Author: @lazyvillager1, Crypto Kol

Compiled by: zhouzhou, BlockBeats

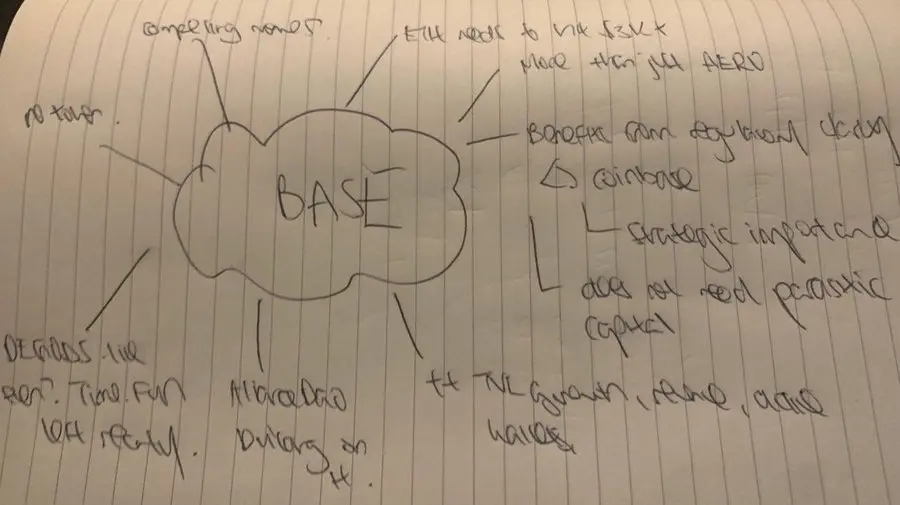

Editor's Note: Since Trump's victory, COIN and BTC have risen significantly, but the author prefers ETH and is optimistic about the development of the Base L2 ecosystem. Base is expected to stand out in the competition, attracting MEME, consumer dApps, and more on-chain activities. ETH remains the core of digital assets, while Base, as Coinbase's on-chain leverage, benefits from Coinbase's resources and support, possessing scarcity and innovation, which can attract users in the long run without relying on traditional token incentives. The activity and TVL of the Base ecosystem continue to grow, proving its great potential in ETH-L2.

The following is the original content (reorganized for better readability):

Fundamental Judgments for Future Development

Since Trump's victory on November 5, COIN and BTC have led the way, rising 70% and 16% respectively. Personally, I still lean towards ETH, and based on my October writing on MEME coins, I believe several advantageous factors are converging for the Base L2 ecosystem:

Winning the competition against other L2s and even the ETH mainnet, becoming the preferred ecosystem to accommodate MEME, consumer dApps, and attract attention.

Competing alongside SOL's "fully functional" integrated casino model as a top EVM-compatible ecosystem.

My core viewpoint is simple: ETH remains the key center of the digital asset ecosystem, and all derivative projects rely on two core principles to drive network effects:

a. The "underlying" currency must perform strongly relative to its competitors;

b. The "underlying" currency must possess "scarcity."

Therefore, in this attention-grabbing competition, most of the time, you are essentially choosing a currency (even if this is just a simplified way) to reflect its advantages. In the coming weeks (this trend has already begun), the CT community will discuss why a certain currency may prevail (e.g., SOL's competitors or MEME coins) or why an application supporting a certain currency may succeed (such as utility tokens, DeFi governance, etc.).

What I want to propose is that starting today, a more risk-adjusted choice is to bet on an ecosystem without a currency. In my view, the organization of Base creates the strongest potential for its continued adoption, while the double-edged sword is that it may rely on ETH's resurgence.

However, given that I believe ETH's potential is currently underestimated—if/when the relative value between BTC, ETH, and SOL increases in the coming weeks, there will inevitably need to be a "reservoir" to accommodate this newly generated and circulating wealth.

I believe Base is likely to win this position

The "faucet" interconnectivity on Base has greatly improved this year but has not received enough attention.

Base has significant strategic value to COIN and has a real balance sheet to provide support.

Base has undergone multiple tests this year and has performed quite well.

I have accordingly adjusted my layout and will discuss my logic and the risks and mitigation measures involved in redirecting on-chain traffic to Base, which I believe is the most vibrant "playground," in the upcoming tweets.

