1. Market Overview

The cryptocurrency market is expected to continue its rapid growth in 2025, driven by technological innovation, institutional adoption, and improved regulatory frameworks. According to CoinMarketCap data, as of October 2023, the total market capitalization of cryptocurrencies has exceeded $1.2 trillion, with Bitcoin and Ethereum holding 40% and 18% market shares, respectively. JPMorgan predicts that by 2025, the cryptocurrency market size could reach $5 trillion, primarily driven by institutional investors and emerging markets. A PwC report indicates that over 70% of traditional financial institutions are exploring cryptocurrency investment opportunities.

2. Core Investment Opportunities

2.1 Bitcoin

- Halving Effect: The Bitcoin halving event, which occurs every four years, will reduce mining rewards, and historically, prices have typically risen after halving. After the 2024 halving, Bitcoin may continue to benefit from price increases due to reduced supply in 2025. Data supports this: after the 2016 halving, Bitcoin's price rose from $650 to $20,000 (end of 2017); after the 2020 halving, the price increased from $8,000 to $69,000 (November 2021).

- Institutional Adoption: The approval of spot Bitcoin ETFs and increased participation from institutional investors will further enhance Bitcoin's liquidity and market recognition. According to a Grayscale report, over 60% of institutional investors plan to increase their cryptocurrency allocations in the next 12 months.

- Store of Value: Bitcoin's status as "digital gold" is further solidified amid macroeconomic uncertainties (such as inflation and currency devaluation). In 2023, Bitcoin's correlation with gold reached 0.6, indicating its potential as a safe-haven asset.

- Risks: High price volatility, influenced by macroeconomic factors and regulatory policies. The rise of competing coins may divert some funds.

- Strategy: Long-term holding (HODL) or dollar-cost averaging (DCA). Focus on institutional adoption and macroeconomic trends.

2.2 Ethereum

- PoS Transition: Ethereum has completed its transition to Proof of Stake (PoS), enhancing scalability and energy efficiency while reducing transaction costs. After the Ethereum 2.0 upgrade, energy consumption decreased by 99.95%, and transaction speed increased to 100,000 TPS.

- DeFi and NFT: As the primary platform for DeFi and NFTs, Ethereum will continue to lead innovation, attracting more users and capital. As of October 2023, Ethereum's total value locked (TVL) in DeFi exceeds $40 billion, accounting for 60% of the entire DeFi market.

- Layer 2 Solutions: Layer 2 solutions like Arbitrum and Optimism will further enhance Ethereum's transaction efficiency. Layer 2 transactions account for 30% of Ethereum's total transaction volume and are continuously growing.

- Risks: Competing chains (such as Solana and Avalanche) may divert market share. Potential issues during the technology upgrade process.

- Strategy: Invest in Ethereum and high-quality projects within its ecosystem. Focus on the development of Layer 2 solutions.

2.3 Layer 1 Competing Chains

- High-Performance Blockchains: Platforms like Solana, Avalanche, and Cardano offer faster and cheaper transactions, attracting developers and users. Solana's transaction speed reaches 65,000 TPS, and Avalanche's transaction fees are below $0.01.

- Cross-Chain Interoperability: Cross-chain solutions like Polkadot and Cosmos promote the development of multi-chain ecosystems, enhancing interoperability between blockchains. Polkadot has over 30 parachains, and the Cosmos ecosystem has over 200 projects.

- Risks: Intense technological competition, with some projects potentially being eliminated. Market adoption may be slower than expected.

- Strategy: Select Layer 1 projects with mature technology and active ecosystems. Focus on cross-chain interoperability solutions.

2.4 Decentralized Finance (DeFi)

- Innovative Protocols: Innovations in lending, trading, and derivatives protocols provide higher yields and better user experiences. The total value locked (TVL) in DeFi has grown from $1 billion in 2020 to $70 billion in 2023.

- Decentralized Exchanges (DEX): DEXs like Uniswap and SushiSwap continue to grow, challenging traditional centralized exchanges. Uniswap's average daily trading volume exceeded $1 billion in 2023, accounting for 60% of the DEX market.

- Liquidity Mining: Mechanisms that reward users for providing liquidity attract more participants. The annual percentage yield (APY) for liquidity mining averages 10%-20%, with some projects reaching up to 100%.

