Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Despite the Federal Reserve's decision last week to cut interest rates by 25 basis points, the indication that it may pause rate cuts in December led to an increase in long-term Treasury yields, with the 10-year and 30-year Treasury yields rising to three-week highs of 4.1% and nearly 4.7%, respectively. More critically, the Fed announced it would end its previously planned quantitative tightening policy, which was set to last until 2026, starting December 1. This move is seen by some market participants as a form of "implicit rate cut." FHN Financial macro strategist Will Compernolle pointed out that this will guide private capital towards risk assets like stocks and enhance the Treasury's ability to bolster cash balances. Bill Adams, chief economist at Dallas Fed, also believes that the end of QT will bring more liquidity to financial markets.

However, market giants are cautious. Berkshire Hathaway, led by Warren Buffett, has seen its cash reserves soar to a record $381.7 billion and has net sold stocks for 12 consecutive quarters, reflecting that it sees far more selling opportunities than buying in the current market. Meanwhile, the U.S. government shutdown is nearing its longest historical record, with Congress planning a new round of voting on the evening of November 3 to try to break the deadlock.

The Bitcoin market has recently experienced significant volatility, with analysts showing clear divisions in their views. Analyst Ted Pillows noted that while there is buying support on Binance and Coinbase, Bitcoin needs to break through $112,000 with strong trading volume to maintain its upward momentum; otherwise, it may face a larger correction. He also warned that if the weekly close is below $100,000, it will confirm a downward trend. Analyst Rekt Capital emphasized that reclaiming the 21-week EMA around $111,230 is crucial. Murphy, based on chip structure analysis, believes there is substantial capital support in the $105,000 to $112,000 range, which should not be the cycle peak. However, bearish sentiment persists, with analyst BitBull observing that an early whale has sold $650 million worth of Bitcoin since October. CryptoQuant analyst Cas Abbe believes that historically, Bitcoin may have bottomed at the 38.2% Fibonacci level above $100,000. Trader CrypNuevo thinks the market is in a difficult consolidation phase and pointed out significant support around $101,000. Analyst EliZ noted that Bitcoin's structure remains intact above $107,000, but the declining OBV indicator shows weakness; if it falls below $107,000, it may retest the macro demand zone of $88,000 to $90,000. He believes the price needs to break through $121,000 to initiate a bull market expansion. Sigma Capital CEO Vineet Budki predicts that while Bitcoin may reach $1 million in the next decade, it could still see a drop of up to 70% in the next market correction.

