The promise of Solana is to enable anyone with an internet connection to participate in capital markets.

Written by: akshaybd

Translated by: zhouzhou, BlockBeats

Editor’s Note: The recent surge in Solana's performance, with intense meme trading on-chain and rising token prices, is attributed to the Solana Foundation's focus on enhancing infrastructure performance and reducing latency to meet market demands, fostering the growth of founders, applications, and tokenized projects.

Below is the original content (reorganized for better readability):

Internet Capital Markets and the F.A.T. Protocol Engineering

Solana's promise is to allow anyone with an internet connection to participate in capital markets. Today, you only need to download a wallet or app, click a few buttons, and you can join the internet capital market—a globally accessible ledger that can tokenize entities, currencies, and culture.

Why is this important?

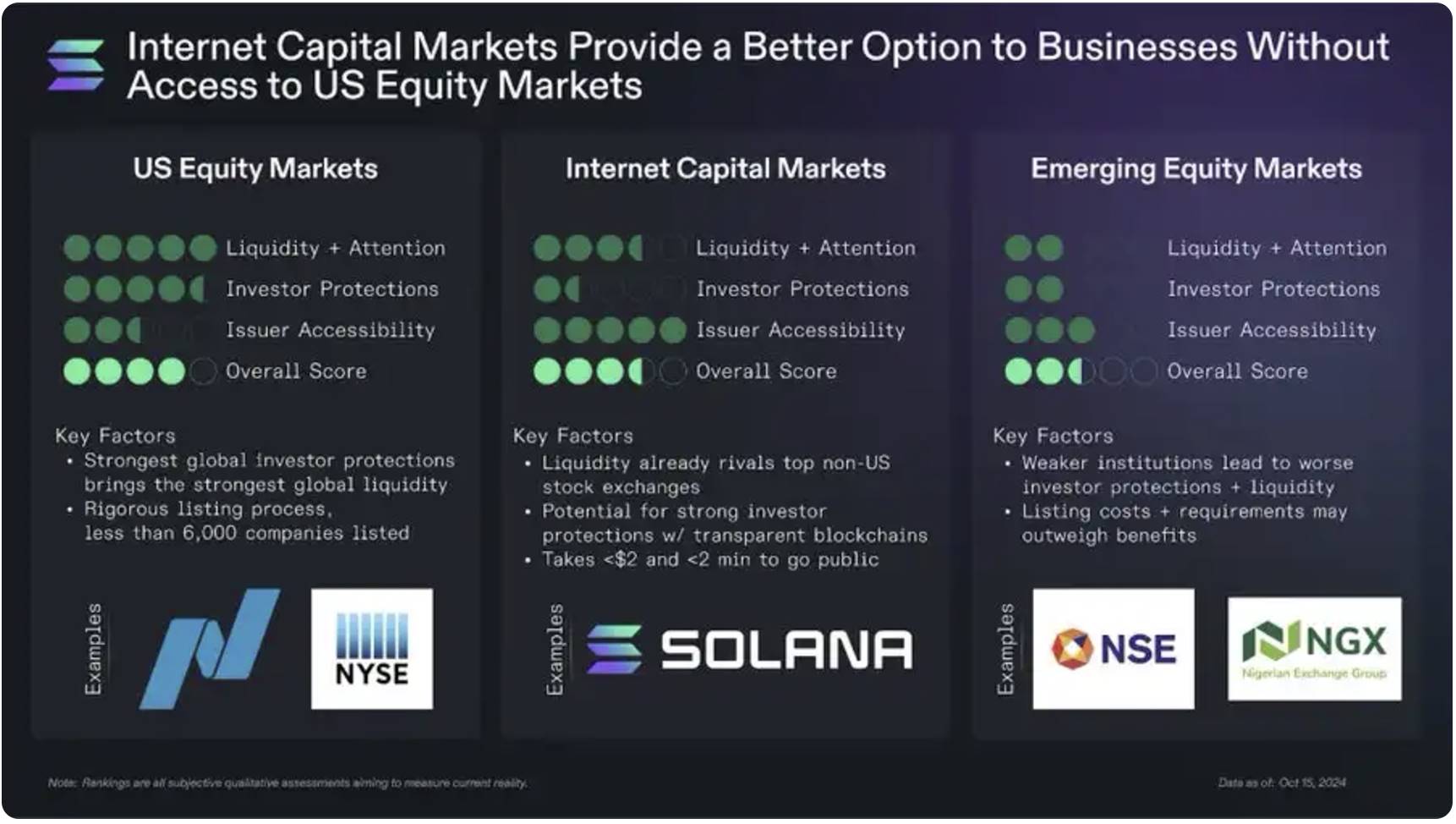

