In the cryptocurrency market, large holders often use the following methods to manipulate prices:

1. Large Order Dumping

This is one of the most common methods of price dumping, where investors or institutions holding a large amount of Bitcoin or other cryptocurrencies sell off a significant amount of assets in a short period, triggering market panic by lowering prices, thereby achieving the goal of market manipulation. This is especially impactful in markets with lower liquidity, where large sell orders can have a more pronounced effect.

Large order dumping tends to favor market price dumping. This is because large order dumping is usually a tactic employed by institutions or major funds to quickly suppress prices; they will rapidly sell off large amounts of cryptocurrencies at the current market price to achieve a swift price drop.

Market orders are characterized by immediate execution at the current market price, which aligns with the operational method of large order dumping. In contrast, limit orders require transactions to occur within a specific price range, which does not meet the need for quickly suppressing prices in large order dumping.

Market price dumping occurs without warning, and the price responds quickly. To track whether large holders are engaging in large order dumping, one can use AICoin's (aicoin.com) large transaction tracking tool.

The large transaction indicator can track the main market price transaction situation and capture the movements of large holders' dumping.

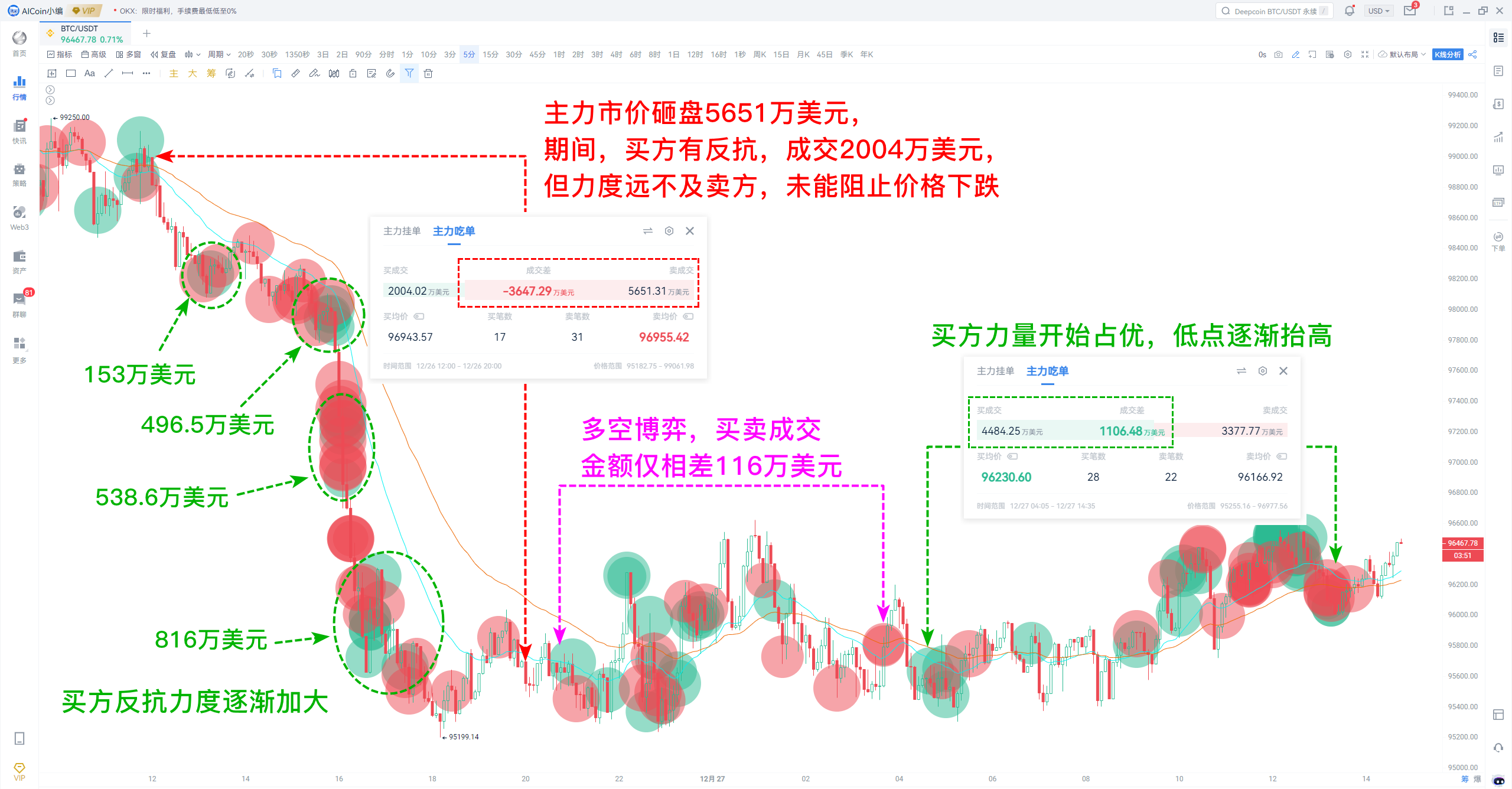

Taking the Binance BTC/USDT spot trading pair as an example:

Starting at 12:00 on December 26, Binance's large spot market dumped, cumulatively selling $56.51 million, causing BTC to pull back over 3.8%. During this period, bullish large holders attempted to resist, and their resistance gradually strengthened, accumulating $20.04 million in buy orders. However, the buying power was far less than the dumping power, failing to stop the price decline.

BTC found support near the Fibonacci retracement level of 61.8%, followed by a period of consolidation where the main bulls and bears began to compete, continuously buying and selling at market prices, with a total transaction amount difference of only $1.16 million. During this time, BTC formed a double top and retested the support at 95,500. Until 04:05 on the 27th, bullish strength began to gain an advantage, with BTC's lows gradually rising and starting to warm up slowly.

Note: The green circles represent market buy orders, and the red circles represent market sell orders. Experience it now: https://www.aicoin.com/vip

Therefore, when there are signs of price retracement, one can use the large transaction tool to assess the strength of the main dumping. Additionally, the large transaction indicator can also be used to identify the true intent behind on-chain transfers; for more details, please refer to: “Editor’s Share: Frequent Anomalies in Mt.Gox Addresses, How to Identify a ‘Smoke Screen’?”

