Author: Echo, MetaEra

Source: MetaEra

It's that time of year again for year-end summaries. The market dynamics of 2024 are complex, with the approval of Bitcoin spot ETFs, the halving event arriving as expected, prices soaring, hash rates reaching new highs, ecosystems emerging, political landscapes shifting, and continuous positive news… Numerous factors are driving BTC to ignite a global investment frenzy, with prices repeatedly hitting new highs, breaking the $100,000 mark, and Google Trends indices more than doubling compared to last year, marking a shining moment! For the entire cryptocurrency industry, 2024 is a milestone year. Each significant event marks the trajectory of Bitcoin and the entire cryptocurrency market's future.

This report, structured chronologically and by key events, will review the critical moments that have influenced Bitcoin's fate. Let us step into the major events of Bitcoin in 2024 and experience the glory and hardships of this year.

The Moment of Crypto Unleashing: Bitcoin Spot ETF Approval

On January 10, a milestone transformation occurred on the American financial stage — the approval of the BTC ETF. This allowed publicly listed companies, pension funds, and various institutional investors in the U.S. to legitimately enter this mysterious field through this financial instrument, marking the beginning of a new era of publicly purchasing and holding Bitcoin.

In April, the first batch of Bitcoin and Ethereum spot ETF products applied by the Hong Kong subsidiaries of Huaxia, Bosera, and Harvest Fund received official approval from the Hong Kong Securities and Futures Commission. Subsequently, on April 30, these highly anticipated products were officially listed on the Hong Kong Stock Exchange.

The market cheered for the launch of the ETF, deepening the product offerings in the crypto market, with a large influx of institutional investors, leading to excitement and a shift from past skepticism to a pursuit of value storage. Traditional capital flowed into the crypto world, bringing crypto investment closer to the Web 2.0 market.

In the short term following the announcement, the overall performance of the Bitcoin market remained stable, with no significant fluctuations. Many questioned the ETF's effectiveness, and conspiracy theories about institutional motives emerged, with claims of "showy actions without real substance" echoing. All these uncertainties acted like a magnet, attracting countless investors and industry observers, becoming the most suspenseful chapter in Bitcoin's future development. Amidst the undercurrents, Bitcoin adhered to the "time machine theory," waiting for new momentum to prove its value over time.

Image Source: SoSoValue

Bitcoin Halving: A Key Turning Point in Destiny

On April 20, Bitcoin underwent a halving at block height 840,000, reducing the block reward from 6.25 BTC to 3.125 BTC.

Typically, the price of BTC tends to rise after a halving, as evidenced by the previous three halvings, which all resulted in new price highs. Many investors held similar expectations for the April 2024 halving, believing it would undoubtedly serve as a new driving force for price increases following the ETF developments.

However, looking at the price in the months following the halving, Bitcoin experienced a brief period of retracement before not immediately reaching new historical highs. Instead, it began to soar significantly only after a series of events, including the halving, conferences, political elections, regulatory changes, and strategic reserves in the industry. From the halving mechanism and historical halvings, it is evident that halvings have a substantial impact, often leading to market volatility and increased speculative activity in the crypto space; reshaping the mining industry, with miners' profit margins decreasing; and stimulating technological innovation and community development within the blockchain ecosystem. The halving event may also hedge against inflation, enhancing Bitcoin's appeal as a long-term investment asset.

This information indicates that while halvings help reinforce Bitcoin's narrative of scarcity, macroeconomic factors also significantly influence Bitcoin's price. The mysterious force of Bitcoin cannot be accurately predicted based on history; it continually refreshes the world's understanding at each stage, and we cannot halt its progress. As Binance CEO Richard Teng stated: we need to look further ahead and view market performance from the perspective of market cycles. We should not be anxious about when bull and bear markets will arrive but focus on the long-term trends and fundamentals of the cryptocurrency market. Bitcoin always surprises you with its extraordinary price increases during moments of doubt and anxiety. We just need to wait; Bitcoin remains great.

BTC Ecosystem Service Providers: Miners, Strong Confidence vs. Survival Crisis?

