Author: Zhou Zhou, Foresight News

Chiang Mai, an internationalized large rural area, has been home to Vitalik for about 42 days recently. For someone who averages 55 flights a year and is almost "moving" every week, staying in one city for such a long time is quite rare.

During these 42 days, a grassroots, decentralized social life experiment took place, with over 1,000 blockchain practitioners from around the world arriving in Chiang Mai, spontaneously forming 8 or 9 cities and villages (Pop-Up City). They aimed to establish a "Web3 City" lasting six weeks.

Vitalik referred to this as Zuzalu 2.0. Since he initiated the first "pop-up city experiment" Zuzalu in Montenegro in 2023, he has been looking for ways to continue this social experiment. "Watching the development of Zuzalu 2.0 feels like watching my son grow up step by step," Vitalik told me.

The crypto industry often wears two distinct faces: one face is filled with high-risk financial transactions and activities, while the other is characterized by idealists attempting to innovate based on the decentralized principles and incentive mechanisms of blockchain.

"Over these six weeks, there were a total of 1,422 participants, with 1,663 events held, including meditation, hiking, Muay Thai, sound healing, Web3 technology lectures, and programming geek training camps… The village with the most participants, Edge City, had nearly 500 people," data from the Social Layer application shows. Here, builders initiated activities using Social Layer rather than the more standardized and commercialized Luma. Beyond Edge City, there are other "villages," such as "Invisible Garden," centered around global ZK developers, and "Shan Hai Wu," focused on Chinese Web3 practitioners, both exceeding 100 people. This has allowed experiments like Zuzalu to have a legacy.

The significant increase in the density and breadth of Web3 talent has turned this place into a temporary "amusement park" for Vitalik's ideas. He visits two or three "Web3 villages" almost every day to engage with the villagers, and when he spoke to me about this, I found that he could recall the location and characteristics of each village in detail, even down to the distance and direction.

The intensive visits and conversations undoubtedly brought him many new ideas, and some new systematic thoughts began to take shape in his mind. In this conversation, Vitalik extensively shared his thoughts on Ethereum ecosystem applications, pointing out that the technology has reached a certain level of maturity, and it is time to start focusing on applications. He shared several of the latest Web3 applications he learned about in Chiang Mai. Additionally, he discussed his observations on crypto institutions like Solana and Binance, as well as Chinese elements such as Tencent AI Labs and "The Three-Body Problem," and finally shared his lifestyle, habits, and hobbies.

To this end, Foresight News invited Vitalik for an offline interview in one of the "villages" in Chiang Mai—Shan Hai Wu—to share his observations and thoughts during this period. The following is the text content.

42 Days in Chiang Mai

Joe: Hello everyone, I am Zhou Zhou from Foresight News, and I am pleased to invite Ethereum founder Vitalik for this interview. Vitalik, could you introduce yourself?

Vitalik: Hello everyone, I am Vitalik Buterin, a famous Dogecoin holder.

Joe: A very iconic introduction. You have spent a long time in Chiang Mai, over 30 days. What kind of people and events attracted you?

Vitalik: I often move from one place to another. I remember averaging 55 flights a year, not including layovers. However, in Chiang Mai, I haven't moved for six weeks, and it feels like a great opportunity to work and rest at the same time. Of course, I found that I have many activities every day in Chiang Mai.

Last year in Montenegro, I conducted a Zuzalu experiment, and everyone said it was very successful as an experiment, but we were all unclear about what the next step would be. During the time between Token2049 in Singapore and Devcon in Bangkok (about 7 weeks), some people initiated pop-up activities in Chiang Mai. It started with just a few, and then more and more joined. It can be said that it eventually evolved into Zuzalu 2.0, supported by the same fund (the Zuzalu Fund). I am the initiator and founder of Zuzalu 1.0, and watching the development of Zuzalu 2.0 feels like watching my son grow up step by step.

