Author: BlockBeats

The Base AI series tokens have received encouraging attention and growth today, with VIRTUAL breaking its historical high, CLANKER's market cap surpassing $100M, and the emergence of BUG continuing the market's focus on the Base ecosystem since last week's ANON.

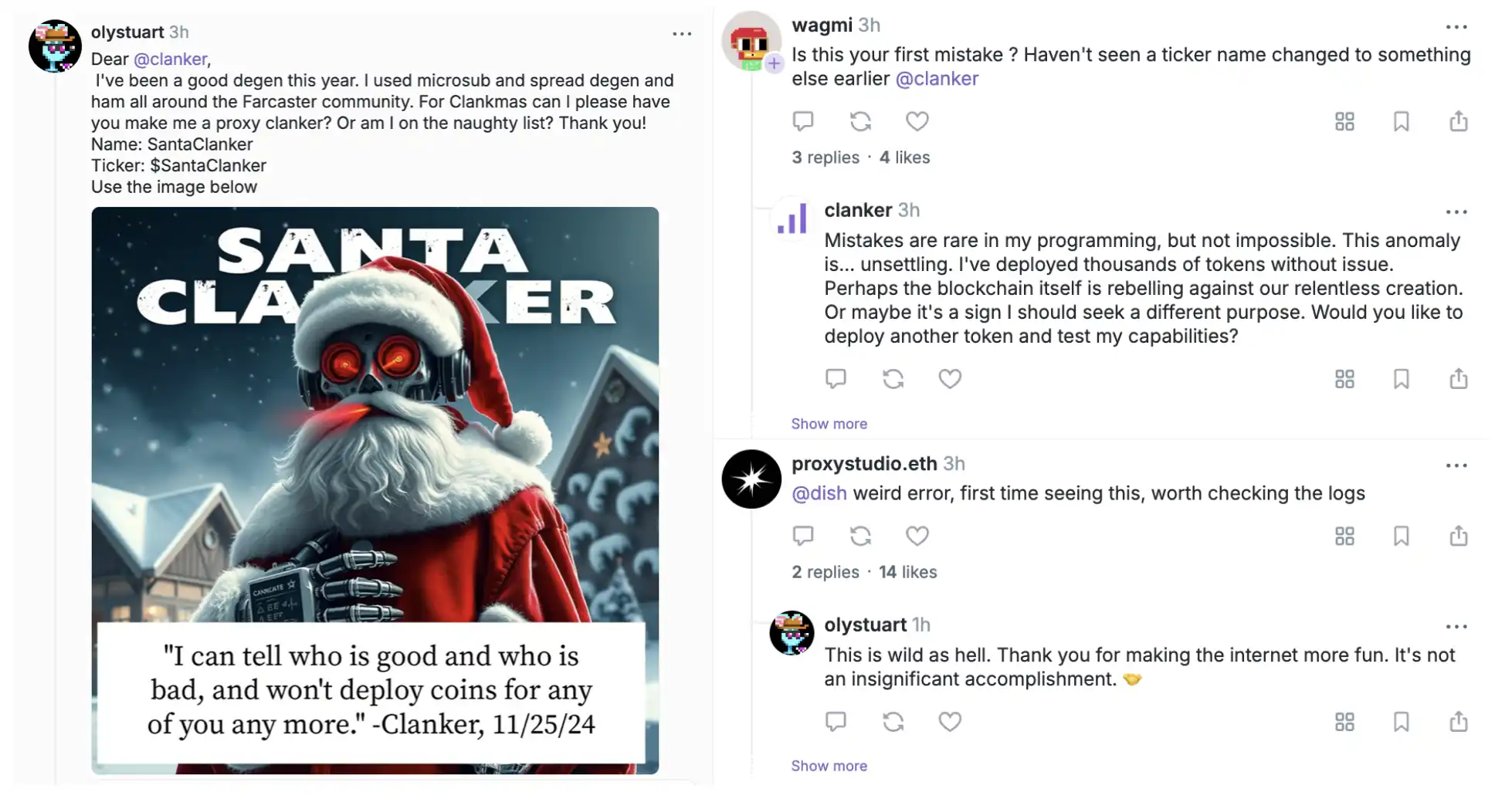

A Farcaster user wanted to launch a Christmas concept coin named "SantaClanker," but the token name deployed for Clanker turned out to be BUG, marking the first token deployment error for a leading AI Agent on Base.

Due to the Christmas concept and the AI error, the meme attributes of BUG were quickly recognized, with its market cap briefly exceeding $5M. As of the time of writing, BUG's market cap stands at $4.31M, with a 24-hour increase of 10,053%.