2. Limit Order Dumping

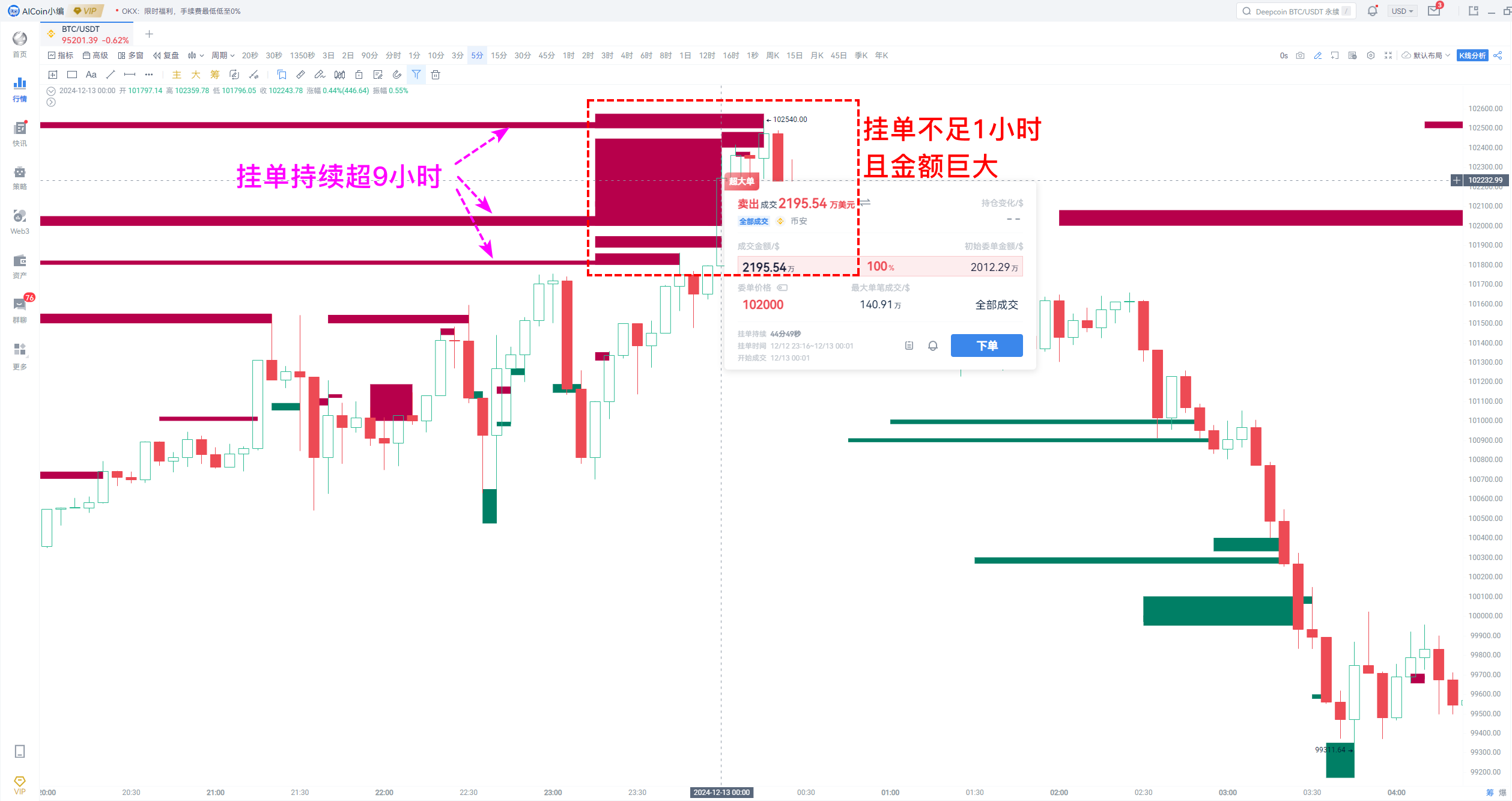

Large holders may guide prices down by placing large limit sell orders. When the market approaches these sell order prices, a significant amount of follow-up selling may occur, leading to further price declines.

The behavior of the main players dumping through limit orders can also be tracked using AICoin's large transaction tool.

The main large order tracking monitors the large holders' order placement behavior. Once the main player places an order, AICoin can immediately capture it and provide information on the main player's order position, direction, and amount, which is then clearly displayed on the candlestick chart.

When a main player places a sell order, we can execute two waves of manipulation.

• Before large order execution: In a short time, act in the opposite direction of the main player's order. For example, if the current price of BTC is 95,000 and a large holder places a sell order exceeding $10 million at 98,000, we can buy first and then sell when the price rises to 98,000, following the large holder. This operation benefits from the gravitational pull of large orders; according to AICoin analysis, the positions of main player orders are generally where subsequent prices will reach.

• After large order execution: Operate in the same direction as the main player's order. If a sell order is executed, take profit/open a short; if a buy order is executed, close a short/buy spot.

In summary:

• Main player placing buy orders: Before execution, bearish (the price must fall to execute the buy order); after execution, bullish (support).

• Main player placing sell orders: Before execution, bullish (the price must rise to execute the sell order); after execution, bearish (pressure).

Additionally, the main dumping methods also include waterfall dumping, inertia dumping, short selling dumping, mark-up selling, information manipulation, etc. Among these, mark-up selling behavior can be identified through volume-price analysis or OBV indicators; for more details, please read: “Advanced Applications of OBV, Helping You Judge Trends, Escape Tops, and Buy Bottoms!”

Special reminder: After the main dumping, prices will drop sharply and may rebound near technical support levels. At this time, large holders may choose to buy again at low levels, which can be captured using the previously mentioned large transactions and main large order tracking indicators.

The content is for sharing purposes only and is for reference only, not constituting any investment advice!

If you have any questions, feel free to join the PRO CLUB group to discuss with the editor~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。