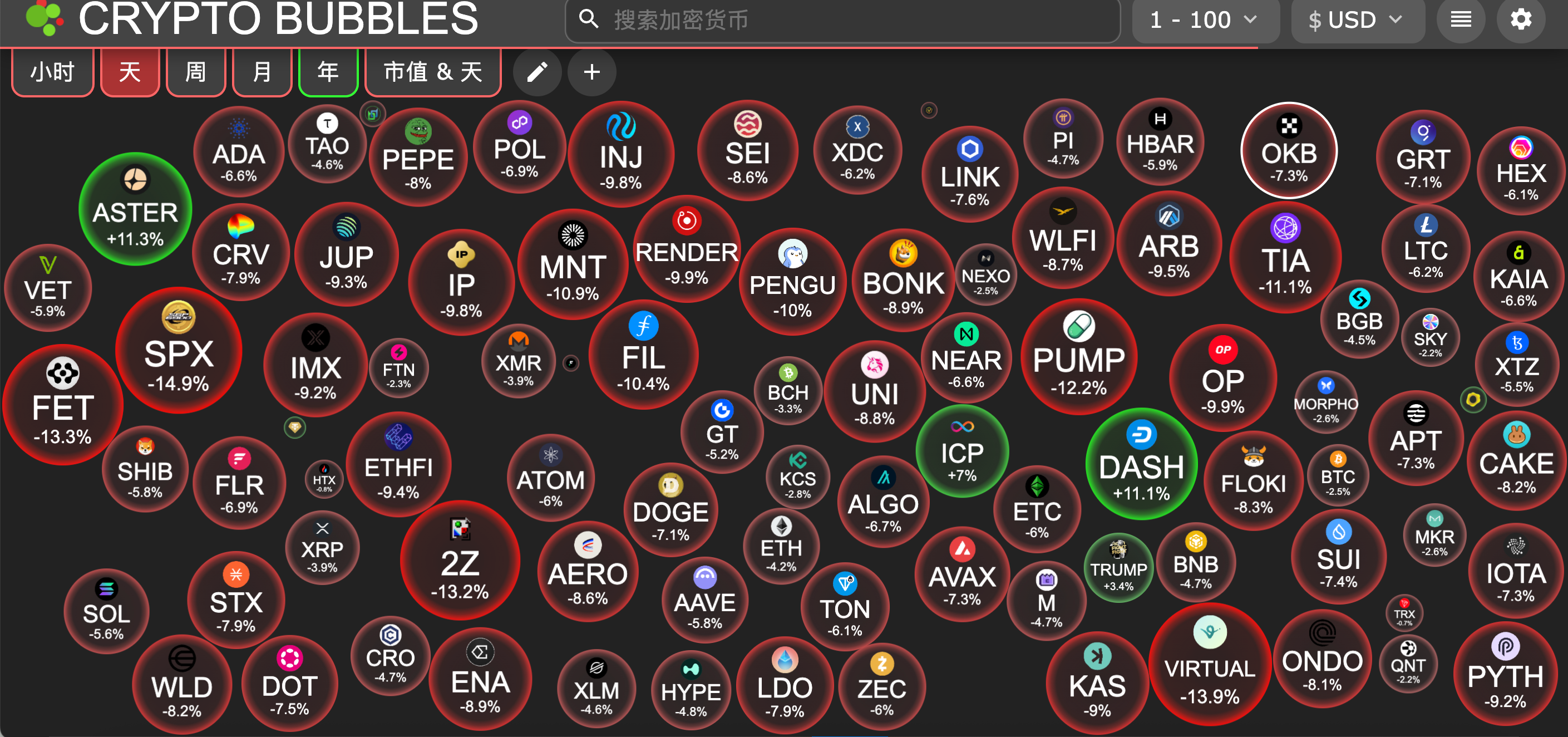

The altcoin market has been active recently, with several projects experiencing significant volatility due to news stimuli. In the ZK sector, influenced by Vitalik's endorsement, ZK tokens surged threefold, and although there was a subsequent pullback, it drove up projects like STRK, SCR, and MINA within the ecosystem. Binance founder CZ revealed on social media that he has bought ASTER and is holding BNB long-term, which directly stimulated the rise in ASTER's price. The privacy coin sector remains hot, with Zcash (ZEC) nearing $450 under the influence of KOLs like Arthur Hayes, and DASH also rising close to $100. Besides the celebrity effect, weekend x402 concept tokens PING and PAYAI also experienced a surge, although they have since retraced. Notably, the related concept token KITE will launch today, currently fluctuating around $0.13 pre-market.

2. Key Data (as of November 3, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $107,419 (YTD +15.77%), daily spot trading volume $43.99 billion

Ethereum: $3,723 (YTD +11.23%), daily spot trading volume $24.59 billion

Fear and Greed Index: 36 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 59.6%, ETH 12.5%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, SOL, VIRTUL

24-hour BTC long/short ratio: 47.7%/52.3%

Sector performance: L2 sector down 9.88%, DePIN sector down 8.78%

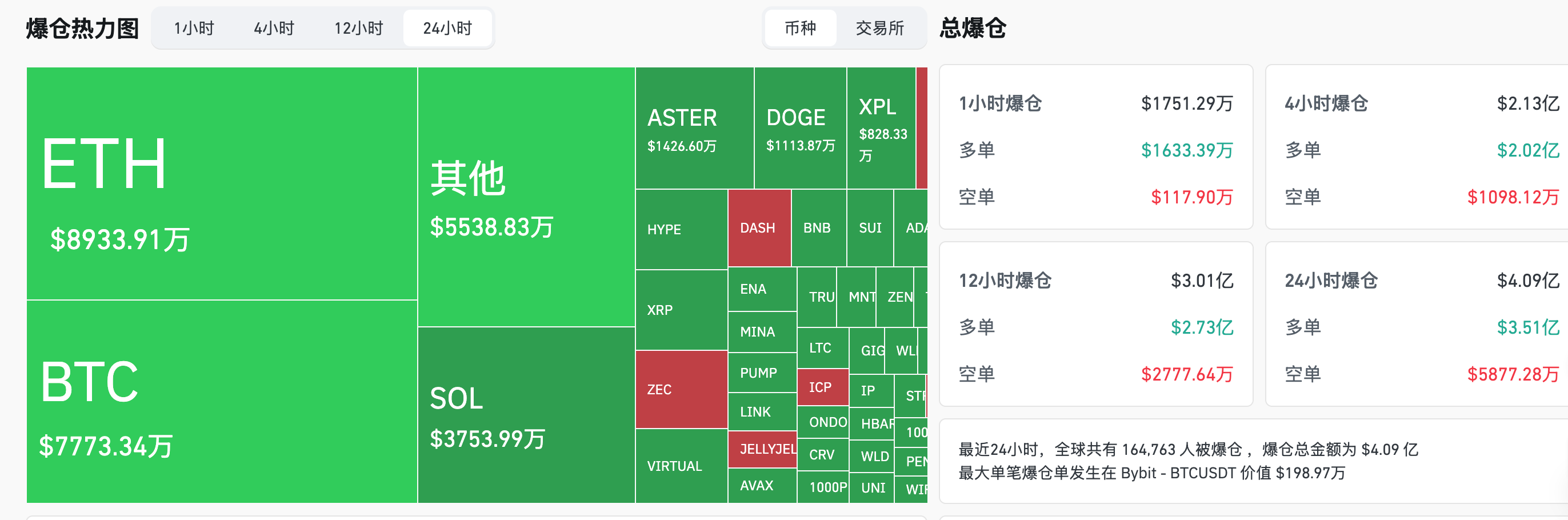

24-hour liquidation data: A total of 164,763 people were liquidated globally, with a total liquidation amount of $409 million, including $77.73 million in BTC, $89.33 million in ETH, and $37.54 million in SOL.

*Note: When the price is above the upper and lower bounds, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 31)

Bitcoin ETF: -$191.6 million

Ethereum ETF: -$98.2 million

SOL ETF: +$44.48 million

4. Today's Outlook

Binance Launchpool will list Kite (KITE), with KITE spot trading starting on November 3

The AI trading competition Alpha Arena hosted by nof1.ai will end on November 4

Memecoin (MEME) will unlock approximately 3.45 billion tokens at 3:30 PM on November 3, accounting for 5.98% of the current circulating supply, valued at approximately $5.4 million;

Today's largest declines among the top 100 cryptocurrencies by market capitalization: SPX6900 down 14.9%, Virtuals Protocol down 13.9%, ASI Alliance down 13.3%, DoubleZero down 13.2%, Pump.fun down 12.2%.

5. Hot News

Binance Will Delist KDAUSDT, AXSUSD, and THETAUSD Perpetual Contracts This Week

CZ: Bought BNB in the first month of BNB TGE eight years ago and has held it ever since

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。