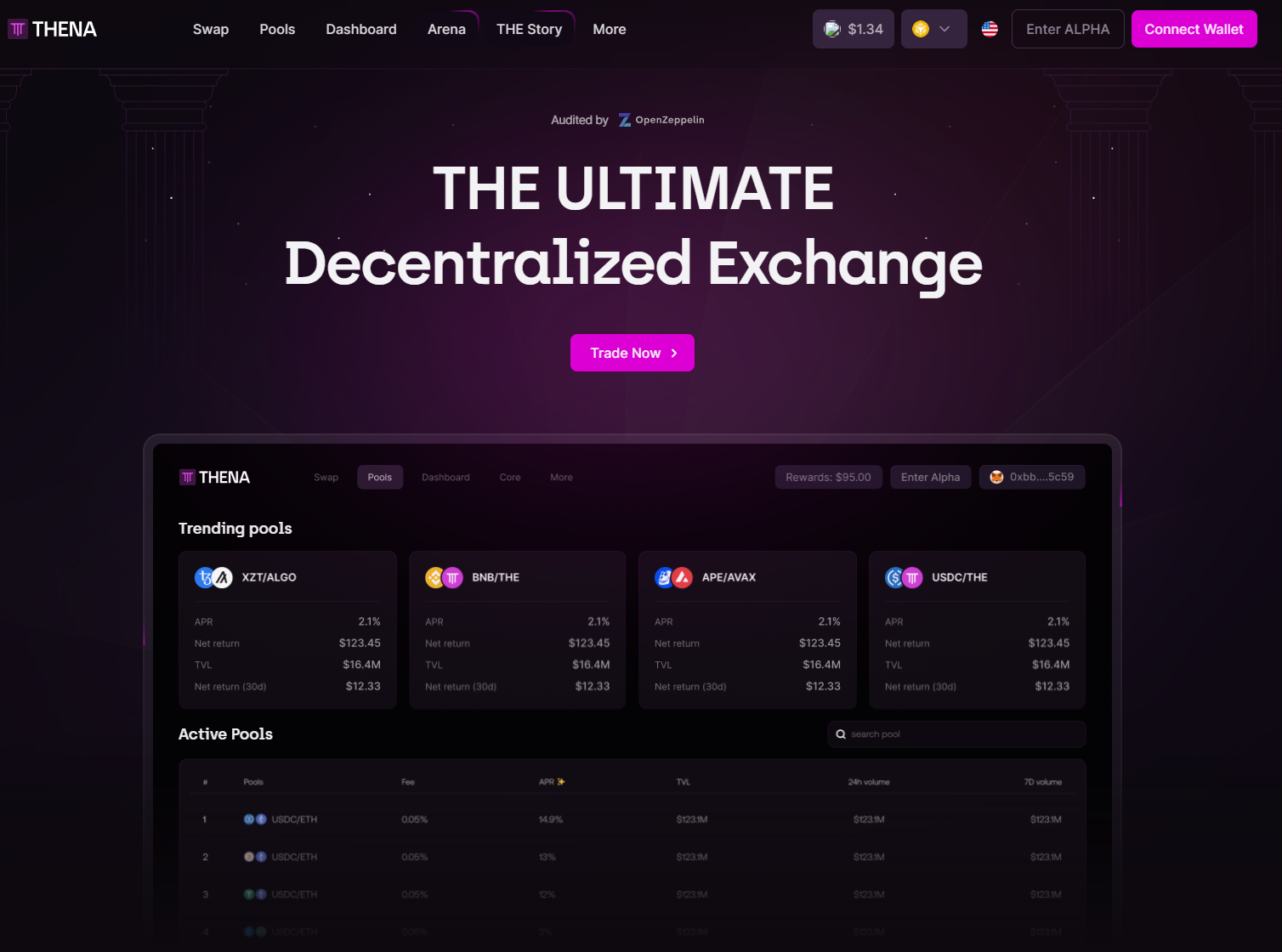

With the rapid development of decentralized finance (DeFi), more and more innovative projects are emerging, and THENA, which will be launched by Binance today (November 27), is one of them.

