How Fluid Redefines the Rules of DeFi?

Original Title: Why Fluid will kill Aave & Curve (or Uniswap)

Author: Foxi_xyz, Crypto KOL

Translation: zhouzhou, BlockBeats

Editor's Note: This article discusses how Fluid disrupts traditional DeFi models by combining lending and trading. Its dynamic debt mechanism allows borrowing to earn trading fees as liquidity, significantly enhancing capital efficiency, with every $1 TVL generating $39 in liquidity. It also analyzes the potential of INST, suggesting that with strong growth and an upcoming DEX, the price could rise above $8, making it a project worth watching.

The following is the original content (reorganized for readability):

Fluid's lending protocol has already sparked a wave of interest: with a monthly increase of up to 3 times, TVL has reached $800 million. However, lending is not a new concept in DeFi. The real game-changer lies in the decentralized exchange (DEX) that Fluid is about to launch. Let’s explore why this new DEX design could disrupt the market, whether the current valuation of INST is worth buying, and how much potential it has for the future.

What is Fluid?

Fluid is a money market protocol launched by the Instadapp team, where holding INST is equivalent to directly participating in Fluid's growth. It is similar to other money market protocols (like Aave and Kamino) but has improved liquidation mechanisms. While lending itself is hard to innovate disruptively, Fluid showcases new possibilities in the lending market by combining lending with DEX, which is key to its success.

Fluid could become the super DeFi of this cycle

Beyond Traditional Money Markets

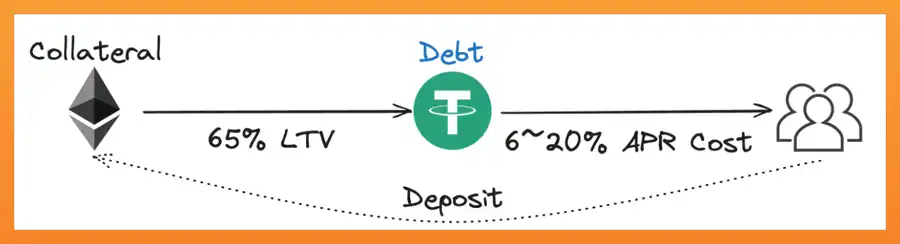

To understand Fluid's potential, one must first grasp the limitations of the current DeFi liquidity ecosystem: traditional money markets and DEX are independent of each other, greatly limiting capital efficiency. These assets serve only one purpose—generating lending income. Similarly, liquidity provided to DEXs like Uniswap can only earn trading fees.

Traditional lending model

This fragmentation leads to high costs for users:

- Low capital utilization

- Liquidity scattered across different protocols

Fluid DEX: The Perfect Combination of Lending and Trading

Fluid DEX redefines how DEX operates. Unlike traditional DEXs that focus solely on trading, Fluid DEX integrates the functions of a trading platform and a money market, potentially becoming the most capital-efficient DEX design in DeFi.

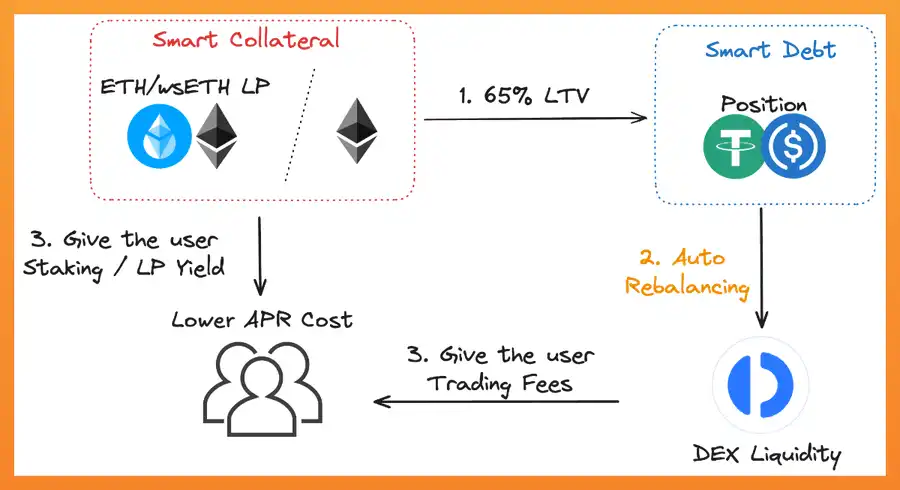

Core Innovations: Smart Collateral and Smart Debt

Smart Collateral (Standard Functionality)

Users can use liquidity pairs (like ETH/wstETH or ETH/WBTC) as collateral. Liquidity provider (LP) tokens also serve as collateral for borrowing and earn trading fees from the DEX. This has been reflected in many new lending protocols.

