Author: Hedy Bi, OKG Research

This Tuesday, the reversal trend of the overnight "Trump trade" affected the Bitcoin market. Bitcoin's price surged to about $99,000 before quickly retreating to below $93,000, with a maximum drop of over 6%. This was triggered by rumors of a potential ceasefire agreement between Israel and Lebanon, causing market turbulence. Not only Bitcoin, but gold and crude oil prices also fell sharply in response.

Due to Bitcoin's growth performance over the past month (over 40%), the risk sensitivity of its investors has also been amplified. Is this 40% gain a beginning or an end? The author believes this is a short-term impact of a single event; with external macro conditions remaining unchanged in the long term, liquidity may not allow this cycle to come to a sudden halt.

Liquidity is the "cause" of risk assets

From a macro perspective, on September 18, 2024, the Federal Reserve cut interest rates by 50 basis points to 4.75%-5.00% for the first time since 2020, ending a 525 basis point rate hike cycle. As Bobby Axelrod from "Billions" said, "Power is not everything, but without power, you are nothing." The Federal Reserve's influence on Bitcoin has led it to seek a balance between liquidity flooding and inflation hedging demand. Bitcoin serves as both an amplifier of U.S. stocks and a tool for hedging inflation; the interest rate cut releases liquidity, injecting broader space for risk assets. Meanwhile, potential economic fluctuations and policy uncertainties make cryptocurrencies like Bitcoin a choice for "hedging real-world risks."

Image source: Christopher T. Saunders, SHOWTIME

Image source: Christopher T. Saunders, SHOWTIME

With Trump returning to power and forming a new team, implementing a series of fiscal stimulus policies to ensure "America First," the increase in government spending will further drive market liquidity. Moreover, during his campaign, Trump proposed a plan to establish a national Bitcoin reserve, using cryptocurrency to weaken the dollar's competitors. As Trump and his team consider appointing regulatory officials who are friendly to cryptocurrencies, this also promotes the establishment of a U.S.-led international cryptocurrency regulatory framework.

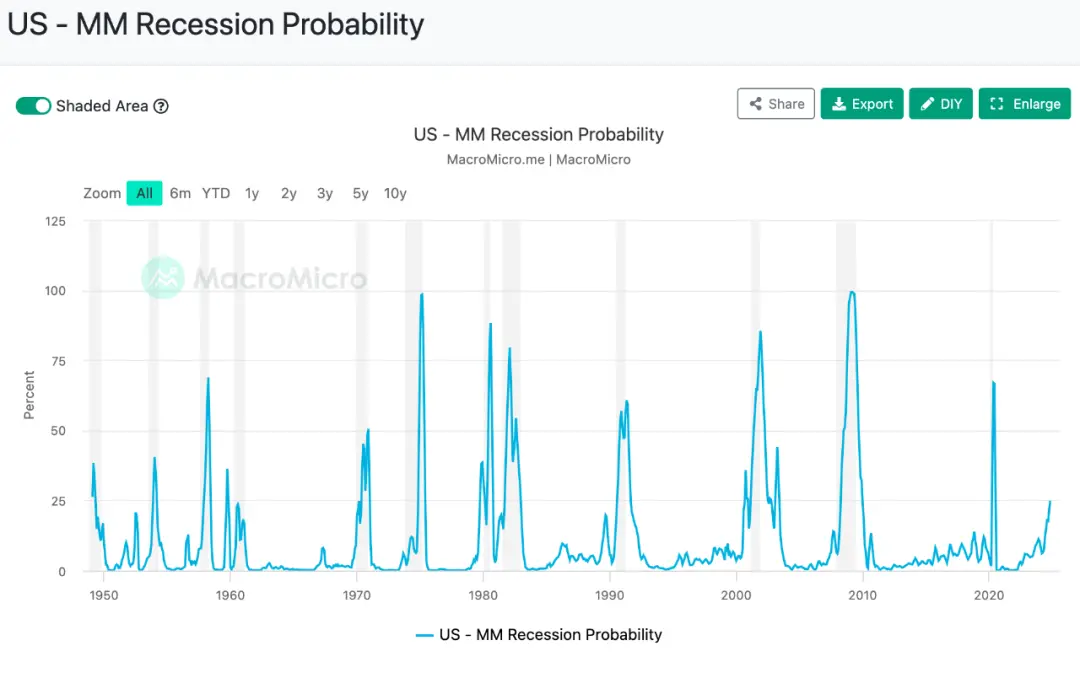

However, there are also voices questioning the interest rate cuts, shouting that "a financial crisis is imminent." According to MacroMicro's U.S. recession index (probability), the likelihood of a recession in the U.S. in November 2024 is 24.9%. Compared to the last economic recession triggered by a financial crisis, if this round is a recession cycle, it may peak within six months. In the game between liquidity and inflation hedging, Bitcoin in this economic adjustment reflects more of its sensitivity to changes in liquidity.