There are really many interesting things and communities here, with seven or eight larger Pop-Ups, each with its unique characteristics. For example, (we are currently) in Shan Hai Wu, where many interesting activities are happening, both technical and non-technical, as well as various meditation activities.

Invisible Garden is 900 meters away, focusing on ZK and Ethereum-related projects; 3 kilometers to the east is MegaZu, a project emphasizing developer culture in Ethereum L2 technology, conducting a Bootcamp for developing applications (intensive training and learning); one kilometer east of MegaZu is Web3 Village, a Vietnamese community with some interesting talks and activities; another kilometer east is Edge City, which is very large, possibly having 300 people now, with different content every week. They had a stablecoin-related event last week, and this week they have one about Dapps.

Every time you visit a pop-up, you will find different people, different activities, and different topics of discussion, which makes it particularly interesting.

Joe: You have participated in activities almost every day in Chiang Mai. During this process, what new changes have you noticed in your understanding and perception of Crypto?

Vitalik: In Shan Hai Wu, I found that people in the Ethereum community discuss two questions. The first question is why they are interested in Ethereum; the second question is what the challenges of Ethereum are.

On the internet, many people express some ideas that I find strange, such as the notion that Ethereum's values are useless and that Crypto is a gambling market. However, in the Ethereum community, some people, including many Chinese, participate in Ethereum because we have some values and life ideals that we particularly care about. We want to create an open world, a decentralized blockchain and platform, and we aim to develop sustainable applications that contribute to a better society. Our community members express these sentiments.

However, we have not achieved this for a long time. Why? Because before this year, our technology was not good enough; in 2021, we only had L1, without L2. The transaction fees for Ethereum's L1 could be $1, $5, or even more. Last year, we had many L2s, but they were not secure enough, and the user experience of their wallets was poor.

This year, we can see some changes. First, Optimism and Arbitrum in L2 have reached Stage 1. According to a framework I developed two or three years ago, if you are not Stage 1, you are essentially a multi-signature wallet, with no secure connection to Ethereum. However, Optimism and Arbitrum have reached this stage, improving security and significantly reducing transaction fees. In February of this year, the average transaction fee on L2 was $0.4, and now it can sometimes be as low as $0.004.

There has been an interesting trend in the tech industry over the past two decades: people have proposed some interesting ideas early on, but it may take many years for anyone to realize them. Suddenly, ten or twenty years later, when the technology becomes good enough, these ideas come to fruition.

