Original|Odaily Planet Daily (@OdailyChina)

Recently, Binance Wallet officially announced the launch of the trading entry for tokenized stocks and ETFs of the RWA leading project ONDO Finance, completing an important piece of the puzzle in the field of tokenized asset trading. With the support of Binance's over 290 million users and millions of wallet users, the RWA sector is expected to usher in a new round of growth momentum. This not only marks the accelerated integration of TradFi and DeFi but also reflects the grand vision behind ONDO Finance's "three-step strategy for crypto finance." Odaily Planet Daily has summarized ONDO Finance's layout plans in the tokenized stock market to explore the future prospects of the RWA sector.

ONDO Finance's Long-Term Layout: Cross-Chain, Connecting Entry, Qualifications, and TVL Across the Entire Chain

As early as May this year, there were reports that "Ondo Finance is about to launch the on-chain securities trading platform Ondo Global Markets," targeting the Solana ecosystem, which offers lower trading costs and higher trading efficiency—this is also the preferred ecosystem for on-chain US stock trading platforms like xStocks and MSX.com.

Of course, as the leading project in the RWA sector, ONDO Finance's every move has never been aimless; rather, it has been methodical and strategic, making it a rare example of "building strong fortifications and fighting a steady battle" in the crypto market. Overall, its long-term layout can be divided into the following "three-step strategy":

Step One: A Good Man Has Three Helpers, A Project Has Multiple Allies

In June this year, to coordinate industry standards in the crypto sector and promote the interoperability of tokenized securities, Ondo Finance took the lead in announcing the launch of the Global Markets Alliance, which includes participating organizations such as the Solana Foundation, Bitget Wallet, Jupiter, Trust Wallet, Rainbow Wallet, BitGo, Fireblocks, 1inch, and Alpaca.

Understanding the lengthy and time-consuming process of mainstreaming RWA, ONDO Finance did not rush to launch a trading market but instead made ample preparations with partners and platform allies.

After all, no matter how well a trading platform is built, if there are no participants or liquidity funds involved, it can only be said to be a source-less water and a tree without roots.

Step Two: Technical and Qualification Issues That Can Be Solved with Money Are Never a Problem

If the first step in building a tokenized stock trading platform is "to release news and gather allies," then ONDO Finance's second step demonstrates its cautious and firm compliance attitude.

In early July, Ondo Finance announced its acquisition of the SEC-regulated securities broker Oasis Pro; although this acquisition took nearly three months to finally receive approval from the SEC, ONDO Finance ultimately succeeded in acquiring Oasis Pro.

This acquisition allowed ONDO to obtain qualifications such as being a registered digital asset broker-dealer, alternative trading system (ATS), and transfer agent (TA) with the SEC.

Additionally, Ondo Finance also announced in July the acquisition of blockchain development company Strangelove to expand its RWA on-chain infrastructure development capabilities. Thus, both technical and qualification barriers were simultaneously overcome.

As Ondo Finance CSO Ian De Bode stated in August on The Rollup Co. program that, the current market is ready for tokenization. He pointed out that unlike in the past, the on-chain adoption rate is continuously increasing, stablecoin liquidity is abundant, and the DeFi ecosystem already exists, providing the necessary infrastructure support for the landing and development of tokenization.

It is worth mentioning that ONDO's "homework" on regulatory compliance goes far beyond mere acquisitions; significant efforts have also been made in government relations and organizational personnel: At the end of July, ONDO was mentioned in the latest White House report released by the President's Working Group on Financial Markets. The report recognized tokenized securities, stablecoins, and programmable settlements as important components of the future financial system; in September, ONDO officially announced that Peter Curley had joined the company as the global head of regulatory affairs. The latter, as a "veteran in financial policy," has an impressive resume: he has served as a senior policy advisor at Coinbase, a senior advisor for financial institution policy at the U.S. Treasury, deputy director of the SEC, and head of strategy and IPO regulation at Hong Kong Exchanges and Clearing Limited, making him a "global regulatory expert."

Thus, the compliance barriers in front of ONDO for building the tokenized stock and ETF platform have been cleared away.

Step Three: Everything for Liquidity

With everything in place, ONDO Finance did not hesitate and first announced in late August that it would launch the on-chain stock and ETF trading platform Ondo Global Markets on the Ethereum network on September 3.

The platform indeed launched as scheduled, unlike some crypto projects that frequently miss deadlines.

On September 3, ONDO Finance announced that it had launched over 100 tokenized US stocks and ETFs on the Ethereum chain, supporting 24-hour on-chain trading. The platform is open to qualified users in the Asia-Pacific, Europe, Africa, and Latin America (Odaily Planet Daily notes: the official emphasized that services are not provided to investors in the U.S. and the U.K. to ensure compliance), with plans to expand to over a thousand assets by the end of the year and to support BNB Chain and Solana. The platform supports asset minting, redemption, and on-chain transfers, with partners including OKX Wallet, Bitget Wallet, and Gate, while Chainlink provides price oracles.

Subsequently, liquidity surged dramatically:

On September 10, just a week after launch, the on-chain US stock platform Ondo Global Markets surpassed $100 million in TVL;

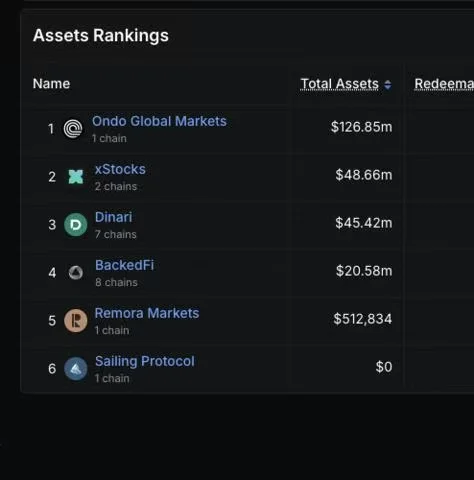

On September 12, on-chain data showed that in the total locked value (TVL) of the tokenized stock sector, Ondo Global Markets ranked first with $126.85 million, exceeding the total of other platforms combined.