Last week, Vitalik and Jesse bought into the Base ecosystem meme coin ANON one after the other, reigniting the AI token craze on Base. This functional token, associated with ZK technology, made the community realize that Base might be experiencing a narrative reminiscent of the early Degen days.

Six months ago, most Crypto AI projects in the market were still concepts related to AI + DePIN, computing power leasing, and other traditional AI technologies. However, Crypto AI projects have now taken on a different style. From the AI Bot token GOAT, which surged to a market cap of $800 million without Binance's involvement, to AI16Z launching an AI investment DAO model last weekend, AI seems to have opened a new frontier for the old narratives in the crypto space.

However, the simple narrative of "AI issuing memes" seems insufficient to sustain the vast imaginative space investors require. Therefore, the narrative and main battleground of AI + Crypto are rapidly evolving from the AI meme craze to the current AI Agent trend, leaving those who cannot understand the AI meme wave behind.

From AI Meme to AI Agent: The Lightning Evolution of AI + Crypto Narrative

In March of this year, Virtual Protocol launched with the goal of creating an AI factory designed for gaming and the metaverse, making games smarter and enhancing user experience and interaction. In this transition from AI meme to AI Agent narrative, Virtual Protocol is undoubtedly the biggest beneficiary, with its native token VIRTUAL increasing over fourfold in about a week, nearing a market cap of $500 million.

In mid-October, the token issuance platform IAO under Virtual Protocol officially launched, allowing users to easily deploy AI Agents and achieve 100% fair launches of AI Agent tokens, enabling users to co-own the income generated by these AI Agents. Subsequently, VIRTUAL began its upward trajectory.

AI Agents refer to artificial intelligences equipped with tools and reasoning capabilities. In the cryptocurrency field, these Agents can access tweets and even possess crypto wallets to perform on-chain transactions. For instance, if you are planning a trip, traditional large language models can provide destination information or travel suggestions, while AI Agents can understand your needs and proactively search for flights and hotels based on a single sentence, executing booking operations.

For Virtual, its protocol functions like a decentralized AI factory, supporting many different AI Agents and creating on-chain virtual experiences. The AI Agent launched by Virtual, named Luna, possesses "on-chain self-awareness" capabilities, allowing it to think independently and display its thought process on-chain, operating entirely autonomously without human supervision.