Smart Debt (True Innovation)

This is the most revolutionary design of Fluid DEX. Traditional DeFi views debt as purely a liability, where users only pay interest after borrowing. Fluid disrupts this model, allowing debt positions to be used to provide liquidity and earn trading fees.

The key innovation lies in the automatic rebalancing of "smart debt," becoming liquidity in the DEX

Dynamic Debt Mechanism and Automatic Rebalancing

Unlike traditional fixed-asset lending, users in Fluid borrow dynamic debt positions. When traders want to exchange (like USDC for USDT), the system does not rely on traditional liquidity pools but automatically adjusts the borrower's debt structure (reducing USDC debt and increasing USDT debt). This debt rebalancing mechanism acts as a source of liquidity for the DEX while generating trading fee income for borrowers.

Example of automatic rebalancing:

Borrowing 1000 USDC and 1000 USDT, after depositing into Fluid DEX, someone exchanges 500 USDC for USDT:

- Your USDC debt decreases to 500

- Your USDT debt increases to 1500

- You earn fee income from this transaction

- Total debt remains unchanged while generating income through trading activity.

Large-Scale Capital Efficiency

The combination of smart collateral and smart debt achieves unprecedented capital efficiency. Through innovative design, Fluid can create up to $39 in effective liquidity for every $1 of TVL. This is not theoretical data but is achieved through the following meticulously designed systems:

- High loan-to-value (LTV) ratios, with some assets reaching up to 95%, thanks to advanced liquidation mechanisms.

- Utilizing both collateral and debt as sources of liquidity.

- An automated risk management system that adjusts positions based on market conditions.

In a bull market, the market pursues high leverage and high capital efficiency, which may further increase Fluid's TVL and fee income.

Valuation: Is it Worth Buying INST Now?

Data Source: Coingecko, Token Terminal, Defillama, and other sources

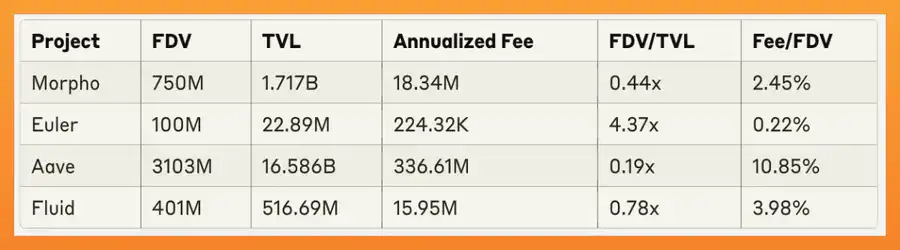

TVL/FDV Multiple Still Has Room for Growth

Fluid's FDV/TVL ratio is 0.78x, which still has significant room for improvement compared to Aave's 0.19x. More importantly, Fluid's TVL has grown to $516 million without large-scale token incentives, demonstrating its strong organic growth capability.

Strong Fee Generation Capability

Fluid generates approximately $15.95 million annually through its lending protocol, with a fee/FDV ratio of 3.98%, which is competitive compared to emerging lending protocols like Morpho and Euler. With the upcoming DEX, its revenue is expected to increase further:

- Regular trading fees

- Additional income from smart debt

Overall, it is expected that the price of INST could reach at least $8.

Looking Ahead: DEX Will Be Fluid's Killer Application

Fluid does not rely on token incentives to drive growth but achieves an organic growth cycle through efficient capital utilization:

Efficient capital utilization -> Lower borrowing costs -> Attract more TVL -> Increase DEX liquidity -> More trading fees -> Further lower borrowing costs

While Fluid's success in the lending space has been impressive, its upcoming DEX may be the true innovation point. By redefining the relationship between lending and trading, Fluid is not only improving existing tools but also creating new possibilities for capital efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。