It helps us create a world where anyone can own assets anytime and anywhere, simply by having an internet connection. These assets can be global companies, real estate, commodities, or even cultural expressions. This lays the foundation for "universal base ownership." The competition among high-performance L1s is not just to establish a decentralized Nasdaq but to create an internet-native successor to Nasdaq—a capital market with better accessibility, lower latency, and shared global liquidity.

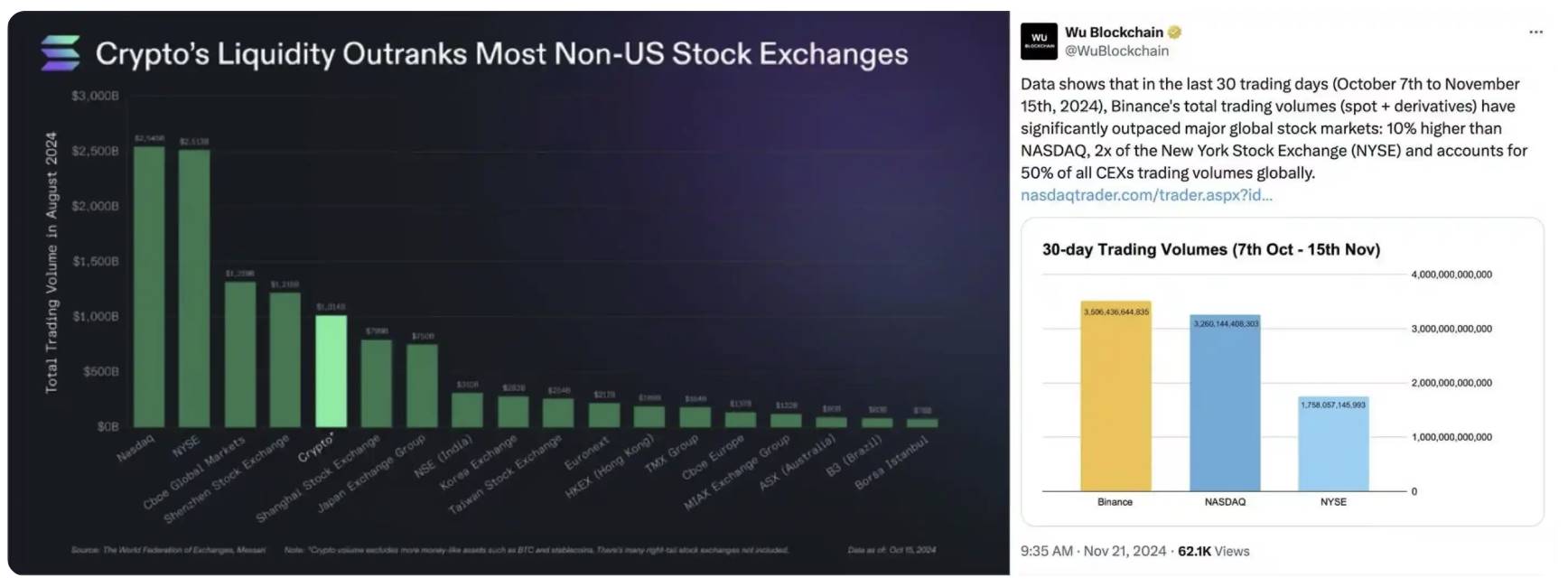

The opportunity is both simple and immense: currently, only about 15% of the global population can participate in the U.S. capital markets—the most liquid market in the world. Many other countries' capital markets lack liquidity, have high entry costs, and inefficient settlement processes. The cryptocurrency market, on the other hand, is more accessible and liquid. At its peak, its trading volume even surpassed NASDAQ and NYSE, giving us the chance to build the best capital market on the internet.