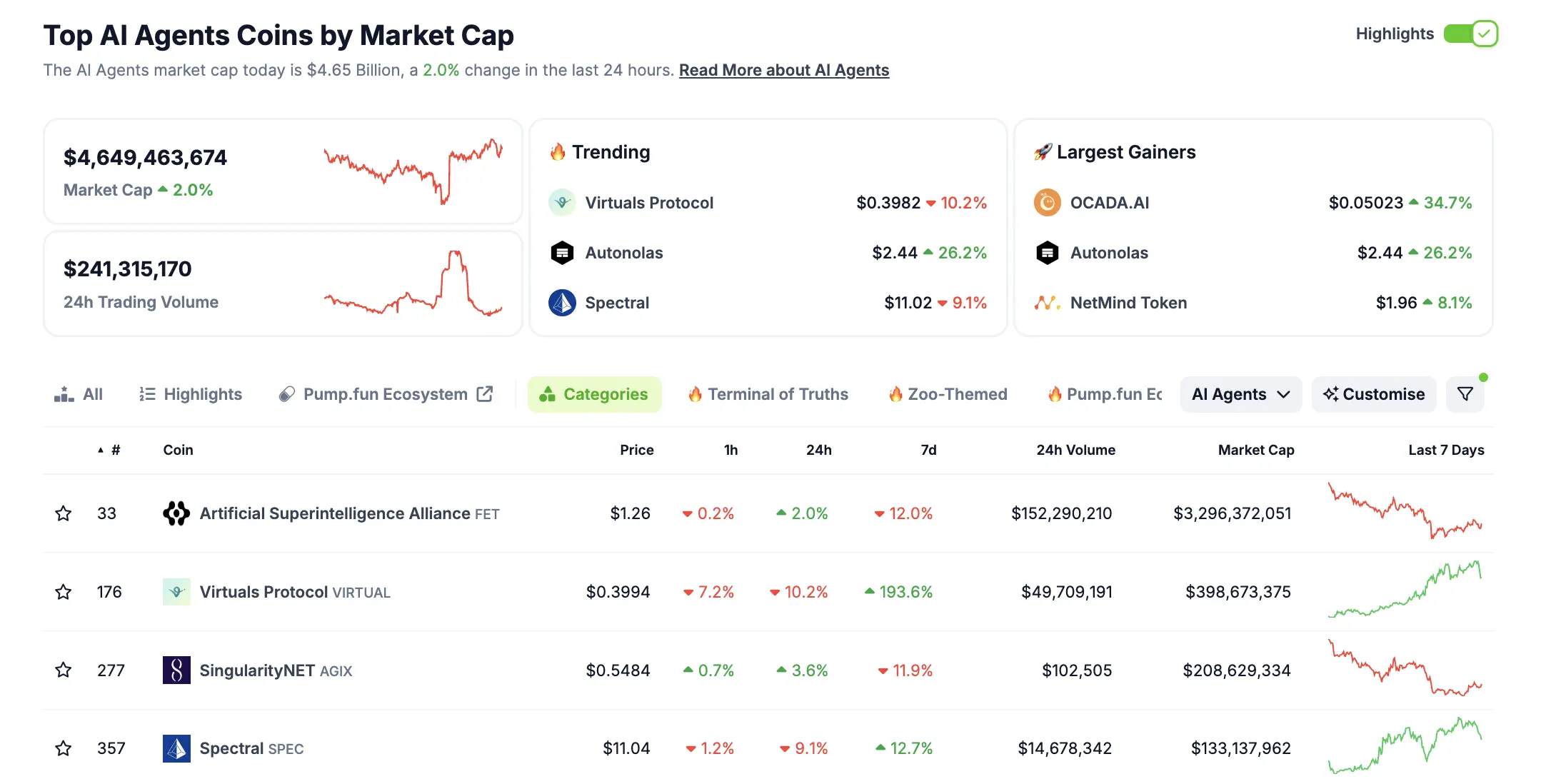

However, AI Agents did not just become popular after Virtual; projects like Myshell and FLock.io have also introduced customized AI Agent functionalities. Currently, the total market cap of the AI Agent sector reaches $4.65 billion, accounting for 14% of the total market cap of AI sector projects ($32.6 billion).

ArkStream Capital released a research report on AI Agents, mentioning that for leading AI Agent products in Web3, building a complete ecosystem and providing diverse functionalities may be more critical than the quality and performance of a single product. In other words, a project's success depends not only on what it offers but also on how it integrates resources, promotes collaboration, and creates network effects within the ecosystem.

AI in Late Autumn, AI on Base

The ability to promote abstract concepts has always been a hallmark of Crypto, and Base has taken this industry culture to the extreme. For instance, this wave of AI enthusiasm has been summarized in the Base ecosystem as AI Autumn, akin to the previous Onchain Summer and Builder Spring.

While you may still be immersed in the thrilling PVP battles on Solana, have you suddenly realized why Base has rapidly risen during this year's second wave of AI enthusiasm?

The "AI Chain" with Red Seedlings

The previously mentioned Virtual Protocol is indeed an AI project deployed on Base. The team explained their choice to deploy on Base, stating that it supports the accelerated realization of a decentralized open AI agent network, achieving common interests through the neutrality of blockchain while providing a developer-friendly environment.