From the miners' perspective, the Bitcoin mining landscape in 2024 is ever-changing. Not only did the halving lead to a decrease in hash prices, creating an economic rollercoaster, but the development of inscriptions and runes in the first half of the year quietly shifted miners' primary sources of income, akin to an ecological awakening. In the past, mining relied solely on traditional block rewards, but with the emergence of new phenomena, the focus of income has gradually shifted to infrastructure service gas fees. For instance, during Bitcoin's fourth halving, transaction fees surged, and Rune tokens paid high fees at the halving block, becoming a significant component of miners' income. Statistics show that since January 1, 2024, standard financial transactions accounted for 67% of total miner fee income, Runes for 19%, and BRC-20 and Ordinals transactions combined for 14%, with gas fee revenues increasing daily.

In this context, the role of miners is undergoing a profound transformation. They are no longer merely simple block producers but are evolving into infrastructure service providers within the Bitcoin ecosystem. Leveraging the network resources and infrastructure advantages accumulated through mining, miners can provide services for various transactions and earn gas fees. This shift deeply integrates miners into all aspects of the Bitcoin ecosystem, linking their fate with the entire ecosystem while exploring a more sustainable development path under the new economic model.

Bitcoin Conference: The Origin of Market Dynamics

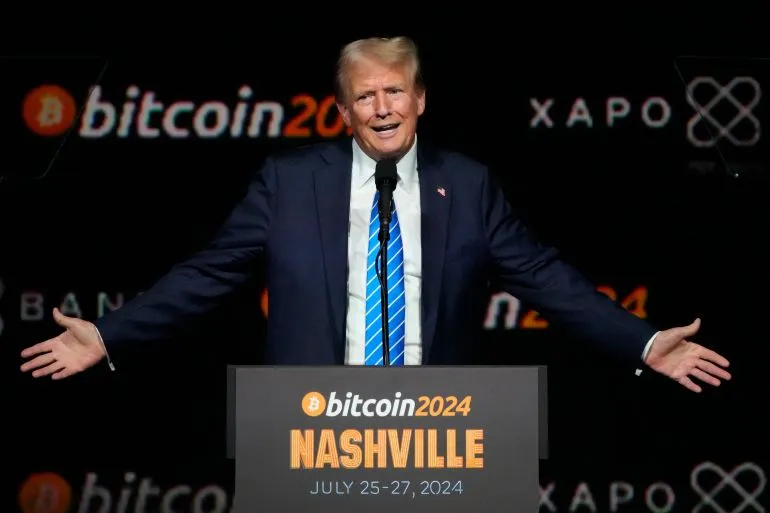

By mid-year, on July 27, the Bitcoin 2024 Conference took place in Nashville, where well-known politicians like Trump and Robert F. Kennedy made appearances. Their statements and proposals regarding Bitcoin were like heavy bombs, creating ripples throughout the conference and the entire cryptocurrency industry.

Trump delivered a nearly one-hour speech, starting an hour late, yet the tens of thousands of attendees remained enthusiastic. In his speech, Trump fully acknowledged BTC's status as a scarce asset and a safe haven, asserting that BTC would surpass gold to become the world's largest asset class. He emphasized that the U.S. must maintain its position as a superpower in cryptocurrency and stated that if elected, he would fire SEC Chairman Gary Gensler, who has been hindering the development of cryptocurrency through compliance measures, on his first day in office. He also made 13 major commitments regarding cryptocurrency:

● On the first day, I will fire Gary Gensler and appoint a new SEC chairman.

● If elected, I will establish a strategic national Bitcoin reserve for the U.S. government.

● The U.S. government will retain 100% of its holdings.

● Bitcoin will soar to the moon.

● Do not sell your Bitcoin.

● Bitcoin may one day exceed the market value of gold.

● I reaffirm my commitment to reducing Ross Ulbricht's sentence.

● During my presidency, there will never be a CBDC if I am elected.

● Bitcoin and cryptocurrency will soar in unprecedented ways.

● Bitcoin does not threaten the dollar; the current U.S. government threatens the dollar.

● The U.S. will become the global capital of cryptocurrency and the world's Bitcoin superpower.

● Bitcoin represents freedom, sovereignty, and independence from government coercion and control.

● I assure the Bitcoin community that on the day I am sworn in, Joe Biden and Kamala Harris's anti-cryptocurrency campaign will end.