On September 19, just a week later, the platform's TVL nearly doubled, surpassing $240 million;

A month later, on October 20, ONDO announced that the number of wallet addresses participating in tokenized stock and ETF trading had exceeded 90 million, and it had simultaneously connected with Blockchain.com’s global users, marking another milestone breakthrough in the tokenized stock and ETF trading market.

By the end of October, Ondo Global Markets announced the expansion of the platform to BNB Chain, further strengthening its ecological layout based on Ethereum. Other data showed that at that time, its TVL had surpassed $350 million, with a total on-chain trading volume of $669 million. For a newly established tokenized stock trading platform that has been around for less than two months, this achievement is already quite remarkable.

Based on the above three steps, ONDO has successfully transformed from a comprehensive RWA leading project to securing its place in the vast potential market of tokenized stocks, which could reach trillions of dollars.

And ONDO's ambitions go far beyond this. This is evident from its recent launch on Binance Wallet.

The Battle for Tokenized Stock Trading Entry: ONDO's Long-Distance and Close-Range Strategy

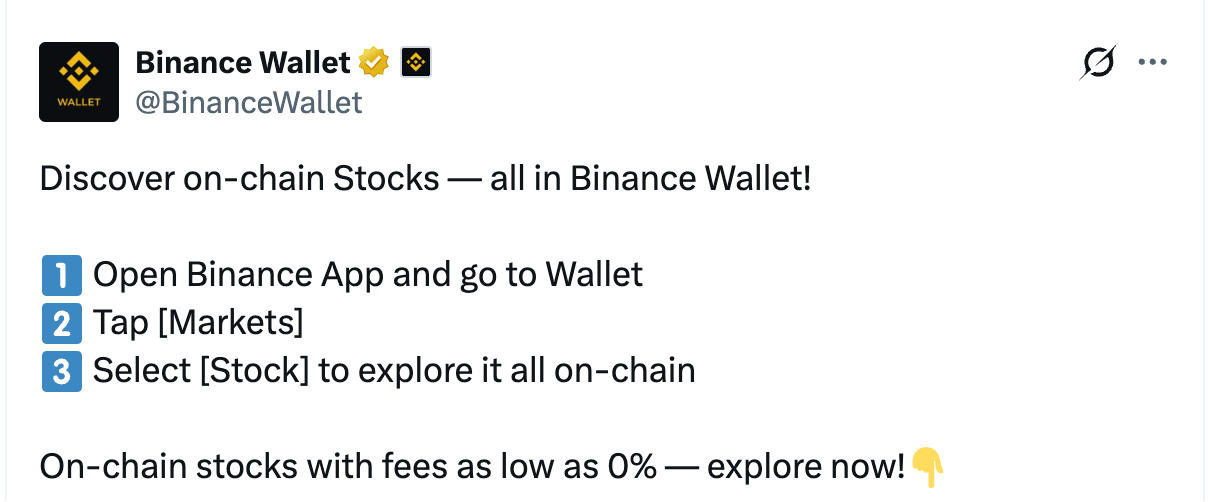

On November 25, Binance Wallet officially announced the launch of the trading entry for ONDO Finance's tokenized stocks and ETFs. More importantly, it provided a "foolproof operation guide"—only 3 steps are needed to trade on-chain stock tokens, with 0 fees.

"Binance Wallet Official Tutorial"

Function Entry Demonstration

Early this morning, ONDO Finance officially retweeted the above announcement to confirm the news and unabashedly pointed out its target users—millions of Binance Wallet users and over 290 million Binance platform users.

Image Source: Binance Official Homepage

As the hottest comprehensive application and the number one CEX by trading volume, Binance is undoubtedly the largest and most popular "crypto financial entry" at present. The integration of ONDO Finance with Binance Wallet may herald a massive influx of liquidity for tokenized stocks and ETFs. According to information from Binance's official website, its user base has exceeded 290 million, reaching around 298 million. Considering that the user scale of the crypto market is about 600 million, calling it "half of the crypto market" is not an exaggeration.

This is precisely the best entry point for ONDO Finance and its Ondo Global Markets to choose "internal breakthroughs." From a strategic perspective, it can be seen as a "close-range strategy," similar to the previous formation of the Global Markets Alliance, aiming to rally internal allies in the crypto market and unite all possible forces.

In addition, ONDO Finance has also adopted a "long-distance attack strategy"—targeting Nasdaq, which hopes to actively initiate tokenized stock trading and is committed to "self-revolution." (Recommended reading: “Self-Revolution of US Stock Exchanges: Nasdaq Applies for Tokenized Stock Trading, Aiming at a Trillion-Dollar Market”)

In mid-October, Ondo Finance submitted a letter to the SEC, requesting to delay or reject Nasdaq's proposal for tokenized securities trading. Ondo pointed out that the plan relies on undisclosed settlement details, which could give large institutions an unfair advantage.

In the letter, Ondo stated that regulators and investors cannot fairly assess the proposal without understanding how the Depository Trust Company (DTC) handles blockchain settlements. Although supportive of the tokenization trend, Ondo believes that approval should be paused until the DTC system is improved to ensure fairness and transparency.

Since then, ONDO's layout has been set. Everything is just waiting for the platform to be gradually built, using time and trading volume to prove who the ultimate winner is.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。