Title: AICoin

Macro News Analysis:

① At 8:30 tonight, the US June CPI annual rate will be announced; the previous value was 3.3%, and the forecast value is 3.1%. If the announced value is greater than the forecast value, it will be positive for the US dollar and negative for crypto assets; if the announced value is less than the forecast value, it will be negative for the US dollar and positive for the crypto market.

② Of course, the market trend is not determined by a single logic. The specific trend still needs to be determined by the difference between the actual announced value and the forecast value, as well as the market sentiment at that time and other factors within the industry that affect the coin price.

③ Currently, Wall Street institutions predict that the CPI annual rate may accelerate to 3.5%, compared to May, it has increased. We speculate that this may be due to the recent rise in oil prices, which may cause inflation data to rise. This will also affect the Federal Reserve's interest rate policy and market expectations.

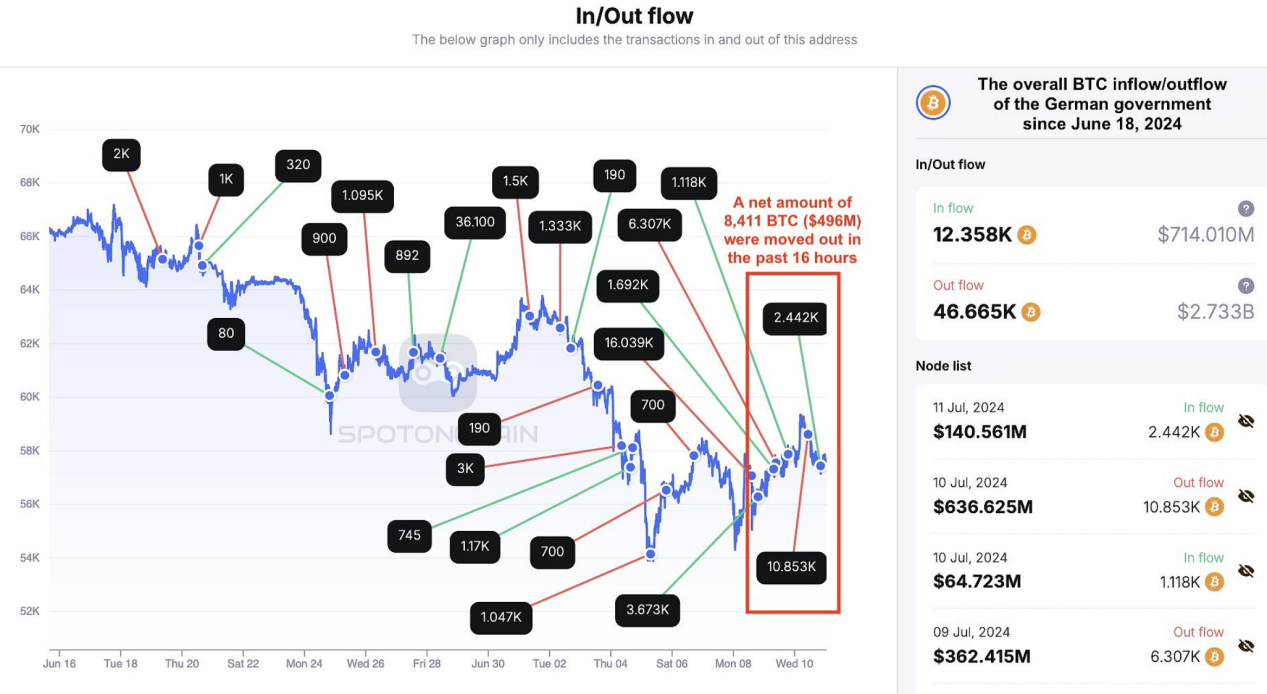

German Government Sells BTC - On-Chain Data Analysis

① According to on-chain data monitoring, we estimate that approximately 8411 BTC were sold (i.e., 10853 BTC transferred to cex minus 2442 BTC withdrawn), and the average selling price is approximately near $58,000. In the past 16 hours, the German government may have sold BTC worth as much as $496 million.

