This article delves into the issues with existing stablecoin models and attempts to predict how we can end the currency civil war.

Written by: Minerva

Translated by: Block unicorn

It has been ten years since Tether launched the first USD-backed cryptocurrency. Since then, stablecoins have become one of the most widely adopted products in the cryptocurrency space, currently valued at nearly $180 billion. Despite such significant growth, stablecoins still face many challenges and limitations.

This article delves into the issues with existing stablecoin models and attempts to predict how we can end the currency civil war.

I. Stablecoins = Debt

Before diving deeper, let’s introduce some basics to better understand the meaning of stablecoins.

A few years ago, when I started researching stablecoins, I was puzzled by people describing them as debt instruments. But as I delved into how money is created in the current financial system, I began to understand this.

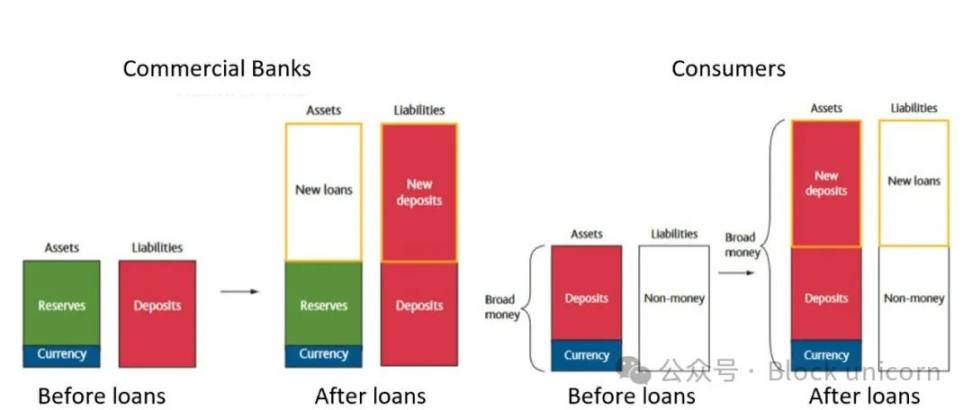

In the fiat currency system, money is primarily created when commercial banks (hereinafter referred to as "banks") provide loans to customers. However, this does not mean that banks can create money out of thin air. Before creating money, banks must first receive something of value: your promise to repay the loan.

Suppose you need financing to buy a new car. You apply for a loan at your local bank, and once approved, the bank will deposit an amount matching the loan into your account. At this point, new money is created in the system.

When you transfer these funds to the car seller, if the seller has an account at another bank, the deposit may be transferred to that bank. However, this money remains within the banking system until you start repaying the loan. Money is created through loans and destroyed through repayments.

Figure 1: Money creation through additional loans

Source: "Money Creation in Modern Economies" (Bank of England)

Stablecoins operate in a somewhat similar manner. Stablecoins are created when the issuer provides loans and are destroyed through the borrower's repayments. Centralized issuers like Tether and Circle mint tokenized USD, which are essentially digital IOUs based on the USD deposits made by borrowers. DeFi protocols (such as MakerDAO and Aave) also mint stablecoins through loans, but this issuance is backed by crypto assets as collateral rather than fiat currency.

Because their debt is supported by various forms of collateral, stablecoin issuers effectively act as crypto banks. Sebastien Derivaux, founder of Steakhouse Financial, further explores this analogy in his research "Cryptodollars and the Hierarchy of Money."

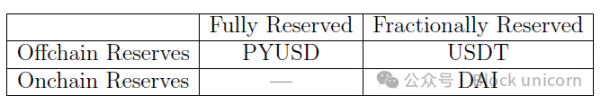

Figure 2: A two-dimensional matrix of cryptodollars

Source: "Cryptodollars and the Hierarchy of Money," September 2024

Sebastien classifies stablecoins using a two-dimensional matrix based on the nature of their reserves (such as off-chain RWA assets and on-chain crypto assets) and whether the model is fully reserved or partially reserved.

Here are some notable examples:

- USDT: Primarily supported by off-chain reserves. Tether's model is partially reserved, as each USDT is not 1:1 backed by cash or cash equivalents (such as short-term government bonds) but also includes other assets like commercial paper and corporate bonds.

- USDC: USDC is also supported by off-chain reserves, but unlike USDT, it maintains a fully reserved status (1:1 backed by cash or cash equivalents). Another popular fiat-backed stablecoin, PYUSD, also falls into this category.

- DAI: DAI is issued by MakerDAO and is supported by on-chain reserves. DAI operates on a partially reserved basis through its over-collateralization structure.

Figure 3: A simplified balance sheet of current cryptodollar issuers

Source: "Cryptodollars and the Hierarchy of Money," September 2024

Like traditional banks, these crypto banks aim to generate substantial returns for shareholders by taking on moderate balance sheet risks. The risks are sufficient to be profitable but not so high as to jeopardize collateral and face bankruptcy risks.

