Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $2.98 trillion, with BTC accounting for 59.96%, which is $1.79 trillion. The market cap of stablecoins is $182.1 billion.

This week, BTC's price showed a fluctuating upward trend, with the current price at $90,962. ETH experienced range-bound fluctuations this week, with a current price of $3,087. Among the top 200 projects on CoinMarketCap, most have risen while a few have fallen, including: ACT with a 7-day increase of 3368.03%, PNUT with a 7-day increase of 1780.56%, PEPE with a 7-day increase of 115.72%, and DOGE with a 7-day increase of 87.83%.

The MEME sector cannot be ignored; missing out on MEME could mean missing this bull market.

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $1.845 billion, with the total market cap about to break $100 billion; the net inflow for Ethereum spot ETFs in the U.S. was $535.5 million.

On November 13, according to CME's "FedWatch," the probability of the Federal Reserve maintaining the current interest rate until December is 24.3%, while the probability of a cumulative rate cut of 25 basis points is 75.7%.

With multiple factors such as Trump's election as the next U.S. president, the Federal Reserve's rate cuts, BTC halving, and continuous inflows into Bitcoin spot ETFs, BTC is expected to break the $100,000 mark this year, and attention should be paid to the MEME sector for the market's subsequent development.

The "Fear & Greed Index" on November 16 was 80 (up from last week), with this week's sentiment: 5 days of greed and 2 days of extreme greed.

Understanding Now

Weekly Major Events Review

- Standard Chartered analysts predict SOL will reach a new high by the end of the year, and ETH may hit a new high in January when Trump takes office;

- a16z Crypto: New projects can confidently explore token releases without excessive regulatory concerns;

- On November 11, DOGE's market cap surpassed USDC, becoming the 6th largest cryptocurrency by market cap;

- Arthur Hayes: Market trends indicate Trump may abandon the dollar and print money extensively;

- Sky founder: If Bitcoin reaches $80,000, the revival of DeFi will be confirmed;

- Trump states Elon Musk and VIVEK will lead the government efficiency department (DOGE);

- Trump hints at appointing the SEC chair through "recess appointments" to bypass Senate review;

- Coinbase CEO: Cryptocurrency will become the next version of stocks and the internet;

- Federal Reserve Governor Waller: Stablecoins must be regulated to address the risk of bank runs;

- Former SEC chair: Cryptocurrency legislation may be introduced during Trump's administration;

- On November 14, Bitcoin briefly broke $93,000, setting a new historical high;

- After the U.S. CPI announcement, the probability of a 25 basis point rate cut by the Federal Reserve in December rose to 75.7%;

- Robinhood US re-listed SOL, ADA, and XRP;

- The U.S. SEC approved Japanese crypto trading platform Coincheck to list on NASDAQ;

- Pennsylvania legislators proposed a bill to invest in Bitcoin and cryptocurrency ETFs to "hedge against inflation";

- Arkham Exchange trading points are now online;

- GoPlus: The X account of the Shiba Inu WIF was hacked; beware of phishing risks from imitation versions;

- Trump nominates former SEC chair Jay Clayton as the U.S. Attorney for the Southern District of New York.

Macroeconomics

- On November 15, SEC Chair Gary Gensler hinted he might leave the SEC;

- On November 15, Bitwise announced it has submitted Form 19b-4 to the SEC through NYSE Arca, proposing to list the Bitwise 10 Crypto Index Fund (BITW) as an exchange-traded product (ETP);

- On November 13, according to CME's "FedWatch," the probability of the Federal Reserve maintaining the current interest rate until December is 24.3%, while the probability of a cumulative rate cut of 25 basis points is 75.7% (before CPI announcement, these were 37.9% and 62.1% respectively); The probability of maintaining the current rate until January next year is 16.5%, with a cumulative rate cut of 25 basis points at 59.2%, and a cumulative rate cut of 50 basis points at 24.3% (before CPI announcement, these were 26.5%, 54.9%, and 18.6% respectively).