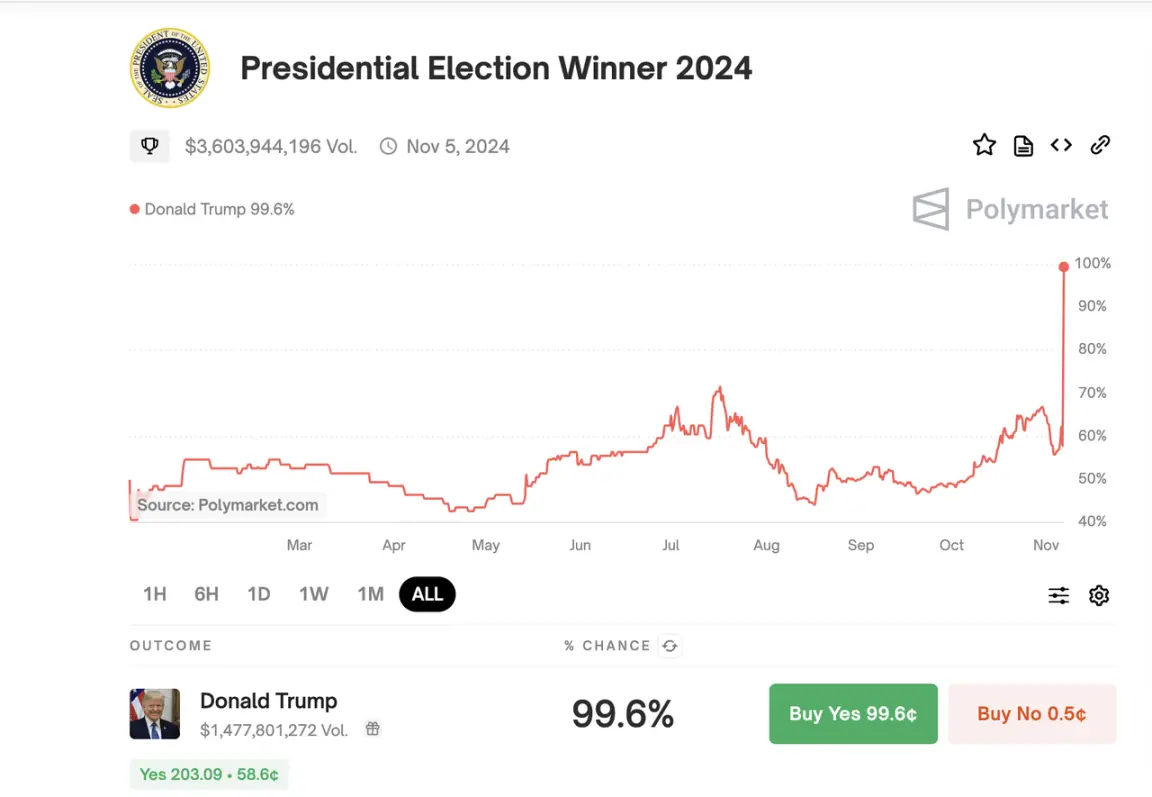

Since 2014, I have been interested in the topic of prediction markets. I participated in Augur (a prediction market platform founded in 2014) in 2020, but at that time, there were not many users, and my own user experience was poor. In early 2021, I wrote an article titled "Prediction Markets Tales from the Election," where I earned $58,000, but I paid $1,000 in transaction fees. Now, Polymarket, based on Polygon, can be said to be almost free.

Prediction markets existed in 2014, and for ten years, entrepreneurs have been trying to create them, but it wasn't until 2024 that Polymarket suddenly became popular. Why could these applications become a reality? I believe two key reasons are lower transaction fees and faster transaction confirmation speeds.

Blockchain is not a standalone technology; it may require the maturity of various other technologies before applications can explode. If you are a developer wanting to create blockchain applications, the first scenario is that users pay $5 for each transaction, the second scenario is $0.5, and the third scenario is $0.005. In the first scenario, the only possible successful applications are high-value, high-risk financial products.

Farcaster is another very interesting example. They use a hybrid on-chain and off-chain architecture, where important information, such as account registration, is on-chain, while user messages are off-chain. They have a very interesting decentralized off-chain storage method. Every time you register an account or deal with important information, they need to send a transaction, which incurs a transaction fee. If a transaction costs $5 or $15, that application is completely unlikely to succeed. However, if the transaction fee is $0.001 or $0.05, it becomes feasible.

Thus, our industry has entered a situation where many idealistic blockchain practitioners want to create non-financial applications, solve identity issues, and develop decentralized governance, but the only successful applications are high-risk financial ones. Because if the transaction fee is $5, high-risk finance is the only thing you can do. If the transaction fee drops to $0.005, many previously impossible things become possible.

Therefore, I believe many blockchain applications are experiencing a new trend of change, where many previously impossible things are now becoming possible.

Joe: Besides Polymarket and Farcaster, which you often mention, what other interesting applications have you seen during your time in Chiang Mai?

Vitalik: I found that MegaZu is working on some particularly fun applications.

In 2018, I saw an interesting application where they wanted to create a crypto event platform. Sometimes an event would have 200 people registered, but neither the organizers nor the registrants knew whether 100, 50, or just 20 people would actually attend.

So the model they proposed was "trustworthy commitment." If participants wanted to join, they had to send 0.01 or 0.02 Ether. If they ultimately did not attend, they would lose their Ether. If they did participate, they would receive a portion of the Ether contributed by those who did not attend. This ensured that most registrants would actually show up for the event.

