In the early hours of today (November 22), SEC Chairman Gary Gensler announced via Twitter that he will resign from his position as SEC Chairman in January 2025. His agenda during his tenure included climate risk disclosure, stock trading reforms, and cracking down on violations in the cryptocurrency industry.

Image source: x

Since taking office as SEC Chairman in 2021, Gensler has been known for his strict regulatory stance on the cryptocurrency industry. He has repeatedly emphasized a cautious approach to cryptocurrencies, especially concerning investor protection and market manipulation. Gensler's departure may signal a potential reshuffling of regulatory policies within the SEC, which could have far-reaching implications for the cryptocurrency industry.

This news is undoubtedly seen as positive for the crypto market. Qinbafrank tweeted, "The SEC has largely dominated the ultra-high-pressure crypto regulatory environment for the past two years, and everyone should be able to breathe a sigh of relief," and believes that "a friendly crypto industry environment that encourages innovation and a relaxed regulatory environment for cryptocurrencies is on the way in the coming years."

Trump mentioned at the Bitcoin 2024 conference held in Nashville this July that if elected president, he would fire the current SEC Chairman Gary Gensler on his first day in office and would keep every Bitcoin-related job in the United States.

According to insiders, key figures such as former SEC Commissioner and Robinhood Chief Legal Officer Dan Gallagher, former SEC Commissioner Paul Atkins, and Wilkie Farr & Gallagher partner Robert Stebbins are all potential candidates to be appointed as SEC Chairman. Daniel Gallagher currently works at fintech company Robinhood and has previously criticized the SEC's "scorched earth policy" in the cryptocurrency space.

Peirce and Uyeda have criticized the policies and enforcement actions taken by their agency under President Joe Biden's leadership. Peirce is considered a potential candidate for interim SEC Chair after Trump takes office, and there are rumors that she may lead a special federal cryptocurrency policy task force.

Trump Steadily Promotes Bitcoin as a Strategic Reserve

Trump first mentioned the Bitcoin strategic reserve on July 27, 2024, stating at the Bitcoin 2024 conference in Nashville, Tennessee, that if he returns to the White House, he would designate Bitcoin as a strategic reserve asset for the United States, and the latest news confirms his commitment.

Plans to Establish a Cryptocurrency Advisory Committee

Reports indicate that Trump plans to establish a cryptocurrency advisory committee specifically responsible for promoting crypto legislation, coordinating multi-agency regulation, and implementing the Bitcoin reserve plan. Well-known crypto companies like Ripple, Kraken, and Circle are vying for seats to exert greater influence in this emerging field. It is said that the committee may fall under the White House National Economic Council or exist as an independent entity, further elevating the status of cryptocurrencies within the U.S. government. Trump has promised to adjust existing regulatory policies to support the crypto industry.

Image source: x

Creation of a White House Position for Cryptocurrency Affairs

Yesterday (November 21), it was reported that Trump's team is considering establishing a position in the White House dedicated to cryptocurrency affairs. According to U.S. political circles, the person in this position would be referred to as the "Cryptocurrency Czar." The Trump-led federal government may elevate the cryptocurrency industry to unprecedented heights, and Trump's team is reviewing potential candidates. If implemented, this would be the first position in the White House specifically responsible for cryptocurrency.

Plans to Establish a Cryptocurrency Payment Platform

On Monday (November 18), Trump Media & Technology Group applied for a service named TruthFi, describing it as a platform for making cryptocurrency payments. The company's trademark application for TruthFi describes it as a platform for financial custody services and digital asset trading—NYT.

How Will Trump's Trade Policies Affect Market Performance?