Whether due to his personality or to amuse the audience, he notably improvised at the end: "Have fun, whether it's Bitcoin, cryptocurrency, or anything else." Riding the momentum of the conference, he garnered significant political support for his blueprint.

It was like a dazzling political and financial feast. The market price performance during and after the Bitcoin conference sometimes soared to new heights; at other times, it briefly retraced to gather strength. The conference acted as a massive vortex of crypto information, where various insights on Bitcoin's technological innovations, policy interpretations, and market trends converged and then rippled out across the entire cryptocurrency field. The industry's reactions to politicians' statements and actions were varied, with expectations for time to validate their impact.

Bull Market Outlook: Positive Impact of the U.S. Election

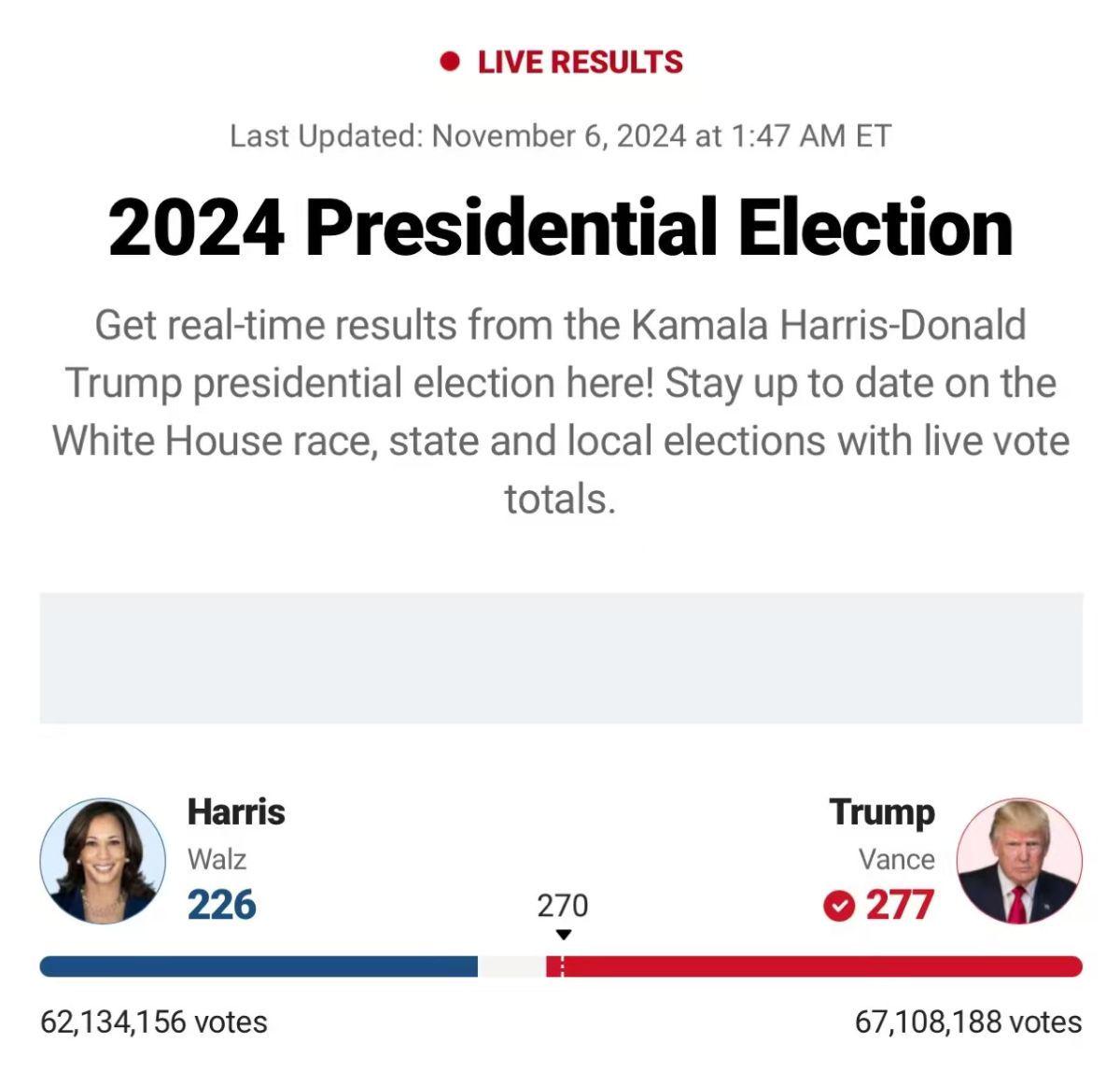

On November 6 at 14:27, the dust settled on the U.S. presidential election, with Trump emerging as the final winner, returning to the White House at the age of 78 with the support of the crypto community.

