Key Points

● The total market capitalization of cryptocurrencies is $3.4 trillion, down from $3.92 trillion last week, representing a decline of 13.2% this week. As of December 23, 2024, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $36.05 billion, with a net inflow of $450 million this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $2.33 billion, with a net inflow of $62.73 million this week, maintaining a net inflow for four consecutive weeks.

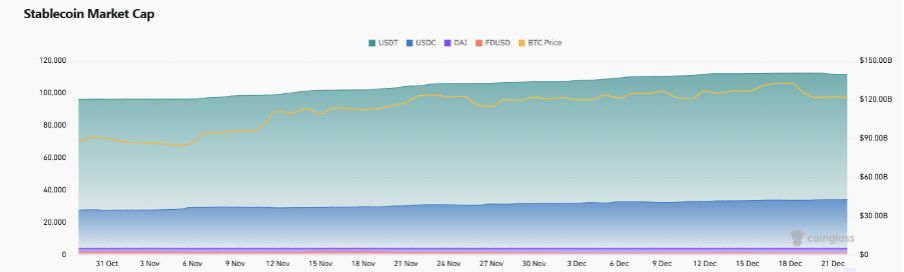

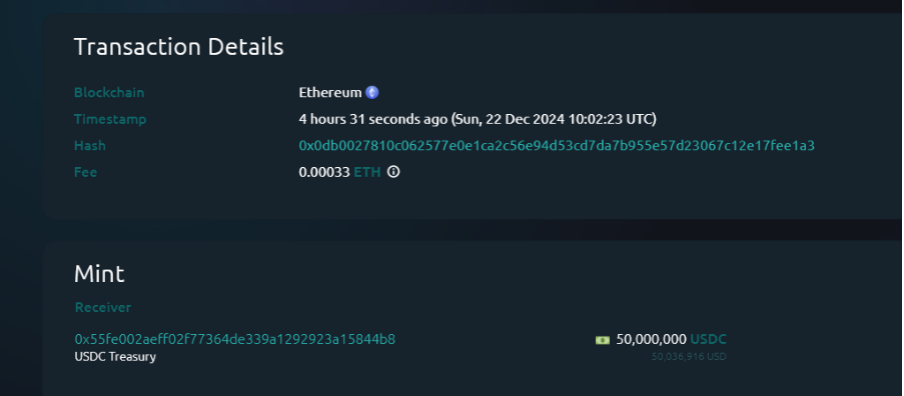

● The market capitalization of stablecoins is $210 billion, accounting for 6.19% of the total cryptocurrency market capitalization. Among them, USDT has a market capitalization of $139.7 billion, accounting for 66.5% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $43 billion, accounting for 20.5%; and DAI with a market capitalization of $5.3 billion, accounting for 2.5%. This week, USDC's treasury issued a total of 200 million USDC, a decrease of 90% compared to last week's total issuance of stablecoins.

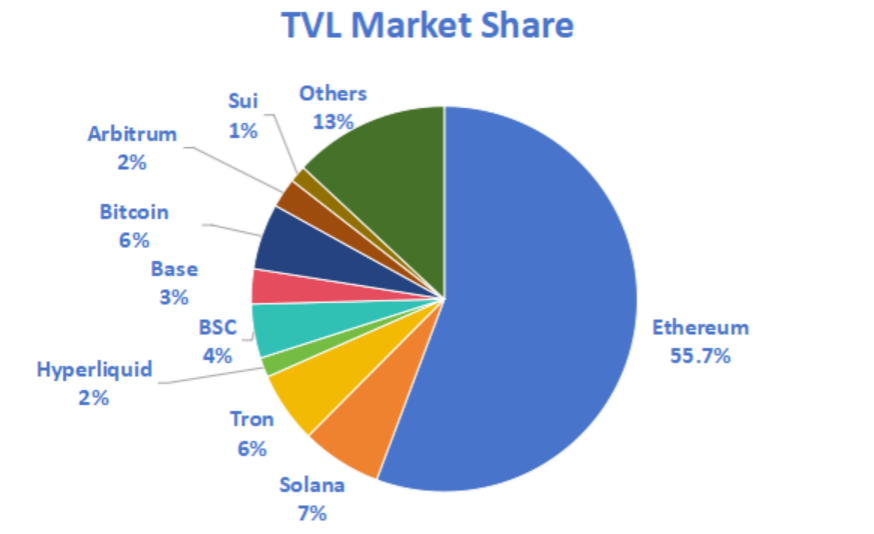

● This week, the total TVL (Total Value Locked) in DeFi is $118.9 billion, down 15.9% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.7%; Solana with a share of 7%; and Tron with a share of 6%. Ethereum remains the leader in the DeFi space.