In the future, companies will list "on the internet" and be able to reach over a billion investors holding private keys—voting with their funds to decide the future they want. This is not limited to stocks but includes all valuable asset classes, cultures, and ideas.

How to accelerate towards this future?

This is the significance of the F.A.T. protocol engineering. In the past, the industry was largely built on the idea that "value will primarily concentrate at the infrastructure layer" (Fat Protocols, 2016). Eight years later, we are still building infrastructure because it often attracts higher valuations.

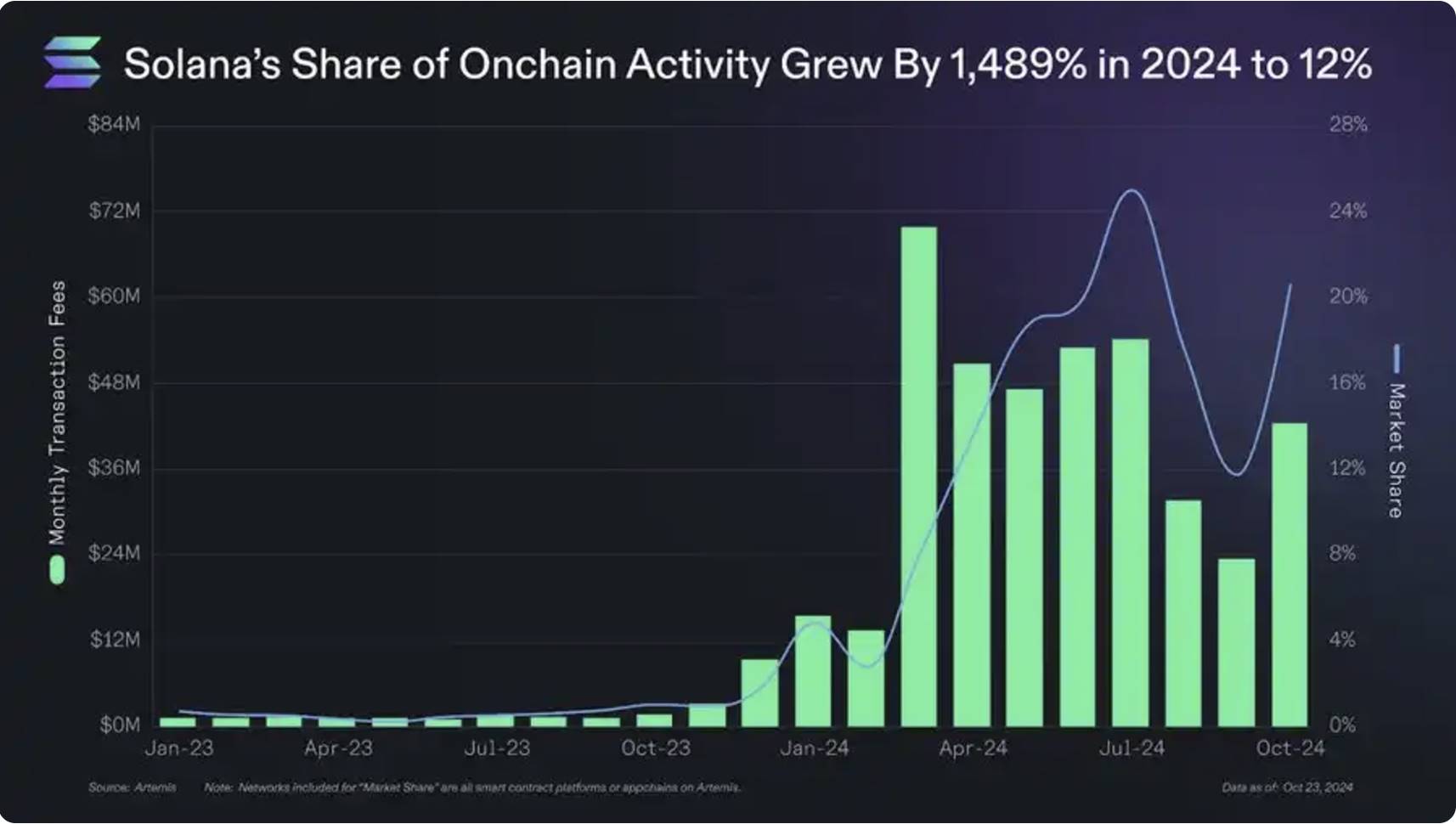

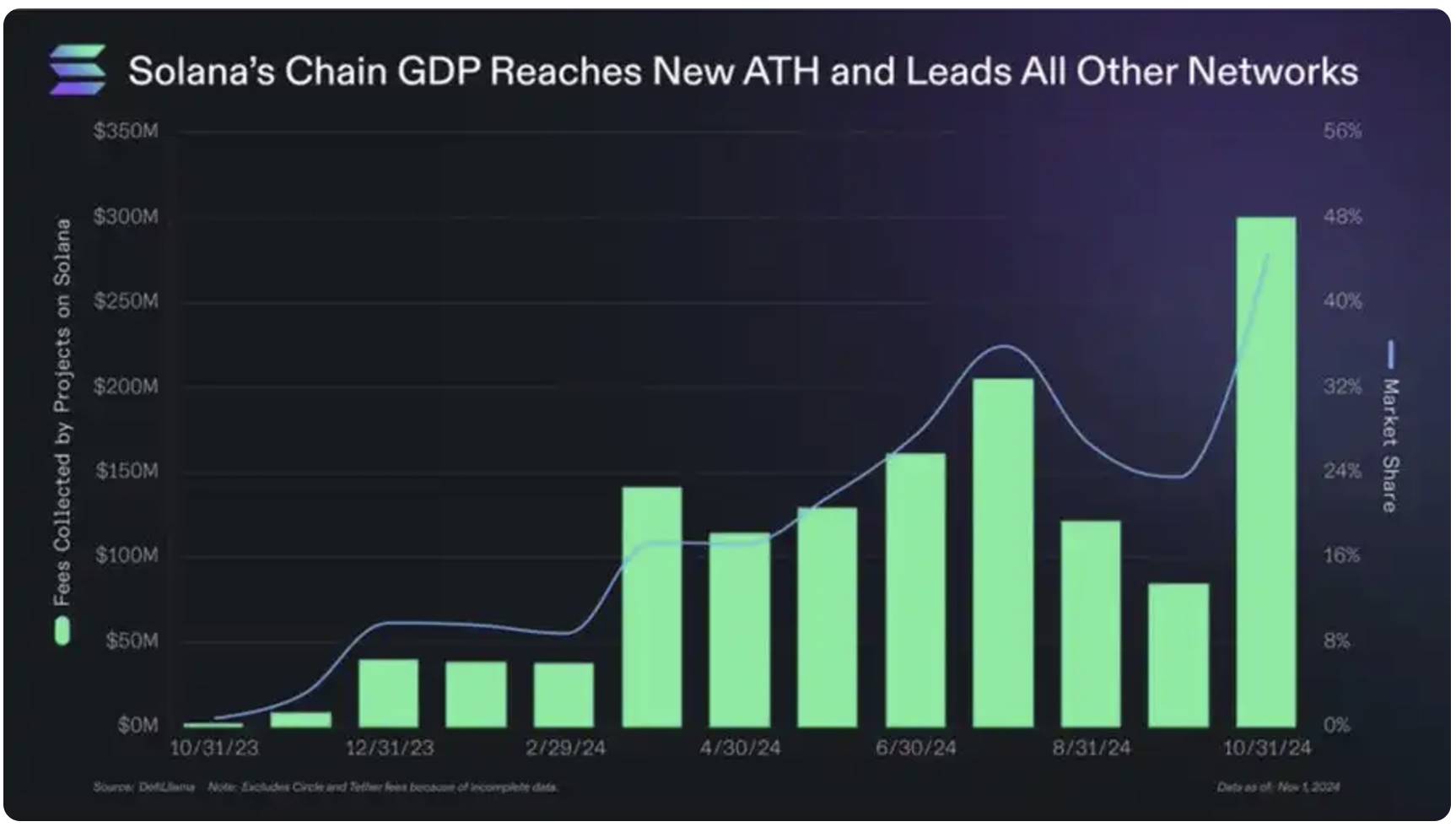

In contrast, Solana's ecosystem chooses to bet on products, as evidenced at the 2024 Breakpoint conference. By focusing on founders, applications, and tokenization, Solana's market share in transaction fees—a great indicator of ecosystem activity and overall health—grew by 1,489% in 2024, reaching 12%.

F = Founders, not just developers

Now, for a determined group of founders, it has never been easier or faster to go from a garage startup to a billion-dollar company with just an internet connection.

