Author: White55, Mars Finance

U.S. Treasury Secretary Scott P. Bessenet announced on Wednesday that he will submit a final list of three to four candidates to President Trump in December for the selection of the next Federal Reserve Chair. This decision will impact the direction of U.S. monetary policy and the stability of global financial markets for years to come. Bessenet revealed that he has narrowed down the previous list of 11 candidates to 5. The five candidates include current Federal Reserve Vice Chair for Supervision Michelle Bowman, Governor Christopher Waller, Director of the National Economic Council Kevin Hassett, former Federal Reserve Governor Kevin Warsh, and BlackRock's Chief Investment Officer for Global Fixed Income Rick Riedel.

Selection Process and Background

The selection process for the Federal Reserve Chair has entered a critical stage. The screening led by Treasury Secretary Bessenet began with a list of 11 candidates in August and has been narrowed down to 5 key candidates after two months of detailed evaluation by mid-October. According to the plan, Bessenet will conduct a new round of interviews with the five candidates in the coming weeks to months. The interview team will be personally led by Bessenet, with two senior Treasury officials and two senior White House officials participating. Due to Bessenet's need to attend the World Bank and International Monetary Fund annual meetings and accompany Trump on an Asian visit, the final interview process is expected to be completed after Thanksgiving. Current Federal Reserve Chair Jerome Powell's term will end in May 2026. Interestingly, the new chair may first be nominated as a Federal Reserve Governor to fill a seat that will expire in January 2026, allowing the new chair to secure a full 14-year term as a governor. Trump's decision-making style has consistently been to "listen widely," seeking the opinions of "dozens or even hundreds of people" before making a final decision. Bessenet has made it clear that he will not be a candidate for the Federal Reserve Chair, reiterating his previous statement that he is not on the list of candidates.

Bessenet's Selection Criteria and Intent for Federal Reserve Reform

Treasury Secretary Bessenet has clear criteria for selecting candidates. He hopes the new Federal Reserve Chair will maintain an open mind regarding monetary policy and central bank operations and possess experience in economics, monetary policy, banking regulation, and management. Recently, Bessenet criticized the Federal Reserve for becoming "too large" and experiencing "mission creep," calling for a comprehensive review of its policies, structure, and mission. He tends to favor candidates who support reducing the size of the Federal Reserve and limiting the use of unconventional tools like quantitative easing. When asked whether candidates must support interest rate cuts, Bessenet did not respond directly, only stating that his two main criteria for candidates are: "First, whether you maintain an open mindset; second, what is your judgment of the current situation." He added, "The Federal Reserve is a large and complex institution, involving payment systems and regulatory affairs, so candidates must also possess certain management capabilities."

