Original Title: Behind the XRP breakout: Drivers and Dynamics

Original Author: KoreanDegen, Crypto Kol

Original Translation: zhouzhou, BlockBeats

Editor's Note: The recent surge in XRP has caught everyone's attention, resulting from a combination of factors, including a technical breakout, renewed interest from Korean investors (along with the resolution of the SEC lawsuit and the push from the WisdomTree S-1 filing), and the absence of historical sellers like Jed McCaleb. These factors collectively drove the demand for XRP, leading to an extraordinary market performance.

The following is the original content (reorganized for better readability):

The recent surge in XRP reveals the complex interaction between technical aspects, market structure, and regional dynamics.

Market Background

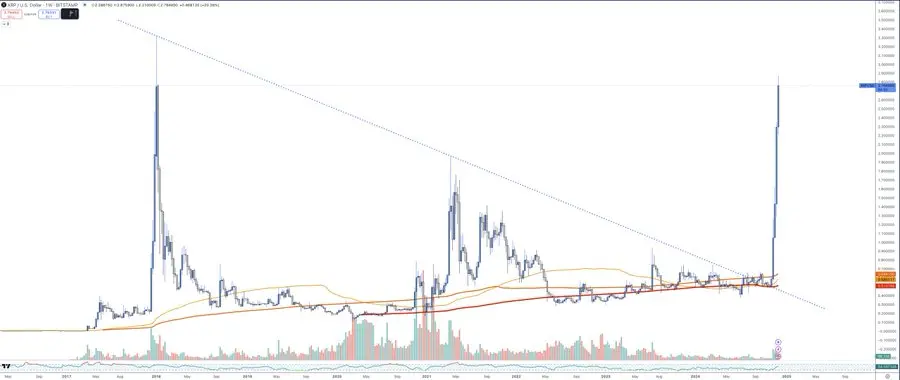

On November 10, XRP broke through approximately $0.55, decisively surpassing the 100-week, 200-week, and 350-week moving averages.

Perpetual contract CVD: Decreasing.

Open interest: Increasing.

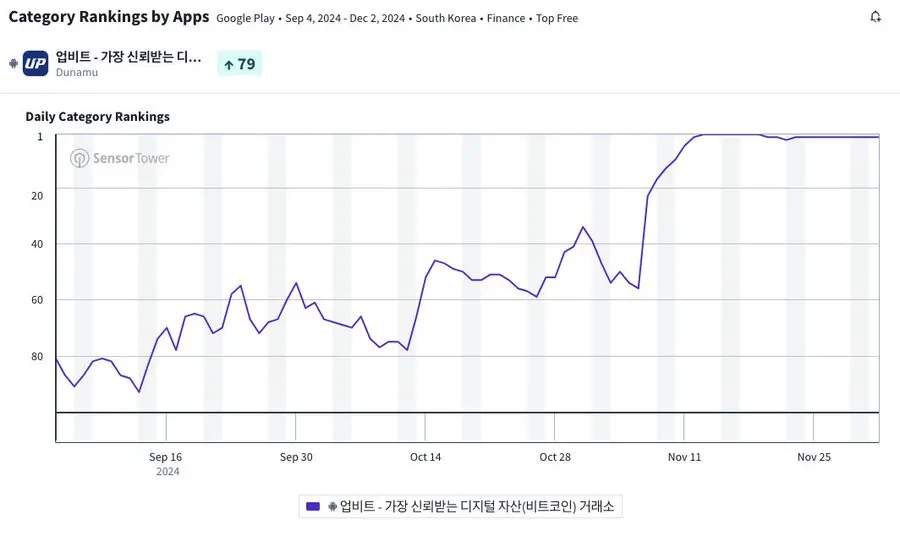

Meanwhile, Upbit's ranking in the App Store and Play Store began to rise. This series of intertwined factors suggests a brewing market activity.

November 12: Turning Point

Upbit topped the rankings in the Play Store, which is particularly significant given the demographic structure of Korean users—primarily older investors aged 50 to 60, who mainly use Android devices, with Samsung being dominant.

As demand surged, XRP broke through ₩1,000 (approximately $0.71). Arbitrageurs quickly adjusted the market imbalance, leading to a large number of short positions being liquidated.

Supply Vacuum

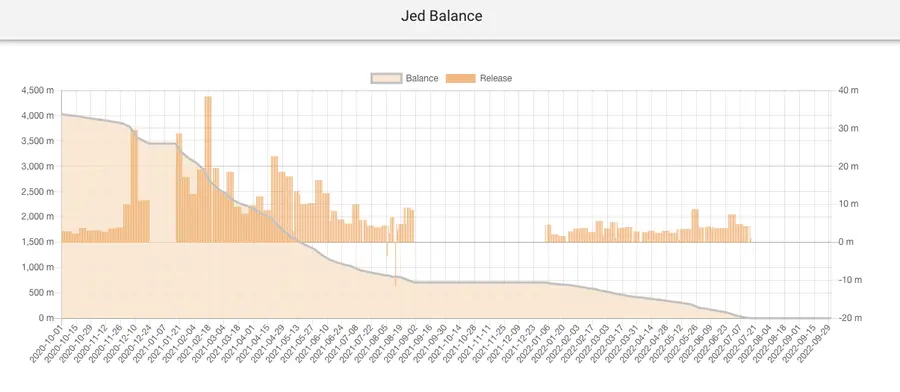

In previous cycles, Jed McCaleb's ongoing sell-off limited XRP's upward momentum. However, this time he has no more coins to sell.

Structural Breakout

Only Bitstamp and Upbit have historical charts dating back to 2017, showing a diagonal breakout that has persisted for 6 years, while Upbit's overwhelming dominance in spot trading volume has become a hallmark of Korean investment enthusiasm.

Demographic Characteristics of Demand

According to a recent report from Hankyung, the role of older Korean investors in the crypto market is becoming increasingly prominent:

Since 2021, the number of crypto accounts held by individuals over 60 has increased by 30% (+188,000 new accounts).

The number of accounts held by individuals over 50 has increased by 22.5% (+356,000 accounts).

As of September 2024, individuals over 60 hold a total of $4.8 billion in crypto assets.

This demographic shift indicates that older investors, particularly in Korea, have played a key role in driving the demand for XRP.

Article link: Hankyung Article

Larger Context

While trading volume in Korea is a major factor, it is not the only driving force. Other exchanges, such as Coinbase and Robinhood, have also contributed to the surge in XRP. To date, XRP's spot trading volume has exceeded $6.6 billion.

This is not just an ordinary rise. It is the result of the following intertwined factors:

Key technical breakthroughs.

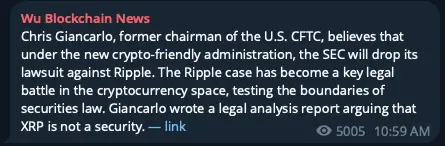

Renewed interest from retail investors, particularly Korean investors. (Subsequently driven by the resolution of the SEC lawsuit and the release of the WisdomTree S-1 filing)

The absence of supply pressure from major historical sellers like Jed McCaleb.

When causal relationships and multiple factors collide, the results are often extraordinary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。