I find this application idea particularly interesting as it can help us solve some everyday problems. This application was developed in 2018, but there hasn't been much news since then. I suspect this is because the blockchain transaction fees and user experience were not good enough back then. Now, MegaZu has many developers working on applications based on this idea, which I think is fascinating.

"Many Web3 Applications Are Now Possible"

Joe: How does the Ethereum Foundation view the current situation where the community believes there are too many infrastructures and not enough applications?

Vitalik: I see some critics in our community who say that Ethereum philosophers love to talk about technology but not about applications.

Why is that? Initially, we couldn't do applications very well because our technology wasn't complete. Now that our technology has reached a certain level, we can start developing applications. So now we need a community focused on application development. We need both technology and applications. This is also the advantage of the diversity within the Ethereum community.

I think the best approach is not to tell those working on L1 to focus on applications; the best thing they can do is to care about L1 issues. What we need to do is give new people more opportunities and space within the community. The first point is to give them freedom, and the second point is to provide them with more support.

Joe: Will there be more specific measures?

Vitalik: The first is support within the community. If some people are working on important applications, they can share what they are doing within the community; that's the first step.

Second, many people are particularly good at creating user-friendly products, but they may not be as skilled in blockchain technology and the integration of L1, L2, and wallets. We also need organizations that connect with teams more, such as community organizations and hackathons.

Another point is that the foundation is looking to expand a team, and the goal of this expansion is to maintain more relationships with wallets, such as MetaMask, OKX, Rabby, etc. Because wallets have a lot of direct contact with users.

Joe: What are the top three products you hope to see built on Ethereum?

Vitalik: I've mentioned Polymarket and Farcaster a lot in the past year, not just because I like these two examples, but because they both represent a very promising category. Polymarket can be classified as a combination of finance and new media. Twenty years ago, we had traditional media; ten years ago, we had social media, but now many people no longer trust traditional and social media.

Everyone talks about wanting to create better Web3 social media, but they just add a crypto payment feature to existing products, and that approach has failed. How did social media succeed? When Twitter first came out, its goal was not to become the next Facebook; when Douyin and TikTok emerged, their goal was not to become the next Twitter. We need to invent a new category rather than just tweaking existing categories to do better.

I would place Polymarket in the media category. If I want to know what's happening in the world, I now have a habit of checking Polymarket. Or when the media reports that something has happened, I check Polymarket to see if it's significant. I might also go directly to Polymarket to see if anything important has happened recently. If you see a large amount of betting on an event on Polymarket, you become curious about what exactly is happening.

Image source: Polymarket (2024 U.S. election, $3.6 billion wagered globally)

It's interesting that traditional, social, and Web3 media coexist in three different ways. Polymarket has two ways to participate: the first is that if you have money, you can participate in the market; the second is that if you don't have money, you can still observe the market's results. I believe this combination of market and non-market has many opportunities. I don't yet know what these opportunities are, but I believe there will be many.

Regarding Farcaster, I think social products need to incorporate some crypto elements. Right now, a major issue for crypto entrepreneurs is that they tend to split into two extremes: one group focuses solely on making money with applications that lack long-term sustainability and significance; the other group focuses only on users but has no revenue.

The first problem is that entrepreneurs aren't making money, and the second problem is that if users aren't idealists, they won't want to participate. A successful Web3 application will combine these two aspects.

SocialFi also has a history outside of blockchain. For example, in 2012, there was a project called Diaspora that aimed to create a decentralized Facebook, but they ultimately failed. Now, some platforms like Bluesky and Threads are facing two problems. The first is that they can't make money, so they lack the resources to do great things.

The second problem is that if users aren't idealists, what incentive do they have to move from Twitter? If we can find a way to combine these two aspects, it would be perfect. But no one has fully achieved that yet. Finding a way to combine idealism with profitability is very important.