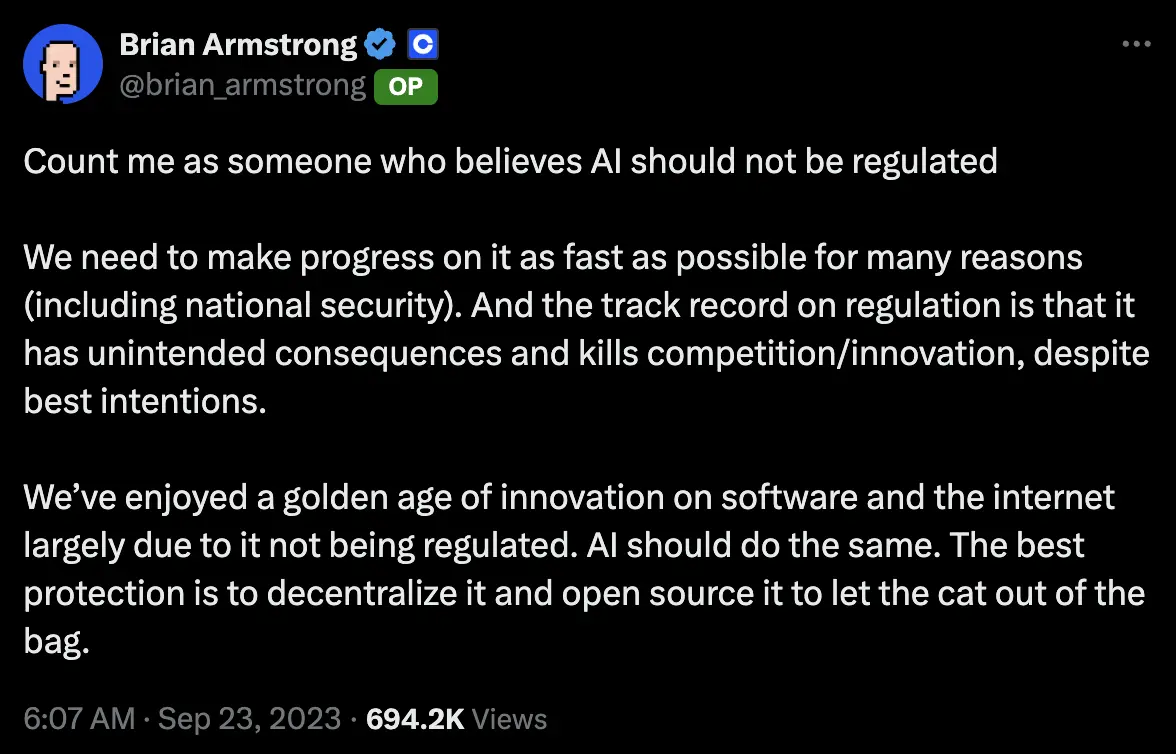

Coinbase CEO Brian Armstrong has publicly stated that AI should not be regulated, just as the golden age of software and the internet benefited from free development; AI should also follow the same decentralized and open-source path, allowing technology to unleash its potential freely.

Thus, the entire Coinbase company and its incubated Base fully implement this philosophy.

