In the fourth quarter of 2024, the cryptocurrency market experienced significant growth driven by the U.S. election, with Grayscale adding six new assets, focusing on decentralized AI, the Solana ecosystem, and long-term scaling trends.

Author: Grayscale Research

Translation: Blockchain in Plain Language

In the fourth quarter of 2024, the cryptocurrency market performed strongly, as indicated by the FTSE/Grayscale cryptocurrency industry index series, with the market surge primarily attributed to the positive market reaction to the U.S. election results.

Competition in the smart contract platform space remains fierce. As the leader in this category, Ethereum's performance has lagged behind that of Solana, which ranks second by market capitalization. Investor interest in alternative Layer 1 networks such as Sui and The Open Network (TON) continues to rise.

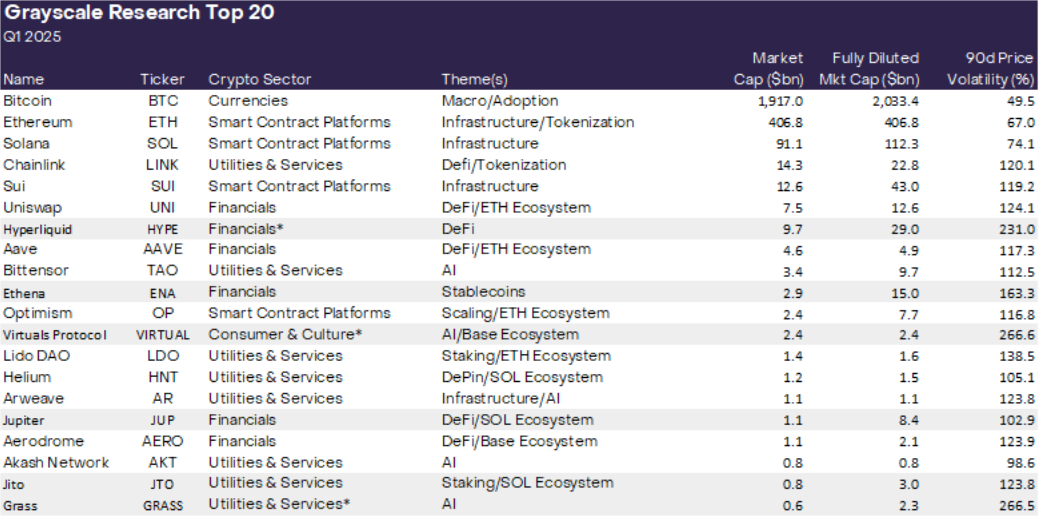

We have updated Grayscale Research's list of the top 20 assets. This list covers a diversified portfolio of assets in the cryptocurrency industry that we believe have high potential in the upcoming quarter. The newly added assets this quarter include HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS. It is important to note that all assets in the top 20 list exhibit high price volatility and are considered high-risk assets.

The Grayscale cryptocurrency industry framework provides a comprehensive analytical tool for understanding the full scope of investable digital assets and their relationship with underlying technologies. Based on this framework and in collaboration with FTSE Russell, we developed the FTSE Grayscale cryptocurrency industry index series to measure and monitor the cryptocurrency asset class. Grayscale Research incorporates these cryptocurrency industry indices into its ongoing analysis of the digital asset market.