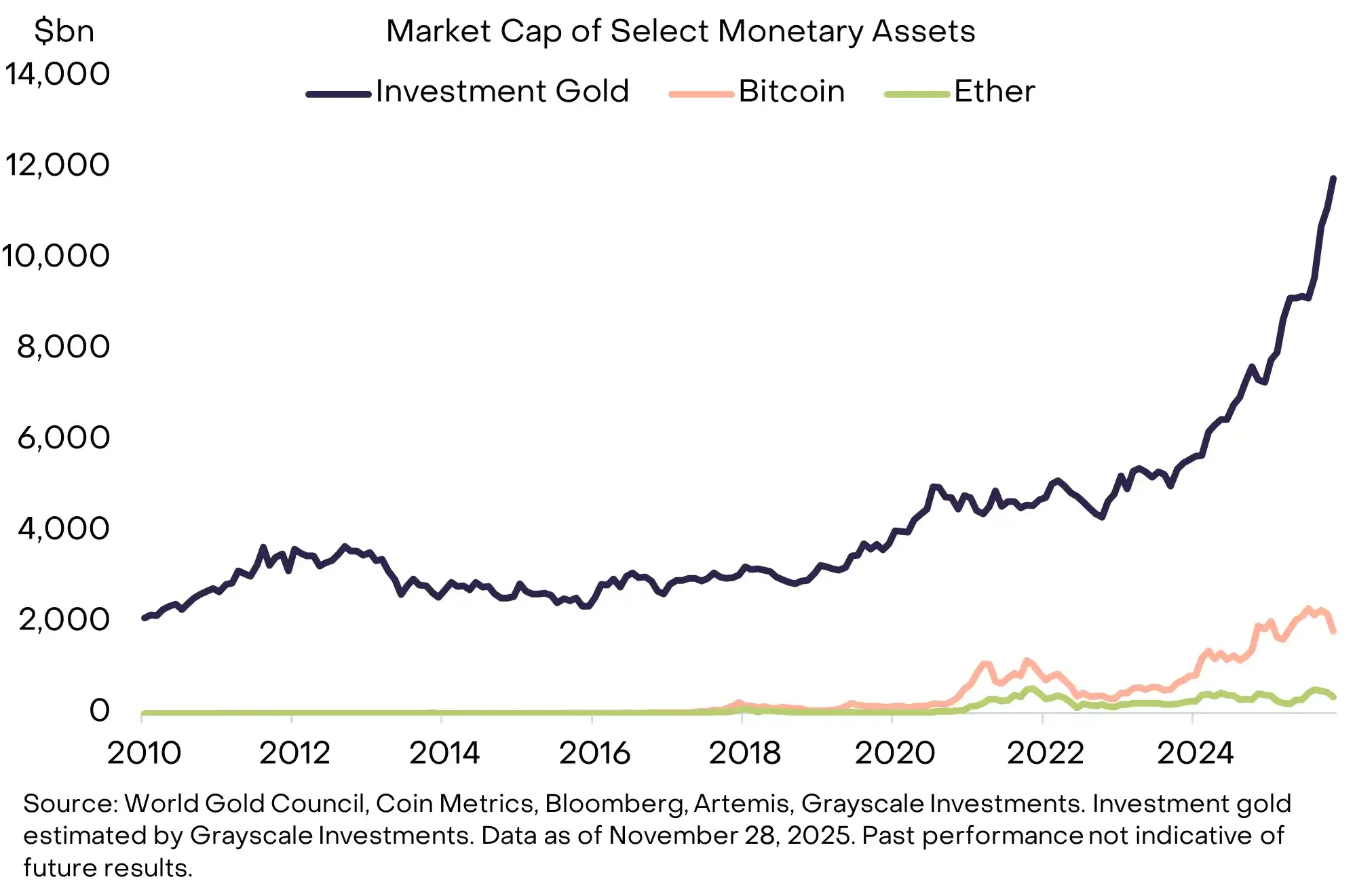

The impact of Trump's policy plans on the crypto market has already begun to manifest. Since Trump's announcement of his candidacy, the overall market capitalization of cryptocurrencies has increased by over $800 billion, with Bitcoin's price even breaking historical highs, reaching as much as $98,000. This surge has been referred to by industry insiders as the "Trump Trade," reflecting market optimism regarding potentially favorable policies from the Trump administration.

Jeffrey Ding of HashKey Group pointed out that after Trump's election, Bitcoin received significant policy support, including being included in government reserves and the establishment of a presidential advisory committee. These initiatives will create a more favorable market environment for Bitcoin and expand its upward potential. Additionally, the current loose monetary policy has also contributed to rising demand for high-risk assets like Bitcoin.

The current performance of the "Trump Trade" is characterized by multiple dollars, multiple Bitcoins, and short positions on U.S. Treasuries, while gold has rapidly declined. Yang Tianxia, CEO of Variant Perception, stated, "The market should be very optimistic about Trump overall, leading to rising yields, a rising stock market, and a rising dollar," while also noting that the next wave of "time windows" may only come after Trump officially takes office in January and policies are implemented.

Conclusion

With Gary Gensler's resignation and Trump's accelerated push for a Bitcoin strategic reserve plan, the cryptocurrency market is at a significant turning point. Trump's emphasis on Bitcoin is likely to elevate its status in the global financial market. The future challenge for the cryptocurrency industry will be how to balance regulation and innovation. In this uncertain environment, investors need to remain vigilant and closely monitor the potential impact of policy changes on the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。