- tensor: Two founders from Canada, company valuation of $445 million

- pump.fun: A UK team that achieved $155 million in fee revenue within 8 months

- birdeye: Based in Vietnam, with 24 million users by 2024

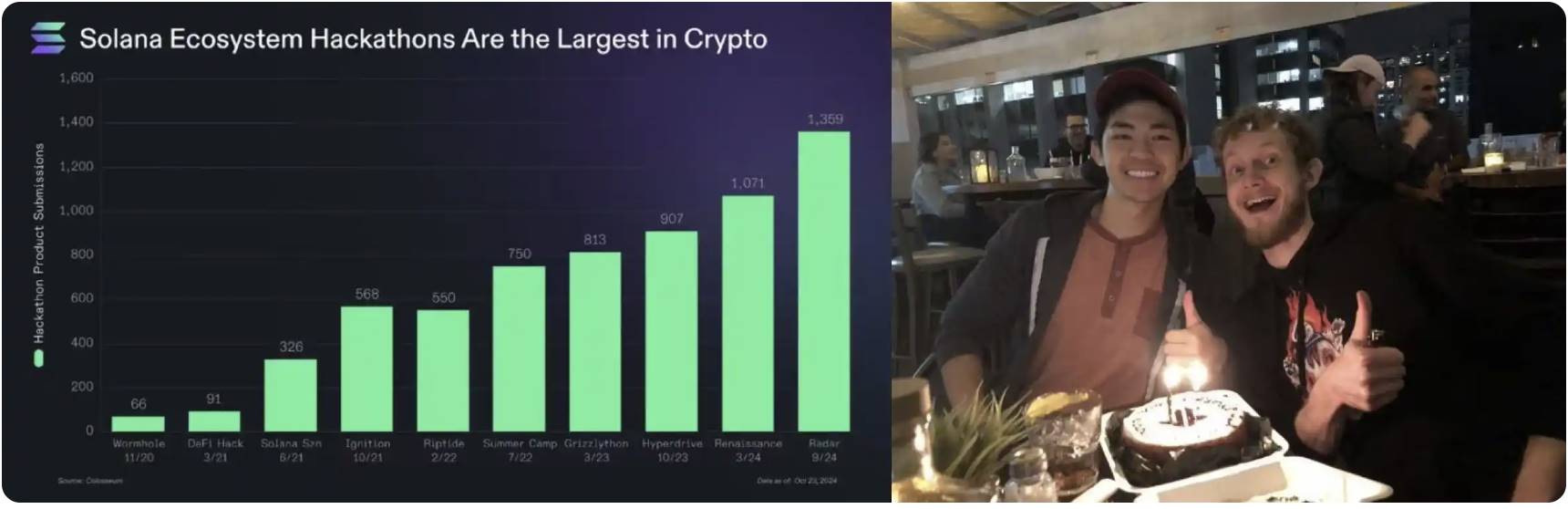