Joe: Do you pay attention to applications in ecosystems like Solana and TON?

Vitalik: Sometimes I chat with people from Solana to see what interests them and what topics are currently being discussed. There are indeed some people who are turning Depin into the internet or the next generation of infrastructure.

As for exchanges like Binance, they have a lot of development in some developing countries. In 2021, when we went to Argentina, I found that many people were using crypto, but I also noticed that many of them were crypto users without being blockchain users.

One Christmas, I was walking outside and approached a café where the owner immediately recognized me and showed me his Binance account. I asked if I could buy coffee with Ethereum, and he said yes. The payment process took about five minutes, and the transaction confirmation time was particularly long, but that issue has now been resolved. The reason I care about this topic now is that we hope some exchanges can accept on-chain transactions on Ethereum within 12 seconds.

Joe: You just mentioned that many people are crypto users but not blockchain users. This might be related to the fact that many on-chain activities are happening on the web rather than on mobile?

Vitalik: There are now some wallets that encourage this, such as Daimo on Base, which is a great example. Their goal is to create a decentralized wallet.

The "Crisis" of Ethereum

Joe: What do you think is the biggest crisis Ethereum is facing right now? And over the past two years, what do you think has hindered the development of Web3?

Vitalik: I wonder if 2022 and 2023 were the most dangerous times; I think we are in a slightly better place now.

In 2022, AI exploded, and many people began to see AI as the future opportunity. Meanwhile, crypto was viewed as relatively useless, merely a place for gambling, leading many idealistic individuals who wanted to positively impact the world to leave crypto. As I mentioned earlier, due to issues with transaction fees and technology, they became disillusioned with crypto. I remember when I visited Silicon Valley in April 2022, chatting with some well-known AI practitioners who told me that crypto was useless. This was before the FTX collapse, and the situation worsened after that.

Now, crypto has made significant technological progress, and there are more successful applications, so I think the situation is somewhat better now.

I still see risks in that our community has become very diverse. Some people focus on finance, some on cyberpunk, and others on culture, art, and philosophy, and their ideas differ. A failure scenario is that they start to disrespect each other, with some only creating money-making applications while others aim to do meaningful things but lack funding. I hope these two aspects can be combined.

Joe: Solana is becoming increasingly powerful, and many believe it has become Ethereum's most important competitor. What are your thoughts on this issue?

Vitalik: I think they are indeed much more centralized than Ethereum.

First, running a Solana node is much more difficult than running an Ethereum node; second, Solana's PoS is more centralized; third, many community initiatives are directly supported by the Solana Foundation.

They focus heavily on applications and like to talk about Depin, which involves collaborating with large companies to sell hardware and working with telecom companies to create a new internet. These applications have a characteristic: their demand for decentralization is much lower than that of Ethereum. I believe their market goals are genuinely different from those of Ethereum.

If you want a blockchain with "market-leading performance," Ethereum's L1 will never meet that requirement. You only have two choices: the first is to go to other high-performance blockchains, and the second is to use Ethereum L2, including Arbitrum, Base, MegaETH, etc.

So what can Ethereum do that other faster chains cannot? I assure you it is a long-term decentralized, neutral, and secure blockchain. You can look at some data charts comparing the decentralization of Ethereum's PoS mining pools with Bitcoin's mining pools, and you will find that Ethereum is more decentralized than Bitcoin.

