Binance Research, a division of the world’s largest cryptocurrency exchange by volume, released its Market Research report on Thursday, detailing key issues that impacted the $3.76 trillion crypto market in January.

The report paints a story of mostly peaks and a few valleys, with positive policy developments dominated by President Donald Trump’s pro-crypto administration which, among other things, established a working group to explore a national crypto reserve.

But perhaps the key event of the month was when Trump and the first lady both launched their memecoins on the increasingly popular Solana network, signaling the peak of what can only be characterized as “memecoin mania.”

But according to the report, that momentum eased toward the end of January when the Chinese artificial intelligence (AI) model Deepseek, made headlines and eventually overtook Openai’s Chatgpt as the most downloaded app on Apple’s App Store. Subsequent concerns about overvalued U.S. tech startups caused a 2% decline in both traditional and crypto markets, the report says, erasing billions in market capitalization.

“Deepseek reportedly developed an AI model at a fraction of the cost and with significantly fewer resources than its competitors,” the report states. “This raised concerns about overvaluations in the U.S. tech sector and triggered a sharp market reaction.”

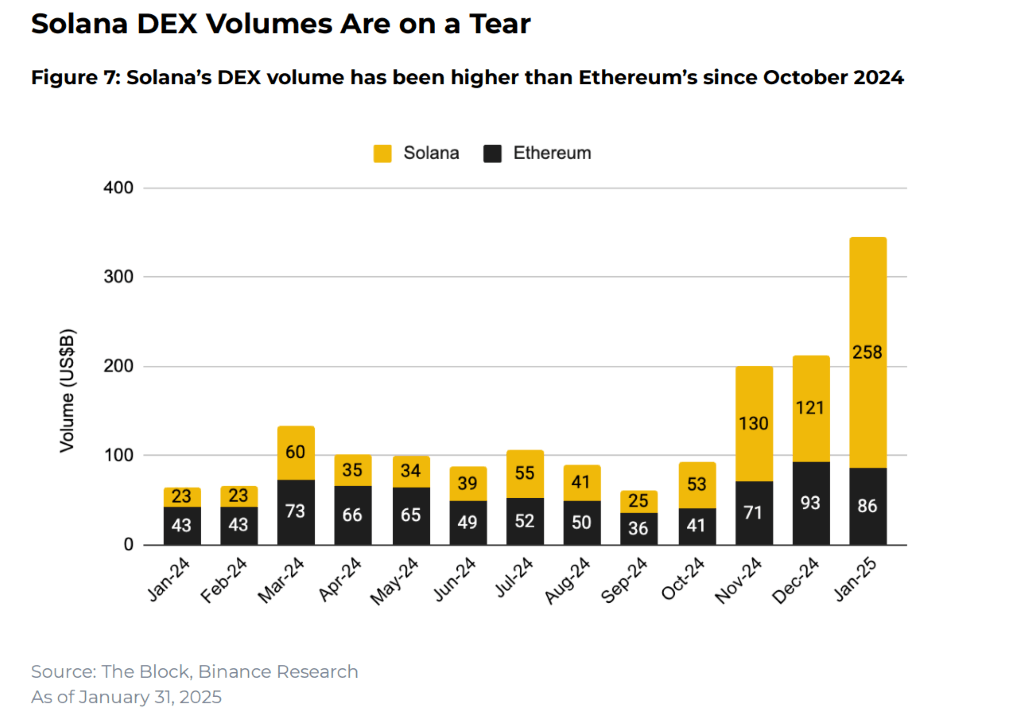

The newly launched Trump memecoins, TRUMP and MELANIA, helped Solana dethrone Ethereum as the king of decentralized exchange (dex) volume for the fourth consecutive month. “Central to recent growth have been the launch of TRUMP and MELANIA memecoins on Solana,” the report says. Adding that Solana’s dex volumes in January were more than 200% higher than Ethereum’s.

The growth of Solana’s decentralized finance (defi) ecosystem was also notable, with protocols like Jito, Raydium, and Pump.fun raking in significant transaction fees. Jupiter, Solana’s leading dex aggregator, further augmented its position with the acquisition of memecoin app Moonshot.

