Perhaps you have lost your "gold coins," but you still possess your "experience points" (XP).

Author: Alexander Choi

Compiled by: Deep Tide TechFlow

"I sacrificed everything for this… just for this…?"

In the past week, your portfolio has plummeted 80% from its all-time high (ATH).

You start to reflect on what you could have done differently. How should you have better assessed risks, and how should you have respected cryptocurrency as a high-volatility risk asset? Of course, there are those sleepless nights spent trading—time that could have been used to spend with friends, family, or learn other skills.

For me, this moment happened in the summer of 2024, during a period of market panic (FUD) that led to a crash.

Before that, I had been at break-even or even in the red for six consecutive months. Sometimes I struggled in the market for up to 18 hours a day while also juggling my studies (I was still in school at the time).

Then, in May 2024, I turned my last $500 into $104,000 in less than two weeks. But in the following month, I lost that money back down to $18,000.

This experience plunged me into one of the worst periods of my life. I temporarily left the crypto market and started going out for drinks every other day, binge-watching "Game of Thrones," and playing "League of Legends."

Image: Once climbed to Emerald 1

Even after this significant drawdown, I now sit more steadily. However, those who have experienced or are experiencing similar situations know that the real damage from a portfolio "explosion" is not just the monetary loss but also the blow to your confidence as a trader.

You start to question yourself:

"Was I just lucky…?"

Image: "Is it all just luck?"

And the worst-case scenario is that you fall into a vicious cycle of self-doubt, constantly trying to turn things around with the next trade.

What should I do?

Remember, every great trader has experienced multiple 80% drawdowns in their portfolio.

What truly makes them great is how they rise from it. And to help you get through this, I want you to remember one thing:

"If I have done it before, I can do it again."

Every morning when you wake up, repeat this phrase to yourself. Reflect on the past and find the strength that inspires you.

I see some people suggesting to "disconnect" from the all-time high (ATH) of your portfolio, saying that it was never the real you, and so on. But I disagree.

No matter what you did to achieve your portfolio's ATH, those abilities are still a part of you. You won't magically lose those skills. Instead, you may have just overlooked certain factors or violated your own trading rules in some areas. So, what we need to do is simple: categorize the issues.