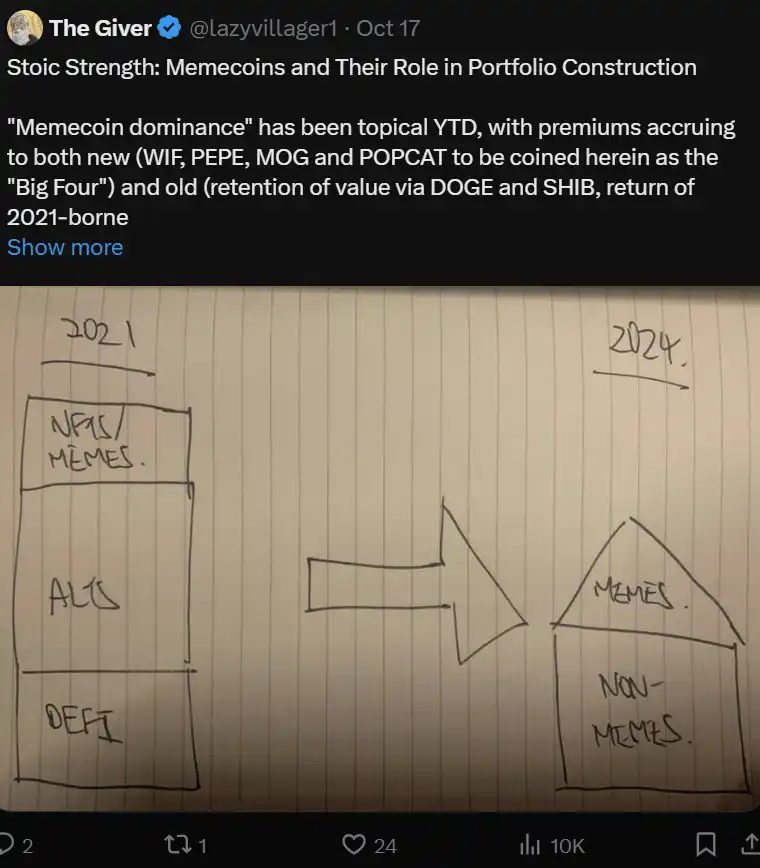

Memecoins and Their Typically Successful Environments

The key is that low-market-cap memecoins often provide unrelated returns, and on-chain activity typically heats up before and after significant uncertainties.

The Resilience of MEME Coins and Their Role in Portfolio Construction

Reflecting on the Strength of Major Assets and Their Driving Role in On-Chain Activity

Based on the above points, I believe that on-chain activity will show very strong performance in the coming weeks.

The performance of major assets supports this trend—buying is primarily driven by spot trading, and the open interest (OI) of ETH and BTC has mostly reset to pre-election levels, with the rise in financing rates mainly stemming from a lack of new short positions (and the levels that broke through in recent days—the amount of short liquidations has reached $1 billion, the highest this year), rather than excessive leverage usage.

Therefore, based on the view that the existing price range has support, I believe on-chain activity will become a gathering place for off-market funds, new funds, and recycled funds. The funds created in the past week contrast with those from 3-4 weeks before the election. The latter witnessed a significant rise in financing and open interest, but aside from BTC, other assets struggled to attract what I call "mercenary funds."

The flow of funds in the past week has not only appeared widely among assets outside of BTC (all selected assets have generally risen globally) but even includes DOGE—this is a very important indicator reflecting the characteristics of these "buyers": willing to use leverage, willing to speculate, and trading 24 hours a day. These buyers are not limited by U.S. trading hours, similar to BTC's rise in October.

We are still less than a week into this price environment—the market's misalignment is significant: capital needs time to assess whether these funds are irrational or substantive. During this period, projects that can significantly fluctuate on the margin should produce the most notable re-rating effects.

Base is Already "Winning"—Even Without Issuing Tokens

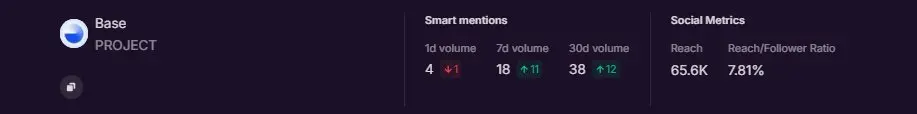

Base may be one of the most misunderstood ecosystems currently; due to its unique construction, Base lacks typical crypto-native investors/KOLs to manage and disseminate information. However, from various indicators, Base is "winning." The attention Base attracts relative to its user/wallet/TVL growth may be the most disproportionate among all projects currently.

