Author: White55, Mars Finance

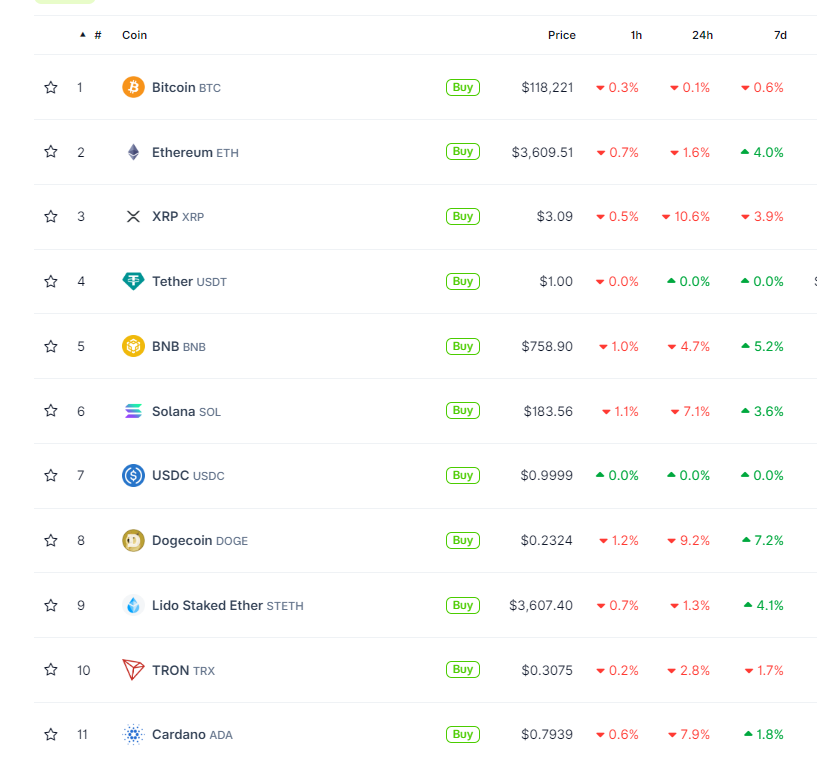

From July 23 to 24, 2025, the cryptocurrency market experienced a two-day deep correction, with Bitcoin briefly falling to the critical support level of $117,100 and Ethereum dropping to a low of $3,500.

The altcoin sector was even more severely affected: PUMP plummeted over 16% in a single day, while mainstream tokens like XRP, SUI, and ADA saw declines generally exceeding 5%-8%.

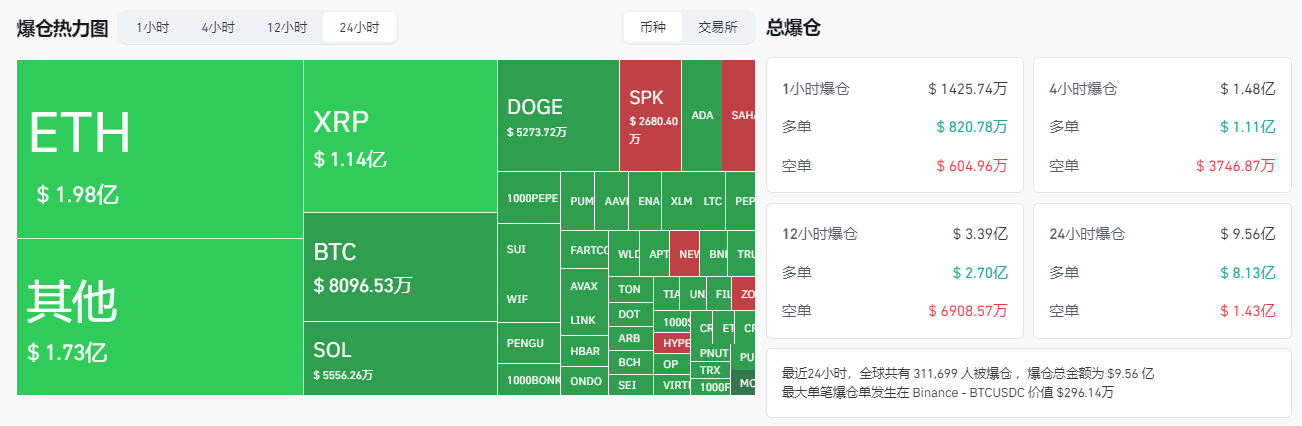

During this sharp decline, the total liquidation amount across the network reached $956 million, affecting over 310,000 investors.

Liquidation Storm: The Cost of Leverage Frenzy

The Harsh Reality Behind the Data

In the past 24 hours, the crypto market faced the most intense long liquidation wave since June. According to CoinGlass statistics, the amount of long liquidations reached $813 million, accounting for 85% of the total liquidation volume, while short liquidations were only $143 million. The largest single liquidation occurred in Binance's BTCUSDC contract, amounting to $2.96 million. This imbalance in data exposes the leverage risks accumulated in the market under a "Greed Index of 71" operating at a high level.

