Original source: Dongcha

On August 12, following Coinbase, the second cryptocurrency exchange will officially land on the New York Stock Exchange—Bullish plans to raise approximately $990 million through its initial public offering (IPO).

On the surface, this is just another routine appearance in the crypto industry. The impressive IPO performances of companies like Circle and Figma over the past six months, along with Coinbase's inclusion in the S&P 500, have already whetted the appetite of the U.S. stock market for crypto companies.

Bullish's debut seems to be a continuation of this trend, and it may even be the most ostentatious one yet. This exchange, with $3 billion in assets on its balance sheet, has not only garnered strong support from top investors like Peter Thiel, Alan Howard, and SoftBank but has also acquired the crypto media giant CoinDesk, firmly holding the "microphone" with the most influence in the industry. Its CEO, Tom Farley, previously served as the chairman of the New York Stock Exchange.

The powerful background and aura have led to "extraordinarily strong" demand from investors for Bullish's IPO, prompting Bullish to raise its fundraising target from $629 million to $990 million on the eve of the IPO.

However, beneath Bullish's glamorous resume lies a past that could stir memories in the crypto circle—a massive financing direction, a rift between the community and capital, and a discarded public chain—EOS.

Li Xiaolai, the "evangelist" of EOS, once wrote in his WeChat Moments on August 10, 2018, "Let's look at EOS again in seven years." Ironically, seven years later, what the community sees is not the growth of EOS but the glory of Bullish ringing the bell—an entirely unrelated company to EOS.

$4.2 Billion Betrayal

If one were to describe the relationship between Bullish and EOS in one sentence, it would probably be—exes and current partners, both understanding each other but unable to sit together again.

After the news of Bullish secretly submitting its IPO application broke, the price of EOS tokens surged by 17%, creating an illusion of rekindled romance. However, in the eyes of the EOS community, this price increase felt more like irony, as the former operator Block.one had long turned its back and embraced Bullish, leaving EOS behind—at the cost of its decline.

The story begins in 2017. At that time, the public chain race was in its golden age; white papers could serve as entry tickets, and visions were the best fundraising tools. Block.one launched EOS with the grand claim of "one million TPS, zero fees," attracting global investors to flock in.

In 2018, it raised $4.2 billion through an ICO, setting a record for fundraising in the crypto industry, and EOS was crowned the "Ethereum killer."

However, the myth collapsed faster than expected. Shortly after the mainnet launch, users discovered an insurmountable chasm between reality and the white paper: transfers required staking CPU and RAM, making the process cumbersome and the barriers high; node elections were not the "decentralized democracy" expected but quickly devolved into a game of votes among large holders and exchanges.

The technical flaws were merely superficial; the deeper rift stemmed from uneven resource allocation.

Although Block.one promised to allocate $1 billion to support the EOS ecosystem, $2.2 billion of the $4.2 billion raised was ultimately used to purchase U.S. Treasury bonds, as well as for investments in BTC, stock trading, acquiring Silvergate (which went bankrupt in 2023), and purchasing the Voice domain, among other attempts.

The actual funds flowing to the EOS developer ecosystem were embarrassingly small.

The final straw that broke the patience of the EOS community was Bullish's debut in 2021. Block.one announced the launch of this brand-new crypto trading platform, with a fundraising scale of up to $1 billion, yet it had no connection to the EOS technology system—no use of the EOS chain, no support for EOS tokens, no acknowledgment of any relationship with EOS, not even a symbolic thank you.

In the eyes of the EOS community, this was a blatant betrayal: Block.one raised huge sums through EOS but chose to start anew and make a glamorous turn at the peak. EOS was left behind, losing its original resources and spotlight.

Bullish's $1 Billion New Starting Point

Born from the shattered dreams of EOS, Bullish initially received a cash injection of $100 million from Block.one.