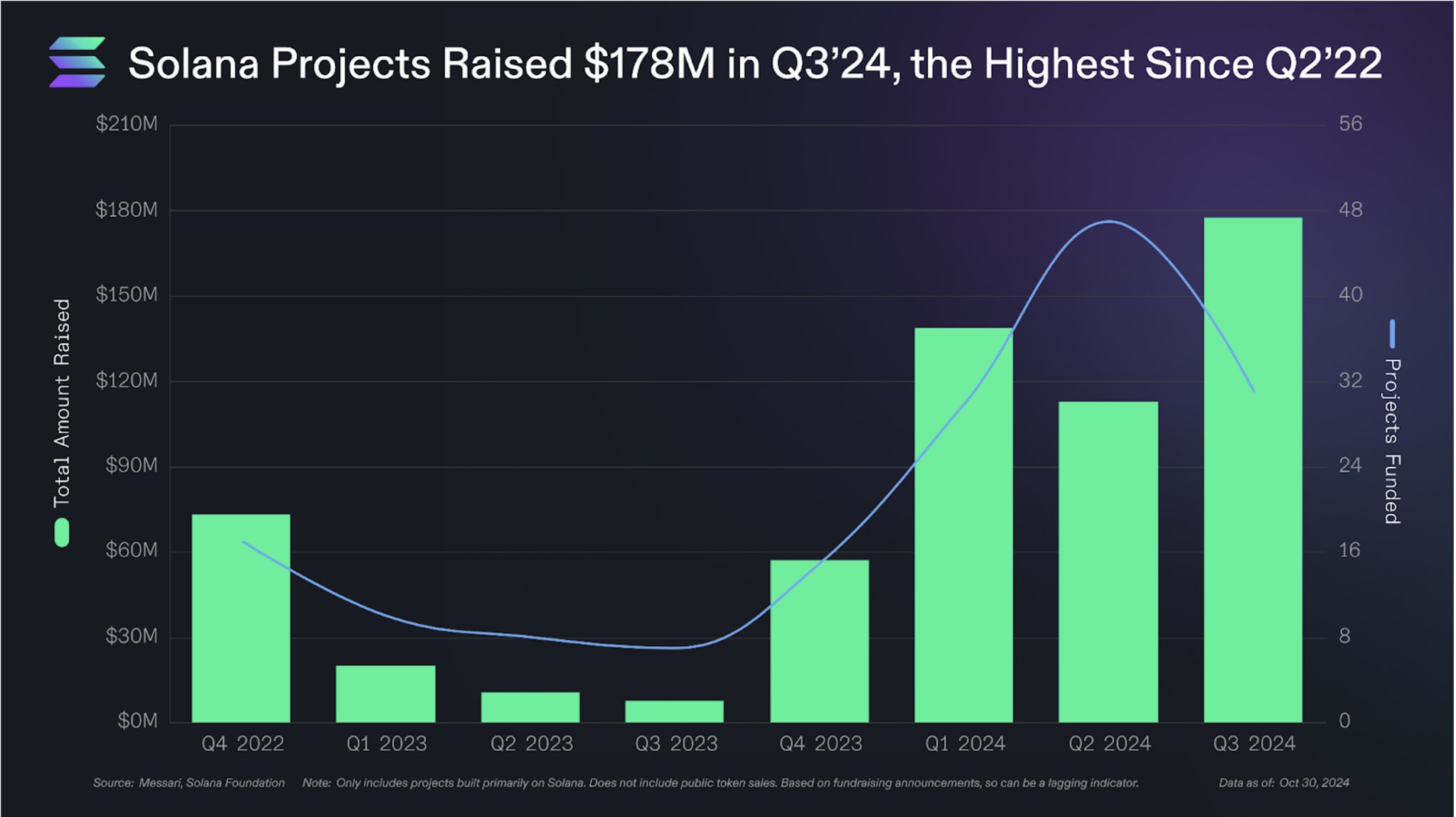

The startup flywheel will continue to spin rapidly in 2025, with the Colosseum hackathon (Solana's hackathon) being the largest talent discovery and growth program in the crypto space, with past participants having raised a total of $650 million.