② Regarding the total of 2442 BTC withdrawn from CEX and other addresses this morning (about $141 million), I need to explain that the German government has transferred this batch in batches to several international giants such as Coinbase, Bitstamp, and Kraken, with each transfer ranging from 300 to 1000 BTC. Some were sold at the target price, and the unsold portion was returned to the German government by the exchange.

③ After our investigation, the German government currently only holds 15552 BTC ($893 million), which is approximately 31% of the original amount seized from a pirated movie website in January this year, and has decreased significantly from the peak of 50,000 BTC.

- The above data is from this morning, and according to the latest monitoring by Arkham, the German government has just transferred out 2375 BTC (about $138 million), of which 2125 BTC were transferred to CEX and market maker addresses, and another 250 BTC were transferred to an unknown address.

Technical Analysis:

BTC Technical Analysis

Weekly Level:

After the BTC weekly K-line broke below the M top neckline at the close of this Monday, with the temporary phase of oscillating adjustment, the bearish momentum has eased.

The weekly Bollinger Bands continue to converge, and the K-line has gained some support near the lower rail, but considering the previous long shadow real body K-line, there is still strong resistance.

The upper resistance refers to the lower support position of the previous wide-ranging oscillation range, which has now turned into a platform pressure level.

The J value of the KDJ indicator has been in the oversold zone recently and is tending to flatten, reaching a new low level since September last year, which may be a sign of a rebound in the future.

The VOL trading volume has been in a shrinking adjustment state since setting a new high of $73,777 during this round of bull market, and the fast and slow lines have formed a second death cross. Looking back over the past five years, the current trading volume is only lower than that of August to October last year, indicating that the market is currently playing with existing funds and temporarily lacks fresh capital inflows. If there is an increase in funds in the future, there may be some changes.

Here, I reiterate the downward target of the weekly double top, which we calculated to be near $48,000 and $41,000 based on the equal height of 1:1 (theoretical value, specific judgment still needs to be combined with other conditions).

Daily Level:

Yesterday, BTC rose slightly to near $59,470 and then fell back. The daily MA200 level of $58,900 has once again become a short-term resistance point. It has failed to break through effectively in the past four tests, indicating insufficient bullish strength, and the repeated situation at this level still needs to be closely monitored in the short term.

The Fibonacci 38.2% rebound level of this round of decline is $60,560, which is also the lower position of the previous oscillation range of $59,000-$60,800, and there is strong resonant resistance.

The lower daily support refers to the upper position of the upward continuation pattern trading volume dense area of $50,500-$53,000 in mid-to-late February.

Four-Hour Level:

The four-hour chart shows that after breaking through the $58,475 neckline yesterday, BTC has established a double bottom pattern. Currently, it has fallen back below the neckline. If it can effectively stabilize in the future, the theoretical target of the 1:1 equal height upward target is near $62,660-$63,560 (arrow height). Of course, this is only a theoretical target, and it still needs to be measured from other angles.

The Vegas channel resistance on the four-hour level is also roughly in the range of $61,000-$63,000 (blue circle mark).

On the four-hour volume-price distribution chart, the upper POC resistance is concentrated near $61,270, and there is relatively little downward trading volume, indicating a lack of obvious support in the short term, and changes in trading volume need to be closely monitored.

Hourly Level:

Yesterday, it broke through the Dow Theory's high point, and the hourly level has turned into a trend where the bulls are dominant, seeking support buying points.

The two upward trend lines are currently near $55,300-$56,000, and will gradually move upward over time.

In short, the weekly and daily levels are biased towards the bearish side, but due to touching key support, technical indicators also indicate a rebound in the near future. Considering the numerous upper resistances, the main idea is to maintain a phased short position when the rebound is blocked; although the four-hour double bottom pattern has retraced, the hourly level has trend line support, and the left-side trading idea is to try to buy in batches at support levels to speculate on the rebound.

In addition to the technical analysis itself, we also need to pay attention to macro data, on-chain trends, and industry news that affect the market, such as the recent transfers by the German government. Traders in the market who see such transfers may also engage in selling and shorting behaviors, which may to some extent affect the height and expectations of the rebound.

Follow us: AICoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。