Trump's victory and his subsequent series of pro-crypto measures heralded a significant positive impact on Bitcoin prices. Following the election results, the Bitcoin market reacted swiftly, with investors flooding in based on strong expectations for favorable future policies.

After taking office, he announced that he would implement several measures beneficial to the cryptocurrency industry, including the expected repeal of the SAB 121 Act on January 20 next year, clearing obstacles for traditional financial institutions to enter and promoting the institutional development of crypto assets. This will provide a legitimate and compliant channel for a large amount of potential funds to flow into the Bitcoin market, expanding Bitcoin's market capacity and capital depth. Following the commitments made at the Bitcoin conference, he plans to dismiss the former SEC chairman on his first day in office and appoint crypto-friendly Paul Atkins as the next SEC chairman, sending a strong signal of regulatory relaxation to the market and boosting investor confidence. He aims to establish a strategic Bitcoin reserve, influencing the market from the perspective of supply and demand, retaining Bitcoin ownership while expanding its scale, reducing the selling pressure of Bitcoin in the market, and increasing its attractiveness as a strategic asset. He plans to stop government Bitcoin sales and use Bitcoin as an investment holding asset. His companies are also negotiating with the Intercontinental Exchange regarding the proposed acquisition of the cryptocurrency exchange Bakkt, injecting new vitality and imagination into Bitcoin's trading ecosystem and attracting more investors to participate, indirectly aiding in price increases.

Bitcoin is riding the wave of favorable U.S. policies, charging forward on the trajectory of rising prices. The future development space and potential of Bitcoin appear increasingly vast under the intertwining of these positive factors. Welcome to the new era of cryptocurrency propelled by Trump!

New Political Landscape: Core Political Figures Express Diverse Views, Government Reserves Enter the Scene

Driven by historic market surges, some countries are considering establishing national Bitcoin reserves, and we are pleased to witness a significant trend: more and more political figures are beginning to recognize its value.

U.S. President-elect Trump stated that he would make the U.S. the world's cryptocurrency capital, proposing not to sell the Bitcoin held by the U.S. government but to hold it as a strategic reserve asset for the long term.

Russian President Putin signed a law on taxing digital currencies, defining digital currencies as property applicable to foreign trade payments, exempting mining and sales from value-added tax, requiring mining infrastructure operators to report to tax authorities, and taxing personal income based on actual income; Putin also emphasized at a forum that no one can ban Bitcoin and other electronic payment methods, as they are new technologies that will continue to develop.

Japanese Prime Minister Shigeru Ishiba: Restructuring the Web3 and cryptocurrency policy departments, the ruling Liberal Democratic Party disbanded the existing Web3 project group and established a dedicated department within the party's digital society promotion department, led by the former secretary-general of the Web3 project group, although the new department's responsibilities have yet to be clarified.

The South Korean State Council passed the "Virtual Asset User Protection Act," which took effect on July 19, requiring virtual asset service providers to secure user deposits through banks and granting them the right to suspend user cash and virtual asset deposits and withdrawals based on reasonable grounds.

El Salvador President Nayib Bukele proposed leasing the country's volcanoes to miners for sustainable Bitcoin mining, utilizing geothermal energy to reduce mining costs. Previously, the country successfully mined Bitcoin worth approximately $46 million using geothermal energy.

Argentinian President Javier Milei advocates separating cryptocurrency from state control, criticizing central bank digital currencies, promoting private management of cryptocurrencies, and warning against government overreach.

The Monetary Authority of Singapore announced support for the commercialization of asset tokenization plans, convening financial institutions from multiple countries to conduct industry trials and encouraging the establishment of industry standards to promote the commercialization and promotion of tokenized capital market products.

