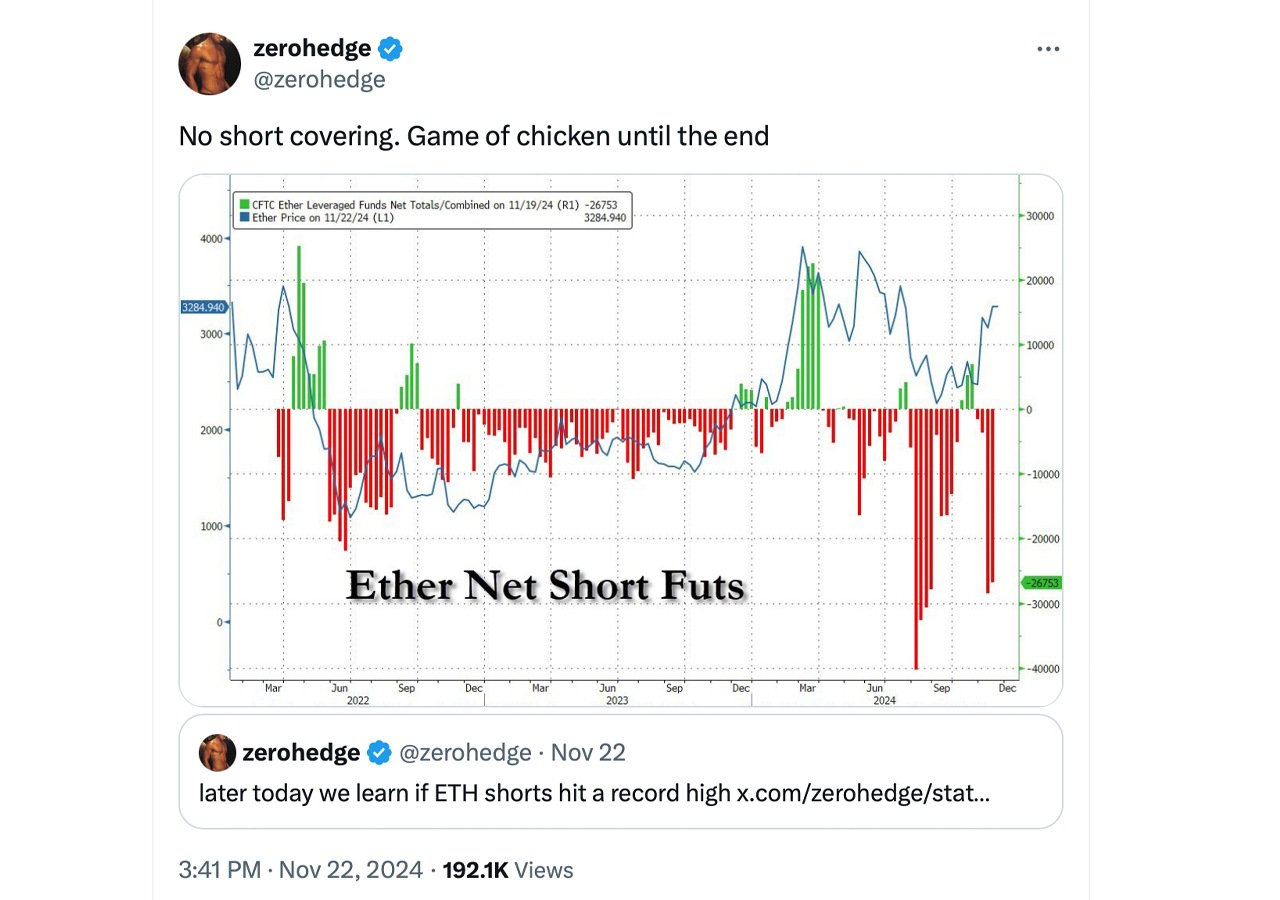

Open interest in ethereum futures has surpassed $20 billion, setting a new record and highlighting heightened speculative activity. This upswing in short positions indicates an increasing number of traders are wagering on ethereum’s price dropping. At the same time, the estimated leverage ratio (ELR) has reached a peak, reflecting a greater reliance on borrowed funds—an approach that magnifies the potential for rapid liquidations.

Sentiment among traders reinforces this cautious outlook. Options activity shows a growing preference for protective put contracts, which now account for more than 34% of trades compared to 26% favoring bullish calls. Although bearish sentiment via other indicators has eased to 47% from 70% in October, it remains a strong signal of lingering caution.

Additional metrics point to ether’s uphill battle. Resistance near $3,600 has proven tough to breach, while a weakening relative strength index (RSI) hints at dwindling momentum. Institutional interest also appears to be cooling, as ethereum exchange-traded funds (ETFs) recently experienced several single-day net outflows last week.

The spike in leveraged shorts adds another layer of tension to the market. If prices unexpectedly rise, short sellers could face forced liquidations, potentially unleashing a chain reaction of buy orders that drive prices higher—a phenomenon known as a short squeeze. On the flip side, a sustained downturn might validate bearish bets, albeit at the cost of heightened market strain.

Despite the prevailing negativity, some analysts remain optimistic about a turnaround before year-end, forecasting ethereum could reach between $5,000 and $10,000. However, such projections hinge on significant shifts in market conditions.

Ethereum’s derivatives market, marked by record-breaking short positions and leverage, is not for the faint of heart. Traders should proceed with caution as the market balances on a knife’s edge between bearish dominance and the possibility of sharp reversals. Whether this marks the start of a deeper decline or sets the stage for recovery remains an open question.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。