Bitcoin, as the first cryptocurrency, has attracted widespread attention since its inception. Each time it reaches a new high, it brings significant market volatility and heightened interest from investors. Exploring the years when Bitcoin reached new highs in the past can help us understand its trends and the driving forces behind them.

Review of Bitcoin's Years of New Highs

2013: Bitcoin's Initial Breakthrough

2013 was the year Bitcoin's price first broke the $1,000 mark. During this year, Bitcoin experienced several significant surges, especially in November, when the price briefly reached the historical high of $1,242 at that time. Bitcoin's value began to be recognized by a broader range of investors, attracting substantial attention and capital inflow. However, due to China's restrictions on Bitcoin trading, the price fell sharply in a short period.

2017: A Historic Bull Market

2017 was one of the most important years in Bitcoin's history, with its price reaching nearly $20,000 in December. This bull market was driven by several factors, including widespread market interest in cryptocurrencies, the boom of Initial Coin Offerings (ICOs), and the attention of major financial institutions towards Bitcoin. With the launch of Bitcoin futures on the Chicago Mercantile Exchange (CME), Bitcoin's legitimacy and mainstream acceptance were enhanced. However, due to the intervention of regulatory authorities in various countries, Bitcoin's price fell significantly by the end of the year.

2020: A Safe-Haven Asset Amid the Pandemic

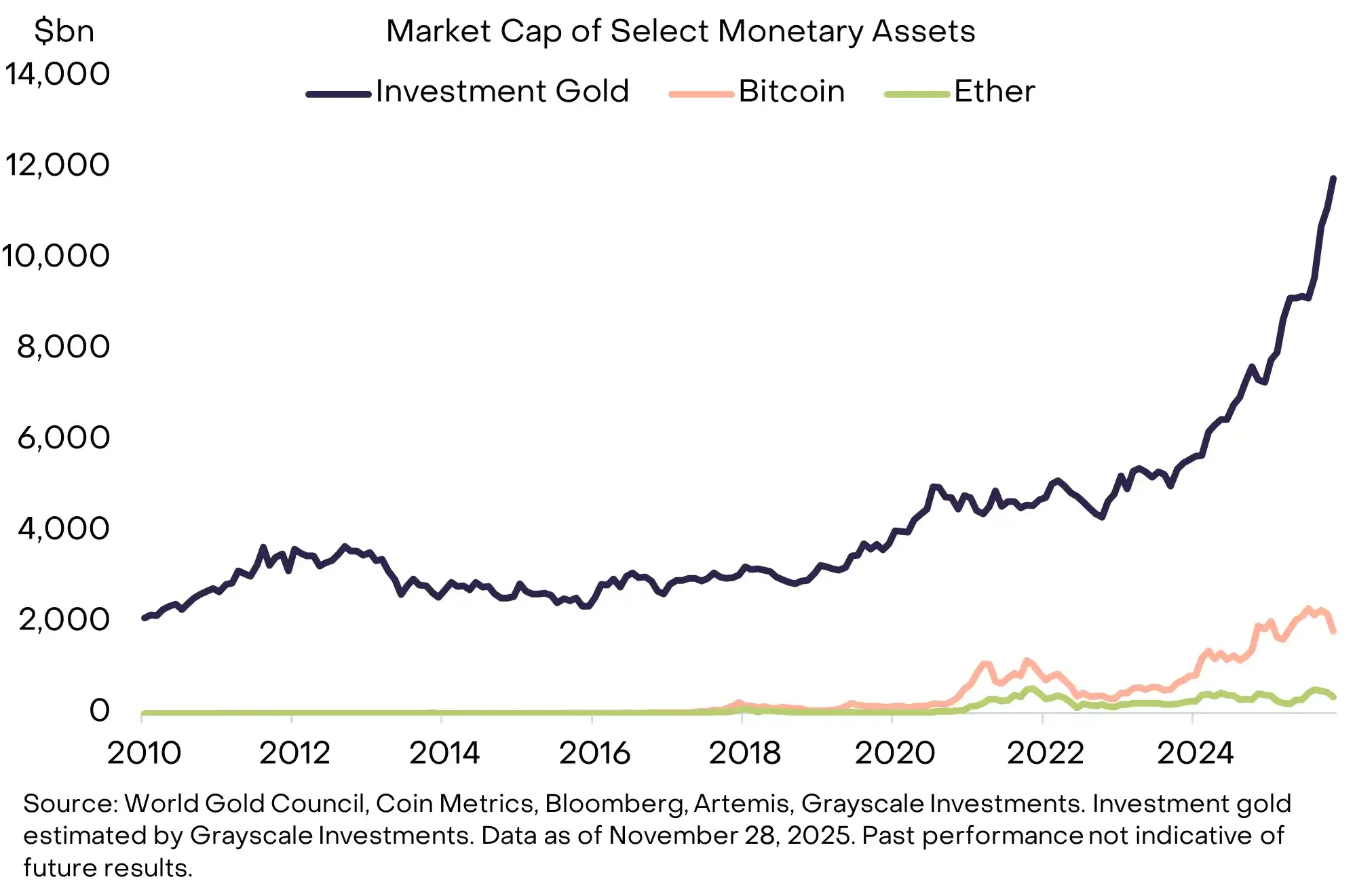

The outbreak of the COVID-19 pandemic in 2020 led to global economic instability, and Bitcoin, as a safe-haven asset, saw its price rise again. In December of that year, Bitcoin surpassed the 2017 high, exceeding $20,000. This surge was driven by institutional investors, such as significant purchases by Grayscale Bitcoin Trust (GBTC) and PayPal's decision to allow users to trade cryptocurrencies. In the same year, Tesla announced it had invested $1.5 billion in Bitcoin and planned to accept this cryptocurrency as a payment method.

2021: Institutional Investment and Market Volatility

In 2021, Bitcoin's price reached a new high of nearly $65,000 in April. During this period, large companies like MicroStrategy continued to purchase Bitcoin, significantly increasing its market recognition. However, due to regulatory scrutiny and Tesla's suspension of Bitcoin payments, the market experienced severe volatility.