THENA is a decentralized liquidity layer and exchange built on the BNB Chain. The design inspiration for THENA comes from Curve's voting escrow model and Olympus's anti-dilution mechanism, allowing token holders to have complete control over THENA's token issuance and benefit from weekly redistributions.

THENA Ecosystem

The THENA ecosystem includes a spot decentralized exchange (Spot DEX), a perpetual contract decentralized exchange (Perpetuals DEX), a social trading platform (ARENA), and an upcoming project launch platform (WARP). These platforms aim to provide users with a convenient experience similar to centralized exchanges (CEX) while maintaining the advantages of high decentralization.

THENA Core Features

Wallet abstraction and fiat on/off ramps: Simplifying the process for users to go on-chain and supporting seamless integration between traditional banking and DeFi.

Cross-chain bridging: Supporting asset transfers across blockchains to enhance user flexibility.

Asset acquisition and yield services: Users can earn yields through single-token staking or complete instant trades in the spot market.

Trading and derivatives services: Supporting crypto derivatives trading and providing high leverage options.

Liquidity management and incentives: Utilizing a ve(3,3) incentive model and a modular AMM system to provide liquidity solutions for partners.

Architecture Mechanism

ve(3,3) Model

THENA introduces an improved ve(3,3) model, inspired by and optimized from Solidly's design. Under this mechanism, users can lock THE tokens as veTHE, with longer lock-up periods granting more voting power. This locking mechanism enhances users' long-term commitment to the platform, providing a more solid foundation for governance.

veTHE holders have significant say in governance, as they can vote on the incentive distribution of liquidity pools. This governance participation grants users greater control, forming a healthy ecosystem that promotes the platform's continuous development. Additionally, veTHE holders can earn a share of the platform's trading fees and gain extra income by accepting bribes from other protocols or stakeholders. This design establishes a positive feedback loop between users and the platform, further enhancing liquidity and governance vitality.

Dual AMM Model

To meet the liquidity needs of different asset types, THENA adopts a combined model of vAMM (virtual automated market maker) and sAMM (stable automated market maker):

vAMM: Suitable for trading general crypto assets, optimizing capital efficiency and pricing mechanisms. vAMM provides liquidity through virtual asset pools, allowing trading without actually holding the underlying assets, thus improving capital utilization.

sAMM: Specifically designed for trading similar assets (such as stablecoins), offering an extremely low slippage experience. sAMM provides a more efficient trading environment through precise price curves and low volatility.

The combination of this dual AMM model not only improves trading efficiency for users but also lowers the barriers to liquidity provision, offering a more user-friendly trading experience.

Token Economics

THENA's economic system is designed around three core tokens: THE, veTHE, and theNFT. THE is the platform's base token, used to incentivize liquidity providers and participate in governance. veTHE is the "upgraded version" of THE, obtained by locking THE, primarily used for governance voting and earning fee shares. theNFT is a unique asset of THENA, aimed at early supporters, allowing holders to earn a share of the platform's trading fees by staking theNFT.

The distribution plan for THE includes: ecosystem funding, team allocation, and initial liquidity providers, among others. Specifically, the initial weekly emission is 2,600,000 THE, decreasing at a rate of 1% per week thereafter.

THENA's deep integration on the BNB Chain significantly enhances trading speed and effectively reduces slippage. Combined with the ecological advantages of the BNB Chain, THENA attracts more new users and drives the DeFi ecosystem towards higher capital efficiency.

According to the latest data, THENA's TVL is currently 38.65 million, with a market cap of 75.31 million, and the THE token is currently priced at $1.40.

Image source: Internet

Conclusion

THENA is an innovative DeFi platform, serving as a bridge between decentralized finance and traditional finance. Its unique architecture and powerful features allow it to occupy a place in the rapidly developing DeFi market. THENA has the potential to become a benchmark for DeFi liquidity ecosystems, leading decentralized exchanges into a new phase of greater efficiency and fairness. We look forward to THENA's continued innovation, bringing new possibilities to the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。