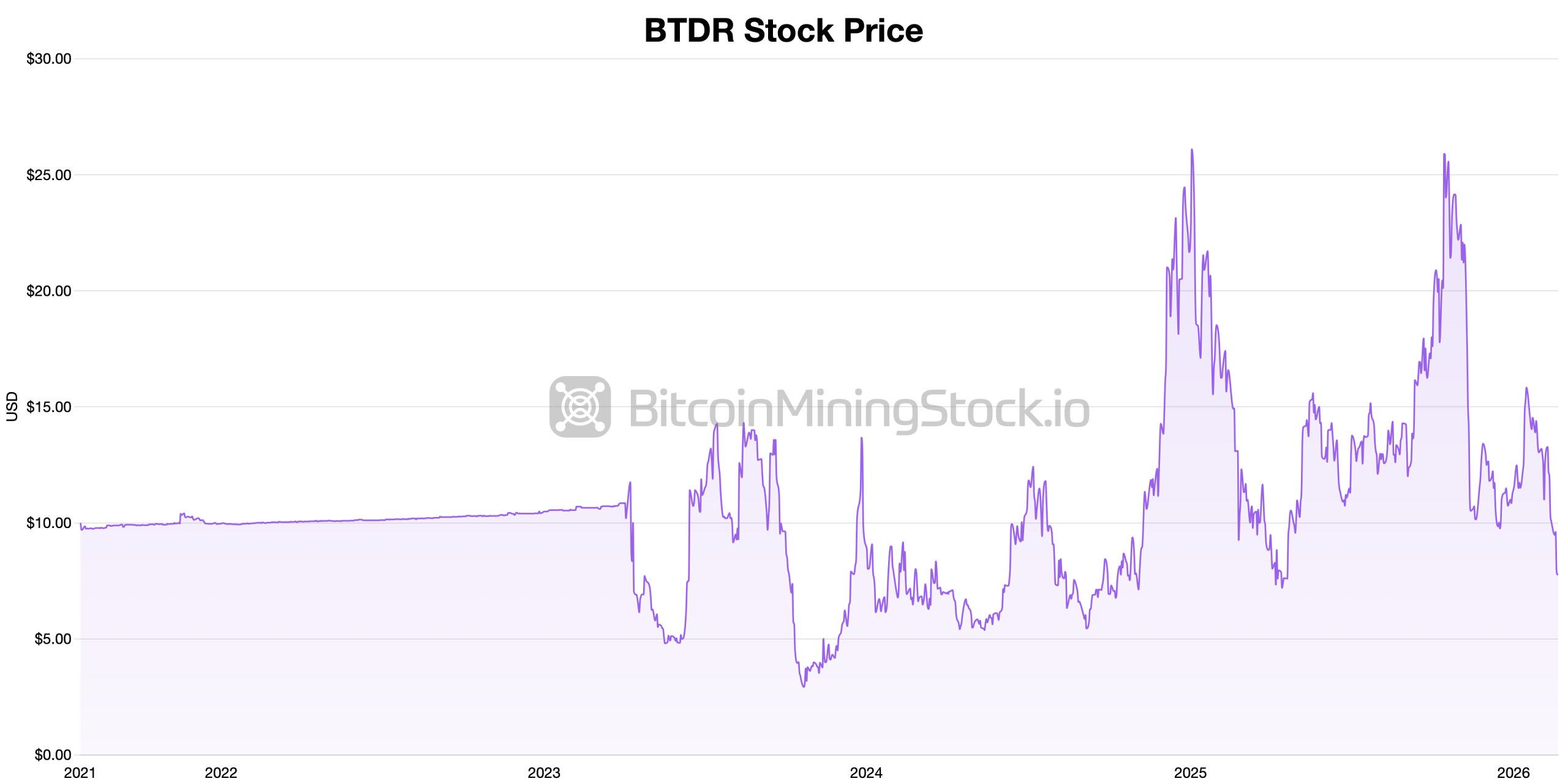

Still, the added leverage increases fixed obligations on a balance sheet that already carries roughly $1 billion in borrowings. Investors reacted swiftly. Shares of Bitdeer Technologies Group (Nasdaq: BTDR) fell following the announcements, as dilution concerns from the convertible notes and equity issuance weighed on sentiment. BTDR closed on Friday down just over 2% and over the last week, it has shed 22%.

According to a report from theenergymag.com’s Wolfie Zhao, “Tether-affiliated entities” have recently scooped up $42 million worth of BTDR.

The stock has declined more than 47% over the past 12 months. Moreover, the broader mining sector is undergoing a similar identity check. As block rewards shrink and competition intensifies, a great majority of today’s publicly listed miners are managing AI colocations and HPC services as supplemental revenue streams. In that context, Bitdeer’s decision to trade bitcoin reserves for liquidity may prove less a surrender and more a calculated reset.

Whether the bet pays off will depend on execution.

FAQ 🔎

- Why did Bitdeer sell 943.1 BTC from reserves?

The reason is unknown, but the sale appears aimed at generating liquidity to fund data center expansion, AI and HPC initiatives, and debt refinancing. - Does Bitdeer still hold any bitcoin?

As of Feb. 20, the company reported zero pure corporate bitcoin holdings, excluding customer deposits. - How did the market react to the treasury liquidation?

BTDR shares fell following the announcements, reflecting dilution and strategic shift concerns. Over the last five trading sessions, BTDR is down more than 22%. - Is this a permanent exit from bitcoin for Bitdeer?

That is unknown at this point in time. Bitdeer was once the 51st largest treasury holder as of last week, but today, it is not among the digital asset treasury (DAT) lists.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。