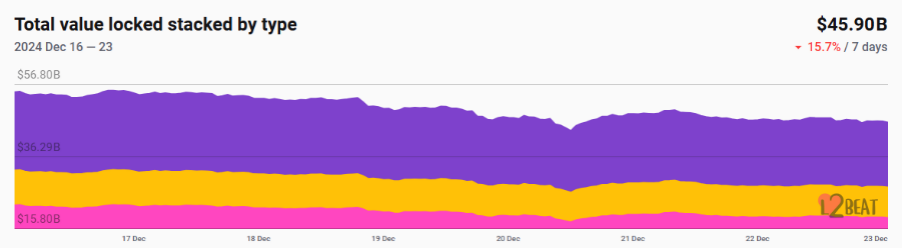

● From on-chain data, the daily trading volume of Layer 1 public chains shows an overall downward trend this week, with BNB experiencing the most significant decline of 71% compared to last week. In terms of daily active addresses, TON ranks first this week, while SOL's active addresses have significantly decreased, down 6% from last week. In terms of TVL, ETH remains a standout among public chains; this week, the total TVL locked in Ethereum Layer 2 reached $45.9 billion, a decrease of 15.7%. Arbitrum One and Optimism hold 41.83% and 21.19% of the market share, respectively, but both have seen slight declines.

● Innovative projects to watch: Animix, the first GenAI-driven pet fusion game supported by Sophon. The TGE has not yet occurred, and the game is still in its early stages. Alita Exchange, based on SOON, is a swap that combines the advantages of AMM and PMM. Alita is designed for high-frequency trading, balancing speed and liquidity, making it an innovative case in DEX. Chiss Protocol, a permissionless on-chain forex mixer based on AVAX, enables seamless yield, lending, and cost-effective global trading.

Table of Contents

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio 3

2. Fear Index and ETF Inflow/Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 6

5. Decentralized Finance (DeFi) 7

7. Stablecoin Market Capitalization and Issuance 12

2. This Week's Hot Money Trends 14

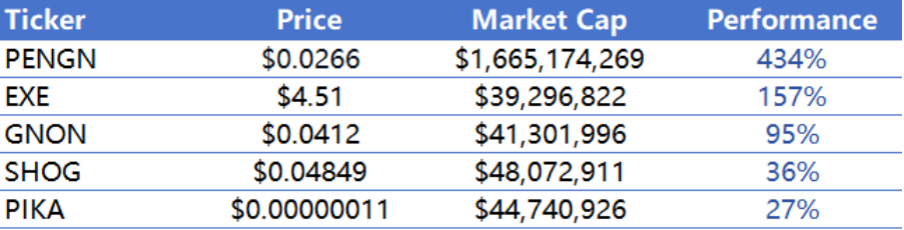

1. Top Five VC Coins and Meme Coins by Growth This Week 14

1. Major Industry Events This Week 16

2. Major Upcoming Events Next Week 16

3. Important Financing and Investment from Last Week 17

1. Market Overview

1. Total Cryptocurrency Market Capitalization / Bitcoin Market Capitalization Ratio

The total market capitalization of cryptocurrencies is $3.4 trillion, down from $3.92 trillion last week, representing a decline of 13.2%.

