Master Discusses Hot Topics:

Today is the 23rd, and in a day or two, you will definitely be bombarded with news about the Santa Claus rally. The problem is that every year, some people believe in this, and every year, some get buried, and they have no one to blame but themselves. To put it bluntly, this is a holiday trap set for retail investors, specifically designed to collect the "intelligence tax."

The real battle point is not on the 24th or 25th, but from the 28th to the 31st. The so-called average rise during Christmas is pure nonsense. In the past seven years, the only significant rise was in 2020; the other years basically saw declines.

In 2018, 2021, 2022, 2023, and 2024, which year didn’t see a slow bleed during the holidays? Especially in 2021, when Bitcoin had just dropped from 69K, a bunch of people were waiting for Santa Claus to lift the market, but what happened? It continued to drop.

In 2024, it was even harsher, dropping from 106K all the way to 90K, with many holding long positions over the holidays, only to wake up to zero in their accounts. The most classic example is the Christmas drop in 2021. Some people, on the night of the 24th, were convinced that the market would rise, and opened 10x longs. Stop-loss? Not a chance, because they believed the legend.

As a result, on the 25th, the market consolidated, and in early January, it plummeted by more than 8%. With 10x leverage, if you don’t get liquidated, who will? From fifty thousand dollars to just a few thousand, Santa Claus didn’t show up, but the liquidation robots were right on time.

So, the question arises, why do issues often occur on the 24th and 25th every year? Because market makers understand holiday sentiment better than you do. They know what you are waiting for. On the 24th, they slightly push the price up to create some FOMO, waiting for you to step in and take the bait.

On the 25th, with Europe and the U.S. on holiday, liquidity is as stagnant as dead water. At this point, just a little bit of capital can crash the price; on the 26th and 27th, it continues to decline, grinding you down until you panic and cut your losses.

The real smart money never spends Christmas with you; they are focused on the last few days of December, racing to capitalize on the January effect. While retail investors are still chanting about Santa Claus, institutions have already started positioning for next year’s performance.

Starting on the 28th, large on-chain whales will move first, and before the U.S. stock market opens, they will be quietly accumulating. From the 29th to the 31st, ETFs and institutional traders will return, bringing real money into the market, and that’s when the real game begins. This year is even more exciting, with over 20 billion dollars in Bitcoin options expiring at the end of December, so the volatility in these days will be more intense than you can imagine.

Back to the market, Bitcoin at 90K is simply a curse. For eight consecutive days, it has touched or approached 90K six times, only to be pushed back down. Yesterday, it stabilized at 87.5K, pushed up a bit, reclaimed last week’s high, and touched 90K again, only to be crushed at 90.7K.

At midnight, it couldn’t hold, and the bears came down, clean and swift. From 0 to 4 AM, it was a direct drop, and from 4 to 8 AM, after the U.S. market opened, it gave you a false hope of a rebound, only to continue hammering down from 8 to 12 AM. The routine hasn’t changed at all.

Now the key is whether 87.5K can hold. If it holds, there’s liquidity waiting to be taken from 90.5K to 90.7K, so a slight upward sweep wouldn’t be surprising. If it doesn’t hold, then don’t pretend to be bullish; first, honestly return to the 86K OB area to find support.

If 85K to 86K can’t hold, then continue looking for support lower. Conversely, if 85K to 86K absorbs all the liquidity, rebounds back to 87.5K, then we can talk about 90K and 92 to 93K; otherwise, it’s all nonsense.

Ethereum is slightly stronger, having managed to stay above 3000, but last night, when it surged above 3100, it was immediately shot down by large sell orders. This is not a trend reversal; it’s a normal pullback.

The targets for the short term can be 3144 and 3269, but the premise is that you shouldn’t mindlessly chase before the U.S. stock market opens. Those without longs or looking to go long can wait for 2980 to 2950 to discuss further.

Master Looks at Trends:

To conclude, the current market is not strong; it is cooling down after overheating. Bitcoin is currently around 88K, which is not a strong hold, and market sentiment is very clear.