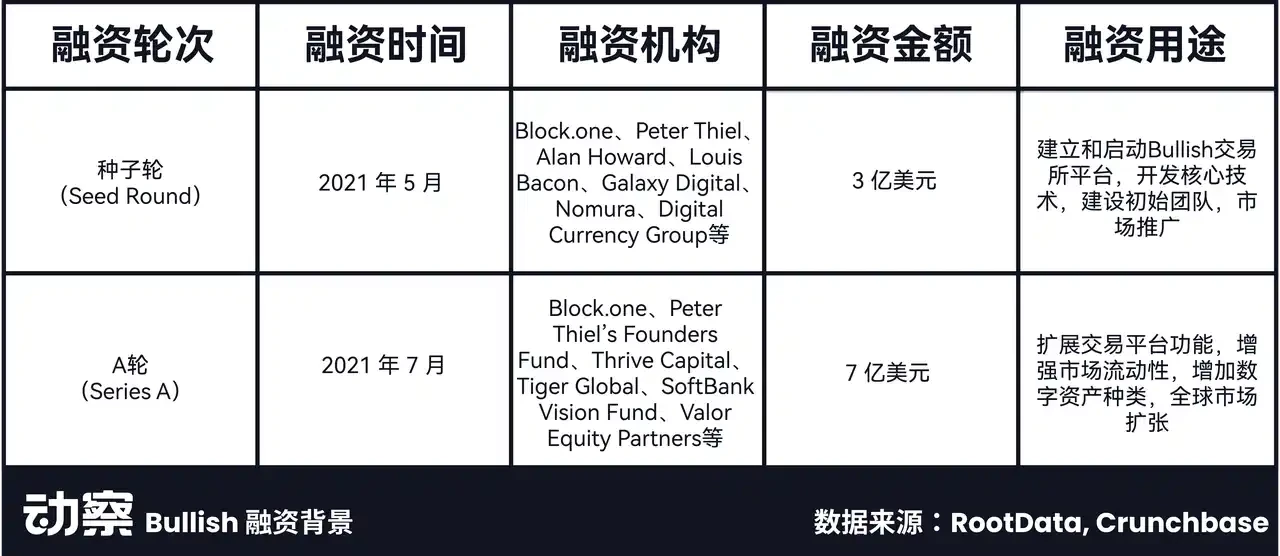

It also attracted a host of well-known investors, including Peter Thiel, Alan Howard (investors in FTX and Polygon), as well as top venture capital firms like Galaxy Digital, DCG, and SoftBank, creating a luxurious lineup.

This gave Bullish an initial capital of up to $1 billion early on, a figure far exceeding its competitor Kraken, which raised only $65 million in its seed and Series A funding rounds.

Since 2021, Bullish's core business has revolved around its exchange. With its innovative hybrid liquidity model (a combination of CLOB and AMM), Bullish can provide low trading spreads in high liquidity environments while maintaining stable market depth in low liquidity conditions.

This technological innovation quickly gained favor among institutional clients, allowing Bullish to successfully become the fifth-largest crypto exchange globally.

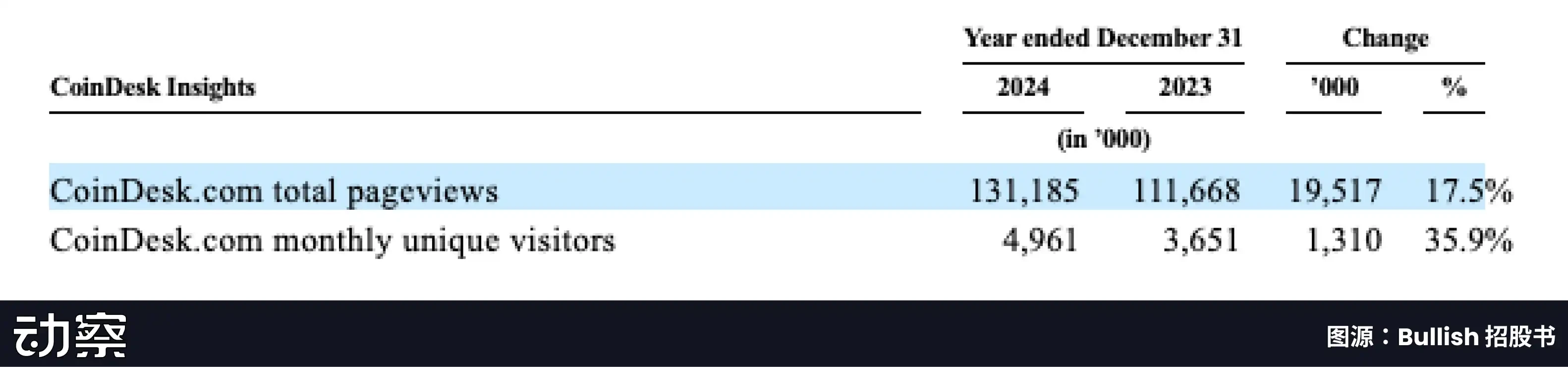

While steadily growing its exchange's core business, Bullish acquired the globally leading crypto media platform CoinDesk in 2023, further consolidating its voice in the industry. CoinDesk's monthly unique visitor count reached 4.96 million in 2024.