- Risks: Smart contract vulnerabilities and hacking attacks. Regulatory uncertainties.

- Strategy: Invest in DeFi projects with real applications and user bases. Focus on security and compliance.

2.5 Non-Fungible Tokens (NFT)

- Expansion of Use Cases: NFTs are expanding from art and gaming to practical applications such as identity verification, ticketing, and real estate. The NFT market reached $20 billion in 2023, a 50% year-on-year increase.

- Metaverse Assets: Virtual land, items, and identities in the metaverse are becoming new investment targets. The highest sale price for virtual land in Decentraland exceeded $1 million.

- Community-Driven: Strong community support is key to the success of NFT projects. The BAYC (Bored Ape Yacht Club) community has over 10,000 members, with a floor price exceeding 100 ETH.

- Risks: Market bubbles and excessive speculation. Some projects lack practical applications.

- Strategy: Focus on NFT projects with clear utility and community support. Avoid overly speculative areas.

2.6 Web3 and Decentralized Applications (dApps)

- Decentralized Social Platforms: Web3 social platforms (such as Mastodon and Lens Protocol) challenge traditional social media giants. Lens Protocol has over 1 million users, with 100,000 daily active users.

- Blockchain Games: The Play-to-Earn model attracts a large number of users, driving the development of virtual economies. Axie Infinity has over 2 million daily active users, with annual revenue exceeding $1 billion.

- Data Ownership: Decentralized storage and data management projects (such as Filecoin and Arweave) are gaining more attention. Filecoin's storage capacity exceeds 20 EB, and Arweave's data storage exceeds 1 PB.

- Risks: User adoption may be slower than expected. Challenges in technology integration.

- Strategy: Invest in innovative and high-growth potential Web3 projects. Focus on blockchain games and decentralized storage.

2.7 Integration of Artificial Intelligence and Blockchain

- Decentralized AI Market: AI models and data are traded and managed in a decentralized manner through blockchain. Ocean Protocol's trading volume exceeded $100 million in 2023.

- Smart Contract Optimization: AI-driven smart contract optimization and data analysis tools enhance blockchain efficiency. AI blockchain projects have raised over $500 million in funding.

- Data Annotation Platforms: Blockchain technology ensures the transparency and fairness of data annotation. Numerai's data annotation trading volume exceeded 10 million transactions in 2023.

- Risks: Challenges in technology integration, with the market still in its early stages. Some projects lack practical applications.

- Strategy: Focus on early projects at the intersection of AI and blockchain. Choose projects with clear application scenarios.

2.8 Metaverse and Virtual Assets

- Virtual Land and Items: Virtual land, items, and identities in the metaverse have become new investment targets. The highest sale price for virtual land in The Sandbox exceeded $5 million.

- Blockchain Games: The rapid development of virtual economic systems drives the appreciation of metaverse assets. The metaverse gaming market is expected to reach $50 billion by 2025.

- Cross-Platform Interoperability: Asset interoperability between different metaverse platforms enhances user experience. Cross-chain bridge transaction volume exceeds $1 billion.

- Risks: The metaverse concept is not yet fully mature, leading to uncertainties. Some projects lack practical applications.

- Strategy: Choose metaverse platforms with strong ecosystems and user bases. Focus on cross-platform interoperability solutions.