II. Issues with Existing Models

While stablecoins have ideal characteristics such as lower transaction costs, faster settlement speeds, and higher yields compared to traditional financial (TradFi) alternatives, existing models still face many issues.

(1) Fragmentation

According to data from RWA.xyz, there are currently 28 active stablecoins pegged to the US dollar.

Figure 4: Market share of existing stablecoins

Source: RWA.xyz

As Jeff Bezos famously said, "Your margin is my opportunity." Although Tether and Circle continue to dominate the stablecoin market, the recent high-interest-rate environment has spawned a wave of new entrants trying to get a piece of these high profits.

The problem with having so many stablecoin options is that, although they all represent tokenized dollars, they are not interoperable. For example, a user holding USDT cannot seamlessly use it at a merchant that only accepts USDC, even though both are pegged to the dollar. Users can exchange USDT for USDC through centralized or decentralized exchanges, but this adds unnecessary trading friction.

This fragmented landscape is reminiscent of the era before central banks, when various banks issued their own banknotes. During that time, the value of banknotes fluctuated based on their issuer's credit stability, and if the issuing bank failed, they could become worthless. The lack of standardization in value led to market inefficiencies, making cross-regional trade difficult and costly.

The establishment of central banks was to solve this problem. By requiring member banks to maintain reserve accounts, they ensured that bank-issued paper money could be accepted at face value throughout the system. This standardization achieved what is known as "monetary unity," allowing people to view all paper money and deposits as equivalent, regardless of the issuing bank's creditworthiness.

But DeFi lacks a central bank to establish monetary unity. Some projects, such as M^0 (@m0foundation), are attempting to address interoperability issues by developing decentralized cryptodollar issuance platforms. I personally look forward to their grand vision, but the challenges are significant, and their success is still a work in progress.

(2) Counterparty Risk

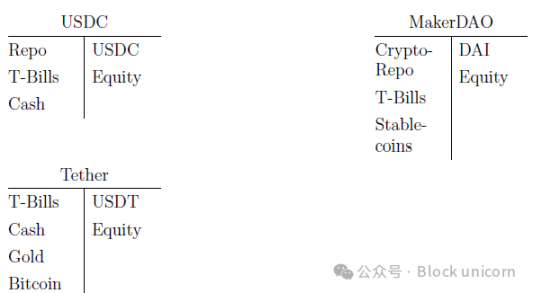

Imagine you have an account at J.P. Morgan (JPM). While the official currency in the US is the US dollar (USD), the balance in that account actually represents a form of bank note, which we can call jpmUSD.

As mentioned earlier, jpmUSD is pegged to the dollar at a 1:1 ratio through an agreement between JPM and the central bank. You can redeem jpmUSD for physical cash or exchange it with other bank notes (like boaUSD or wellsfargoUSD) at a 1:1 rate within the banking system.

Figure 5: A diagram of the currency hierarchy structure

Source: #4 | Currency Classification: From Tokens to Stablecoins (Dirt Roads)

Just as we can stack different technologies to create a digital ecosystem, various forms of currency can also be layered to build a currency hierarchy. Both the dollar and jpmUSD are forms of currency, but jpmUSD (or "bank money") can be seen as a layer above the dollar ("token"). In this hierarchical structure, bank money relies on the trust and stability of the underlying token and is supported by formal agreements with the Federal Reserve and the US government.

Fiat-backed stablecoins (like USDT and USDC) can be described as a new layer above this hierarchy. They retain the fundamental characteristics of bank money and tokens while adding the advantages of blockchain networks and interoperability with DeFi applications. While they serve as an enhanced payment rail layer above the existing currency stack, they remain closely tied to the traditional banking system, thus introducing counterparty risk.

Centralized stablecoin issuers typically invest their reserves in safe and liquid assets, such as cash and short-term US government securities. While the credit risk is low, the counterparty risk is high since only a small portion of bank deposits is insured by the Federal Deposit Insurance Corporation (FDIC).