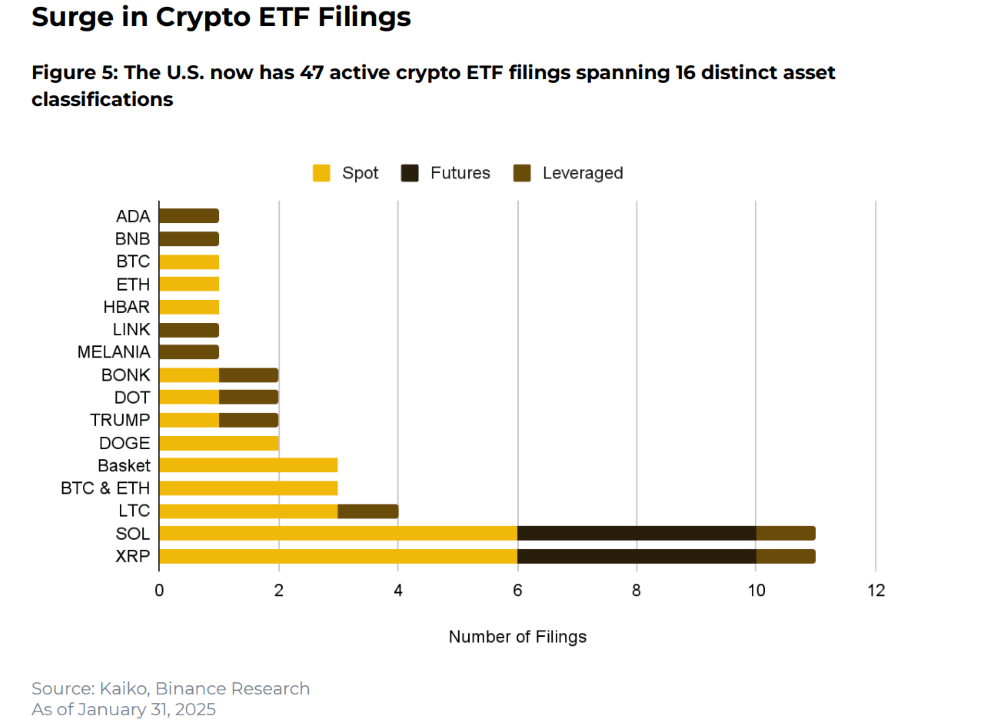

Trump’s crypto-friendly administration has emboldened firms to file for an increasing number of crypto exchange-traded funds (ETFs). The report says there are forty-seven active filings in the U.S., spanning sixteen asset categories, including memecoins. “This marks a significant shift from a market once dominated by bitcoin (BTC) and ether (ETH) ETFs.”

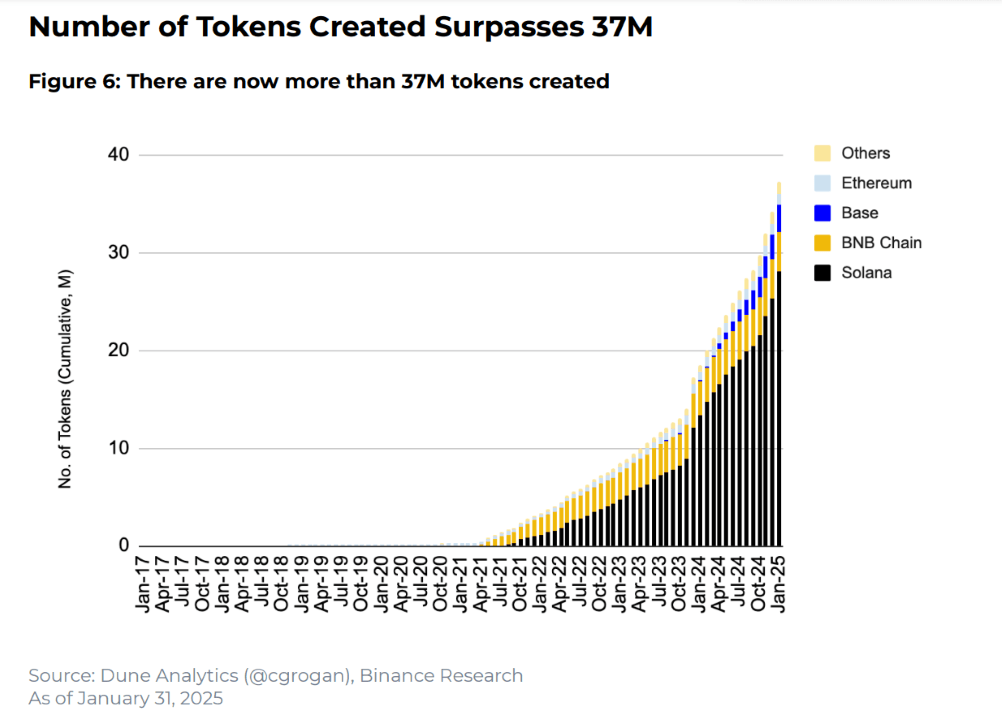

The filings will likely become more diverse, given that there are now more than 37 million tokens in circulation, a situation the report says has fragmented capital, making it difficult for tokens to sustain prices and achieve high valuations. Notably, the top one hundred tokens still dominate 98% of the total crypto market capitalization.

The report also describes the growth of Decentralized Finance Artificial Intelligence or “DeFAI,” indicating that it has become one of the more dominant narratives in crypto. “AI tokens can be seen as representations of the rapid expansion of innovation moving beyond traditional AI sectors into new, decentralized spaces,” the report says.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。