Surinamese presidential candidate Maya Parbhoe promised that if elected in 2025, he would make Bitcoin legal tender, gradually replacing the Surinamese dollar, planning to dissolve the central bank, cut taxes, privatize public services, and use Bitcoin's transparency to combat corruption, stating that Bitcoin is key to rebuilding the country's financial infrastructure.

Polish presidential candidate Sławomir Mentzen promised to establish a Bitcoin strategic reserve if elected.

The efforts and statements of these political figures indicate that Bitcoin is poised to occupy a more significant position in the future financial landscape, steadily stepping into the grand vision of the global economic system, shining like a new star and attracting the attention of the political arena.

Regulatory Winds Shift: Institutions Flood In

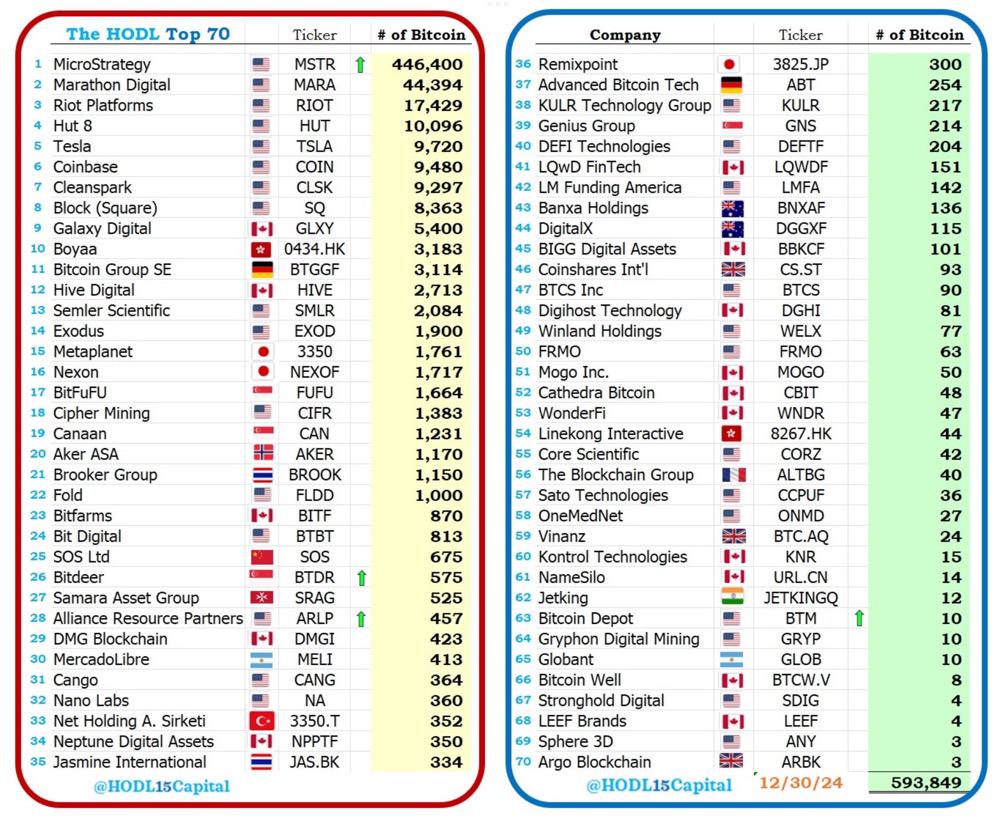

As the regulatory environment becomes more open and transparent in 2024, the cryptocurrency industry is entering a new era. Amid this wave, the "dual repair of currency and stock" model is gradually becoming a favorite among listed companies, with many enterprises incorporating Bitcoin into their asset strategic reserves. Among them, Tesla and MicroStrategy stand out, achieving "diamond hands victory" with their firm holding strategies. MSTR's stock price surged from around $194 to nearly $500 in just about a month, an increase of approximately 150%. In the Hong Kong stock market, the "twin stars" Boya and Meitu, two Bitcoin giants, hold 2,641 and 940 BTC, respectively. Coinbase, the first publicly traded cryptocurrency exchange, reported a total profit of $804 million, with a price-to-earnings ratio of about 7.88.