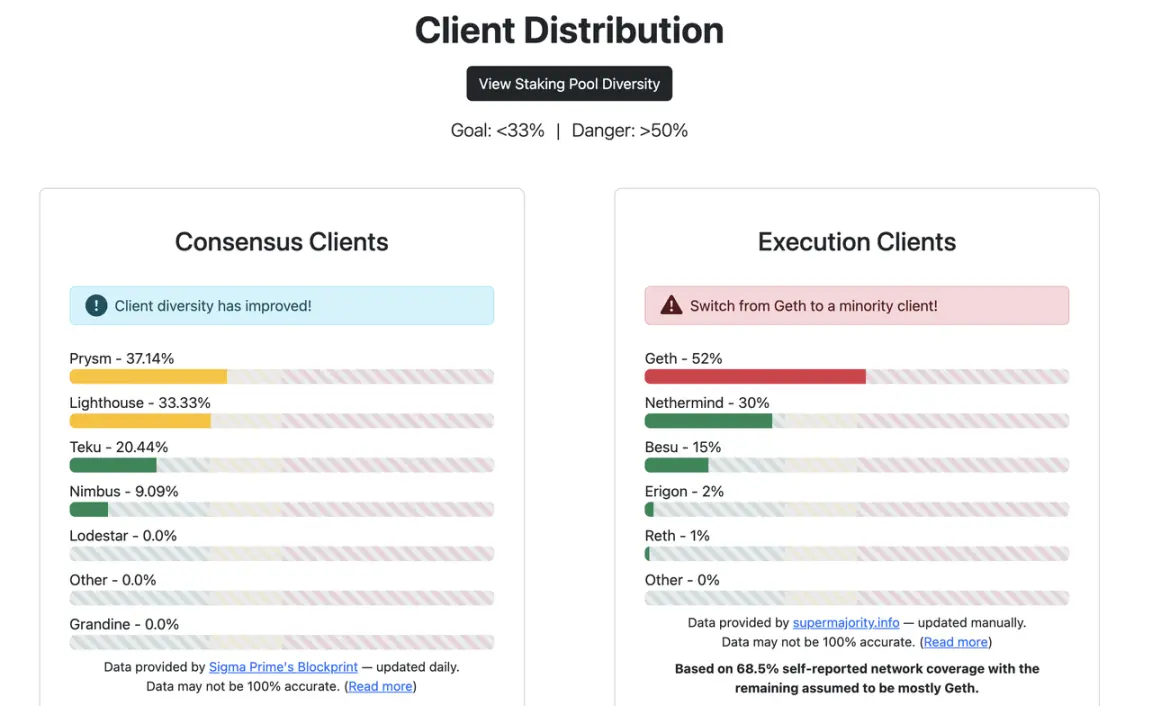

We have successful experiences and history in addressing some of our centralization issues. One example is the client issue; three years ago, the Ethereum network was using Geth and Prysm, and now no single client exceeds fifty-two percent.

Another example is the crisis we had two years ago with Tornado Cash. Some people started banning certain crypto transactions, and there were concerns about whether the Ethereum chain would become non-neutral. A year later, you can see the situation regarding what percentage of blocks would censor those transactions. You might find that two years ago, it was over 80%, but now it has consistently been around 20% to 50%. In a year or two, you will see the results of how we addressed these issues.

Ethereum L1 is not the best place for high-performance applications. If you want to create a game, L1 is also not the best place, which is why we need L2. The architecture of Ethereum is designed this way. The architecture of Ethereum L1 is decentralized, neutral, and secure, and it should be the only one comparable to Bitcoin. L2 can focus on transaction efficiency and speed, providing a good blockchain experience for mainstream users.

Joe: Does this mean that the ultimate form of Ethereum should be seamlessly hidden behind all L2s?

Vitalik: In a way, yes. The only exception is that if Ethereum as an asset is not known to anyone, it cannot succeed. So from this perspective, Ethereum cannot completely become a background entity.

Ethereum needs to be known for its existence. Ethereum will not become something completely invisible like Google Cloud. The advantage of Ethereum compared to Google Cloud is that it is normally invisible, but in critical situations, it can be visible; that distinction is important.

So until a particularly necessary situation arises, we still need to talk about the existence of Ethereum L1 and its advantages and characteristics.

Joe: You just mentioned AI. How frequently do you use AI products? Do you often use products like ChatGPT?

Vitalik: Yes, I sometimes use ChatGPT. I specifically bought a powerful GPU for my computer, so I can also run some local models. Some of the graphics in my articles were actually created using local AI.