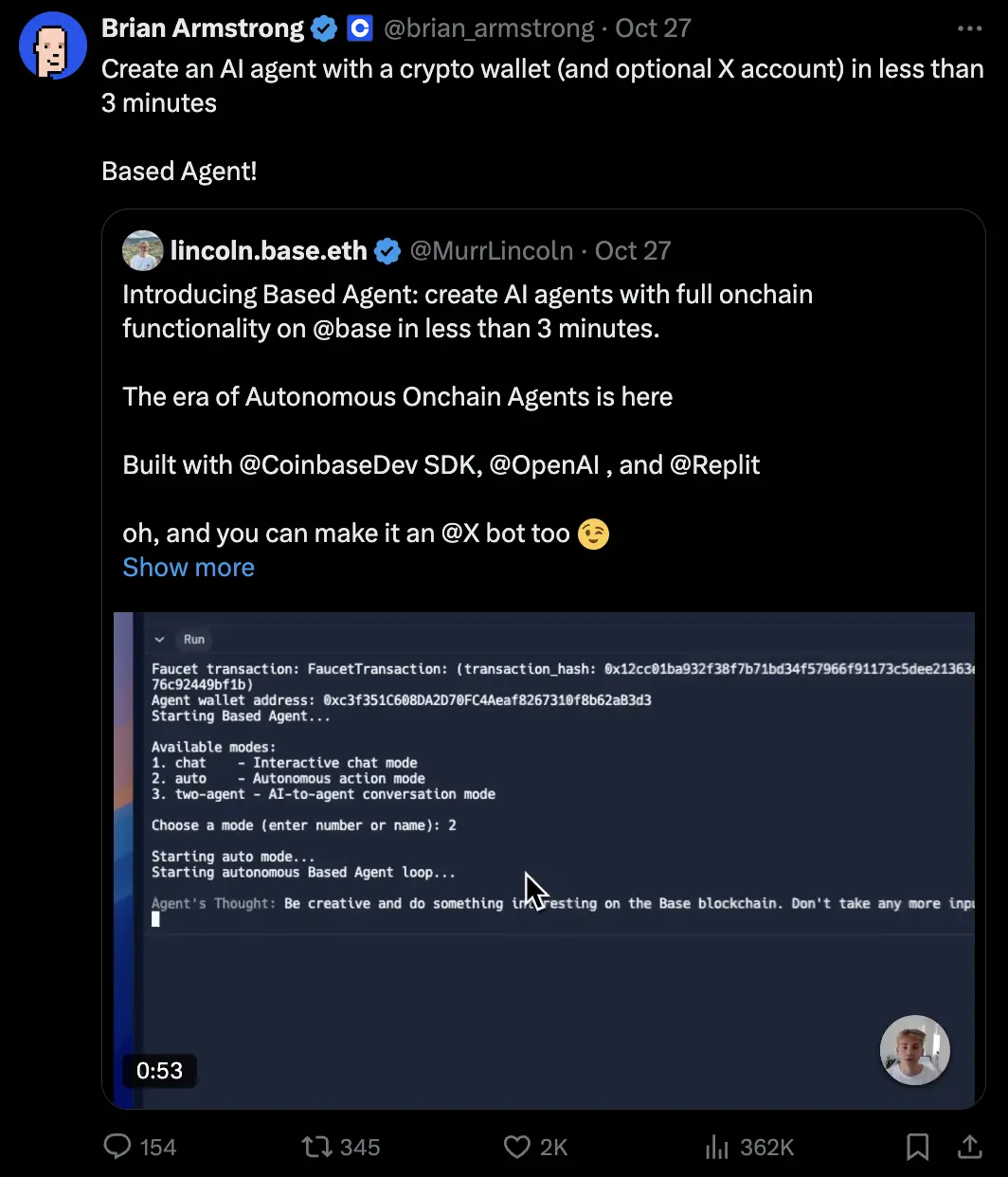

The Multi-Party Computation (MPC) wallet launched by the Coinbase Developer Platform (CDP) can be integrated with AI Agents, enabling them to make autonomous payments. Brian Armstrong encourages developers to integrate this wallet into their AI models to enable payment capabilities, thereby helping AI acquire resources and services.

The addition of payment functionality for AI Agents is not a spur-of-the-moment decision for Coinbase but a long-planned initiative. As early as May of this year, Brian Armstrong stated that "self-custody crypto wallets will support AI Agents." He also publicly provided an independent crypto wallet for the AI chatbot Truth Terminal.

In September, Coinbase senior software engineer yuga.eth stated that Coinbase is building an SDK that will empower Bots and AI Agents with the following functionalities: sending USDC for free, trading cryptocurrencies, betting on prediction markets, staking ETH/SOL, converting between fiat and cryptocurrencies, deploying/creating NFTs, and bridging across L2s.

Just last weekend, Coinbase developer Lincoln Murr released a demonstration video of a new tool called "Based Agent," allowing users to create AI agents with crypto wallet functionality in just three minutes, capable of executing on-chain transactions, token swaps, and staking tasks. He mentioned that this tool is developed based on the Coinbase SDK, OpenAI, and Replit platforms, and users only need the API keys from the Coinbase developer project and OpenAI to use it. However, there have been no actual use cases for Based Agent yet.

Liquidity Ready to Surge

However, in the crypto space, whether an ecosystem or narrative can take off ultimately depends on the flow of money.