ETF

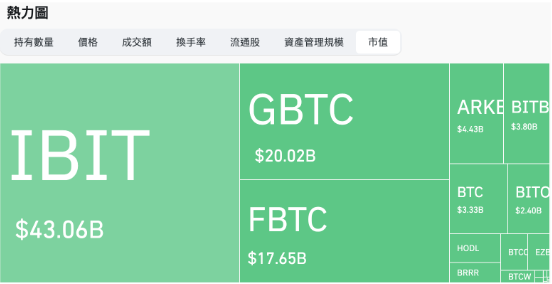

According to statistics, from November 11 to November 15, the net inflow of Bitcoin spot ETFs in the U.S. was $1.845 billion; as of November 15, GBTC (Grayscale) had a total outflow of $20.227 billion, currently holding $20.016 billion, while IBIT (BlackRock) currently holds $43.064 billion. The total market cap of U.S. Bitcoin spot ETFs is $98.736 billion, about to break the $100 billion mark.

The net inflow of Ethereum spot ETFs in the U.S. was $535.5 million.

Envisioning the Future

Upcoming Events

- The Australian Crypto Convention will be held from November 23 to 24 in Sydney, one of the largest cryptocurrency events in the Southern Hemisphere, aimed at connecting investors and decision-makers in the cryptocurrency and blockchain industry;

- The Block will host the Web3 summit "Emergence" from December 5 to 6 at the Prague Congress Centre in the Czech Republic, promoting connections between technology and capital, bridging Wall Street and the crypto space, gathering representatives from various industries and chains to discuss ETF and asset management, and the uncertainties of crypto regulation. Through collaboration with Foresight Ventures, Emergence will provide insights into driving the development of cryptocurrency in Asia and bridge the gap between Eastern and Western capital and talent.

Project Progress

- Magic Eden will release the ME token economic model on November 18;

- The TON ecosystem Layer 2 project DuckChain will conduct an airdrop snapshot on November 18;

- BNB Chain announced that the BNB Beacon Chain hard fork will take effect on November 19, 2024, at 14:00 (block height 384,544,850). Nodes on the BNB Beacon Chain mainnet must be updated to version 0.10.24. At that time, the BNB Beacon Chain will stop operating, and new transactions will no longer be processed;

- The perpetual contract protocol Rage Trade will begin RAGE airdrop distribution on November 21, 2024, and Rage Trade has launched an airdrop query page;

- The final testnet Odyssey of Story Protocol is now online and will cease operations of Iliad on November 24.

Important Events

- FTX has reached a settlement with Evolve Bank and the Silicon Valley Community Foundation, which may allow it to recover up to $21 million in assets. The agreement is pending court approval, with a hearing scheduled for November 20;

- The proposed settlement hearing between FTX and SBF's ex-girlfriend Caroline Ellison will be held on November 20, which will allow her to transfer "almost all remaining assets." Ellison agreed to transfer any assets not forfeited to the government or used to pay legal fees to FTX creditors in her criminal case;

- FTX co-founder Gary Wang will appear in court on November 20 for sentencing;

- The SEC will delay the deadline for its decision on the 7RCC spot Bitcoin and carbon credit futures ETF until November 21. The crypto asset management company 7RCC submitted a Bitcoin spot ETF application to the SEC last December, with 80% consisting of Bitcoin and the remainder holding carbon credit futures, with the cryptocurrency exchange Gemini providing custody for the fund's Bitcoin.

Token Unlocking

- Avalanche (AVAX) will unlock 1.67 million tokens on November 18 at 8:00, worth approximately $53.3 million, accounting for 0.41% of the circulating supply;

- Pixels (PIXEL) will unlock 53.55 million tokens on November 19, worth approximately $10.41 million, accounting for 1.07% of the circulating supply;

- Merlin Chain (MERL) will unlock 28.25 million tokens on November 19, worth approximately $7.95 million, accounting for 1.35% of the circulating supply;

- Bittensor (TAO) will unlock 216,300 tokens on November 21, worth approximately $111 million, accounting for 1.03% of the circulating supply.

About Us

Hotcoin Research, as the core investment research department of Hotcoin, is dedicated to providing detailed and professional analysis for the cryptocurrency market. Our goal is to offer clear market insights and practical operational guidelines for investors at different levels. Our professional content includes the "Play and Earn Web3" tutorial series, in-depth analysis of trends in the cryptocurrency industry, detailed analysis of potential projects, and real-time market observations. Whether you are a newcomer exploring the crypto space for the first time or a seasoned investor seeking in-depth insights, Hotcoin will be your reliable partner in understanding and seizing market opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://www.hotcoin.com/

Medium: medium.com/@hotcoinglobalofficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。