Background and Policy Positions of the Five Candidates

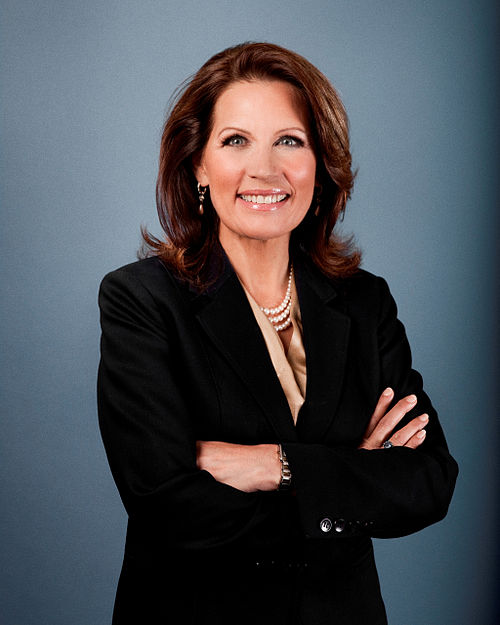

Michelle Bowman: Federal Reserve Vice Chair for Supervision

As the current Federal Reserve Vice Chair for Supervision, Bowman has a series of distinct positions on monetary policy, balance sheet management, and labor market prospects. She emphasizes the need for a more proactive and forward-looking policy stance in the current economic environment and advocates for comprehensive reform of the Federal Reserve's monetary policy implementation mechanism. Bowman stated that given the weakening vitality of the labor market and emerging signs of fragility, "the Federal Reserve FOMC should now act decisively and proactively." She pointed out, "Recent data indicates that we are seriously at risk of falling behind the curve," warning that a "rigid, dogmatic view dependent on data" will lead to policies lagging behind economic realities. Regarding interest rate policy, Bowman tends to favor a gradual approach to adjusting rates but emphasizes, "If these conditions persist, it will be necessary to adjust policy more quickly and forcefully in the future." She expects the neutral interest rate to be in the mid-range of 3%-4% and that "the current neutral rate is above pre-pandemic levels." On the Federal Reserve's balance sheet policy, Bowman proposed systematic reforms. She clearly stated, "In the long run, I prefer to maintain a balance sheet as small as possible, keeping reserve balances close to scarcity levels rather than ample levels." She strongly supports the Federal Reserve's balance sheet "holding only Treasury securities" and advocates for a "slightly short-term securities" bias in the maturity structure to enhance policy operational flexibility.

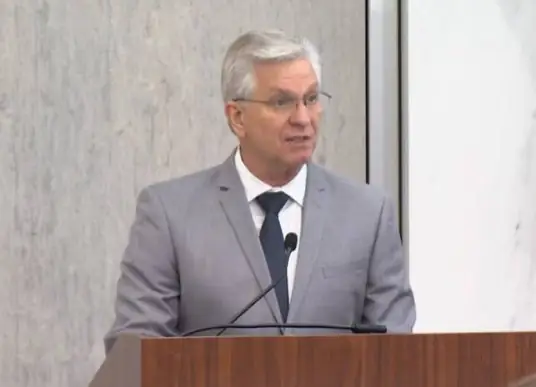

Christopher Waller: Federal Reserve Governor

Waller is one of the members of the current Federal Reserve Board who is more focused on inflation issues. On October 10, he stated that he would continue to support lowering interest rates but emphasized that the Federal Reserve must remain cautious in the face of conflicting economic signals to avoid taking drastic actions. Waller pointed out in a media interview, "I still believe we need to lower interest rates, but we need to proceed with caution." He explained that the current U.S. economy is showing a polarized situation: on one hand, the labor market seems to be losing jobs; on the other hand, GDP growth remains strong, and inflation is still significantly above the Federal Reserve's long-term target of 2%. As part of the selection process, Waller has undergone an interview led by Treasury Secretary Bessenet. Waller stated that his conversation with Bessenet "was entirely focused on policy" and did not involve political considerations. "It was actually a great interview. We discussed many aspects of the Federal Reserve and talked about various speeches I have given and my views."

Kevin Hassett: Director of the National Economic Council

Hassett, as a former senior economic advisor to the Trump administration, has a strong academic background and bipartisan connections. He has years of experience in think tanks and the corporate sector and has served as a senior economist at the Federal Reserve. Recently, Hassett emphasized that "the Federal Reserve must be completely independent of political influence, including from President Trump." However, Hassett's fierce rhetoric during his time as a senior economic advisor to the Trump administration raises concerns. He has publicly accused Federal Reserve officials of "putting politics above their mission," criticized the central bank for being "slow to act" on interest rate cuts, and even cited the cost overruns of the Federal Reserve headquarters renovation project as a potential reason to replace Powell. Hassett pointed out, "The fact is, we see that in countries where leaders are allowed to take over the central bank, inflation often runs high, and consumers suffer." He added that both Democrats and Republicans "recognize the importance of central bank independence," but whether the current Federal Reserve is truly independent and transparent, "I think that is debatable."