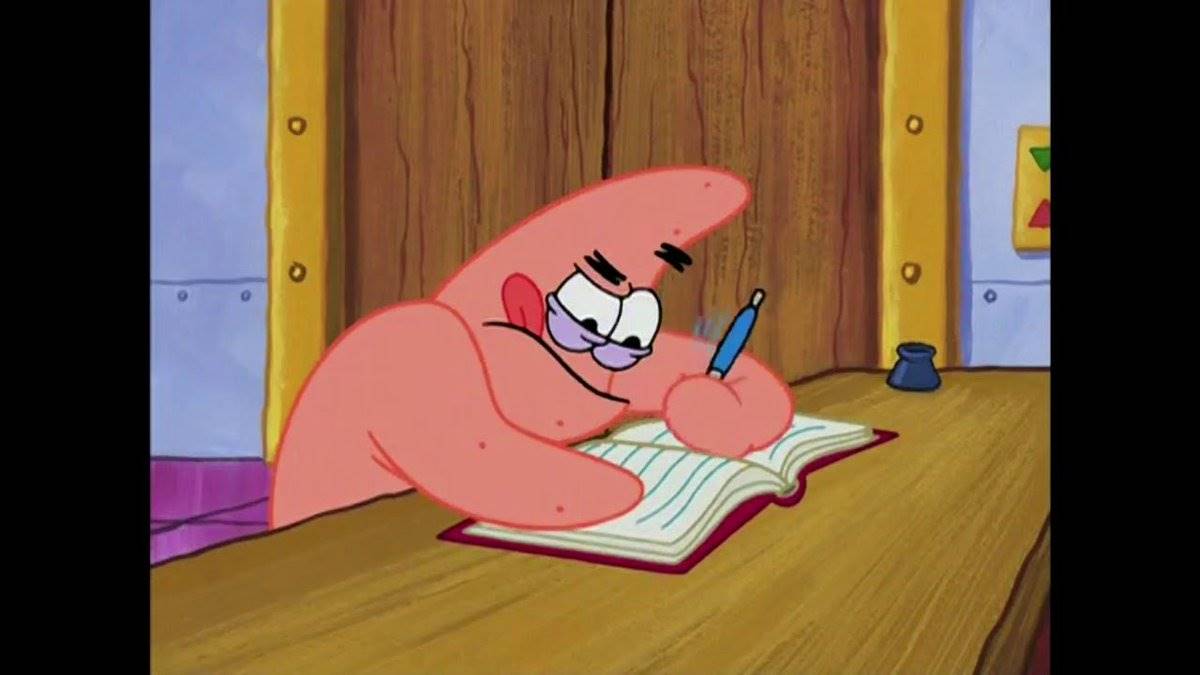

What am I good at? (How did I reach my portfolio ATH?)

Where did I mess up?

Take some time to write down these two things.

Image: Simple questions, complex answers

For example, when I turned $500 into $104,000, I did it entirely by heavily buying new trading pairs that were trending on-chain. I excel at narrative analysis, assessing the ceiling of new narratives, conducting research, and trading high-beta assets. During that time, on-chain trading was exceptionally hot, which perfectly matched my skills.

But where I messed up was that when the market turned and trading volume dried up, I continued to trade with the same high-risk style. After experiencing continuous losses, I tried to make up for it by increasing my position size, which resulted in a double whammy.

You need to view cryptocurrency trading as an ongoing process. Gains and losses do not exist in isolation.

After experiencing a severe drawdown, the only way to truly rebuild your confidence is to re-understand your essence as a trader.

Image: Understanding yourself is more important than understanding the "greater fool"

If you haven't developed the habit of recording your trades, now is the time to start. This is where a trading journal comes into play. From now on, document every trade you make and write down your thoughts about the market daily. You don't need to stick to a specific format; whether it's in a document, notes, or on paper, as long as it's a method you feel comfortable with, just make sure to actually write it down.

Ask yourself:

What is the narrative behind the cryptocurrency I am trading?

Why did I buy at that position?

Why did I hold for so long?

Why did I sell at that position?

And so on, and so forth…

Image: Where did I go wrong?

Recording these details will help you control your mistakes while reinforcing the areas you are already good at. When you see the habits that led to your best performances in your own handwriting, it will give you a clearer understanding of your strengths.

Why are you here?

From now on, with every trade, especially as you return to the peak, ask yourself one question: "Why am I doing this?"

Image: What is your goal?

After experiencing my first 80% drawdown, during those sleepless nights, I often sat there thinking: if I continued like this, would my life forever remain in this state? Staying up late playing games, drinking meaninglessly, achieving nothing beyond my rank in "League of Legends."

It wasn't until I began to find my "why" that I got back on the path of consistent trading.

Why do I desperately need to succeed? Because my parents have poured countless efforts, sweat, and money into me, and I don't want them to end up seeing just a "NEET" (Not in Education, Employment, or Training) who only cares about games and pretty girls.

Why do I desperately need to succeed? Because I want to give back to the family and friends who have helped me along the way.

Why do I desperately need to succeed? Because I don't want to spend years learning only to end up as a "working machine," working for others my whole life.

With every trade, I act with these "whys" in mind. If your only motivation is "making money" without a deeper meaning, then the illusory numbers on the screen won't sustain you through those dark moments.

So now, try to imagine—what if you were dead?

With nothing prepared, leaving nothing behind, just dying like that. What is your first reaction?

Is it feeling that you left nothing for your parents to be proud of?

Is it feeling that you were unable to support your family?

Or is it regretting that you didn't create more life experiences for yourself?

You likely won't think of some virtual number in your account. And that is your "why." That is the meaning of your life now.

Beyond any risk management advice, this is the core question: "If I make this trade, will it help me further achieve my life goals?"

Having a clear goal will give you all the motivation to maintain discipline during those quiet market days.

Believe in yourself

Especially when you are young, you may have more time than you think. So, apply this long-term perspective to your trading.

Do you think this cycle is over?

Then take advantage of the bear market when others give up, hone your skills, prepare for the next cycle, and even achieve financial freedom in the next bull market.

I know this journey is tough. I know you feel like the whole world is against you, and even your social circle doesn't understand your struggles. But as long as you learn something from this failure and maintain discipline when others choose to give up, you will ultimately prevail.

Perhaps you have lost your "gold coins," but you still possess your "experience points" (XP).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。