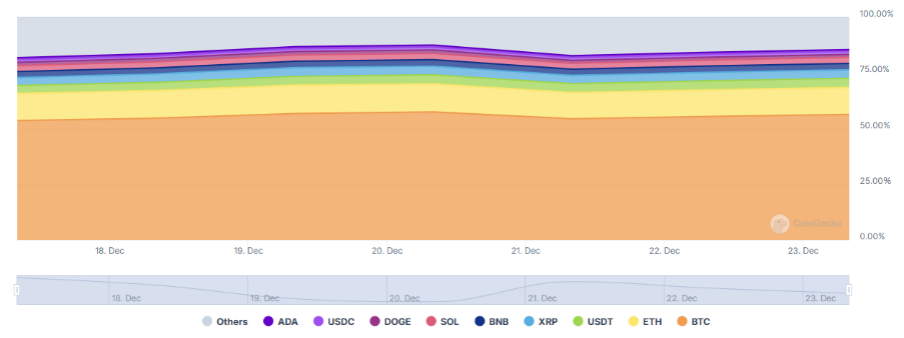

Data Source: cryptorank

As of publication, the market capitalization of Bitcoin (BTC) is $1.88 trillion, accounting for 55.26%. Meanwhile, the market capitalization of stablecoins is $210 billion, accounting for 6.19% of the total cryptocurrency market capitalization.

Data Source: coingeck

2. Fear Index and ETF Inflow/Outflow Data

The cryptocurrency fear index is at 70, indicating greed.

Data Source: coinglass

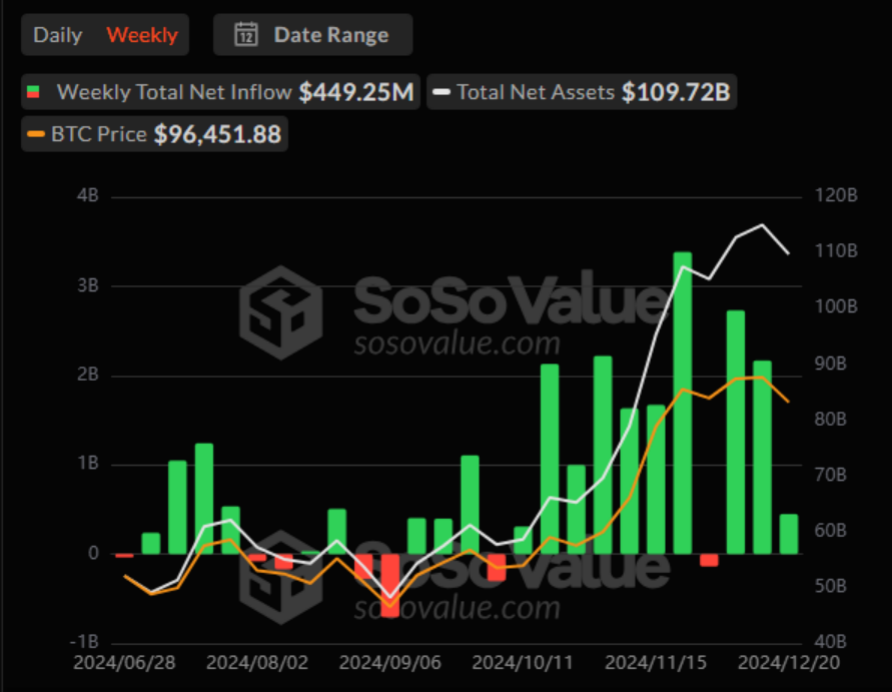

3. ETF Inflow/Outflow Data

As of December 23, 2024, the cumulative net inflow of Bitcoin spot ETFs in the U.S. is approximately $36.05 billion, with a net inflow of $450 million this week. Only three ETFs, including BlackRock's IBIT, achieved a net inflow this week; the cumulative net inflow of Ethereum spot ETFs in the U.S. is approximately $2.33 billion, with a net inflow of $62.73 million this week, maintaining a net inflow for four consecutive weeks. Although Bitcoin prices have declined this week, the amount of BTC purchased by U.S. spot Bitcoin ETFs is nearly twice the amount mined during the same period, reaching $423.6 million.

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Currently $3,257, with a historical high of $4,878.

ETHBTC: Currently 0.034513, with a historical high of 0.1238, a decline of approximately 72.1%.

