Original: Dennis Liu, General Partner at Momentum 6

Translation: Yuliya, PANews

As the Trump family's crypto project $WLFI is about to launch, market attention is increasingly heating up. Dennis Liu, a General Partner at Momentum 6, delves into the investment value of $WLFI in this article. He not only analyzes the stablecoin mechanism linked to U.S. Treasury bonds and the strong institutional backing of the token in detail but also reveals his seven-figure investment position and a price target of $1. The author believes that $WLFI, which combines political, financial, and highly speculative attributes, is one of the most noteworthy events in this cycle. Below is the original article, translated by PANews.

What is $WLFI? Why is it important?

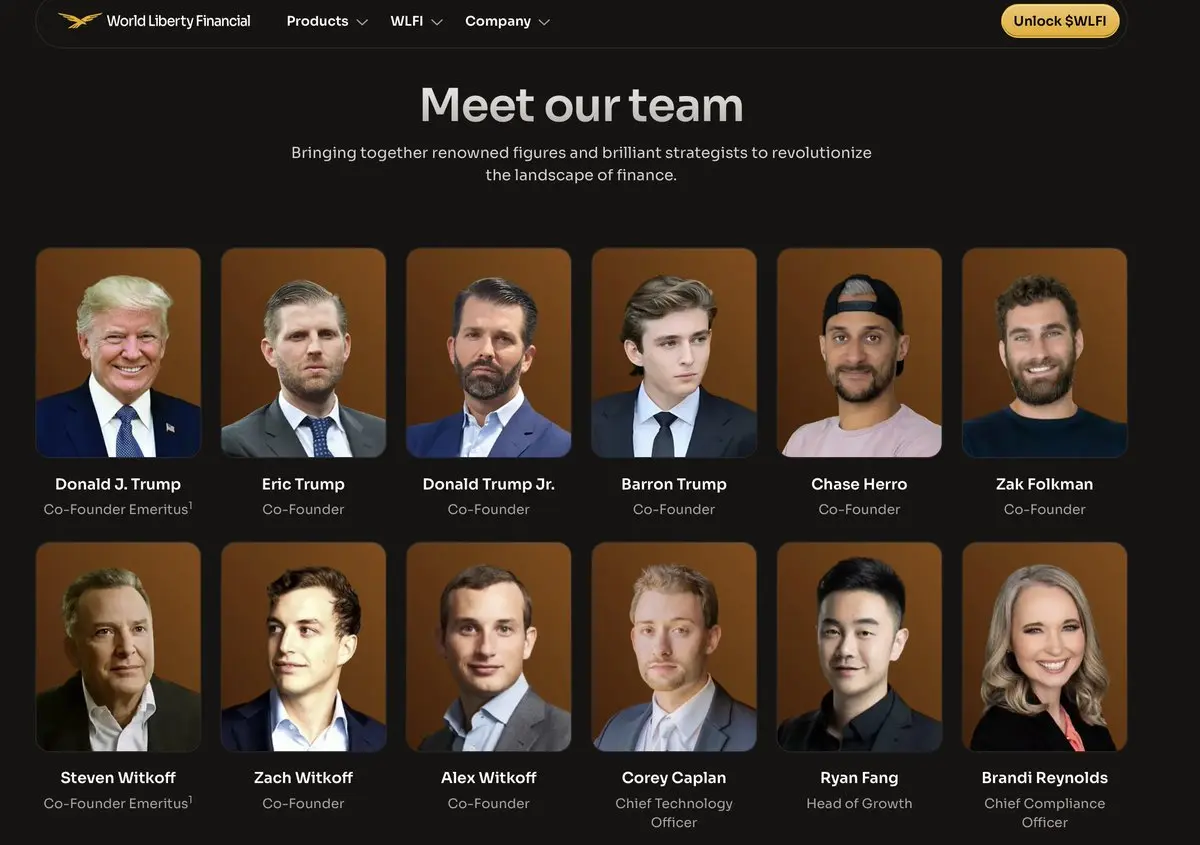

$WLFI is the official token of Trump, with co-founders including Eric Trump, Donald Trump Jr., and Barron Trump. Trump himself was also listed as part of the team before taking office as president. This project is not just a simple memecoin; it is closely linked to the regulated stablecoin USD1. USD1 is backed by U.S. Treasury bonds, making $WLFI a combination of a political tool and financial asset.

On September 1, $WLFI will launch on all major trading platforms, including Binance, and futures contracts have also been initiated. According to the presale arrangement, 20% of the tokens will be unlocked for circulation immediately, while the remaining 80% will enter a lock-up mechanism. For most traders, this is the first opportunity to gain exposure to $WLFI.