This flywheel benefits from ecosystem support designed for scalability: from the superteam hub, shipyard workspaces, to the solanaturbine accelerator, community-led infrastructure further accelerates the growth of founders.

A = Applications, not just infrastructure

Infrastructure represents uncertain optimism, while applications represent certain optimism. The Solana ecosystem prioritizes products that users truly need, and what are the results?

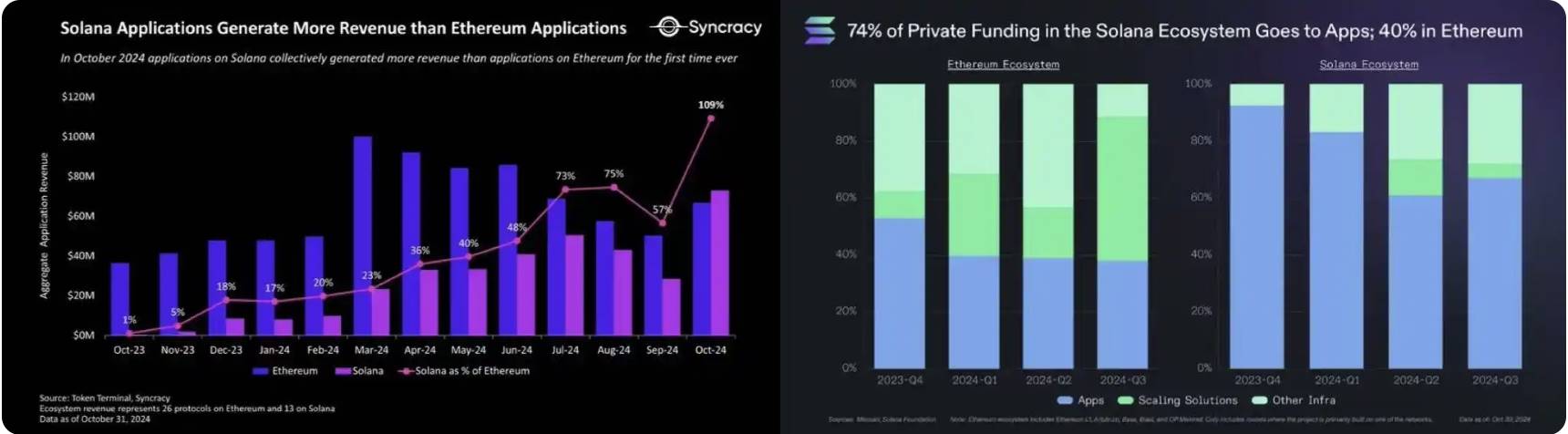

Just in October of this year, application revenue reached $73 million, a 185-fold year-on-year increase, now leading all networks. Additionally, 74% of the funds within the ecosystem flowed to applications (compared to 40% for Ethereum), as founders followed user demand.

Solana has always held the belief that what matters is not TVL, but the aggregation of economic activity. Chain GDP (revenue generated by applications) is the primary metric for measuring the long-term success of a protocol. When the revenue generated by applications exceeds that of the base layer, it indicates that the protocol layer has achieved product-market fit. If your infrastructure layer is exploitative, applications will leave, opting to build their own chains or migrate to others.

Study the Laffer Curve.

T = Tokenization, not just TVL

TVL is a passive, self-referential metric. Active metrics like capital efficiency and trading volume are more instructive. The more important ultimate goal is: Solana is the best platform for launching internet assets. In the past six months, we have witnessed the launch of 2.6 million tokens, accounting for 78% of the total across all chains. While memes may occupy a significant share of public consciousness, they are not the only things growing.

The treasury balance has doubled to $134 million, stablecoins have grown by 120% to about $4 billion, and there are also 4,200 physical assets from BAXUSco and dvinlabs, 190 million digital collectibles from drip haus, and over 1 million hotspots from helium—these are just a few examples.