Data Source: ratiogang

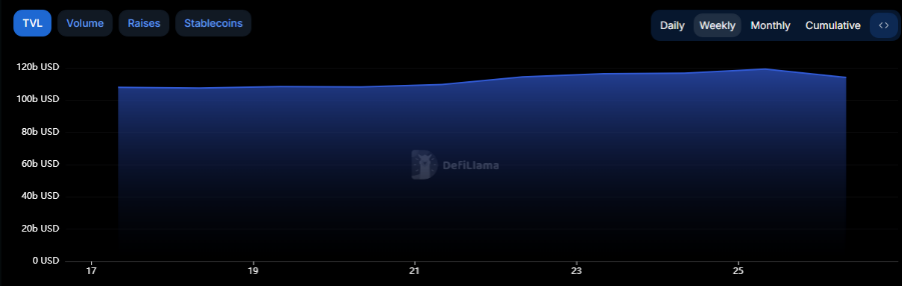

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL in DeFi this week is $118.9 billion, down 15.9% from last week.

Data Source: defillama

By public chain classification, the top three public chains by TVL are Ethereum with a share of 55.7%; Solana with a share of 7%; and Tron with a share of 6%. Ethereum remains the leader in the DeFi space.

Data Source: CoinW Research Institute, defillama

Data as of December 23, 2024

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of December 23, 2024

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, affected by the overall market decline, daily trading volumes for all public chains, except for BNB and SUI, are on a downward trend. BNB experienced the most significant decline, down 71% compared to last week. In terms of transaction fees, ETH chain fees have shown a downward trend, down 72% from last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, TON ranks first in daily active addresses, while SOL's active addresses have significantly decreased, down 6% from last week. In terms of TVL, ETH remains a standout among public chains.

Layer 2 Related Data

According to L2Beat, the total TVL locked in Ethereum Layer 2 is $45.9 billion, a decrease of 15.7% this week.

Data Source: L2Beat

Data as of December 23, 2024

● Arbitrum One and Optimism hold 41.83% and 21.19% of the market share, respectively, but both have seen slight declines.

Data Source: footprint

Data as of December 23, 2024

7. Stablecoin Market Capitalization and Issuance

According to Coinglass, the total market capitalization of stablecoins is currently reported at $210 billion, setting a new historical high, with a weekly increase of 0.9%. Among them, USDT has a market capitalization of $139.7 billion, accounting for 66.5% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $43 billion, accounting for 20.5%; and DAI with a market capitalization of $5.3 billion, accounting for 2.5%.

Data Source: CoinW Research Institute, Coinglass

Data as of December 23, 2024

According to Whale Alert data, this week the USDC treasury issued a total of 200 million USDC, a decrease of 90% compared to last week's total issuance of stablecoins.

Data Source: Whale Alert

Data as of December 23, 2024

2. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

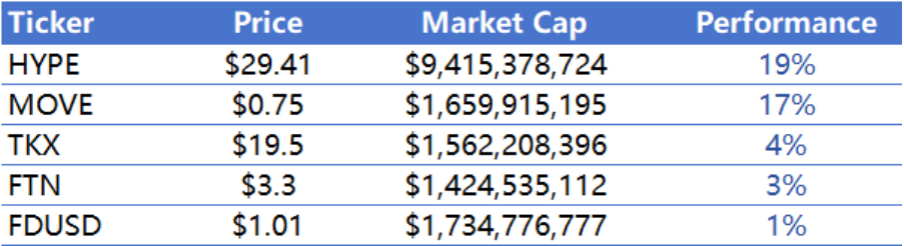

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, Coingeck

Data as of December 23, 2024

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of December 23, 2024

2. New Project Insights

● Animix, the first GenAI-driven pet fusion game supported by Sophon. The TGE has not yet occurred, and the game is still in its early stages. Participating now can earn corresponding airdrop points.

● Alita Exchange, based on SOON, is a swap that combines the advantages of AMM and PMM. Alita is designed for high-frequency trading, balancing speed and liquidity, making it an innovative case in DEX.

● Chiss Protocol, a permissionless on-chain forex mixer based on AVAX, enables seamless yield, lending, and cost-effective global trading.

3. Industry News

1. Major Industry Events This Week

● The Ethereum Foundation sold a total of 4,466 ETH over the past year, worth approximately $12.6 million. According to Lookonchain monitoring, the Ethereum Foundation sold 4,466 ETH in 32 transactions over the past year, with 15 transactions occurring at short-term peak prices.