Image source: MacroMicro

Image source: MacroMicro

Institutions: Exceeding the 5% Key Threshold

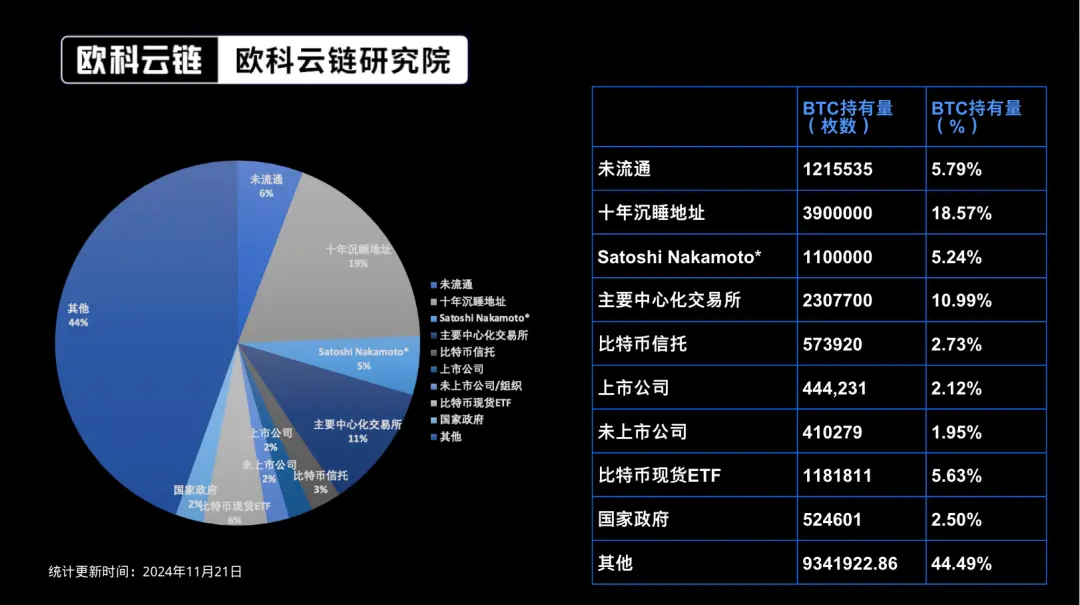

Under such macroeconomic conditions, Bitcoin has also attracted institutional liquidity. Since the opening of the Bitcoin spot ETF channel in January 2024, according to statistics from OKG Research Institute on November 21, global Bitcoin spot ETFs have accounted for 5.63% of the total Bitcoin supply. A 5% holding ratio is typically a key threshold in the financial industry; for example, shareholders holding more than 5% are required to report to the SEC.

Bitcoin holding distribution | Image source: OKG Research, bitcointreasuries, public news

Bitcoin holding distribution | Image source: OKG Research, bitcointreasuries, public news

In addition to Bitcoin spot ETFs, listed companies have also taken action in this political environment. According to incomplete statistics from OKG Research Institute, since November 6, 17 listed companies in the U.S. and Japan have announced holdings or board approvals to use Bitcoin as a strategic asset. Among them, the most prominent is MicroStrategy, which purchased 55,500 Bitcoins for $5.4 billion between November 18 and 24. Currently, only 0.01% of listed companies globally hold Bitcoin, indicating that this is just the tip of the iceberg of large institutional purchasing power, and the market is still in the "elite experimental stage."