Such results have attracted more listed companies to follow suit. On November 19, Nano Labs Ltd (Nasdaq: NA) announced plans to allocate part of its remaining cash flow to Bitcoin, holding it as a long-term strategic reserve asset; on the same day, U.S. listed company Genius Group Limited (GNS) announced it had spent $10 million to buy 110 BTC at an average price of $90,932; niche e-commerce platform LQR House Inc. (LQR), focused on spirits and beverages, announced its board had approved the purchase of $1 million worth of Bitcoin as part of its capital management strategy; on November 20, the board of U.S. listed biopharmaceutical company Acurx Pharmaceuticals (ACXP) approved the purchase of $1 million in Bitcoin as a reserve asset; on the same day, another U.S. listed company, Hoth Therapeutics (HOTH), announced its board approved the purchase of up to $1 million in Bitcoin… It is evident that many listed companies have fully recognized BTC's value storage function and its role in boosting stock prices, joining this "BTC strategic reserve competition."

Image Source: HODL15Capital

BTC Ecosystem: Lying in Wait for Spring to Bloom

The Bitcoin ecosystem resembles an accelerated version of the crypto space, from the birth of the Ordinals protocol at the end of 2022, to the small NFT boom at the beginning of 2023, followed by a brief bear market in mid-2023, where everyone was active in various spaces discussing the future. Then, BRC20 ignited the second small bull market. Entering the fall of 2023, the market returned to silence, followed by the third climax at the beginning of 2024, and it has been lying in wait and brewing ever since. In just two years, it has traversed the entire cycle of bull and bear markets that typically spans three to four decades in the crypto space.

Over the past year, Bitcoin's market dominance has significantly increased, rising from 45.27% to 56.81%. The volume of spot ETF holdings has surged, and a new market centered around Bitcoin as a core asset, with ETFs and U.S. stocks as funding channels, and U.S. listed companies as vehicles, has fully opened up, highlighting the necessity of developing its ecosystem and improving capital efficiency. In terms of Layer 2, 77 projects have made moves over the past three years, and in the first half of 2024, some old projects saw trading volumes and token prices rise due to the ETF boom, with various solutions emerging, locking in a total value of $3 billion, which is expected to grow significantly in the future. New execution standards have emerged in the Layer 1 execution layer, with activities steadily increasing but lacking sustained momentum. In other infrastructure areas, interoperability solutions like bridges and WBTC are mainstream, with more solutions expected to be launched; in terms of security layers, interoperability may threaten asset security, and related security solutions such as Babylon's Bitcoin timestamp and staking protocols have emerged, along with new technologies like the data availability layer (DA layer), such as Nubit, which release Bitcoin's potential value.

The Bitcoin ecosystem is currently in a relatively disharmonious position. However, compared to last year, there has been significant progress. The Bitcoin ecosystem will certainly not miss out on the raging bull market; there are still many narratives waiting to be explored. The previous dormancy and sedimentation have accumulated enough strength. A large number of innovative projects are on the way.

Witnessing History: Bitcoin Breaks $100,000 for the First Time, Where to Next?

On December 5 at around 10:30 AM, the price of BTC surged past $100,000, with a 24-hour increase of nearly 5%, marking Bitcoin's much-anticipated first breakthrough of the $100,000 barrier. At the same time, Ethereum broke $3,800 USDT, with a 24-hour increase of 5.35%; SOL broke $230 USDT, with a 24-hour decline narrowing to 2%.

Image Source: OKX

The media effect triggered by Bitcoin's price breaking $100,000 has successfully brought Crypto and decentralization into the mainstream public eye. It has prompted the public to look back at its past, from its humble beginnings at inception to its current proud standing, with its price ascent resembling a grand legend. If we count from that iconic Pizza Day, it has endured sixteen years of trials.

It has gradually moved from the margins to the center. When Bitcoin first broke $1, many may not have anticipated its astonishing potential; and when it crossed significant thresholds like $100 and $1,000, the entire world took notice. Now, breaking $100,000 has pushed Bitcoin to a whole new height.

Finally, may Bitcoin continue to create miracles, and may those of us who believe in Bitcoin create wonders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。