Positions and Strategy

I have been buying $WLFI through the pre-market futures market, with my initial purchase price at $0.40, then adding to my position at $0.30, and making significant purchases in the $0.22 to $0.24 range. My average entry cost is $0.28, while the current price is $0.25. Yes, you can even enter at a cheaper price than I did now.

The key to my strategy is using only 1x leverage, meaning no leverage at all. The price fluctuations in the pre-market can be severe, and even 1.5x leverage could lead to liquidation. Using 1x leverage is essentially equivalent to spot trading, with no liquidation risk and no funding fees. This is why I can comfortably hold a seven-figure dollar long position in $WLFI.

Price Target and Institutional Layout

My price target is for $WLFI to reach $1 (corresponding to a fully diluted valuation of $100 billion).

For reference, a previous memecoin launched by Trump, which lacked utility and was hardly promoted, still reached a peak FDV of $73 billion. In contrast, $WLFI not only has official recognition but is also linked to U.S. Treasury bonds and launched during Trump's presidency, significantly enhancing its credibility and potential ceiling.

Institutional investors have also positioned themselves early:

- DWF Labs invested $25 million at a price of $0.10;

- Aqua One Fund invested $100 million at a price of $0.125;

- Nasdaq-listed company ALT5 Sigma invested $1.5 billion at a price of $0.20.

Compared to the current price of $0.25, this is only 25% higher than the investment price of the Nasdaq-listed company.

Diversified Investment Strategy

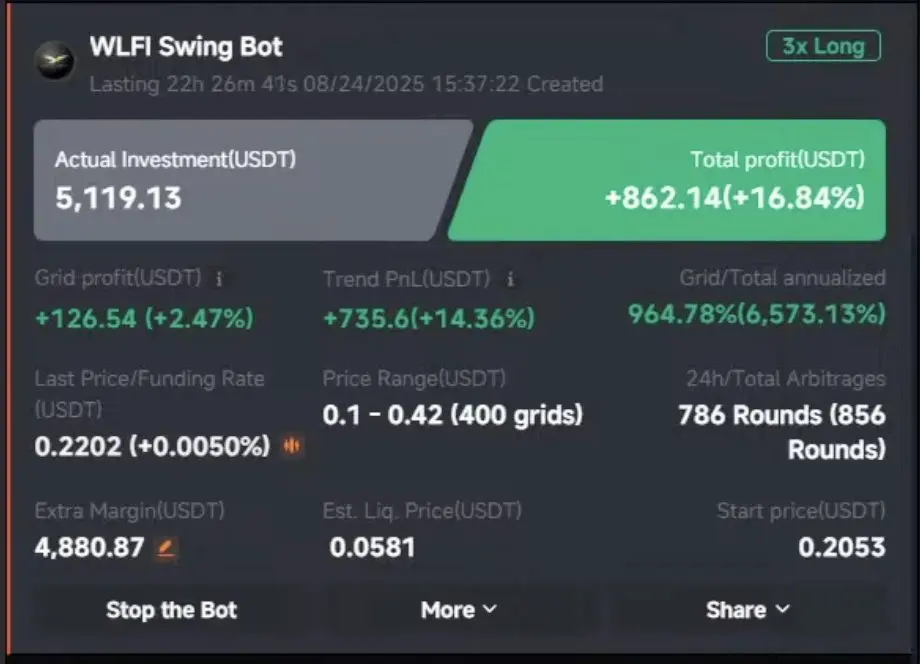

In addition to holding directly, I am also running a $WLFI trading bot on Pionex. The grid range is set between $0.10 and $0.42. In 22 hours, it has already generated a profit of 2.5% (annualized return rate of up to 960%). For investors unwilling to hold long-term, significant returns can still be captured through volatility.

Additionally, there are two higher-risk ecosystem projects worth noting:

- One is $BLOCK (Blockstreet), founded by the Chief Information Officer of $WLFI, which is the launch platform for USD1;

- The other is $DOLO (Dolomite), led by the Chief Technology Officer of $WLFI, which is the DeFi service provider for USD1.

These projects have smaller market capitalizations, meaning greater potential upside, but also higher risks.

If the price of $WLFI doubles, the prices of these two tokens could rise 3 to 4 times; however, if $WLFI falls, their declines could be even more severe. Therefore, achieving balance in the investment portfolio is crucial.

Overall, $WLFI is undoubtedly one of the most significant token events in this cycle. Its identity is not just a narrative but a combination of political influence, financial attributes, and speculative value. The official Trump token, institutional backing, and its link to U.S. Treasury bonds make it a focal point of high market attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。