Kevin Warsh: Former Federal Reserve Governor

Warsh publicly criticized current Chair Powell on October 9, advocating for "a thorough, top-down reform" of the Federal Reserve to restore its credibility in the market and among the public. Warsh cited the teachings of the late legendary Federal Reserve Chair Paul Volcker, stating that the central bank has two core responsibilities: one is "to keep interest rates at appropriate levels," and the other is "to ensure it really looks like it knows what it is doing." He bluntly stated, "But Powell has failed on both counts." Warsh criticized that Powell has "failed to keep interest rates at the right level for most of his tenure" and pointed out that despite the Federal Reserve's "historic rate hikes not seen in years" to curb inflation over the past three years, the U.S. inflation rate is still as high as 2.9% as of August 2025, far from its 2% target. Warsh proposed radical reform plans: the Federal Reserve should divest its functions in areas like banking regulation to specialized government agencies; at the same time, the Treasury should strengthen oversight of the Federal Reserve's balance sheet. He noted that while the Federal Reserve's massive bond purchases after the 2008 financial crisis had historical justification, the crisis has long passed, and continuing to hold trillions of dollars in Treasury securities not only "overflows into the fiscal realm" but also artificially depresses some Treasury yields, distorting market pricing mechanisms.

Rick Riedel: BlackRock Executive

Riedel is the only candidate among the five who has never served at the Federal Reserve, currently serving as BlackRock's Chief Investment Officer for Global Fixed Income, managing approximately $2.4 trillion in assets. His professional standing in the fixed income field has received multiple authoritative recognitions: nominated by Morningstar as "Outstanding Portfolio Manager" in 2021; inducted into the Fixed Income Analysts Society's "Fixed Income Hall of Fame" in 2013. In addition to his internal responsibilities at BlackRock, Riedel is also deeply involved in global financial governance mechanisms. He has served as Vice Chair and member of the U.S. Treasury Borrowing Advisory Committee and has worked on the Federal Reserve's Financial Markets Advisory Committee. Currently, he serves as a member of the Alphabet/Google Investment Advisory Committee and the UBS Research Advisory Committee. In terms of macroeconomic judgment, Riedel acknowledges recent signs of weakness in the labor market but believes this trend provides the Federal Reserve with an opportunity to adjust monetary policy. He estimates that there is still about 100 basis points of room for policy rate cuts. Additionally, he questions the transmission effects of tariffs on inflation, stating, "Their impact on inflation has weakened."

The political background and challenges to the independence of the Federal Reserve place the candidates in a delicate balance: they must demonstrate to Trump their willingness to support significant interest rate cuts while proving to the market that they possess sufficient economic expertise and can maintain relative independence. Trump has repeatedly criticized Powell for "being too slow to cut rates" and has expressed a desire for the Federal Reserve to lower rates by 3 percentage points. However, investors are concerned that such aggressive policies could lead to turmoil in the bond market and soaring inflation. The Trump administration, led by President Trump, has continuously criticized Federal Reserve policies, urging significant interest rate cuts and even attempting to remove Powell. Additionally, the Trump administration attempted to dismiss Federal Reserve Governor Lisa Cook on charges of mortgage fraud, but Cook denied the allegations. This dismissal attempt has been blocked by a lower court, with the case scheduled to be heard by the U.S. Supreme Court in January 2026. These actions have raised concerns about the independence of the Federal Reserve. The Trump administration also attempted to dismiss Governor Lisa Cook on charges of mortgage fraud, but the court has temporarily blocked this action. The U.S. Supreme Court is scheduled to debate this case in January next year, but Cook can continue to serve during the case's deliberation.

Market Impact and Future Outlook

The changes in the Federal Reserve leadership are expected to have profound effects on global financial markets. The market generally hopes that the new chair will maintain the independence of the Federal Reserve and avoid excessive politicization of monetary policy. In Bessenet's considerations, management capability is a key factor. He pointed out, "The Federal Reserve is a large and complex institution, involving payment systems and regulatory affairs, so candidates must also possess certain management capabilities." This statement suggests that Bessenet favors candidates with experience in managing large institutions. So far, no candidate has a clear lead in the selection process. However, reports confirm that Riedel has made a deep impression on Bessenet due to his extensive experience in the fixed income market, broad analysis of Federal Reserve policies, and ability to manage large operations at BlackRock.

As Thanksgiving approaches, the selection process for the Federal Reserve Chair will enter its final stage. Wall Street is holding its breath, as the choice of the head of the world's most important central bank will directly impact capital flows and market dynamics for years to come. For the eventual appointee, the challenge lies not only in balancing the political expectations of the White House with the professional demands of the market but also in navigating the complexities of a $7 trillion balance sheet, all of which suggests that the leadership transition at the Federal Reserve in 2026 will be a significant test for global financial stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。