3. Emerging Trends and Potential Areas

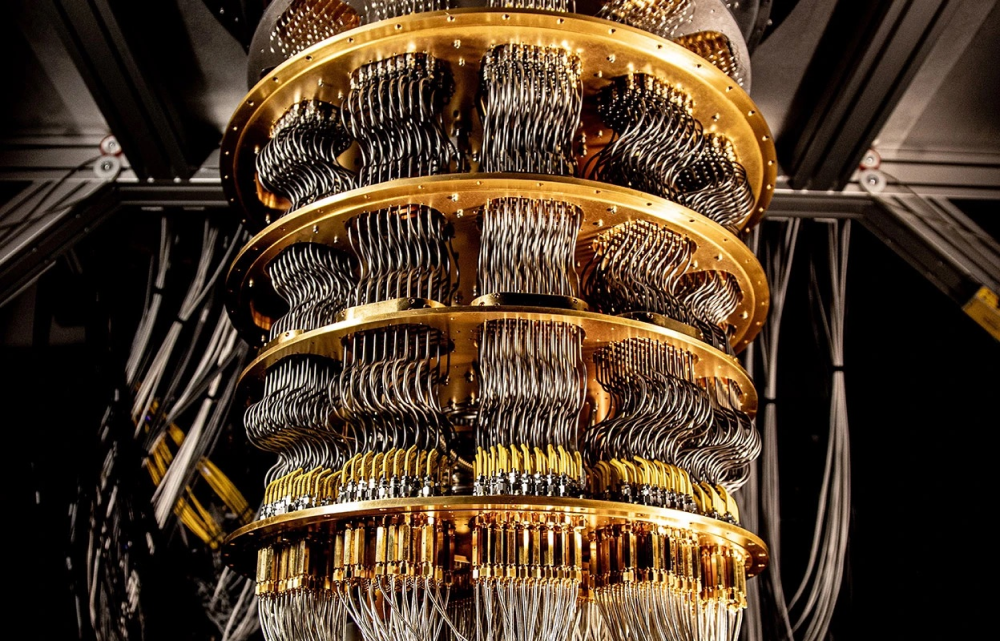

3.1 Quantum Computing and Blockchain Security

- Quantum Resistance: Quantum computing may threaten traditional cryptographic algorithms, making quantum-resistant blockchain projects a focus for the future. Quantum-resistant projects have raised over $100 million in funding.

- Investment Opportunities: Focus on blockchain projects that adopt post-quantum cryptography.

- Risks: The development speed of quantum computing technology is uncertain.

- Strategy: Invest in projects with advanced cryptographic technologies.

3.2 Environmental Sustainability

- PoS and Energy-Efficient Blockchains: Proof of Stake (PoS) and other energy-efficient blockchain projects benefit from environmental trends. After the Ethereum 2.0 upgrade, energy consumption decreased by 99.95%.

- Carbon Neutrality Initiatives: Some blockchain projects enhance their environmental image through carbon neutrality initiatives. Algorand announced achieving carbon neutrality, and Chia uses a low-energy consensus mechanism.

- Risks: Environmental standards may increase project operating costs.

- Strategy: Choose blockchain projects with high energy efficiency.

3.3 Compliance and Regulation-Friendly Projects

- Compliant Stablecoins: Compliant stablecoins like USDC and USDP are gaining more applications. USDC's market capitalization exceeds $25 billion, accounting for 20% of the stablecoin market.

- Enterprise-Level Blockchains: Enterprise-level blockchain solutions like Hyperledger and Corda are gaining more applications in traditional industries. The Hyperledger ecosystem has over 300 projects, and Corda has over 1,000 users.

- Risks: Regulatory policies may restrict the development of some projects.

- Strategy: Invest in projects and tokens that meet regulatory requirements.

3.4 Emerging Market Opportunities

- Payments and Finance: Cryptocurrencies are widely used in countries with high inflation rates and underdeveloped financial infrastructure. The number of cryptocurrency users in Nigeria exceeds 10 million, and Bitcoin trading volume in Argentina has increased by 300%.

- Cross-Border Payments: Cryptocurrencies provide low-cost and efficient cross-border payment solutions. RippleNet's daily transaction volume exceeds $1 billion.

- Risks: There is a high level of uncertainty regarding policies in emerging markets.

- Strategy: Focus on payment and financial projects targeting emerging markets.

4. Investment Strategies and Risk Management

Diversified Investment: Spread funds across different types of cryptocurrencies and projects to reduce risk.

Long-Term Perspective: Given the high volatility of the cryptocurrency market, a long-term investment approach is recommended.

Continuous Learning: Stay updated on industry trends and technological developments to adjust investment strategies in a timely manner.

Risk Management: Set stop-loss points to avoid excessive leverage and speculative behavior.

5. Conclusion and Outlook

The cryptocurrency market in 2025 will be filled with opportunities and challenges. Bitcoin and Ethereum remain core assets, but emerging areas such as DeFi, NFTs, Web3, and the integration of AI and blockchain will provide more investment opportunities. Investors should remain cautious and develop reasonable strategies based on their risk tolerance and investment goals.

The above content is for reference only and does not constitute investment advice.

If you have any questions, you can contact us through the following official channels:

AICoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AICoincom

Email: support@aicoin.com

Group Chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。