Thursday, December 19 - A new day begins, wishing everyone a bright future.

The Federal Reserve's hawkish guidance led to a dramatic drop in the Dow Jones, plummeting by a thousand points, marking the longest losing streak since 1974 with ten consecutive declines. U.S. Treasury bonds, gold, and the cryptocurrency market also collapsed. The Federal Reserve significantly raised its median forecast for future interest rates, indicating that there may only be two rate cuts next year. Fed Chair Jerome Powell stated that they are getting closer to a neutral interest rate. U.S. stocks, Treasury bonds, gold, and Bitcoin all suffered heavy losses, with the Dow experiencing ten consecutive declines and the dollar surging.

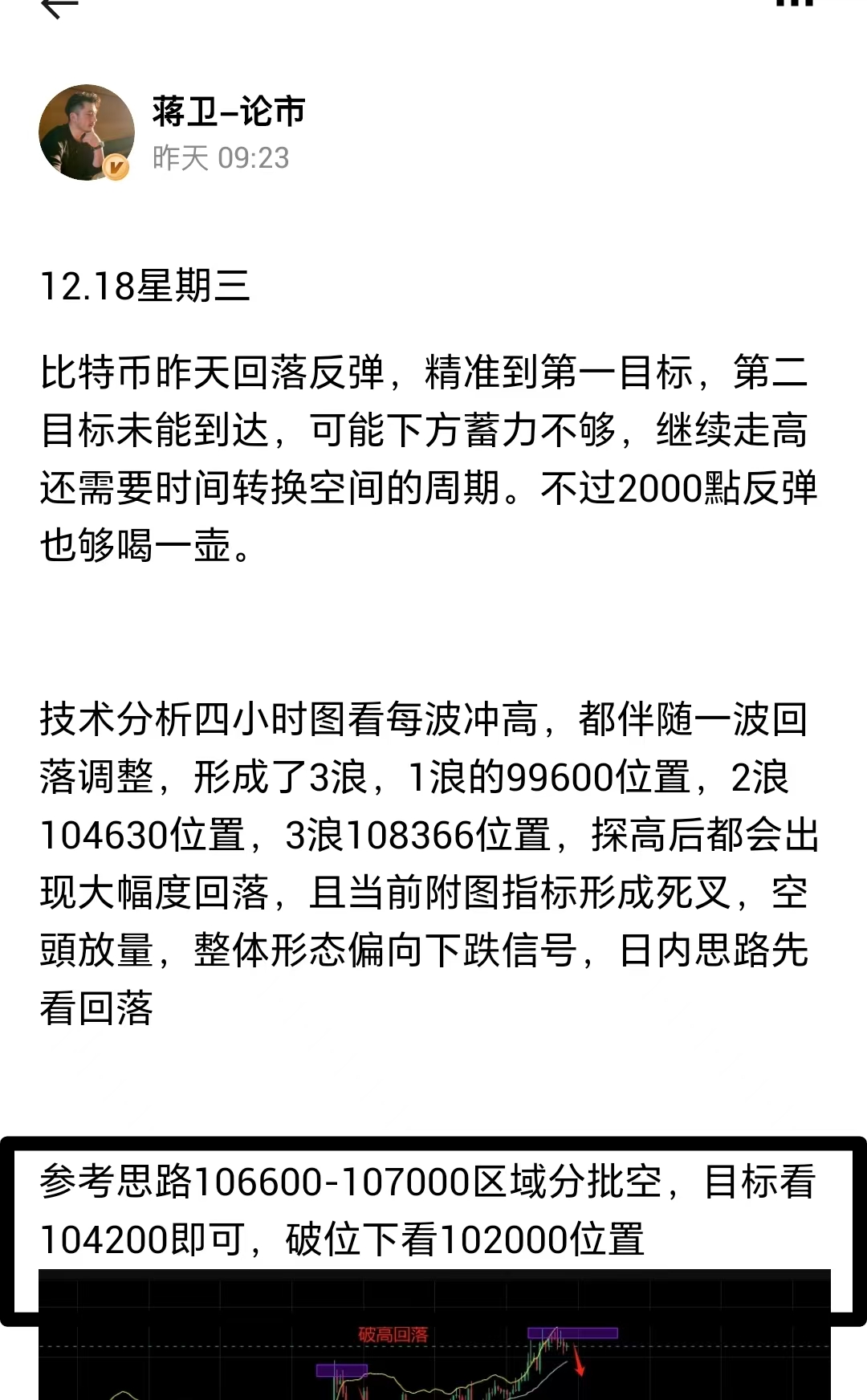

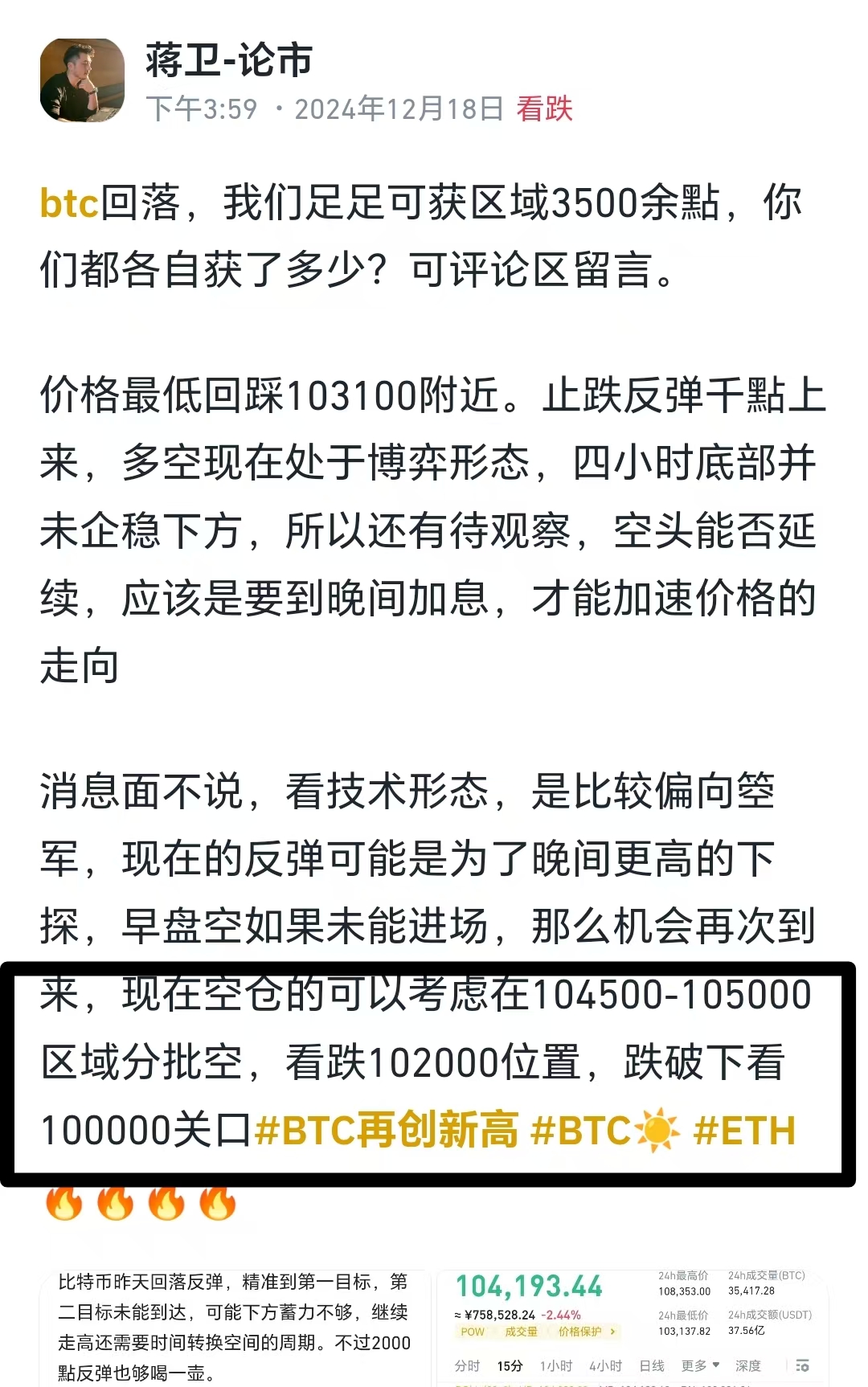

Regarding Bitcoin's performance yesterday, we mentioned in the morning that we were bearish, repeatedly indicating a target of 100,000. The price just happened to reach that point, yet some people say we are just following the trend? It's really quite amusing. To be honest, I really don't want to engage with these people; perhaps this is what they call "sour grapes"?