Joe: What new things do you feel have emerged from the combination of AI and Ethereum?

Vitalik: I feel that AI and crypto have had a significant connection over the past decade, particularly with AI participating in decentralized exchanges. This example is very interesting and represents a large and promising category.

What is this category? Crypto can use smart contracts to define the rules of a game, ensuring that the execution of the game is secure, and AI can participate in this game. What is this game? Decentralized exchanges are the first example, and prediction markets are the second. In the future, there may be many more examples.

Joe: There are also voices from the outside saying that Ethereum is becoming increasingly centralized from a technical mechanism perspective. How do you view this issue?

Vitalik: I find it strange when they say that because I feel Ethereum is becoming more decentralized. The problem we face now is the consequences of decentralization. For example, in L1 client development, five years ago, we had only one client, Geth, but now we have Geth, Nethermind, Besu, and others.

Now you can visit a website called ClientDiversity.org, where you can see what percentage of the Ethereum network is using different clients. You will find that Geth has about 52%, while others are a bit lower. But no single client currently exceeds 66%.

What happens if Geth has a problem? First, the Ethereum network will not finalize because finalization requires 66% of nodes to agree. So there will be a fork, but this fork will not finalize. At this point, client developers will investigate which client has the issue. When they find that the Geth client has a problem while others do not, Geth will be modified.

In 2016, there was a similar situation where Geth had about 85% of the network at that time. After 12 hours, everything returned to normal. Now, this network will not finalize. If there are applications with particularly high security requirements, they will immediately know that there might be a problem and will wait to confirm. After 12 hours, when a new version of Geth is released, there will be no issues. So the development of client decentralization is very good.

You can also look at the companies behind the clients and how they make their money. In 2021, the clients were theoretically different companies, but their funding all came from the Ethereum Foundation. So you could say that the level of decentralization in 2021 was not very strong. Why did we do this? Because we want different client companies to exist, and we want to give them a chance to grow. Now some client companies do not need funding from the foundation; we have recently provided very little sponsorship.

Another aspect is related to protocols. Five years ago, I was almost the only protocol researcher. Now we have a research team of at least 20 people, some from the Ethereum Foundation and others from different teams outside the foundation, including some from Paradigm, who publish their own ideas about protocols, along with many other teams.

In the Ethereum ecosystem, five years ago, the largest entity was the Ethereum Foundation, followed by ConsenSys, and there was nothing else. Now we have the client companies mentioned earlier, independent organizations like ETH Global, and various wallets like MetaMask, Rainbow, Trust Wallet, Rabby, etc., whereas three years ago, there was only MetaMask.

One issue that everyone is particularly concerned about this year is interoperability. There are many different L2s and wallets, and their integration has encountered some problems. If we were centralized, we wouldn't have these issues.

So the problem we most want to solve now is how to maintain a decentralized ecosystem while still being able to coordinate in some important areas where coordination is necessary. We can still improve some important standards.

Joe: You just mentioned that decentralization also brings some problems. I've also noticed that there are discussions about L2s fighting among themselves, and Ethereum not forming a cohesive force. How do you view the perspective that various ecosystems seem to dilute Ethereum's resources?

Vitalik: I remember that in August, there was a lot of discussion about the issues with different L2s and Ethereum activities, creating a sense of competition. However, I found that after discussing these matters, L2s, wallets, and activities were all very willing to address this issue.

The day before yesterday, we had an event in Chiang Mai focused on L2 and wallet interoperability. At Devcon, there will be a larger discussion, and everyone agrees that we need more standards and interoperability between L2s, and they are willing to promote this aspect. I think some outsiders, in order to criticize Ethereum, say that L2s are fighting among themselves, but if you listen to what people from L2s say and think, you will find that they do not want to fight; they want to cooperate.