Figure 1: Our cryptocurrency industry index achieved positive returns in 2024

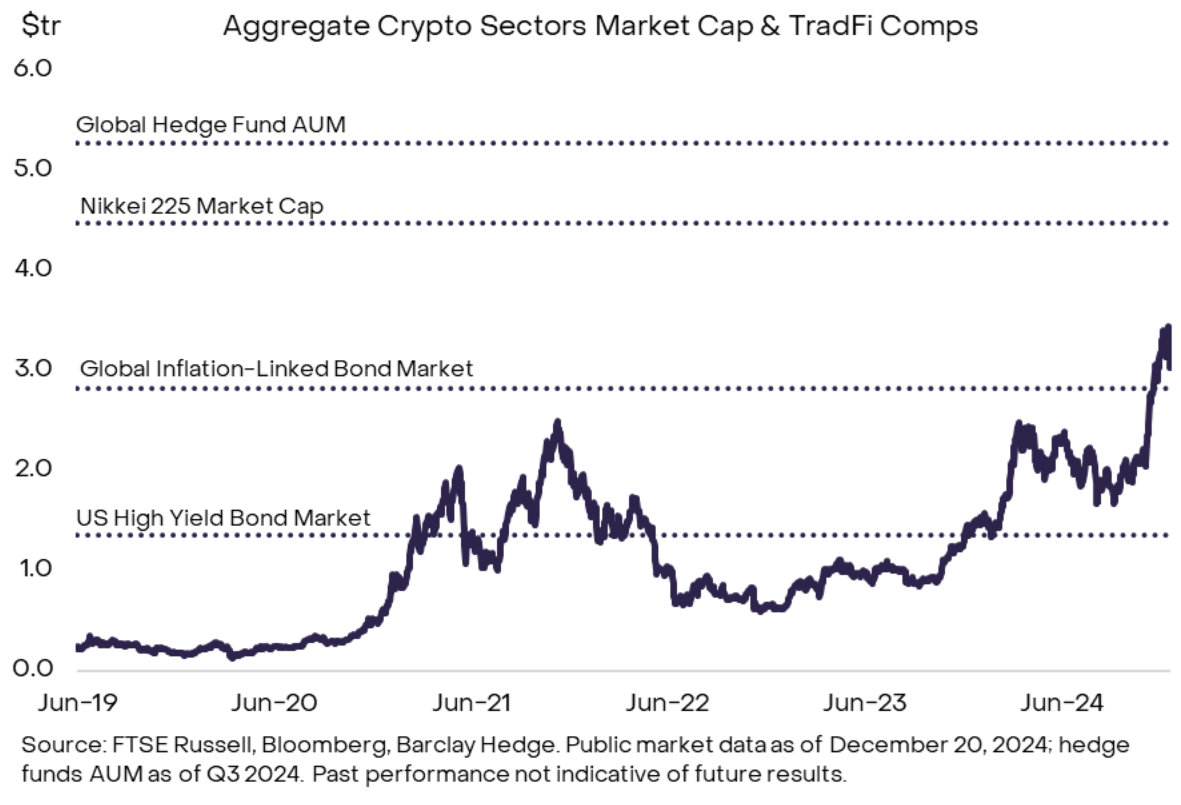

In the fourth quarter of 2024, the valuation of cryptocurrency assets surged significantly, primarily due to the market's positive reaction to the U.S. election results. According to our comprehensive cryptocurrency industry market index (CSMI), the total market capitalization of the industry jumped from $1 trillion to $3 trillion this quarter. Figure 2 compares the total market capitalization of the cryptocurrency market with various traditional public and private market asset classes. For instance, the current market capitalization of the digital asset industry is roughly equivalent to that of the global inflation-linked bond market, more than double that of the U.S. high-yield bond market, but still significantly lower than the global hedge fund industry or the Japanese stock market.

Figure 2: The cryptocurrency market's market capitalization increased by $1 trillion in the fourth quarter of 2024

As valuations rise, many new tokens meet our inclusion criteria for the cryptocurrency industry framework (with a minimum market capitalization requirement of $100 million for most assets). In this quarter's adjustment, we added 63 new assets to the index series, bringing the total to 283 tokens. The largest number of new tokens in the consumer and cultural cryptocurrency space reflects the continued strong returns of memecoins and the appreciation of various assets related to gaming and social media. By market capitalization, the largest new asset in the cryptocurrency industry this quarter is Mantle, an Ethereum Layer 2 protocol that has now met our minimum liquidity requirements.

Competition in smart contract platforms

The smart contract platform segment of the cryptocurrency space may be one of the most fiercely competitive market segments in the digital asset industry. Although 2024 is a milestone year for category leader Ethereum—having received approval for spot trading platform products (ETPs) in the U.S. and completing a significant upgrade—its token Ether has underperformed compared to some competitors, including Solana, which ranks second by market capitalization in this category. Investors are also turning their attention to other Layer 1 networks, including high-performance blockchains like Sui and the blockchain TON integrated with the Telegram messaging platform.

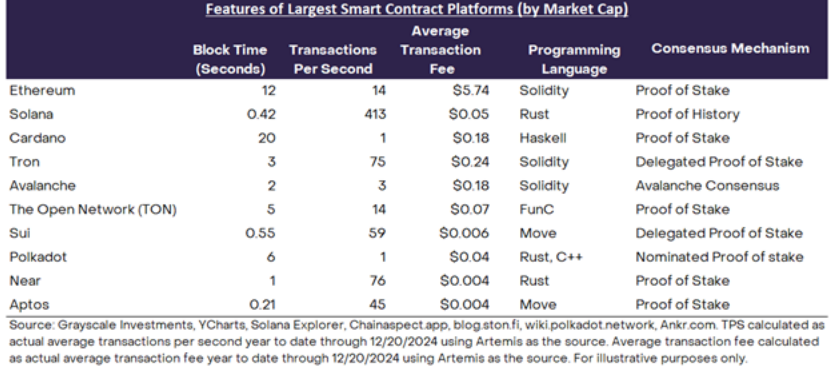

When creating infrastructure for application developers, designers of smart contract blockchains face various design choices. These choices affect the three factors that constitute the "blockchain trilemma": network scalability, network security, and network decentralization. For example, prioritizing scalability often manifests as high transaction throughput and low fees (e.g., Solana), while prioritizing decentralization and network security may lead to lower throughput and higher fees (e.g., Ethereum). These specific design choices result in significant differences in block time, transaction throughput, and average transaction fees (see Figure 3).