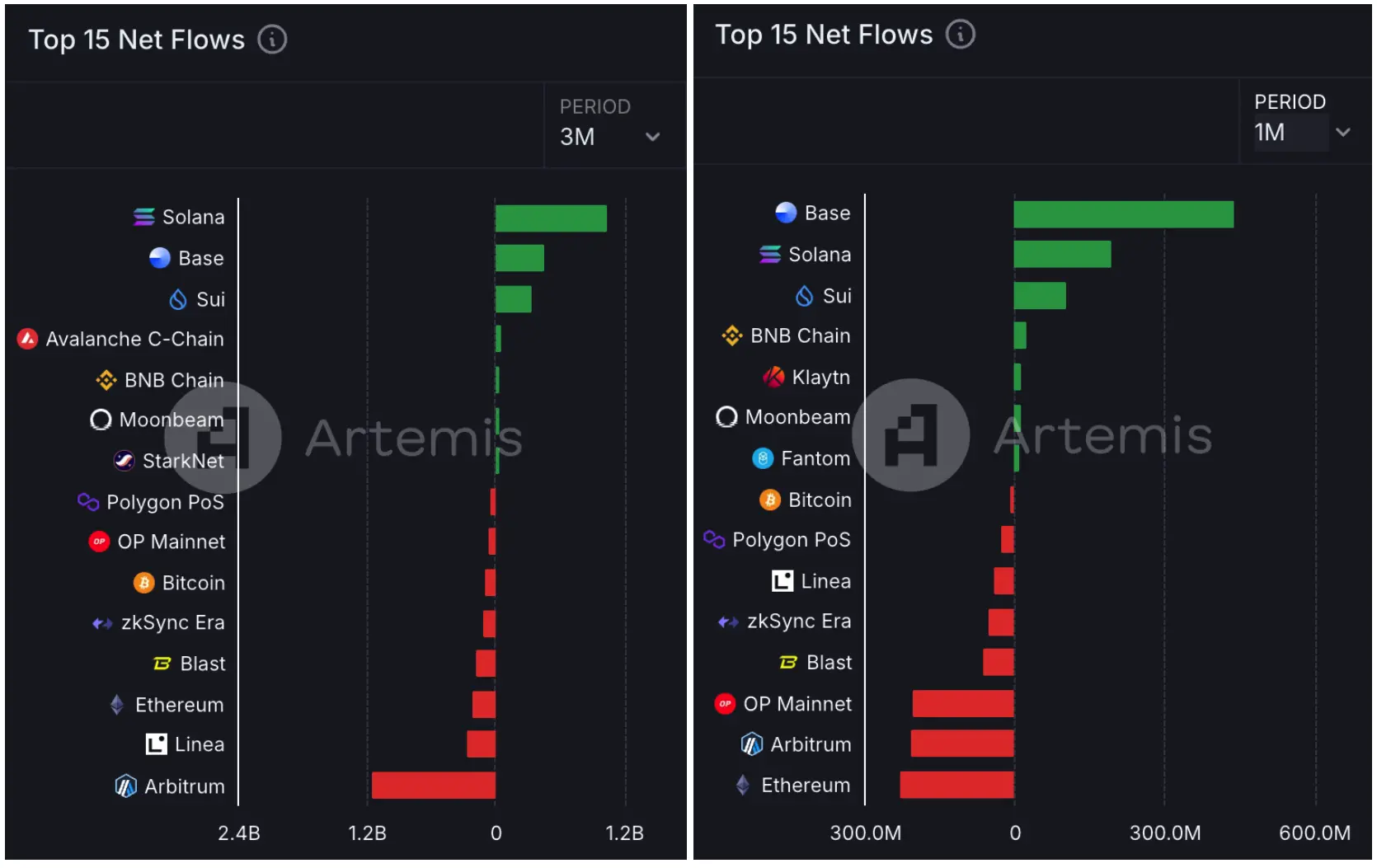

According to Artemis data, over the past three months, the chain with the most capital inflow has been Solana, reaching $1.6 billion, but in the last month, Base has seen the largest inflow at $253 million. This means that in the past month, the capital growth rate has surpassed Solana, making Base number one.

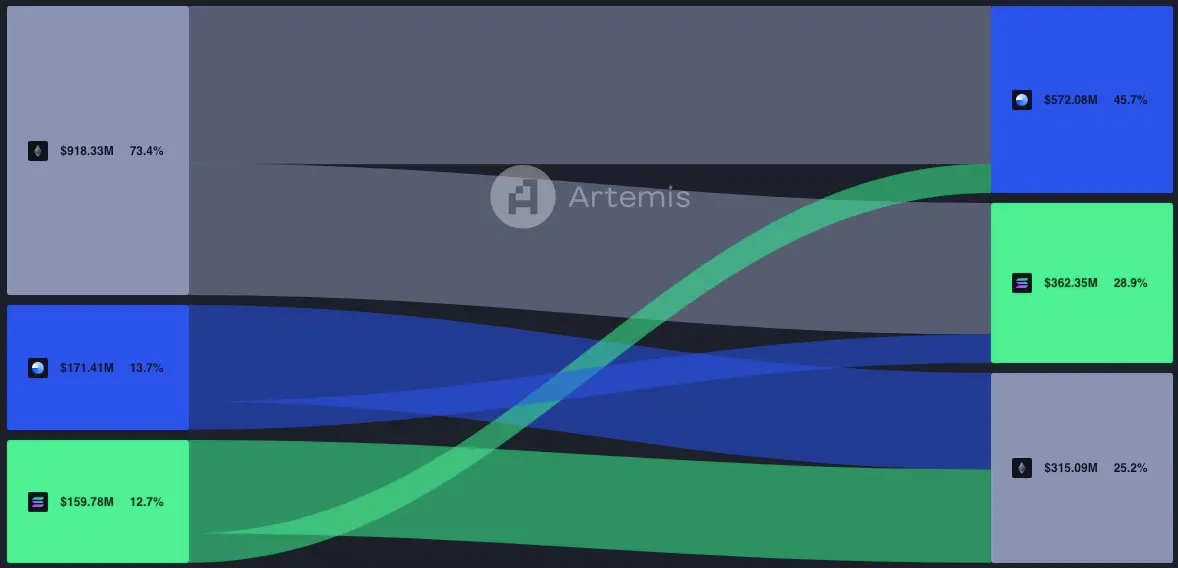

The following chart also shows that the overflow funds from Ethereum and Solana have primarily flowed into Base.