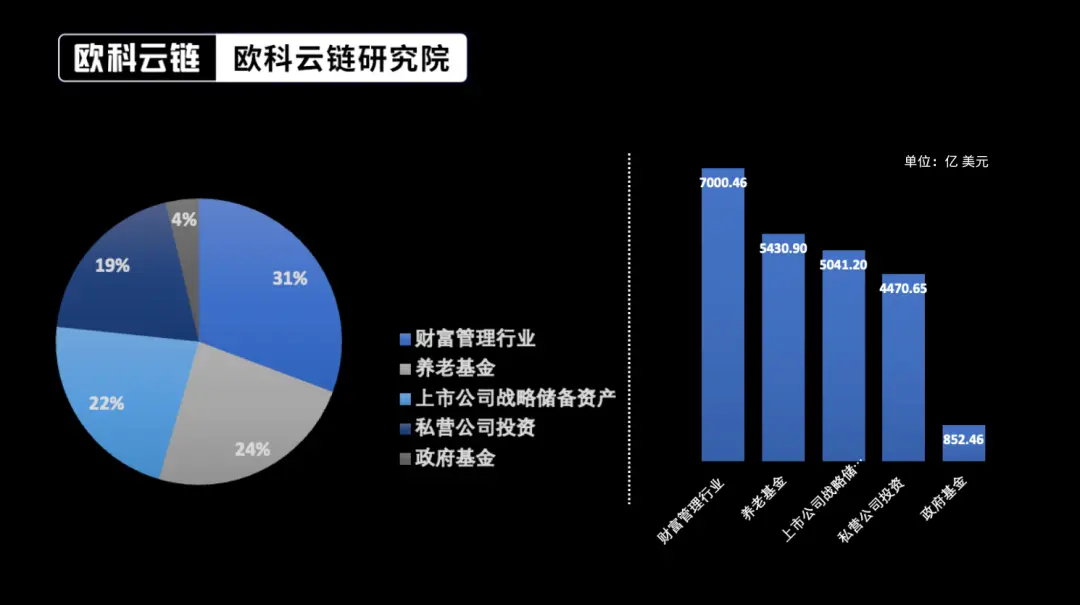

OKG Research Institute conservatively estimates that the statistically available funds entering Bitcoin in the next year will be approximately $2.28 trillion (Note 1), which could push Bitcoin's price to around $200,000, consistent with predictions from Bernstein, BCA Research, and Standard Chartered Bank.

Estimated institutional funds to be invested | Image source: OKG Research (Note 1)

Estimated institutional funds to be invested | Image source: OKG Research (Note 1)

Bubble First, How to Hedge Against Rising Milk Prices?

The liquidity benefits, propelled by various events, have also led the market to question whether they are excessive, transforming the "Trump trade" into a "Trump bubble." Tyler Cowen, author of "The Great Stagnation," believes that bubbles facilitate the concentration of capital into emerging industries and innovative projects, increasing the market's acceptance of high-risk early-stage projects, thereby encouraging entrepreneurs and investors to take bold risks and innovate. Just as the "internet bubble" of the 1990s left behind infrastructure—fiber optic networks and data centers—after its burst in 2000, laying the foundation for the internet+ era. With the timeline for government spending (stimulus economic policies) clearly defined under the Trump administration, if government spending is aggressive, the market's excess liquidity may raise suspicions of a "bubble," causing the crypto market to let "value chase price" due to liquidity.

It is also important to note that in my qualitative assessment of Bitcoin as an asset, I have previously stated that Bitcoin serves as both an amplifier of U.S. stocks and a hedge against real-world risks, which causes Bitcoin to sway in the game between liquidity and inflation hedging. Regarding the prices most perceived by the public, from 2019 to 2024, the average price of milk in the U.S. rose from about $2.58 per gallon to $3.86 per gallon, an increase of approximately 49.22%. During this period, Bitcoin's increase was about 1025%, while gold rose about 73%, slightly exceeding the representative index of risk assets, the S&P 500 (about 40%).

Even some countries have chosen to invest in Bitcoin to protect their wealth from inflation erosion. For example, El Salvador and the Central African Republic have adopted Bitcoin as legal tender, while Bhutan mines Bitcoin, attempting to leverage its scarcity and decentralized characteristics to resist inflation risks.

In the current macro environment, regardless of short-term fluctuations, Bitcoin's fixed supply of 21 million, decentralization, and global liquidity remain unchanged. Its process of moving towards a value storage role is being accelerated by institutions and listed companies competing to allocate it. This financial experiment that began with cypherpunks will ultimately find its footing in the real world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。