Please see the chart below, which captures the attention of Base by elfa ai; in terms of collective mentions, there have been about 18 mentions on CT in the past 7 days, which is 10 times lower than ARB and roughly equivalent to the mentions of STARKNET, BLAST, and OP.

It is the only ETH-L2 whose TVL has continued to grow throughout the year, despite not setting user incentives like other L2s (such as BLAST GOLD). With a TVL of $3 billion, its TVL even surpasses ARB (which hosts the very popular HyperliquidX, which has about $1 billion in TVL).

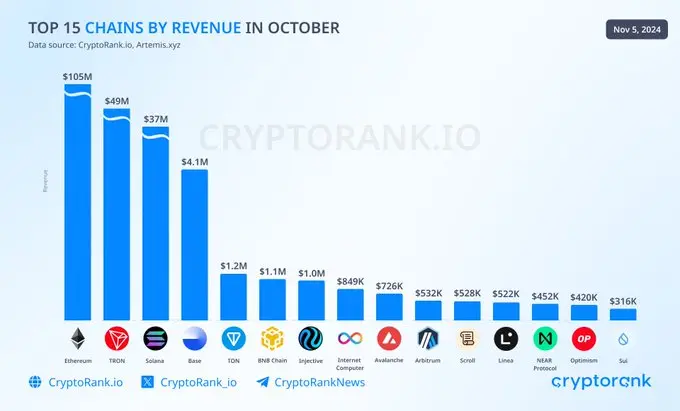

In October, Base also achieved the highest revenue in its developing ecosystem (a month when TRON declined while Base and ETH grew). Currently, Base has the most independent active wallets and transaction numbers (actual data may need to be taken with caution, but this is the only picture we can draw).

Base is reminiscent of SOL in the fourth quarter of last year—a environment that attracted builders when attention was low.

Base Disrupts and Breaks Traditional L1/L2 Operating Models

The traditional operating model usually follows these steps:

There is a conception of an ecosystem, ideally with unique variants (faster, more reliable, more decentralized, easier to build, more trustless, etc.).

Funds are raised by almost giving away tokens at zero valuation (usually to companies with the best relationships and resources).

While building, connections are established with dApp developers—each blockchain typically looks for a local "bank," so there may be some type of lending protocol and trading protocol. Developers are rewarded with token incentives for on-chain development.

Users are attracted through points/token incentive programs, where users deposit/stake stable capital to earn yield rewards.

Users/new TVL provide a foundation for the founding team to raise funds from a new round of investors and conduct a second round of financing at a higher valuation—pointing out the inflow of users/funds.

After the blockchain launches, users are first rewarded with non-locked tokens; while investors and team members must wait through locked tokens. (But the ratio is much larger.)

Lending protocols typically establish partnerships with market makers and investors to store and maintain on-chain capital through promised yields.

Gradually, the hope is to attract and retain organic capital through certain metrics (such as interoperability, ease of use, richness of the ecosystem, etc.)—thus reducing or eliminating the need for dilutive capital.

The founding team pays early supporters and employees with tokens—at this time, tokens effectively become free expenses (used to pay vendors). Ideally, the ecosystem supports the sustainable development of the chain through serialized revenue.

This model has matured and is being disrupted, with HyperliquidX becoming the most typical example of launching without relying on traditional methods and ignoring most of the above measures.

This year, this method of capital raising has clearly failed at multiple stages, with pain points concentrated on:

Mining incentive mechanisms are often very unclear; once capital is locked, it becomes "hostage," allowing teams to disregard consequences and retroactively change terms.

Investors/team members can stake locked tokens—this means that even if the original locked tokens have no liquidity, staking rewards can still be sold at TGE (Token Generation Event), severely diluting retail investors.

New capital is very expensive (the opportunity cost in the crypto space is extremely high), so users are very utilitarian; once the rewards are distributed, they usually choose to leave if there is no significant dilution or manipulation of supply.

Why is Base More Likely to Achieve Greater Success?

Base is not just an L2; it is Coinbase's on-chain leverage—Coinbase has gained this opportunity through the regulatory scrutiny relief brought about by Trump's victory (i.e., an improvement in the policy environment).