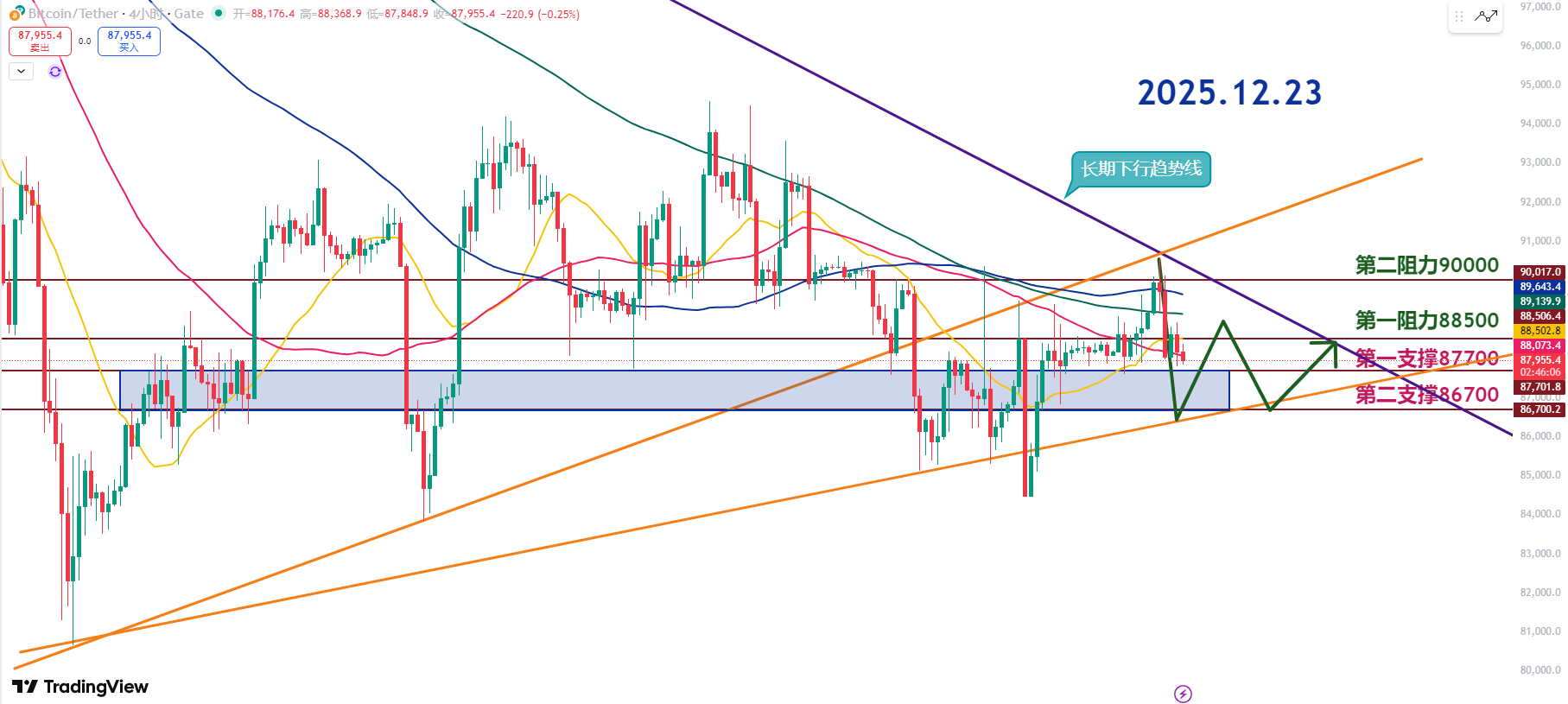

From a technical perspective, the weekend saw a standard script of sideways consolidation + exhausting bullish patience, with the 86.7K–87.7K range being the most important support area right now; whether it drops or not depends entirely on this level.

Currently, the price is operating within a converging structure, pulling people in and out. This kind of market is the most frustrating. If it doesn’t reclaim 88.5K, any rebound is just a retracement. Until it truly stabilizes above 88.5K, the mindset can only be defensive; don’t think it’s going to reverse.

If a large bearish candle continues to form, and we still don’t see a decent bullish engulfing candle, then we need to be wary of the N-shaped downward structure continuing to extend; it’s not just a one-time event.

The RSI is currently around 45, which means it hasn’t dropped enough yet, and there’s still room to fall. The upward trend line below is currently the last refuge for the bulls.

The first support is at 87.7K, and the second support is at 86.7K. If 87.7K is effectively broken, it can easily accelerate downwards in the short term; this is determined by the structure. This upward trend line is now the second line of defense; if it really drops to that area, then we can talk about value for money.

Although the short-term low has been broken, the overall upward trend hasn’t completely died, so if it continues to drop, we can only look for low-risk bets near the trend line; don’t try to catch falling knives halfway up the mountain.

The first resistance is at 88.5K, and the second resistance is at 90K. Only by reclaiming 88.5K can the market have the qualification to test 90K again. Until then, the bearish logic clearly dominates; don’t be fooled by a few rebound candles.

12.23 Master’s Band Trading Setup:

Long Entry Reference: 87000-87700 range long, Target: 88500-90000

Short Entry Reference: 90000-90500 range short, Target: 87700

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, and tomorrow they summarize short positions, making it seem like they "always catch the top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading methods, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by the official public account (as shown above) of Master Chen; any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。