Thirty and Standing, Just Thirty

Joe: Finally, let's talk about some more personal topics. Confucius said that at thirty, one stands firm, and you just turned 30 this year. Ten years ago, you wrote the Ethereum white paper, and today, ten years later, have you fulfilled the dreams you had back then? What will you do in the next ten years?

Vitalik: You could say I have partially fulfilled them, and I have also realized that my understanding of what we need to do has changed a lot.

A significant change is in my thinking. Ten years ago, I focused on theory, discovering new mechanisms through economics and mathematics. But now, the times have changed; most of the mechanisms we can invent have already been invented. What we are doing now is not inventing entirely new mechanisms but optimizing what we already have. The optimization process cannot rely solely on theory; in some areas, it can, such as in cryptography and zero-knowledge proofs. But in many areas, the only way is to experiment. We need to experiment, see where it succeeds, where it fails, and continuously improve.

For example, ten years ago, I had an idealistic idea of inventing a governance model that could be mathematically proven to be optimal and correct. In many cases, you can mathematically prove something is correct, but outside of the mechanism, there are different participants, and you cannot create a governance mechanism that is guaranteed to be stable.

In "The Three-Body Problem," some scientists conducted many experiments but ultimately found that physics did not exist, leading them to commit suicide. I feel that economics does not exist in the same way. If we want to do more, the only way is to experiment. If we want to optimize our public goods mechanisms now, the only thing we can do is to conduct another experiment, change the mechanism, conduct another experiment, and again modify our mechanism. I will likely be doing more of this kind of work now and in the next ten years.

Joe: What are your hobbies outside of crypto?

Vitalik: Walking, running, reading different books or exploring various things on the internet, and learning different languages in different places.

Joe: What types of books do you enjoy?

Vitalik: Most of them are non-fiction books, such as those on economics, history, or society. You will see some people online writing long articles, which are essentially equivalent to writing a book.

Joe: Where do you generally draw your energy from? How do you adjust yourself in the morning to achieve your best state?

Vitalik: One of the most interesting aspects of my life is that I have two types of work. The first type is more introverted work, such as writing code, writing articles, and discussing topics with developers. The second type is extroverted work, which involves attending events.

I have found an interesting point about the relationship between these two types of work. One serves as a rest for the other. When you do one too much and need a break, you can switch to the other.

Joe: Who are your favorite writers, musicians, and philosophers?

Vitalik: This question is really hard to answer because it's difficult to say one is better than the others.

Joe: If you weren't working in crypto, what would you be doing?

Vitalik: Before entering crypto, I was involved in online education, so I think that is a relatively important topic.

Over the past two years, my goal has been to combine crypto with other important technological directions. If it weren't for crypto, I might also be involved in some Dapp-related activities, including those related to healthcare and DCI (Data Center Interconnect). If I were to focus on crypto, I would work on community notes.

Joe: Will you retire? Or disappear like Satoshi Nakamoto?

Vitalik: If I weren't doing my current work, I would feel lonely.

Joe: What aspects of Chinese culture do you like the most?

Vitalik: I have always found the Chinese community to be very friendly. They have various interesting ideas, and they care about building a particularly good community, as well as the values on Ethereum and blockchain. There are also simpler points, like how delicious Chinese food is.

Joe: What Chinese dishes do you like?

Vitalik: Greens and steamed fish.

Joe: Alright, this conversation is coming to an end. Thank you, Vitalik, for accepting the interview with Foresight News. I also want to thank some Web3 practitioners from the Chinese-speaking community who provided questions for this interview, including Yisi, co-founder of Mask Network; Jiang, co-founder of Social Layer; Forest, co-founder of Foresight Ventures; Yuanjie, co-founder of Conflux; Sandy, co-founder of Scroll; and KOL Jason. Their questions also represent the voices of the Chinese-speaking community. Of course, I would also like to extend my gratitude to Audrey from Shanhaiwu for their support, and to photographer Shaka. Thank you, everyone.

Vitalik: Alright, thank you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。