Bullish also launched CoinDesk Indices and acquired CCData in 2024, leveraging the advantages of both in data services to help its institutional clients track the performance of digital assets and provide market data insights.

Additionally, Bullish established a venture capital division—Bullish Capital. Through this business, Bullish can invest in crypto innovation projects, which not only bring potential capital returns but also help maintain its industry-leading position and achieve diversified layouts. Currently, Bullish Capital has invested in several well-known crypto projects, including Ether.fi, Babylon, and Wingbits.

In terms of financial performance, Bullish's current revenue sources remain relatively singular, with spot trading revenue from its exchange accounting for 70% to 80% of total revenue.

According to the prospectus, Bullish reported a net loss of $349 million in the first quarter of 2025, primarily due to a significant decline in the fair value of the crypto assets it holds, such as Bitcoin and Ethereum.

In terms of other revenue, CoinDesk's revenue saw substantial growth, with subscription revenue reaching $20 million in the first quarter of 2025, more than doubling from $9 million in the same period of 2024.

This growth was partly driven by $9 million in sponsorship revenue from the Consensus Hong Kong 2025 conference held in February 2025.

Compared to its main competitors Coinbase and Kraken, Bullish's revenue and profitability appear somewhat lacking. Since 2022, Coinbase's revenue has consistently remained over 20 times that of Bullish. Additionally, Kraken's total revenue of $1.5 billion in 2024 far exceeded Bullish's $214 million during the same period.

In terms of business data, Bullish's spot trading volume has shown impressive growth, with a trading volume of $79.9 billion in the first quarter of 2025, even slightly surpassing Coinbase.

This trading volume is comparable to leading exchanges, but the revenue is significantly lagging, primarily due to Bullish's proactive reduction of trading spreads.

"The strategy of tightening spreads has enhanced our competitive position and captured a larger market share," according to the prospectus, Bullish's market share in global BTC and ETH spot trading volumes grew by 10% and 37% respectively in 2024, and by 31% and 189% in 2023.

However, this strategy of expanding market share by compressing spreads does not bode well for the future.

On one hand, as institutional investors gradually enter the market, it matures, and trading becomes more concentrated on leading assets like BTC, leading to narrowed volatility.

On the other hand, the launch of ETFs has further intensified competition among exchanges. All these changes will compress the trading spreads in the market, thereby affecting Bullish's profitability and competitive advantage.

In the face of increasingly fierce market competition, Bullish's competitive strategy is also similar to that of leading exchanges like Coinbase—using the derivatives market and acquisitions to explore a second growth curve:

"We expect to achieve growth in the future by expanding products, especially options products, to meet the ongoing demand from stable, high-value institutional clients. We will continue to leverage our scale, assets, and expertise to acquire companies that align with our business lines."

A $4.8 billion valuation—Is it "low-key" or is there another plot?

Bullish's confidence in using substantial funds for future acquisitions largely stems from that historic financing in the crypto world—Block.one raised $4.2 billion through the EOS ICO in 2018.