In other words, Base does not intend to win through the traditional "fat tail" approach I mentioned above. What does that mean? Here are excerpts from Coinbase's Q3 conference call, showcasing how the team views Base:

Base is (the following is just a partial list):

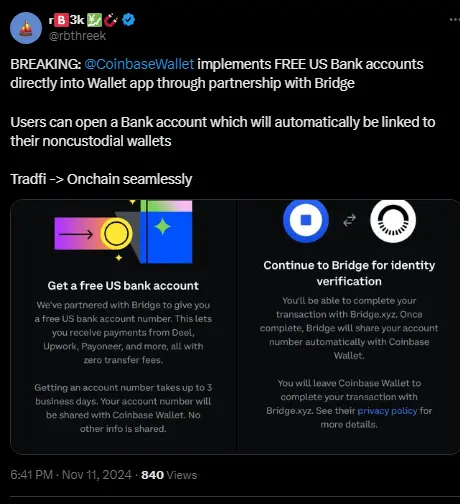

A synergy testing platform with CIRCLE, along with the development of smart wallets. Coinbase can collect data in real-time to comprehensively build a truly independent "Eden" ecosystem (i.e., i. attract users, ii. guide seamlessly, iii. set up smart wallets using passkeys instead of traditional secret phrases, iv. provide a "playground" for speculation).

As Coinbase transitions to a subscription-based service model (e.g., through Coinbase One subscriptions), rather than relying on volatile trading fees, the team's vision is to attract the most retail users in the long term, rather than charging as many fees as possible in the short term.

The latter is a microcosm of the extractive value capture model followed by every blockchain—due to the creation of tokens and their inherent nature. By separating the ecosystem from the tokens, Base can take a longer-term view to "win." In other words, the only way Base will make money in the future (since COIN already exists as equity) is by having applications and users pay "rent."

The most important point is:

The biggest difference between Base and other blockchain projects is that it is supported by a company with a real balance sheet. Any other ecosystem, at least at some point, is supported by counterparties with financial incentives seeking returns. And these counterparties do not possess unlimited capital.

Once returns are obtained, this support (whether financial or community-based) will withdraw. Therefore, other ecosystems have a lifecycle, or a time limit, where new supporting funds will eventually stop flowing in, and the products will have to fend for themselves. You will see some ecosystems starting to struggle in the next 12 to 16 months (e.g., shutting down platforms).

However, the situation for Base > Coinbase may not be the same. If Base stops receiving support, it means that an important part of Coinbase has failed (which also means a failure of the overall strategic vision). Since Coinbase itself generates traffic and revenue through "where the price is," we can speculate that Base may receive a form of "evergreen" funding support.

Base Proves Its Resilience

Base initially emerged as the foundational platform for Friend Tech (at that time, it was basically a shell with limited functional options). Since then, it has gone through several important stages:

Application migration, such as timedotfun. Please see jessepollak's response: link. This reflects a very positive attitude and supportive spirit, understanding that each chain has its unique value.

The only project that successfully incubated another L2—degentokenBase. DEGEN gained attention over a weekend earlier this year, quickly boosting its valuation to $600 million, comparable to apecoin's self-building and rise this month.

The only chain capable of accommodating AI-related applications like SOLANA—VIRTUAL, which surged from $0 to $500 million during the AI and memecoin craze in October this year.

In my view, no other ecosystem can withstand such a level of attention and drive such a scale of capital inflow. Therefore, the question is: if other ecosystems can do this, why haven't they? Thus, Base clearly demonstrates the ability to support novel and interesting projects/applications, far beyond simple yield cycles or lending applications.

Here are some other examples:

- warpcast

- BlueSocialApp

- OnchainKit

- liberoverse

- Sofamon xyz

- BetBase xyz

- dreamcoinswow

- ethxy

This is not an exhaustive list, nor is it an endorsement of any names mentioned here; it merely showcases a snapshot of the highly diverse creative projects built on Base since its last iteration, especially during the Friend Tech era (when most of these applications had not yet officially launched).

Buying at a Moment Considered the Value Bottom

Profiting on Base is essentially betting on the success of the entire ecosystem, even as an agent of Coinbase. No single token can concentrate demand, so true network effects can be realized overall.

Currently, most tokens on Base are at cyclical lows—and I will not provide any token names or recommendations, but you can see some chart examples, which I have chosen randomly.

Therefore, I believe Base is the most attractive capital investment position because you are essentially betting on two aspects—this has nothing to do with leverage or savvy token selection:

ETH stabilizes and finds a bottom that can provide on-chain demand (which I have discussed before),

ETH's winners hope to recoup profits somewhere.

Given the lack of organic options on the main network (which have been transferred to L2) and the weak demand in the NFT market this year, I bet that this attention and funding will concentrate on Base.

In summary— as long as ETH remains hot, Base should also stay hot.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。