Author: BitpushNews

On Tuesday, the cryptocurrency market continued its downward trend.

According to Bitpush data, Bitcoin faced continuous pressure after reaching a high of $95,000 in the early session. In the afternoon, bulls attempted to rebound but encountered bearish resistance at $94,800, briefly dropping below $91,000. At the time of writing, Bitcoin was trading at $91,646, down 2% in the last 24 hours. The altcoin market performed even weaker, with over 90% of the top 200 tokens by market capitalization recording losses.

The overall cryptocurrency market capitalization currently stands at $3.14 trillion, with Bitcoin's dominance at 57.3%.

In the U.S. stock market, the S&P, Dow Jones, and Nasdaq indices all closed higher, rising by 0.57%, 0.28%, and 0.63%, respectively.

The Decline May Be Due to an Overheated Leverage Market

Part of the reason for Bitcoin's decline may be the excessive leverage trading in the market. When volatility occurs, these leveraged positions can be forcibly liquidated, leading to further price drops.

Data analysis platform IntoTheBlock expressed a similar view, suggesting that Bitcoin's pullback "can be attributed to" the rise in funding rates, ultimately leading the market to lean bearish. However, as funding rates return to normal ranges, further leveraged liquidations should be limited.

Cryptocurrency futures market analyst Byzantine General pointed out that, in terms of trading volume, Bitcoin's current price trend resembles some previous local tops. He stated, "Bitcoin is likely to experience a period of sideways consolidation. However, during this time, some other cryptocurrencies may perform well."

From a technical perspective, Bitcoin may test the liquidity area near the psychological level of around $90,000 again, and it could even drop further to $85,000.

This is because Bitcoin rose very rapidly between November 6 and November 22, without a significant imbalance between buying and selling. Such rapid increases are usually followed by subsequent pullbacks to balance supply and demand. Therefore, Bitcoin may retrace to previous support levels or lower to digest the earlier gains.

Additionally, with the Relative Strength Index (RSI) falling below 50 for the first time since November 6, it is expected that sellers will dominate price movements in the coming week, which may lead to Bitcoin prices consolidating below $95,000 for a period.

Cryptocurrency research analyst CoinSeer believes that the important support for Bitcoin lies in the $85,000-$88,000 range, and a drop below this level could trigger large-scale cascading liquidations.

TradingView analyst TradingShot wrote, "Yesterday's significant pullback in Bitcoin caught the market off guard. There are several fundamental reasons behind this: first, the post-election excitement is gradually fading, and second, the psychological pressure from the $100,000 level. However, there is a more important technical reason that has been overlooked."

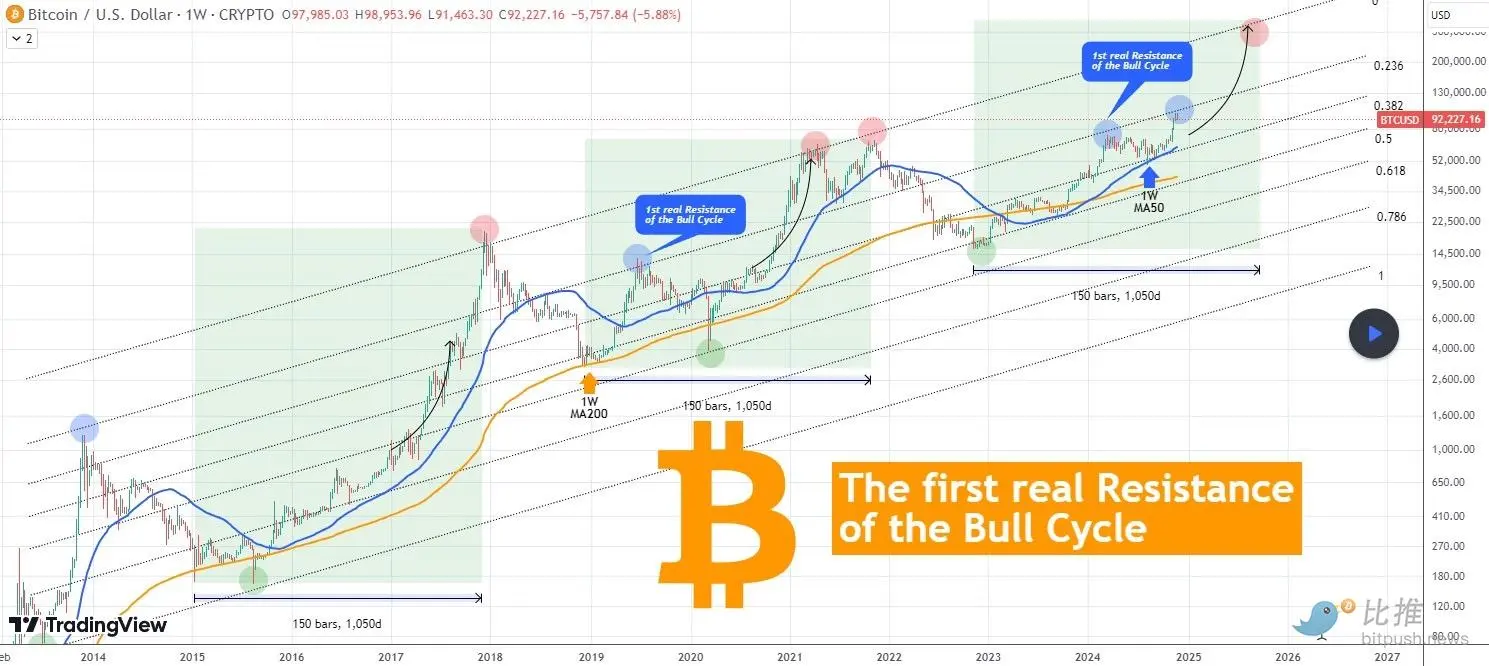

Analysts pointed out, "As shown in the chart, there is a Fibonacci channel present in the past three cycles (including the current cycle). This channel began with a strong rebound when the top was formed in December 2013. The top of that cycle coincided with the 0.236 Fibonacci level, which has previously blocked upward movements during the bull markets on June 24, 2019, and May 11, 2024."

TradingShot stated that the recent pullback occurred because Bitcoin touched "the first real resistance of the bull market cycle."

He explained, "This is the Fibonacci trend line that blocked the upward movement recently (on November 22). We can call this 'the first real resistance of the bull market cycle' because it is the first major resistance level encountered before the bull market cycle ultimately peaks. In the past two cycles, the highs occurred at the 0.0 Fibonacci level, which is the top of the channel (marked by the red circle in the chart). The red dot at the end of 2025 is not a prediction, just for comparison."

TradingShot also observed, "The duration of each past bull market cycle has been approximately 150 weeks (1050 days). If this pattern repeats, the peak may occur at the end of September or early October."

He noted, "Trying to catch the peak and sell is much better than giving a specific price. Interestingly, although BTC is technically facing resistance, the current upward trend began from the low on August 5, 2024, which is right at the 1-week MA50 (blue trend line). Technically, as long as this trend line remains valid, the cyclical bull market wave should be able to stay intact."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。