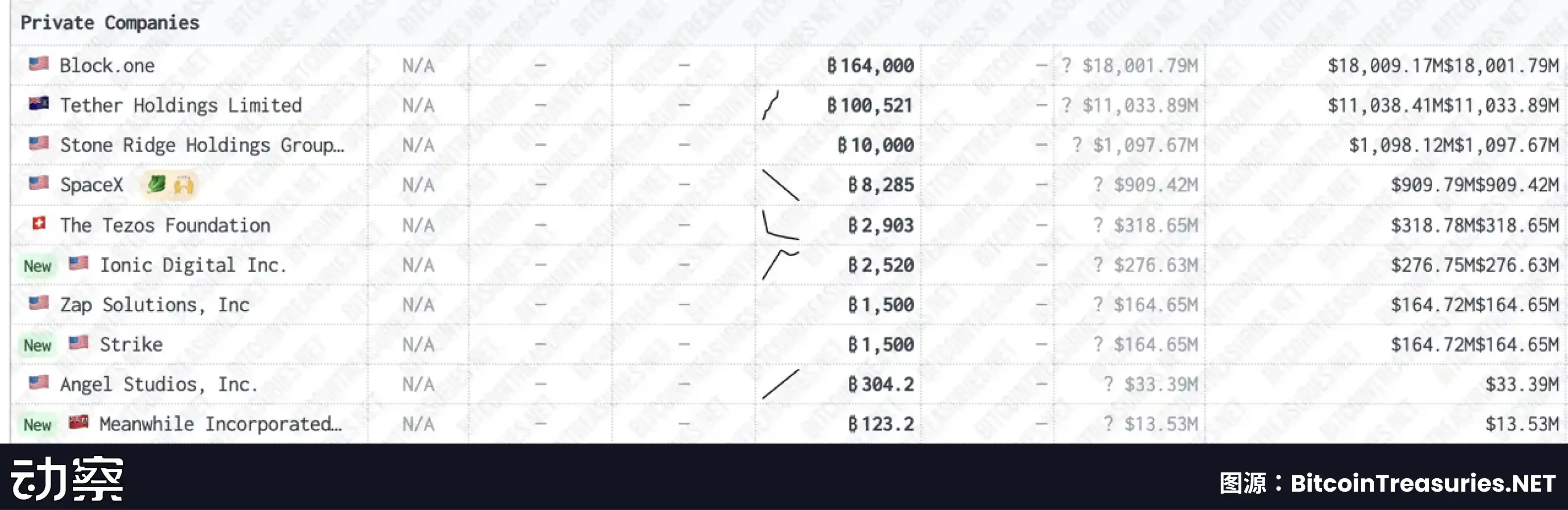

In addition to allocating a significant portion of these funds to stable U.S. Treasury bonds and sporadic equity investments, Block.one also heavily invested in 160,000 Bitcoins early on.

This move made it the largest private holder of Bitcoin globally, surpassing the stablecoin giant Tether by a full 40,000 coins.

Bullish's balance sheet also appears substantial: total assets exceed $3 billion, including 24,000 Bitcoins (approximately $2.8 billion), 12,600 Ethereum, and $418 million in cash and stablecoins.

In contrast, Coinbase's Bitcoin reserves in the second quarter of the same year were only 11,776 coins, with a market capitalization of about $1.3 billion—this means that in terms of BTC holdings, Bullish is nearly twice that of Coinbase.

This asset depth makes Bullish's $4.8 billion IPO valuation seem somewhat "low-key," positioning it more as a digital asset reserve company rather than just an exchange.

At a $4.8 billion valuation, the premium rate (mNAV) for this coin stock is only 1.6. This "low-key valuation" has ignited strong demand from investors for this IPO, creating a fervent market sentiment.

On August 11, the company significantly adjusted its issuance plan at the last moment—raising the per-share pricing range from $28-31 to $32-33, and expanding the issuance scale from 20.3 million shares to 30 million shares. On August 12, the issuance price was further raised to $37.

The prospectus also stated that BlackRock and ARK Investment Management would subscribe to $200 million worth of shares at the IPO issuance price, undoubtedly adding to the optimistic sentiment.

However, hidden behind this enthusiasm is another set of game rules. This IPO has less than 15% of its shares in circulation, with the vast majority still firmly held by major shareholders and early investors. Low circulation means scarcity, and scarcity implies a potential "rush for shares" on the first day, which is highly tempting for short-term funds.

As Renaissance Capital senior strategist Matt Kennedy commented on Bullish's IPO: "Bankers prefer to leave some room in valuations, raising them on a low valuation basis rather than pricing too high from the start, which would dampen market enthusiasm."

However, the flip side of low circulation is a potential selling pressure time bomb. Once the lock-up period ends, if major shareholders and early investors choose to cash out, the market could easily experience a surge in liquidity and a chain reaction of falling stock prices.

The crypto market has seen similar scripts too many times in this cycle.

It is also worth noting that this is not Bullish's first attempt to enter the capital market. As early as the peak of the crypto bull market in 2021, it planned to go public with a valuation of $9 billion through a merger with the SPAC company Far Peak Acquisition Corporation. That time, regulatory uncertainty and market volatility struck simultaneously, causing the plan to abruptly halt in 2022.

Now, as Bitcoin once again approaches the historical high of $120,000, companies like Circle have successfully tested the temperature of the capital market with their IPOs. Bullish, with a valuation nearly halved and a more carefully crafted strategy, is once again aiming for the New York Stock Exchange.

Will this combination of "low valuation + tight circulation + bull market timing" allow Block.one's already substantial balance sheet assets to add another impressive appreciation?

However, for those investors who know the story of EOS, there may be a more important lesson—do not love such companies for too long, lest the final outcome replays the old dream of the EOS community's fate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。