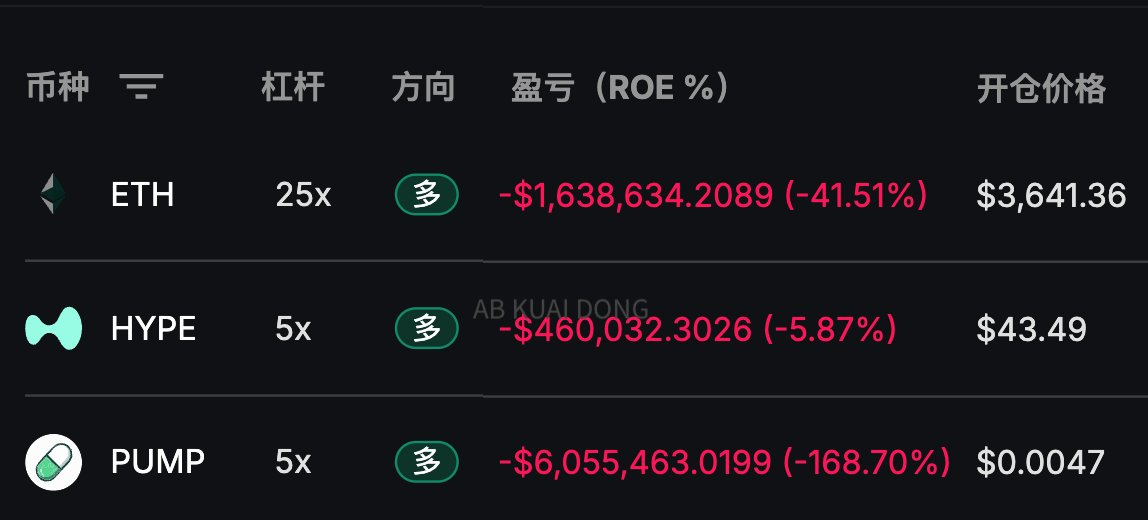

The "Death List" of High-Leverage Players

The position of well-known investor "Brother Maji" has become a typical case. His combination of long positions in ETH, HYPE, and PUMP has accumulated losses of $8.14 million, with PUMP suffering the highest loss percentage due to subsequent increased positions. Currently, his liquidation prices are ETH $2,871, HYPE $19.8, and PUMP $0.0023.

More dramatically, a private investor in PUMP mistakenly transferred 2 billion tokens (worth about $12.8 million) to Binance, which did not have spot trading enabled. When the tokens were returned days later, the price had dropped from $0.0064 to $0.0034, missing a $6 million selling opportunity. This operational error highlights the vulnerability of private institutions' risk control in extreme market conditions.

Market Correction: Structural Differentiation and Macroeconomic Pressure Resonance

The Logic Behind the Retreat of Mainstream Coins

Bitcoin: The intraday low reached $117,072 (OKX quote). Despite institutional funds continuing to flow in through ETFs (with MicroStrategy increasing its holdings), the daily chart formed a "wedge convergence" pattern, with $117,000 becoming a dividing line for bulls and bears. A valid breakdown could trigger a correction of over 10%; a breakthrough above $120,000 would require waiting for macro catalysts like the Fed's interest rate cut in September.

Ethereum: The decline was between 2.55%-3.20%, but the spot trading volume of $2.57 billion surpassed Bitcoin's $2.44 billion for the first time. Whales increased their holdings by 40,591 ETH (about $14.8 million), and the price quickly rebounded above $3,600.

The four-hour chart broke below the middle band of the Bollinger Bands, with $3,500 being a short-term lifeline. If it can break through the resistance at $3,800, it may challenge the $4,000 mark.

In this round of correction, altcoins showed extreme differentiation:

- Plummeting Camp: PUMP (-15.3%) was sold off due to delayed airdrops and competitive pressure; XRP (-9.4%) faced dual blows from regulatory risks and profit-taking.

- Resilient Movements: ZORA (+60%) gained funding support due to the integration of Base App tokenization technology.

Although the total market value of altcoins has retreated, the market value ratio (altcoins/BTC) still holds the May high, suggesting that bottom support has not completely broken.

Before the last altcoin season (2023-2024) started, there was a low-level oscillation for a full 400 days. Currently, although the altcoin ratio has reached the bottom range, history shows that after bottom confirmation, it is often accompanied by a sharp drop to wash out floating positions, followed by a main upward wave.

Indicators for Predicting Capital Rotation

ETH/BTC Trading Volume Ratio: Currently breaking above 1.0, indicating a rotation of funds towards Ethereum and related ecosystems (such as Solana and Base chain).

Stablecoin Market Value Growth: The U.S. Treasury Secretary predicts that the stablecoin market value will exceed $2 trillion; if realized, the usage of underlying chains like Ethereum may see exponential growth.

Conclusion: The Crossroads of the Crypto Market

The current crypto market is at a triple game of technical support, regulatory frameworks, and macro policies. The White House digital asset report on July 30 and the Fed's interest rate decision in September may become key variables to break the oscillation pattern.

Historical experience shows that the real altcoin season has never started when retail investors flock in. When the consensus is that U-based contracts are "hard to trade," and when leveraged liquidations wash out floating positions, the market may welcome the dawn of a new cycle.

As a certain whale commented on-chain after the crash: "400 days of waiting for a 400% increase—this golden rule of the crypto market has never failed."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。