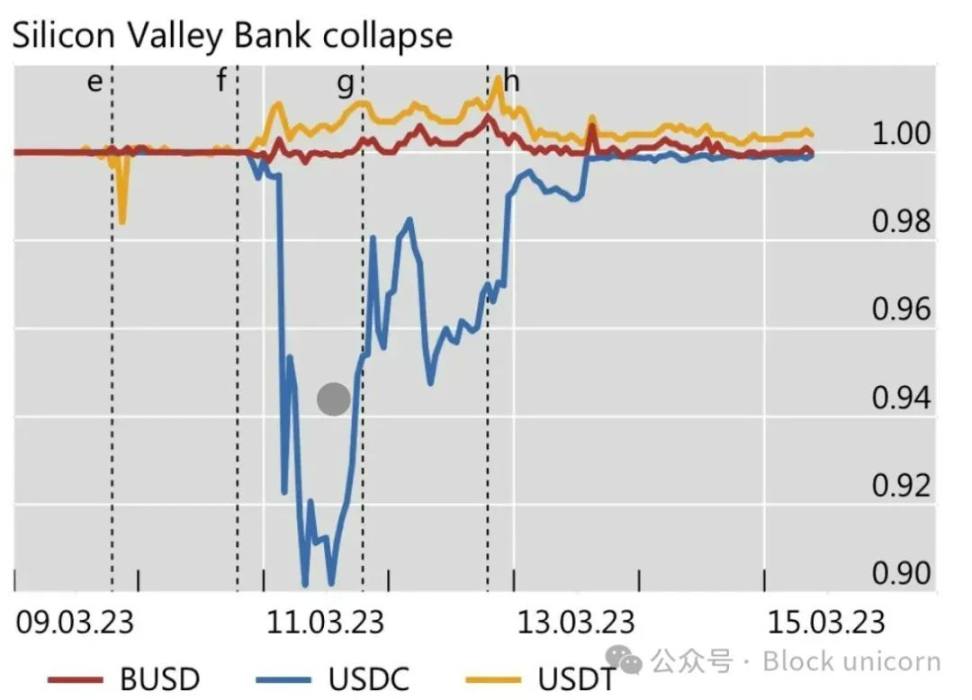

Figure 6: Price fluctuations of stablecoins during the SVB collapse

Source: "Stablecoins and Tokenized Deposits: Implications for Monetary Unity" (BIS)

For instance, in 2021, of the approximately $10 billion in cash held by Circle at regulated financial institutions, only $1.75 million (about 0.02%) was protected by FDIC deposit insurance.

When Silicon Valley Bank (SVB) collapsed, Circle faced the risk of losing most of its deposits at that bank. If the government had not taken special measures to guarantee all deposits, including those exceeding the $250,000 FDIC insurance limit, USDC could have permanently decoupled from the dollar.

(3) Yield: Race to the Bottom

In this cycle, the dominant narrative surrounding stablecoins is the concept of "returning yields to users."

Due to regulatory and financial reasons, centralized stablecoin issuers retain all profits generated from user deposits. This leads to a disconnect between the parties that actually drive value creation (users, DeFi applications, and market makers) and the parties that capture the profits (issuers).

This disparity paves the way for a new wave of stablecoin issuers who mint stablecoins using short-term wealth or tokenized versions of these assets, redistributing the underlying yields back to users through smart contracts.

While this is a step in the right direction, it also prompts issuers to significantly cut fees to gain a larger market share. The intensity of this yield competition is evident when I review the tokenized money market fund proposals for the Spark Tokenization Grand Prix, which aims to integrate $1 billion of tokenized financial assets as collateral for MakerDAO.

Ultimately, yield or fee structures cannot serve as long-term differentiators, as they may tend to converge towards the minimum sustainable rate required to maintain operations. Issuers will need to explore alternative monetization strategies, as the issuance of stablecoins itself does not accumulate value.

III. Predicting an Unstable Future

"Romance of the Three Kingdoms" is a beloved classic in East Asian culture, set during the late Han Dynasty when warlords vied for power and conflict was rampant.

A key strategist in the story is Zhuge Liang, who proposed the famous strategy of dividing China into three independent regions, each controlled by three warring factions. His "Three Kingdoms" strategy aimed to prevent any one kingdom from gaining dominance, thereby creating a balanced power structure to restore stability and peace.

I am not Zhuge Liang, but stablecoins may also benefit from a similar tripartite strategy. The future landscape may be divided into three domains: (1) payments, (2) yields, and (3) intermediaries (everything in between).

- Payments: Stablecoins provide a seamless, low-cost way to settle cross-border transactions. USDC currently leads in this area, and its partnerships with Coinbase and Base Layer 2 may further solidify its position. DeFi stablecoins should avoid competing directly with Circle in the payments space and instead focus their efforts on the DeFi ecosystem where they have clear advantages.

- Yields: RWA protocols issuing yield-bearing stablecoins should learn from Ethena, which has cracked the code for generating high and relatively sustainable yields through crypto-native products and related offerings. Whether leveraging other delta-neutral strategies or creating synthetic credit structures that replicate traditional finance (TradFi) swaps, there is room for growth in this area due to the scalability limits faced by USDe.

- Intermediaries: For decentralized stablecoins with low yields, there is an opportunity to unify fragmented liquidity. An interoperable solution would maximize DeFi's ability to match lenders and borrowers, further streamlining the DeFi ecosystem.

The future of stablecoins remains uncertain. However, a balanced power structure among these three components may end the "currency civil war" and bring much-needed stability to the ecosystem. Rather than engaging in a zero-sum game, this balance will provide a solid foundation for the next generation of DeFi applications and pave the way for further innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。