Figure 3: Smart contract platforms have different technical characteristics

Regardless of design choices and the strengths and weaknesses of the network, one of the sources of value for smart contract platforms is their ability to generate network fee revenue. We have previously pointed out that fee revenue can be seen as a primary driver of token value accumulation in this market segment, although other metrics such as total value locked (TVL) also need to be considered (see "The Value Struggle of Smart Contract Platforms"). As shown in Figure 4, there is a statistical relationship between fee revenue and market capitalization for smart contract platforms. The stronger the network's ability to generate fee revenue, the greater its ability to pass value to the network in the form of token burn or staking rewards.

In this quarter, the following smart contract platforms were included in Grayscale Research's top 20 list: ETH, SOL, SUI, and OP.

Figure 4: All smart contract platforms are competing for fee revenue

Grayscale Research Top 20 List

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to support the rebalancing process of the FTSE/Grayscale cryptocurrency industry index series. Based on this process, Grayscale Research publishes a list of the top 20 assets in the cryptocurrency industry. This list showcases a diversified portfolio of assets covering multiple segments of the cryptocurrency industry that we believe have high potential in the upcoming quarter (see Figure 4). Our approach considers various factors, including network growth and adoption, potential catalysts, fundamental sustainability, token valuation, token supply inflation rate, and potential tail risks.

This quarter, we particularly focused on tokens related to the following three core market themes:

The U.S. election and its potential impact on industry regulation, especially in the decentralized finance (DeFi) and staking sectors;

Ongoing breakthroughs in decentralized AI technology and the application of blockchain in AI agents;

The growth of the Solana ecosystem.

Based on these themes, we added the following six assets to the top 20 list for the first quarter of 2025:

Hyperliquid (HYPE): Hyperliquid is a Layer 1 blockchain designed to support on-chain financial applications, primarily serving as a decentralized perpetual futures trading platform (DEX) equipped with a fully on-chain order book.

Ethena (ENA): The Ethena protocol has developed a new type of stablecoin, USDe, which is primarily backed by hedged positions in Bitcoin and Ethereum collateral. The protocol supports the stability of USDe by holding long positions in Bitcoin and Ethereum while holding short positions in perpetual futures contracts for these assets. The staked version of the token provides yield through the price difference between spot and futures.

Virtuals Protocol (VIRTUAL): Virtuals Protocol is an AI agent platform built on Base (an Ethereum Layer 2 network). These AI agents can autonomously execute tasks and simulate human decision-making. The platform supports the creation and co-ownership of tokenized AI agents that can interact with their environment and other users.

Jupiter (JUP): Jupiter is the preferred DEX aggregator on Solana, boasting the highest total value locked (TVL) in the network. As more retail investors enter the cryptocurrency market through Solana and speculation around Solana-based memecoins and AI agent tokens intensifies, we believe Jupiter is well-positioned in this rapidly growing market.

Jito (JTO): Jito is a liquid staking protocol on Solana. Jito has experienced rapid growth over the past year, with its financial performance ranking among the top in the entire cryptocurrency space, generating over $550 million in fee revenue in 2024.

Grass (GRASS): Grass is a decentralized data network that rewards users for sharing their unused internet bandwidth through a Chrome extension. This bandwidth is used for online data scraping, which is then sold to AI companies and developers for training machine learning models, effectively enabling data scraping while compensating users.

Figure 5: The Top 20 List Update Covers DeFi Applications, AI Agents, and the Solana Ecosystem

Note: The shaded areas indicate newly added assets, applicable for the upcoming first quarter of 2025. *Assets marked with an asterisk are not included in the corresponding segments of the cryptocurrency industry index. Source: Artemis, Grayscale Investments.

Note: The shaded areas indicate newly added assets, applicable for the upcoming first quarter of 2025. *Assets marked with an asterisk are not included in the corresponding segments of the cryptocurrency industry index. Source: Artemis, Grayscale Investments.

Please note that this data is as of December 20, 2024. For illustrative purposes only, assets may be adjusted at any time. Grayscale and its affiliates and clients may hold the digital assets mentioned in this article. All assets in our top 20 list exhibit high price volatility and should be considered high-risk assets.

In addition to the new themes mentioned above, we remain optimistic about themes proposed in previous quarters, such as Ethereum scaling solutions, tokenization, and decentralized physical infrastructure (DePIN). These themes are reflected in the protocols returning to the top 20 list, such as Optimism, Chainlink, and Helium.

This quarter, we removed the following assets from the top 20: TON, Near, Stacks, Maker (Sky), UMA Protocol, and Celo. Grayscale Research still believes these projects hold value and remain important components of the cryptocurrency ecosystem. However, we believe the adjusted top 20 list may offer more attractive risk-adjusted returns in the upcoming quarter.

Investing in cryptocurrency asset classes carries risks, some of which are unique to cryptocurrencies, including smart contract vulnerabilities and regulatory uncertainties. Additionally, all assets in our top 20 list exhibit high volatility and should be considered high-risk assets, making them unsuitable for all investors. Given the risks associated with this asset class, any investment in digital assets should be considered in the context of the overall portfolio and the investor's financial goals.

Article link: https://www.hellobtc.com/kp/du/01/5614.html

Source: https://www.grayscale.com/research/market-commentary/grayscale-research-insights-crypto-sectors-in-q1-2025

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。