With the follow-up of adoption, tools, and regulation, super tokenization will accelerate—this will become a globally accessible ledger where all assets will be tokenized.

Each component of F.A.T. mutually reinforces: more founders launch products, more products attract users, more users drive more capital tokenization, and more capital attracts more founders. In just the third quarter of 2024, Solana's native teams raised $178 million.

The "Protocol" part of the F.A.T. Protocol Engineering

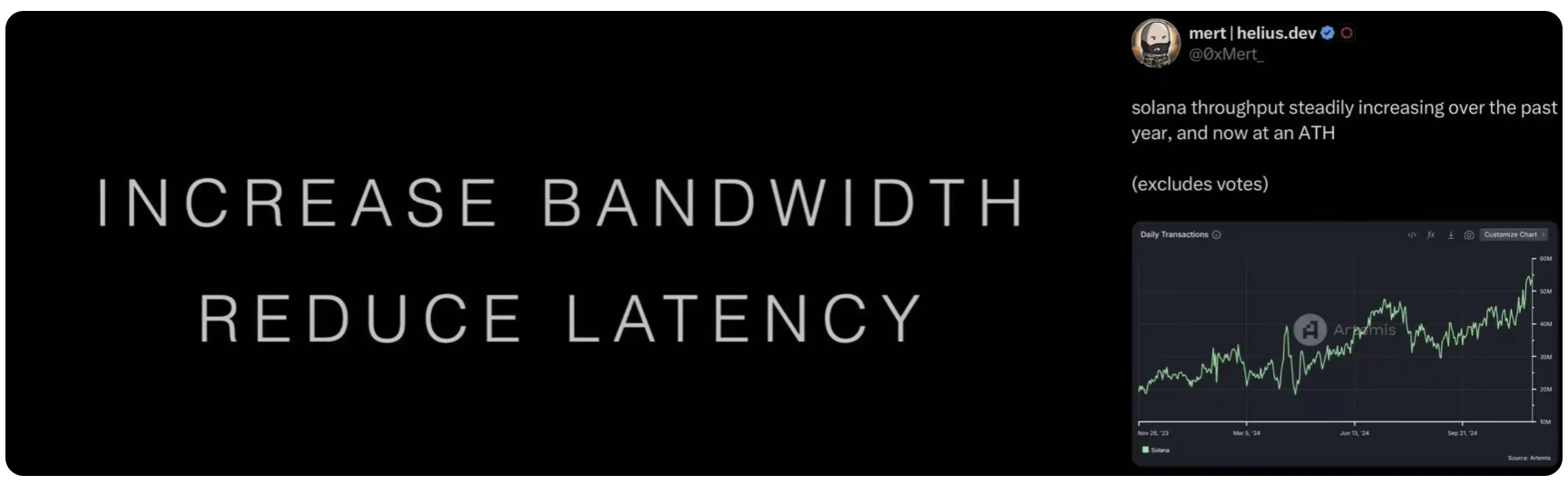

Teams focused on core protocols (such as Anza, Jump, Jito, etc.) are working daily to enhance performance and optimize experiences. They push the limits of hardware and software to improve Solana's performance and capacity at the base layer. Increasing bandwidth and reducing latency are key strategies for Solana, emphasizing its ongoing commitment to building infrastructure for real-world use rather than solely for valuation.

Finally, I call it engineering (rather than theory) because it elucidates an important value inherent in the ecosystem. A product culture that is opinionated yet pragmatic, continuously making tough trade-offs, launching and iterating in the real world to find product-market fit (PMF). This culture attracts practitioners, not just academics.

As the ecosystem continues to grow, we should maintain this culture rather than become dogmatic, or worse—complacent due to any temporary success. The development of cryptocurrency is rapid, and we will always remain adaptable.

Currently, the foundation's marketing activities are expected to support these core pillars through various events and content—celebrating the best founders, applications, and tokenization projects in the process, while teams continue to work on enhancing Solana's speed and performance. Additionally, given that innovation seems to be reviving in the U.S., we will also refocus on the U.S. market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。