Congratulations to those who trust Jiang Wei, achieving a long-term short of 6,000 points. Opportunities are often right beside us; seizing them is like holding gold, while failing to grasp them is like sand slipping through your fingers. Now, back to the main topic, let's follow Jiang Wei and look at the technical structure below.

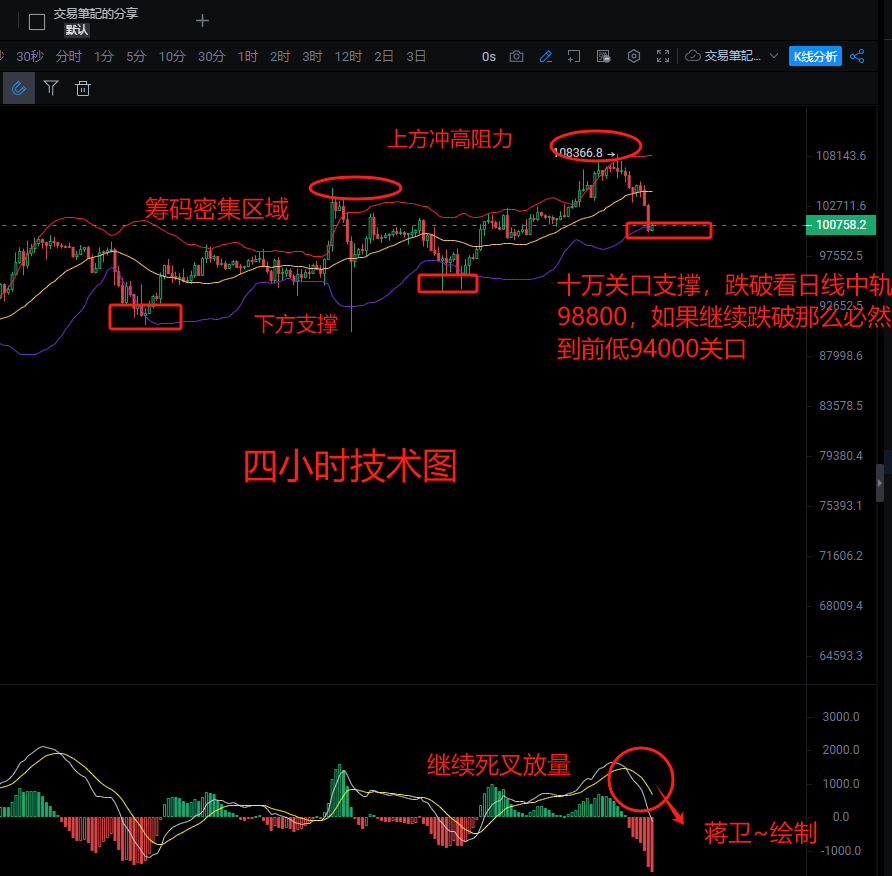

From the technical perspective in the chart below, the four-hour chart shows a large bearish candle retracement. The current price is testing the lower boundary at the 100,000 mark, where it has stopped falling. However, the indicators still show an increasing volume pattern, signaling further downside potential. On the daily chart, a large bearish candle engulfs a small bullish candle, forming an engulfing pattern, indicating that the bearish advantage currently outweighs the bullish. The 100,000 mark may not hold for long. Key attention should be paid to the daily midline at the 98,800 position. If this level cannot be maintained, the bearish trend will continue towards the previous low around 94,000. Therefore, today we continue to look for a bearish rebound.

Reference strategy: Short in batches in the 101,300-101,800 range, targeting the 98,800 position. If it breaks below, then the target will be the 94,000 position.

Follow Jiang Wei's public account for professionalism and focus, and say goodbye to blind trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。