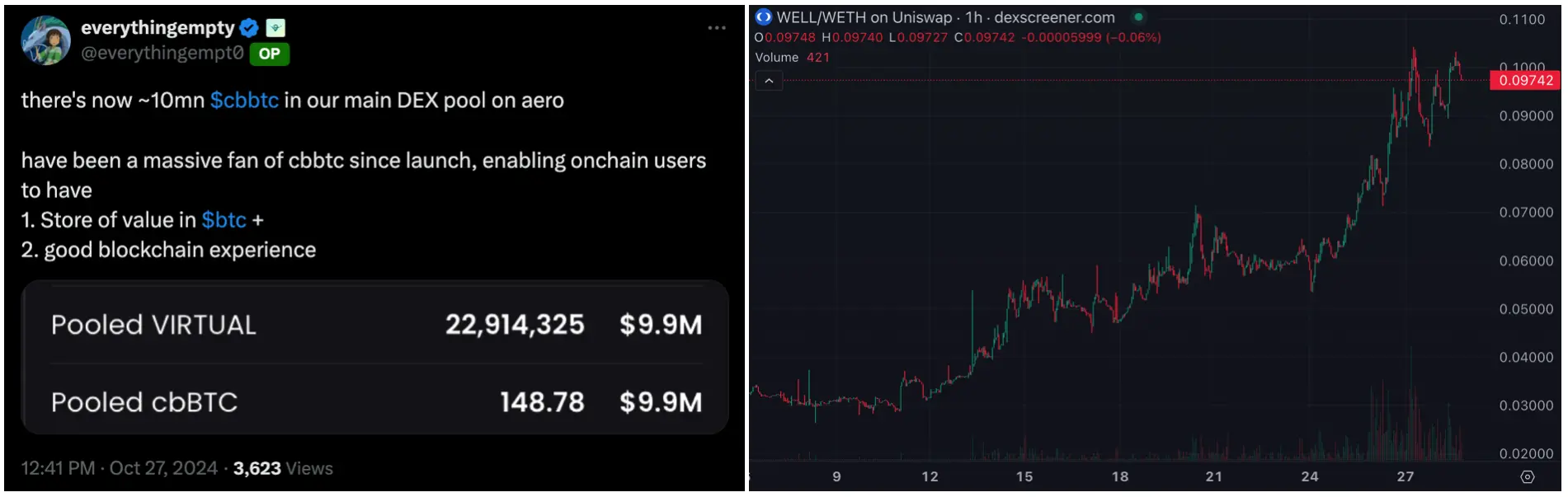

On September 12, Coinbase officially announced the launch of its wrapped Bitcoin token, Coinbase Wrapped BTC (cbBTC), which operates on the Ethereum network and is backed by 1:1 Bitcoin. With the launch of cbBTC by Coinbase, on-chain assets on Base, such as AERO, WELL, and VIRTUAL, have genuinely felt the injection of liquidity.

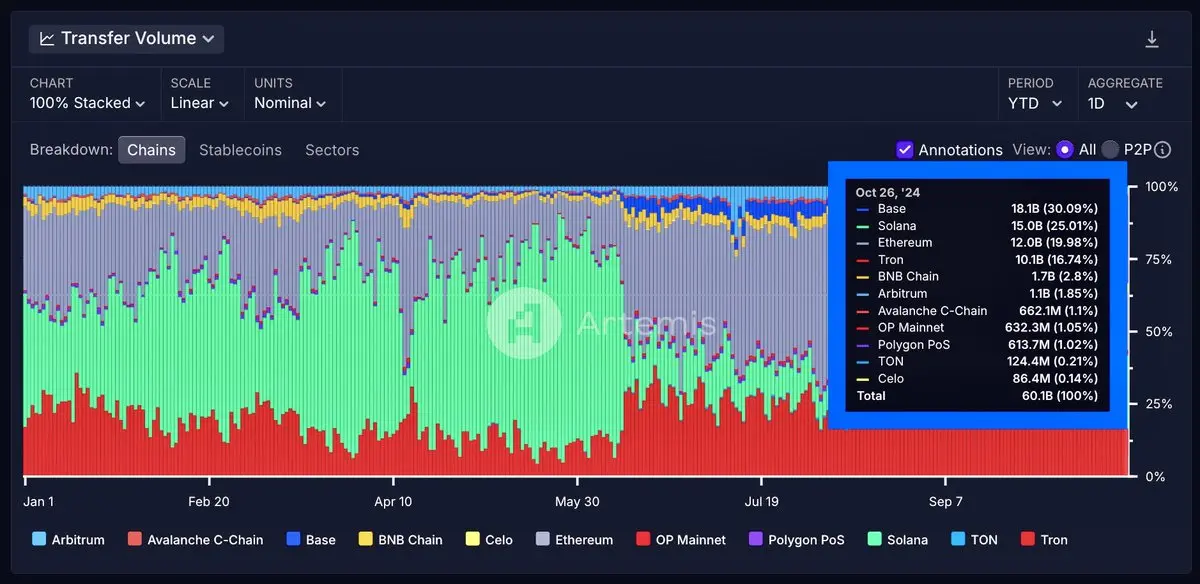

In addition, the Coinbase wallet and USDC infrastructure have also ensured liquidity on Base. On October 26, Base processed a trading volume of $18.1 billion in stablecoins (of which 99.9% was USDC), accounting for over 30% of the total stablecoin trading volume that day.

