Tracking real-time hotspots in the cryptocurrency market and seizing the best trading opportunities, today is Saturday, November 23, 2024, I am Wang Yibo! Good morning, crypto friends! ☀️ Die-hard fans check in 👍 Like to make big money 🍗🍗🌹🌹

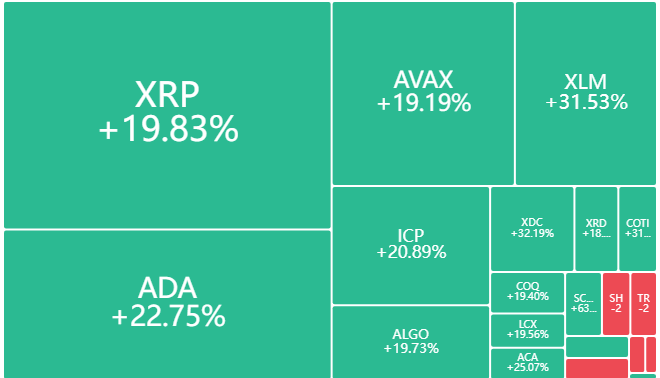

Overnight, the three major U.S. stock indices collectively closed higher, with the Dow Jones rising 0.97%, accumulating a weekly gain of 1.96%; the S&P 500 index rose 0.35%, with a weekly gain of 1.68%; the Nasdaq rose 0.16%, with a weekly gain of 1.73%. Large tech stocks had mixed performances, with Tesla rising nearly 4%, Microsoft up 1%, and Apple, Netflix, and Intel slightly up; Nvidia fell over 3%, Google dropped more than 1%, and Amazon and Meta saw slight declines. Notably, Tesla reached a new high since April 2022, with a total market value of $1.13 trillion; Netflix has set new highs for five consecutive trading days. Bitcoin has reached a new high, breaking through $99,500, and the altcoin market is beginning to show divergence, with newly launched coins experiencing significant declines, while older coins with narratives are leading in gains.

We are about to witness the historic milestone of Bitcoin reaching $100,000. In recent days, the market has continuously surged to high levels, with the prices of Ethereum and other mainstream coins also rising repeatedly. Bitcoin is just one step away from the $100,000 mark. How will the subsequent market trend unfold? Bitcoin has seen five consecutive daily gains, showing a strong rebound. From the weekly rebound perspective, it has also formed four consecutive upward movements. However, we need to pay attention to whether the $100,000 mark can stabilize, as we should guard against the risk of the market probing higher and then retreating. It is not advisable to chase high prices now; previously, the market was steadily rising, but with the release of volume, we must also be cautious of the risk of probing higher and then falling back! Looking at the 4-hour chart, there is a strong upward rebound based on the middle track. Today is Saturday; whether the market continues to rise or maintains the previous tug-of-war trend remains to be tested. Personally, I predict there will be a probing high and a pullback today, and the closing position will determine the strength of the market going forward. Whether it will be a probing high followed by a drop or a probing high followed by horizontal consolidation and accumulation will determine the short-term strength shift. From the market perspective, there is still a significant risk of probing high and falling back, so it is not advisable to chase high prices today. The main strategy could be to look for opportunities to short after a rise!

There will definitely be a season for altcoins, but not all altcoins will rise, so selecting coins is very important. The cryptocurrency market is highly competitive, and the long-tail effect is very weak. If the coin you choose does not have new hotspots to attract funds, then the coin's sustained value (long-term consensus) is generally quite weak, insufficient to support long-term capital inflow, leading to a rapid shrinkage in market value. A track that was popular a year ago may only have a strong leader left after a year, while others have been forgotten. For example, the leading coin in the inscription track, Ordi, can you think of any other inscription coins? What is the current situation of these coins, and how much have they shrunk compared to their historical highs? Coins like BTC, SOL, and PEPE have now surpassed their historical highs. Why are some altcoins lagging behind in this bull market? I suggest friends to replace worthless coins; holding onto them will only cause you to miss out on this bull market.

In this market, it ultimately comes down to ability. If your ability is insufficient, the market will eventually make you pay it back one day. Therefore, when your wealth exceeds your ability, you need to control your drawdown. Although this control may be in vain, that kind of arrogance and hubris from profits will ultimately destroy a person's rationality. However, we do not need to worry about our wealth being lower than our ability in the capital market because this kind of imbalance will eventually be corrected by time. If it has not been corrected, there is only one reason: your ability is insufficient. If you are still in a state of confusion, not understanding technology, unable to read the market, not knowing when to enter, unable to set stop losses, not knowing when to take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits during market fluctuations, and missing opportunities when the market comes, these are common problems among retail investors. But it’s okay; come to me, and I will guide you to think correctly about trading. A single profitable trade is worth more than a thousand words. Instead of repeatedly losing, come find Yibo! Frequent operations are not as good as precise trades; let each trade be valuable. What you need to do is find Yibo, and what we need to do is prove that our words are not empty. 24-hour real-time guidance, the market is volatile, and due to the effectiveness of review, the subsequent market trend will mainly rely on real-time arrangements. Friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。