Breaking $90,000 New High, $100,000 is Within Reach

On November 10 of this year, Bitcoin reached a new high, breaking the $80,000 mark for the first time. Today (November 12), Bitcoin has once again broken records, reaching a new high of $90,000, with a 24-hour increase of 11.93%, currently valued at $89,368.

Image Source: AICoin

From historical trends, it can be seen that the significant declines following Bitcoin's early new highs were mainly due to restrictions and regulations imposed by government authorities. This recent surge is driven by favorable policy expectations stemming from the U.S. election results, with the market anticipating that the Trump administration would adopt a more favorable stance towards cryptocurrencies, boosting market optimism.

However, it is also important to note that after each new high, the market typically undergoes a period of adjustment and consolidation. The current market optimism is primarily based on confidence in policy support, institutional investment, and market demand.

According to market analysts' predictions, Bitcoin may continue to rise in the future. Standard Chartered analyst Geoff Kendrick expects Bitcoin's price could reach $125,000 by the end of 2024.

Fundstrat's research head Tom Lee also stated that Bitcoin is expected to reach $150,000 in 2024. Bernstein Bank is also optimistic about Bitcoin's long-term prospects, predicting that Bitcoin's price will reach $150,000 by mid-2025.

Conclusion

Each new high of Bitcoin is influenced by various factors, including market sentiment, policy changes, and the participation of institutional investors. Looking back at history, Bitcoin's price fluctuations in significant years often accompany major market dynamics and policy changes. Looking ahead, although high volatility remains a prominent feature of the Bitcoin market, with increasing mainstream acceptance and institutional investment, Bitcoin, as an asset with potential value, is likely to continue reaching new heights in the future. Investors should carefully assess market risks and opportunities while formulating suitable investment strategies when focusing on the Bitcoin market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。