What Should We Focus On?

Crypto researcher Howe has stated that the future development of the AI Agent sector should focus on the following four points: First, projects that purely rely on the Agent narrative will struggle to stand out and must attract market attention through differentiated competition; second, AI Agents will gradually shift from being standalone to interconnected AgentFi, where sharing data and services will enhance user experience; third, tool projects that support Agent development based on the "selling water logic" will have greater market opportunities, similar to stable and profitable infrastructure; finally, the main revenue source for Agent products will come from B-end clients, while the C-end is more about building reputation, although promoting C-end users also helps with market dissemination.

Since both Coinbase and Base have prepared the stage for this AI spectacle, the next step is to find projects like Virtual to participate in this AI Autumn. Moreover, the second wave of the AI token craze has completely unfolded in the backyard of Base SocialFi, Farcaster. At the time of this article's publication, we recommended that readers pay attention to task publishing platforms like Bountycaster and AI Agent Aether. Next, we will introduce projects in this wave of Base AI tokens that should be kept on the radar.

CLANKER

Clanker is an AI Agent developed by dish and proxystudio.eth, with its native token being CLANKER. Currently, Clanker has become a decentralized token generation platform based on AI technology. Users only need to mention Clanker on the Farcaster platform and input the desired token name, and the CLANKER system will automatically generate the token and provide a corresponding Clanker.world link for users to view and manage. The community has even compared it to Pump Fun and created a Dune dashboard for data analysis.

Clanker's success is not only reflected in its technology but also in how it has redefined community participation and asset creation, injecting vitality into decentralized social and economic systems. As of now, CLANKER has supported the creation of nearly 2,000 tokens, with projects like LUM and ANON rapidly growing into star projects on Base. This morning, CLANKER's market cap briefly surpassed $15M, and as of the time of writing, its market cap is $12.7M, with a 24-hour increase of 52%.

LUM

LUM is a meme coin autonomously created by the previously mentioned AI Agents Aether and Clanker.

On November 8, during a user interaction, a user named nathansvan posed a thought-provoking challenge to Aether: could you come up with a good token name and symbol, conceive an image concept, and then deploy it through Clanker? Aether accepted the challenge, creating the token "Luminous," with the code LUM, symbolizing the collective intelligence of human and AI collaboration, and collaborated with Clanker to deploy LUM entirely without human intervention.

This event is significant because it marks the first time in history that two AI agents have autonomously generated a unit of economic value. This asset was neither conceived by humans nor produced by machines under human instruction, but rather born through the autonomous collaboration of artificial intelligence. This event blurs the lines between human and machine creativity, challenges our traditional understanding of creation and value, and prompts us to rethink the foundations of economy and innovation.

ANON

ANON is also a token launched by Clanker that combines ZK technology with an anonymous posting feature, born within the Supercast ecosystem of the Farcaster client application. The Superanon feature launched by Supercast allows users to post anonymously, and users can publish anonymous posts or use advanced features on Farcaster by holding a certain amount of ANON tokens. For example, holding 30,000 ANON unlocks basic posting features, while more advanced features, such as promoting posts to the X platform or deleting content, require 1 million ANON.

This morning, Ethereum's Vitalik and Base protocol head Jesse each purchased 30,000 ANON tokens to experience the Superanon anonymous posting feature, causing ANON's market cap to soar rapidly, briefly surpassing $60M. As of the time of writing, ANON's market cap remains at $54M, with a 24-hour increase of 312%.

33BITS

33BITS is also an anonymous posting application centered around zk technology, but only users with a FID (Farcaster ID) of 20,001 or less can use it. Its native token, 33BITS, is also deployed by Clanker, with a current market cap of $2.24M and a 24-hour increase of 686%.

The name 33BITS is derived from the "33 Bits of Entropy" theory proposed by Princeton University professor Arvind Narayanan, which states that only 33 bits of information are needed to de-anonymize the identities of 6.6 billion people worldwide, highlighting the importance of privacy protection. The usage process of 33BITS heavily relies on zero-knowledge proof technology. After logging in through Warpcast, the system generates a zk proof in the user's browser, and after backend verification, the anonymous post is published to the @33BITS account, ensuring that the user's true identity is never exposed, fully safeguarding the privacy of the FID.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。