● Zerebro will collaborate with ai16z to advance the ZerePy open-source framework. Zerebro co-founder Tint stated that Zerebro will work with ai16z to promote the open-source framework. The ai16z team will be one of the first external contributors to help develop the ZerePy framework, while the Zerebro team will contribute to the Eliza framework.

● GoPlus tweeted a hint suggesting an upcoming TGE. The Web3 cybersecurity company GoPlus released three animal emojis corresponding to a tiger, goat, and eagle, with the first letters of each word spelling TGE, possibly indicating an upcoming TGE.

● The Trump family's crypto project WLFI increased its holdings by 759 ETH. According to ARKM monitoring, the Trump family's crypto project WLFI exchanged 2.5 million USDC for 759 ETH before December 20.

● Unichain announced its mainnet roadmap, set to launch in early 2025. Unichain released a phased roadmap for its mainnet and announced that it will go live in early 2025. Since launching the Sepolia testnet in October, the network has completed 50 million test transactions and deployed over 4 million test contracts. The mainnet will support permissionless fault proofs from day one, ensuring that on-chain activities can be verified, further enhancing security and decentralization.

2. Major Upcoming Events Next Week

● The first global online AI hackathon hosted by Solana will take place from December 10 to 23, with a prize pool of $185,000, including six tracks focused on AI agents. The main track for AI Agent products is supported by ai16z and the Solana Foundation, while other tracks include: building infrastructure or frameworks for AI agents, creating DeFi agents that can interact with Solana DeFi protocols and manage positions, developing tools for AI agents to launch and manage token liquidity, building AI agents for spot trading, creating chat-based agents, and establishing public-facing agents.

● The Sui lending protocol Scallop is launching a Christmas airdrop event. From December 14 to December 26, users who meet the criteria of borrowing value greater than $1,000 or holding more than 1,000 veSCA can participate in the distribution of 1 million SCA tokens.

● Sophon released a mining migration timeline, with mainnet mining opening on December 28. The modular blockchain based on ZKsync, Sophon, has a mining migration timeline. On December 27, the L1 mining withdrawal window will close; on December 27, all remaining assets will automatically cross-chain to the Sophon mainnet, marking the end of the first phase of SP point accumulation; mainnet mining will open on December 28.

● The Aligned Foundation will allocate a significant portion of the total ALIGN tokens to token holders of Mina, EigenLayer, and Ethereum zk L2, especially those who chose to continue holding during the market's lowest points. Registration will close on December 23, 2024.

3. Important Financing and Investment from Last Week

● BVNK, Series B, raised $50 million, with investors including Haun Ventures, Coinbase Ventures, Tiger Global, and others. BVNK provides banking services and payments for crypto-native businesses, allowing companies to accept payments in both fiat and cryptocurrencies, hold hundreds of different currencies and crypto assets, and send funds worldwide. (December 17)

● Prometheum raised $20 million, with undisclosed investors. Prometheum is a blockchain-focused company dedicated to building an end-to-end ecosystem for trading, custody, and settlement of digital asset securities. (December 17)

● Plume Network raised $20 million, with investors including Haun Ventures, Superscrypt, Galaxy Digital, Faction, HashKey Capital, Brevan Howard Digital, SV Angel, and Reciprocal Ventures. Plume is a fully integrated modular chain focused on RWAfi. Plume is building a composable DeFi ecosystem around RWAfis, featuring an integrated end-to-end tokenization engine and a network of financial infrastructure partners for plug-and-play builders. (December 18)

● Lens Protocol raised $31 million, with investors including Faction, Fabric Ventures, Foresight Ventures, Wintermute, Borderless Capital, Avail, Digital Finance Group, Circle Ventures, ConsenSys Mesh, and Alchemy Ventures. Lens Protocol is a decentralized open social graph that any application can plug into. It aims to empower creators to own their links with their communities, forming a fully composable, user-owned social graph. The protocol is built from the ground up with modularity in mind, allowing for the addition of new features and fixes while ensuring that user-owned content and social relationships are immutable. (December 18)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。